Free Salon Tax Statement

This document provides a comprehensive overview of the tax liabilities and filings for [Your Company Name] for the tax year of [Year]. It is designed to ensure transparency and aid in financial planning and tax compliance.

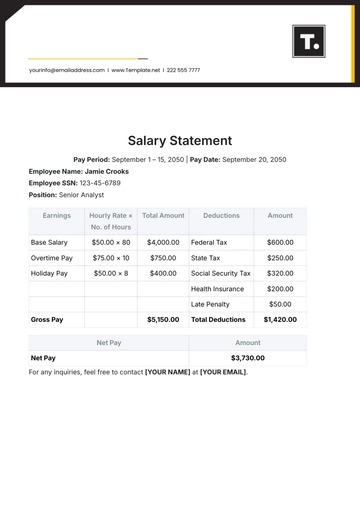

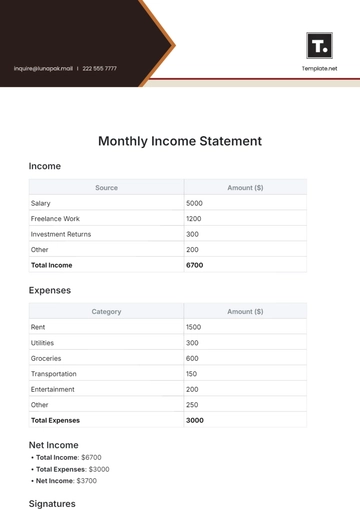

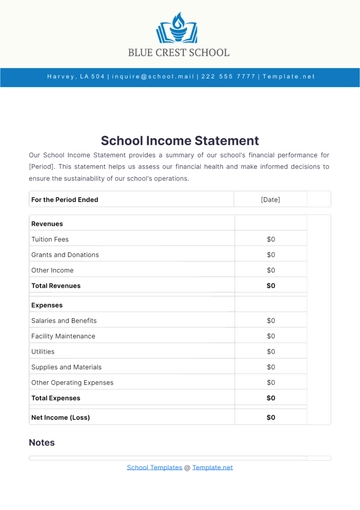

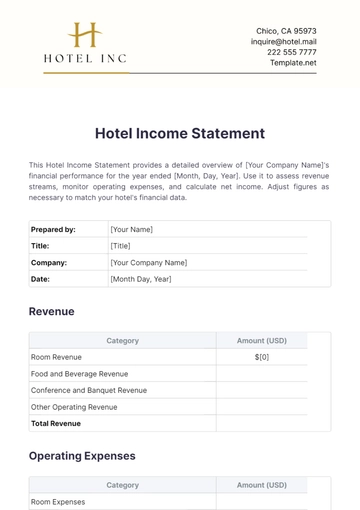

Summary of Taxable Income:

Description | Amount (USD) |

|---|---|

Gross Revenue from Services | $120,000.00 |

Product Sales | $30,000.00 |

Total Gross Income | $150,000.00 |

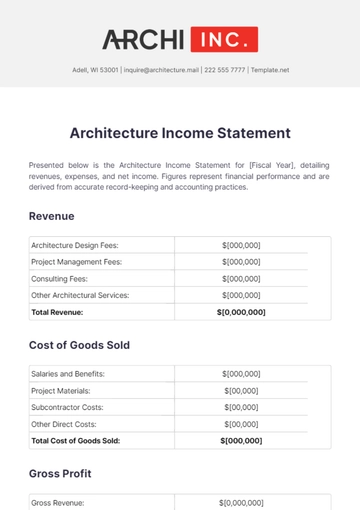

Deductible Expenses:

Category | Amount (USD) |

|---|---|

Rent/Lease | $24,000.00 |

Utilities | $6,000.00 |

Salon Supplies | $14,400.00 |

Equipment Depreciation | $3,000.00 |

Salon Staff Wages | $96,000.00 |

Marketing and Advertising | $7,200.00 |

Insurance | $4,800.00 |

Professional Fees | $4,200.00 |

Cleaning Services | $3,000.00 |

Miscellaneous Expenses | $1,200.00 |

Total Deductible Expenses | $164,800.00 |

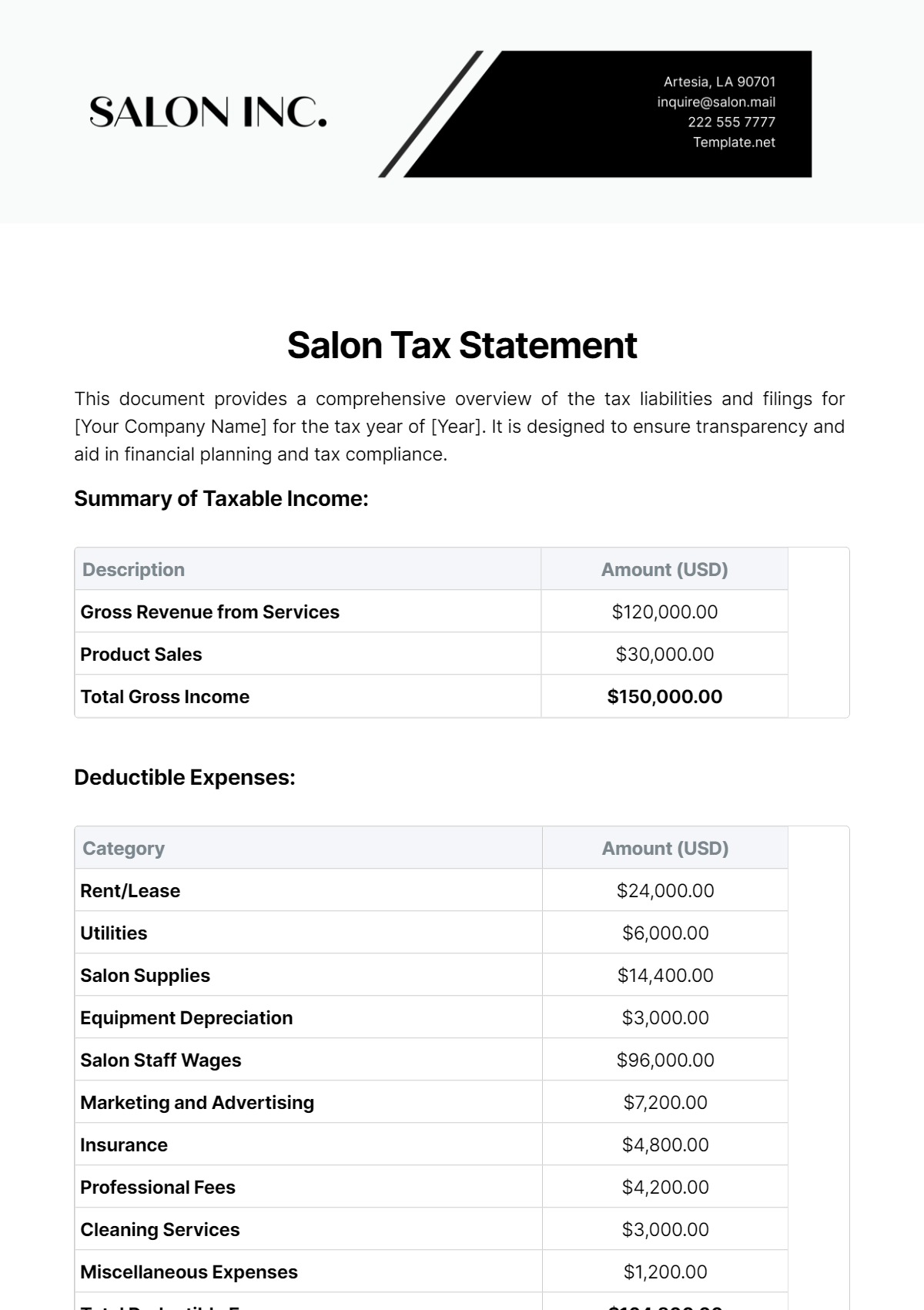

Calculation of Net Income:

Total Gross Income: $150,000.00

Total Deductible Expenses: $164,800.00

Net Income (Loss): -$14,800.00

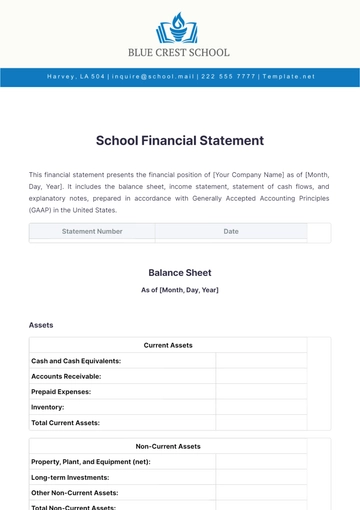

Tax Calculations:

Tax Category | Calculation Basis | Rate | Amount Due (USD) |

|---|---|---|---|

Federal Income Tax | -$14,800.00 | 21% | $0.00 |

State Income Tax | -$14,800.00 | 6% | $0.00 |

Sales Tax on Products | $30,000.00 | 8% | $2,400.00 |

Total Tax Liability | $2,400.00 |

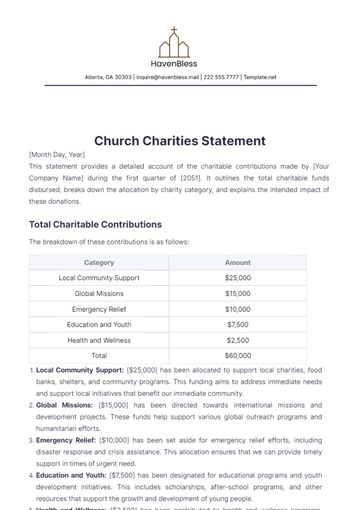

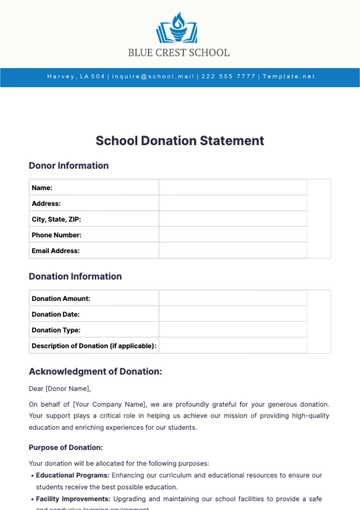

Additional Information:

Federal and State Income Tax: Due to a net operating loss, no income tax is due this year. Losses may be carried forward to offset future income per IRS and state guidelines.

Sales Tax: Collected from product sales and remitted to the state tax department.

Conclusions:

[Your Company Name] has maintained rigorous financial records and adheres to all applicable tax regulations. Our tax strategy ensures that we maximize legal tax benefits while contributing our fair share to public services.

For questions or more detailed financial information, please contact our accountant at [Your Company Email].

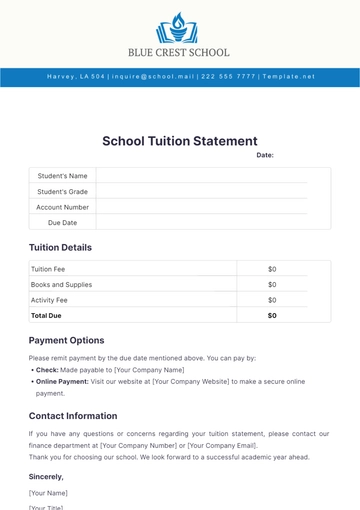

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Facilitate your salon's tax reporting with Template.net's Salon Tax Statement Template. This template, customizable and editable via the Ai Editor Tool, simplifies the preparation of accurate tax documents. Ensure compliance with tax laws and streamline the filing process, reducing errors and stress during tax season.