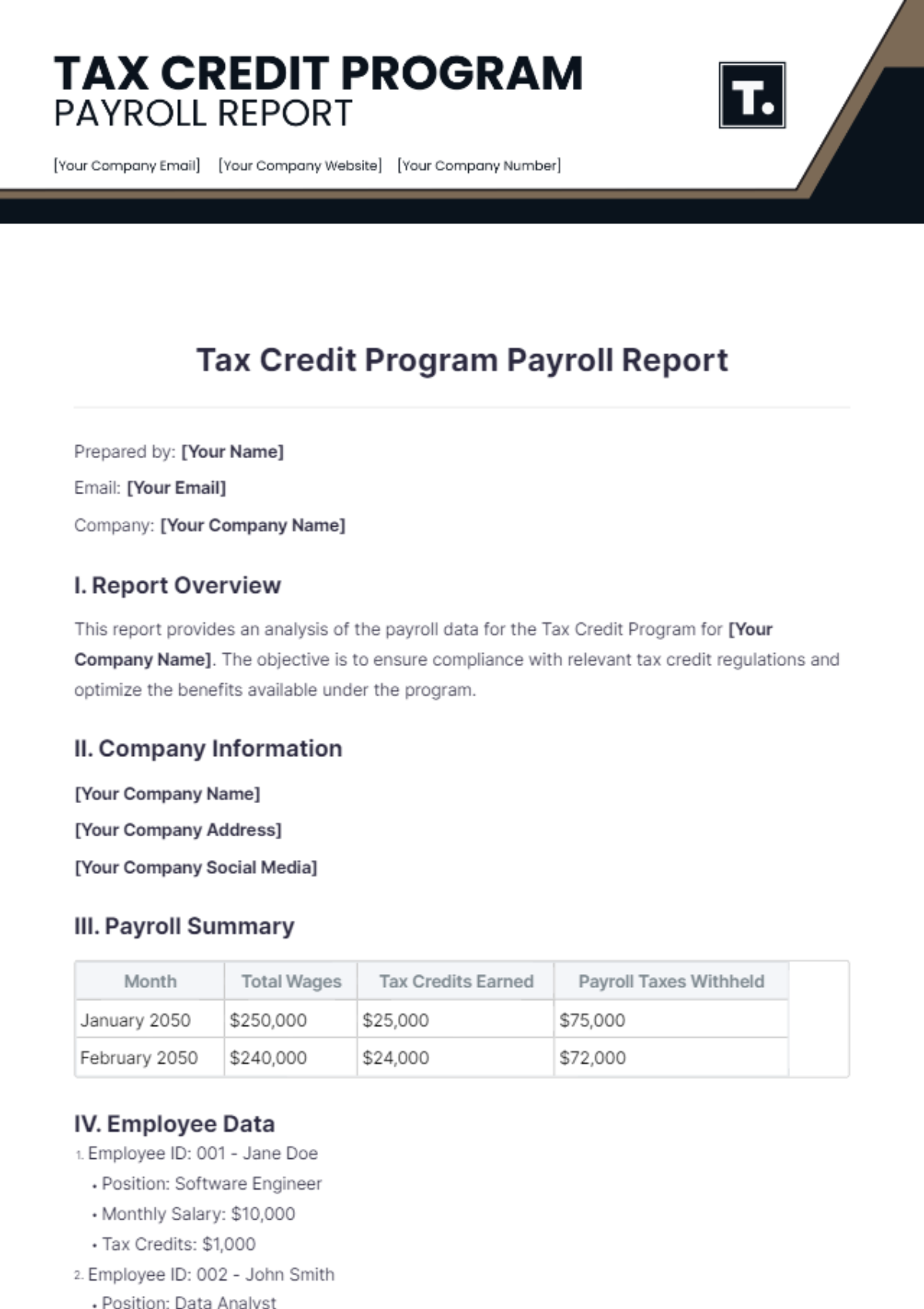

Tax Credit Program Payroll Report

Prepared by: [Your Name]

Email: [Your Email]

Company: [Your Company Name]

I. Report Overview

This report provides an analysis of the payroll data for the Tax Credit Program for [Your Company Name]. The objective is to ensure compliance with relevant tax credit regulations and optimize the benefits available under the program.

II. Company Information

[Your Company Name]

[Your Company Address]

[Your Company Social Media]

III. Payroll Summary

Month | Total Wages | Tax Credits Earned | Payroll Taxes Withheld |

|---|

January 2050 | $250,000 | $25,000 | $75,000 |

February 2050 | $240,000 | $24,000 | $72,000 |

IV. Employee Data

Employee ID: 001 - Jane Doe

Employee ID: 002 - John Smith

Position: Data Analyst

Monthly Salary: $8,000

Tax Credits: $800

V. Compliance Check

Verified adherence to the Tax Credit Program regulations.

Confirmed eligibility of claimed tax credits.

Ensured timely submission of relevant documentation.

VI. Recommendations and Actions

Regularly update payroll systems to incorporate new tax credit rules.

Conduct quarterly audits to maintain compliance.

Ensure all eligible employees are enrolled in the tax credit program.

For any queries, please reach out to [Your Name] at [Your Email].

Report Templates @ Template.net