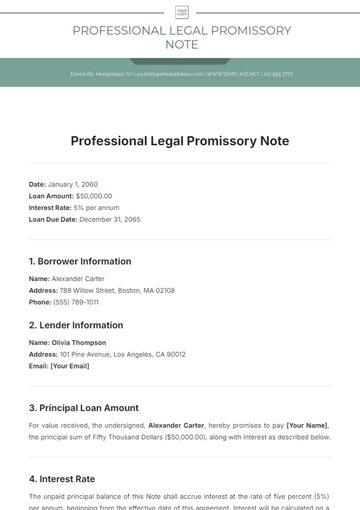

Free Joint Promissory Note Format

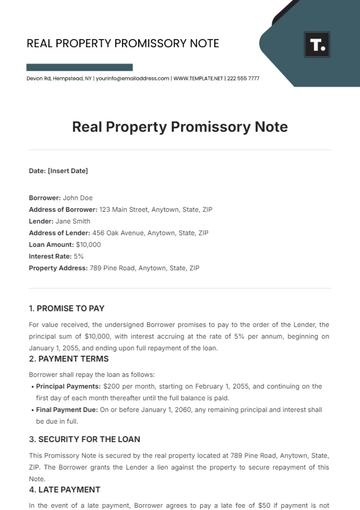

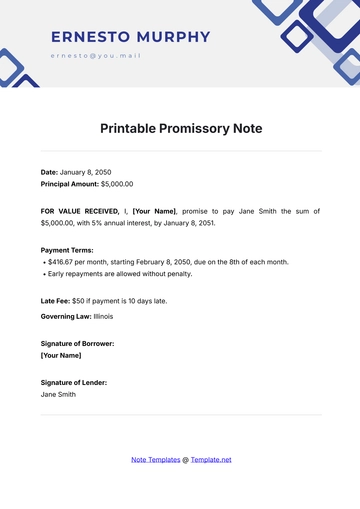

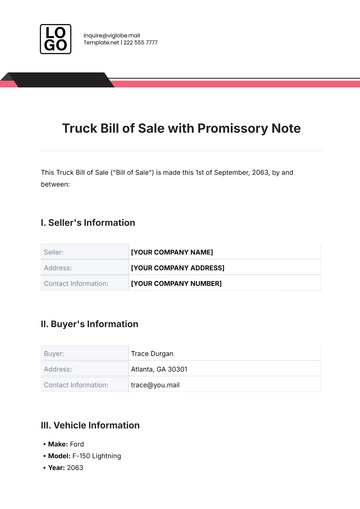

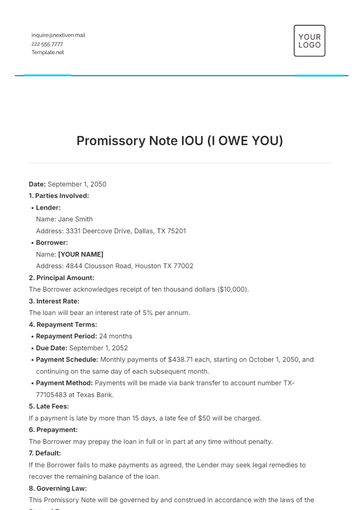

Date: Insert Date

Principal Amount: $Insert Amount

FOR VALUE RECEIVED, we, the undersigned, [Borrower 1 Name], residing at Insert Address, and [Borrower 2 Name], residing at Insert Address Address (collectively referred to as the "Borrowers"), jointly and severally promise to pay to the order of [Your Name], located at Lender Address (the "Lender"), the principal sum of $Insert Amount, together with interest on the unpaid principal balance at the annual rate of Insert Interest Rate%, compounded [insert how often interest is compounded, e.g., monthly, annually].

1. Payment Terms

The total amount, including principal and interest, shall be due and payable in full on or before Insert Maturity Date.

Payments shall be made in Insert Payment Frequency, e.g., monthly, quarterly

installments of $ Insert Payment Amount, commencing on Insert First Payment Date and continuing until the total amount is paid in full.

2. Prepayment

The Borrowers reserve the right to prepay this Note, in whole or in part, without any penalty or additional fees at any time before the due date. Any prepayment shall be applied first to accrued interest and then to the principal balance.

3. Default

In the event of default, which shall include, but not be limited to, failure to make any scheduled payment within Insert Grace Period, e.g., 10 days of its due date, the Lender may declare the entire unpaid principal and accrued interest immediately due and payable.

The Borrowers shall be responsible for all costs of collection, including reasonable attorney's fees, incurred by the Lender in enforcing this Note.

4. Governing Law

This Note shall be governed by and construed following the laws of the State of Insert State. Any legal proceedings arising from this Note shall be conducted in the courts of Insert County/State.

5. Joint and Several Liability

Each Borrower acknowledges and agrees that they are jointly and severally liable for the full repayment of this Note. This means that the Lender may pursue any Borrower for the entire amount owed under this Note, regardless of the payments made by the other Borrower.

6. Notices

All notices required or permitted under this Note shall be in writing and shall be deemed duly given when delivered personally, sent by certified mail, or sent by electronic mail (with confirmation of receipt) to the addresses specified above.

7. Amendments

This Note may only be amended or modified in writing, signed by both Borrowers and the Lender.

IN WITNESS WHEREOF, the undersigned have executed this Joint Promissory Note as of the date first above written.

Borrower 1:

[Borrower 1 Name]

[Borrower 1 Name]

Borrower 2:

[Borrower 2 Name]

[Borrower 2 Name]

[Signature]

Lender:

[Your Name]

[Your Name]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

This Joint Promissory Note Format Template is perfect for documenting loans involving multiple borrowers. Fully customizable and editable in our AI Editor Tool, it offers a simple yet comprehensive format for any joint loan arrangement. Access the template now on Template.net.