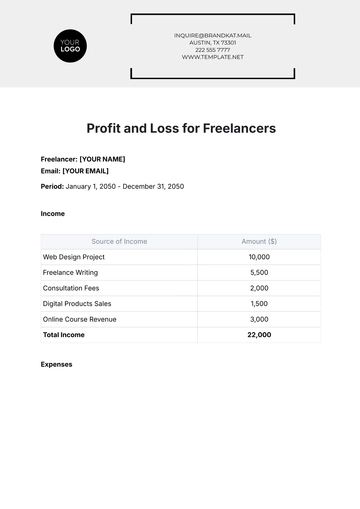

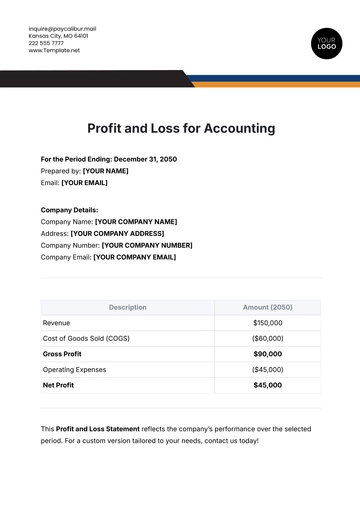

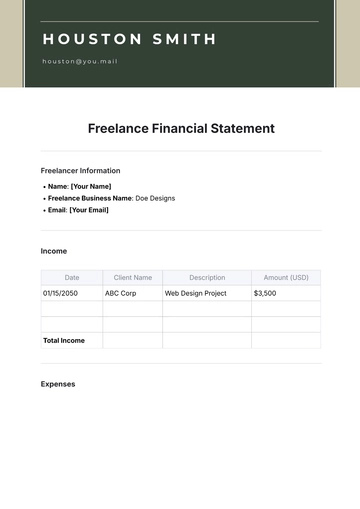

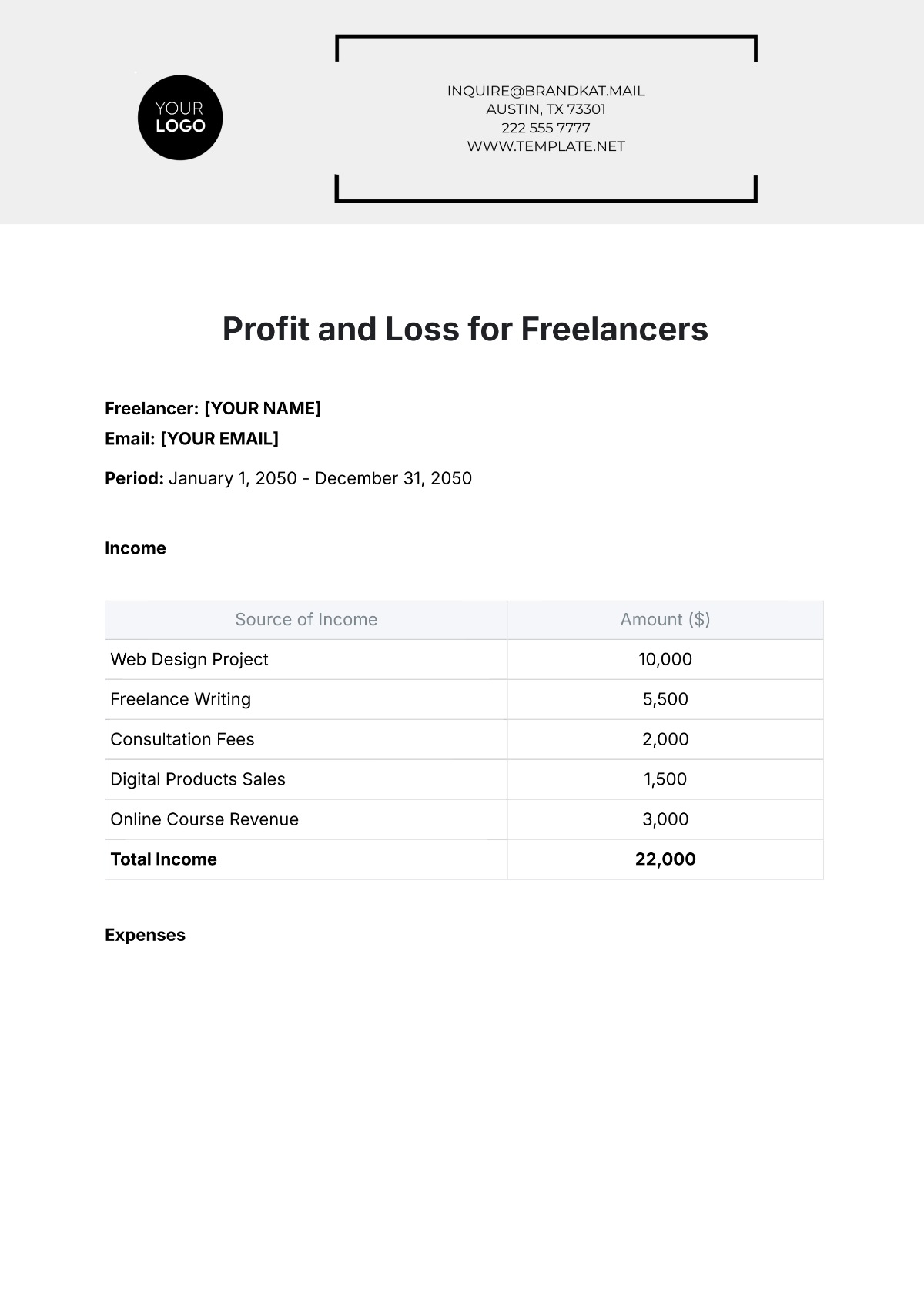

Free Profit and Loss for Freelancers

Freelancer: [YOUR NAME]

Email: [YOUR EMAIL]

Period: January 1, 2050 - December 31, 2050

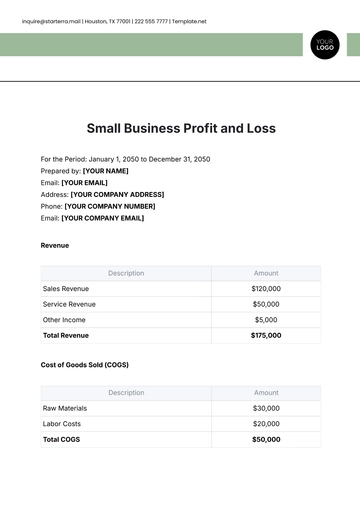

Income

Source of Income | Amount ($) |

|---|---|

Web Design Project | 10,000 |

Freelance Writing | 5,500 |

Consultation Fees | 2,000 |

Digital Products Sales | 1,500 |

Online Course Revenue | 3,000 |

Total Income | 22,000 |

Expenses

Expense Category | Amount ($) |

|---|---|

Software Subscriptions | 500 |

Marketing & Advertising | 1,200 |

Office Supplies | 300 |

Travel & Meetings | 400 |

Professional Fees | 600 |

Total Expenses | 3,000 |

Net Profit

Description | Amount ($) |

|---|---|

Total Income | 22,000 |

Total Expenses | 3,000 |

Net Profit | 19,000 |

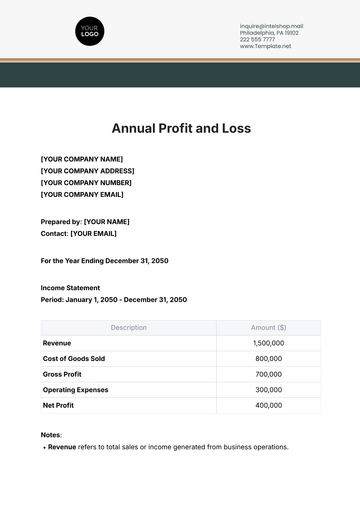

Important Notes:

Net Profit represents the income left after subtracting total expenses.

The P&L statement helps in understanding the freelancer’s financial position for the year 2050.

Ensure accuracy for tax filing or loan applications.

As a freelancer, having an up-to-date Profit and Loss statement is essential to maintain financial clarity. For accurate records, ensure that all income and expenses are recorded regularly.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Keep track of your earnings and expenses effortlessly with this Profit and Loss Template for Freelancers. Available on Template.net, this fully customizable and editable template allows you to manage finances with ease. Utilize the AI Editor Tool to adjust the template to your needs, ensuring accurate and efficient financial reporting.