Free CEO Business Analysis

1. Executive Summary

The executive summary offers an overview of the key findings from this comprehensive analysis. It highlights the company’s strengths, challenges, and long-term objectives, providing a snapshot of what lies ahead for [Your Company Name] from 2050 onward.

1.1 Company Overview

[Your Company Name] is a leading global player in the [industry], recognized for its commitment to innovation, high-quality products, and exceptional customer satisfaction. Founded in [2050], the company has grown substantially and now operates in more than [10] countries. With an eye toward future opportunities, [Your Company Name] has positioned itself as a dynamic force in the market, leveraging cutting-edge technologies, a customer-centric approach, and a commitment to sustainability. By 2050, the company aims to achieve a revenue target of $[50] billion, primarily driven by ongoing market expansion, the development of next-generation products, and an enhanced focus on technological innovation.

1.2 Key Financial Insights

Revenue Growth: [Your Company Name] has experienced a steady increase in revenue, reflecting both organic growth and strategic acquisitions. From a revenue base of $[15] billion in 2050, the company is projected to reach $[50] billion by 2070, with a compound annual growth rate (CAGR) of [10]% over the next [20] years.

Profitability: The company’s profitability has remained strong, with gross profit margins averaging [40]% over the last decade. As the company scales its operations globally, net profit margins are expected to stabilize at approximately [15]% by 2070, maintaining consistent and healthy returns for stakeholders.

Cash Flow: Operating cash flow reached $[3] billion in 2050, a sign of the company’s ability to generate cash even as it reinvests heavily into new initiatives. By 2070, cash flow is projected to grow to $[12] billion, providing the financial flexibility needed to fund expansion into new markets and sustain its innovation pipeline.

2. Market Analysis

This section evaluates the broader market trends, dynamics, and opportunities that will influence [Your Company Name]'s operations and growth trajectory through 2050 and beyond. Understanding these forces is crucial for the company to maintain its competitive edge.

2.1 Industry Trends and Future Outlook

2.1.1 Technological Advancements

Technological innovation is a driving force in the [industry] sector, and the pace of change is accelerating. By 2050, the adoption of next-generation technologies will reshape the competitive landscape.

AI and Automation: The widespread integration of artificial intelligence (AI) and automation will be a game-changer in [Your Company Name]'s sector. By 2050, [20]% of companies in the industry are expected to adopt AI for critical functions such as supply chain optimization, customer service, and predictive analytics. This will enable businesses to operate more efficiently, reduce costs, and enhance customer experiences. [Your Company Name] is heavily investing in AI technologies, committing $[200] million annually to ensure its continued leadership in this space.

Blockchain and Smart Contracts: Blockchain technology is becoming increasingly important in ensuring security, transparency, and efficiency. By 2050, blockchain is expected to facilitate [10]% of all industry transactions. [Your Company Name] plans to leverage blockchain to enhance its product traceability, secure data management, and reduce transaction costs, which will further optimize operations and strengthen its market position.

2.1.2 Sustainability Focus

Sustainability has emerged as a top priority for companies across all sectors. Consumers, investors, and regulators are demanding that businesses align their operations with environmental, social, and governance (ESG) goals.

Green Technologies: By 2050, sustainable products are projected to represent [30]% of total global spending in the tech industry. As demand for green products and services rises, [Your Company Name] is prioritizing the development of sustainable offerings. The company plans to invest $[500] million in green technologies over the next [5] years, with a particular focus on reducing waste, conserving energy, and minimizing carbon emissions.

Carbon Neutrality: [Your Company Name] has committed to achieving carbon neutrality by 2050, reflecting its dedication to environmental responsibility. By 2040, the company expects to reduce carbon emissions by [50]%, in line with global climate goals. This ambitious target is expected to enhance the company’s brand image, align it with evolving regulatory frameworks, and provide access to sustainability-focused investment funds.

2.1.3 Economic Growth and Demographic Shifts

The global economy is undergoing significant changes, particularly in emerging markets. [Your Company Name] is focusing on capturing opportunities in regions where economic growth is expected to outpace developed markets.

Emerging Markets: The combined market potential of Asia, Africa, and Latin America is expected to reach $[8] trillion by 2070. [Your Company Name] is focused on capturing this growth, with plans to increase its revenue from these regions by [15]% annually over the next [10] years. This strategy will allow the company to tap into a younger, tech-savvy consumer base, which is projected to be a major driver of consumption in the coming decades.

Aging Population: The aging global population, particularly in developed countries, presents both challenges and opportunities. The demand for healthcare products, services, and technologies is expected to increase, especially in regions like North America, Europe, and Japan. [Your Company Name] is positioning itself to capture this demand through innovations in health-related products, focusing on elderly care solutions.

2.2 Competitive Landscape

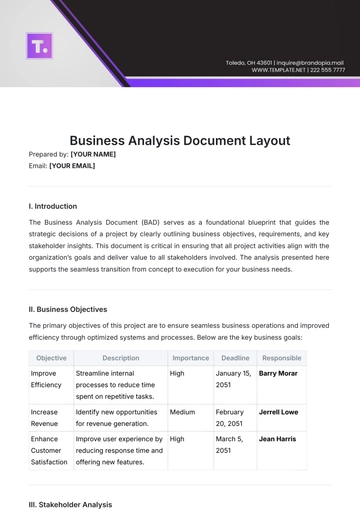

As of 2050, [Your Company Name] holds a [25]% market share in the [industry], positioning it as one of the leading players in its sector. The competitive environment remains dynamic, with established companies and startups alike vying for market share. Below is a table of the current competitive landscape:

Competitor Name | Market Share | Projected Revenue (Billions) | Key Strengths |

|---|---|---|---|

Competitor A | 20% | $40 | Global reach, extensive distribution channels |

Competitor B | 15% | $30 | Technological innovation, scalability |

Competitor C | 10% | $25 | Regional dominance, established customer base |

[Your Company Name] | 25% | $50 | Strong brand, quality products, expanding global footprint |

While competitors A, B, and C maintain significant shares of the market, [Your Company Name] is well-positioned for long-term success due to its focus on technological innovation, strong brand loyalty, and expanding presence in high-growth markets.

3. Financial Performance Analysis

This section analyzes the financial health of [Your Company Name] by reviewing revenue, profitability, and cash flow trends. Financial stability is essential for long-term strategic growth, and understanding these metrics will help guide future decisions.

3.1 Historical Financial Performance

[Your Company Name] has shown impressive financial results, driven by operational excellence and strategic expansion into new markets. The following table provides a projected breakdown of the company’s key financial metrics for the next few decades:

Year | Projected Revenue (B) | Gross Profit (B) | Net Income (B) | Operating Income (B) | EBITDA (B) |

|---|---|---|---|---|---|

2050 | $15 | $6 | $2.5 | $3 | $3.3 |

2060 | $30 | $12 | $5 | $6 | $7 |

2070 | $50 | $20 | $8 | $10 | $12 |

Key Insights:

Revenue Growth: With a projected CAGR of [10]% from 2050 to 2070, [Your Company Name] is set to grow revenue from $[15] billion in 2050 to $[50] billion by 2070.

Profit Margins: The company expects to maintain a strong gross profit margin of [40]%, and net income margins of around [15]% by 2070.

EBITDA: The expected rise in EBITDA reflects both operational efficiencies and strong revenue growth, contributing to overall financial strength and reinvestment capacity.

3.2 Projected Financial Performance

Looking ahead, [Your Company Name] expects to maintain its upward trajectory in revenue and profitability. Below is a financial forecast through to 2070:

These projections assume continued market expansion, successful new product introductions, and a focus on operational excellence.

4. Operational Performance

Operational performance is a critical component in sustaining long-term growth and maintaining competitive advantage. For [Your Company Name], maximizing operational efficiency and staying ahead in product innovation are key factors that contribute to the company's ability to maintain its market leadership. This section will evaluate the company's operational strategies, including supply chain optimization, production efficiency, and R&D investments, with a focus on sustainable and scalable growth.

4.1 Supply Chain Efficiency

The backbone of any global enterprise lies in the robustness of its supply chain. For [Your Company Name], a sophisticated and agile supply chain is not only necessary for meeting customer demand but also essential for optimizing costs and maintaining profitability.

4.1.1 Cost Optimization through Automation

In recent years, [Your Company Name] has focused on integrating automation into its supply chain processes. This includes the automation of order fulfillment, inventory management, and even procurement processes. By doing so, the company has successfully reduced supply chain costs by [12]%. For example, automated order processing systems have led to a reduction in human error by [30]%, ensuring faster and more accurate deliveries.

Additionally, the adoption of AI and machine learning algorithms has allowed [Your Company Name] to better predict demand patterns, leading to more efficient stock management and reduced overstocking. These AI-driven demand forecasting systems have minimized inventory costs by [8]% in the past decade, while also reducing wastage and improving sustainability. As a result, [Your Company Name] expects its supply chain efficiency to increase by an additional [5]% annually through 2070, due to ongoing investments in automation and advanced technologies.

4.1.2 Regional Supply Chain Integration

Given [Your Company Name]'s expansion into emerging markets, regional supply chain integration has become a crucial area of focus. The company has been building strategic partnerships with local suppliers to reduce lead times and ensure supply chain resilience in high-growth markets. This integration allows the company to offer tailored solutions for local markets, which in turn boosts customer satisfaction and market share.

In 2050, approximately [35]% of the company’s supply chain was localized within regional markets, compared to [20]% in 2040. By 2070, this number is projected to rise to [50]%, as [Your Company Name] strengthens its presence in emerging markets like Asia and Africa.

4.1.3 Sustainability in the Supply Chain

Sustainability has become a significant focus of [Your Company Name]'s supply chain strategy. In 2050, the company has committed to ensuring that [30]% of its supply chain partners meet stringent sustainability criteria, with plans to increase this figure to [70]% by 2070. The company’s goals include sourcing materials from ethical suppliers, minimizing packaging waste, and optimizing transportation to reduce carbon emissions. [Your Company Name] is also investing in a greener logistics network, including electric vehicles and renewable energy-powered warehouses, with an expected cost savings of $[100] million by 2070.

4.2 R&D and Product Innovation

Research and development (R&D) are at the heart of [Your Company Name]'s strategy to stay competitive. With rapid technological advancements shaping the [industry], the company must remain at the forefront of innovation to meet evolving customer demands.

4.2.1 Strategic Investment in R&D

In 2050, [Your Company Name] allocated $[750] million to R&D, which accounted for [5]% of its total annual revenue. Over the next decade, this investment is set to increase to $[1] billion annually, as the company focuses on high-growth sectors such as sustainable technology, artificial intelligence, and digital transformation. By 2070, R&D spending is expected to represent [7]% of total revenue, ensuring that [Your Company Name] remains a leader in technological advancements.

The company’s primary focus areas for R&D investment include:

Sustainable Materials and Green Technologies: With a growing demand for environmentally-friendly products, [Your Company Name] has dedicated significant resources to developing sustainable materials. This includes biodegradable packaging, low-energy production processes, and recyclable components. The company expects that by 2070, over [50]% of its product line will consist of green products.

AI and Automation: [Your Company Name] plans to lead the industry in AI-powered solutions, focusing on everything from customer service chatbots to predictive analytics for supply chain management. Over the next two decades, the company will spend an estimated $[2] billion on AI and machine learning innovations alone.

Next-Generation Products: [Your Company Name] is committed to developing new and improved products that meet consumer needs in areas such as health and wellness, digital integration, and lifestyle. The company aims to release [7] innovative products annually starting in 2060, with a projected revenue impact of $[5] billion by 2070.

4.2.2 Innovation Partnerships

To accelerate its innovation agenda, [Your Company Name] has formed strategic alliances with leading universities, tech startups, and research institutions. By 2070, these partnerships will contribute to [10]% of the company’s total R&D efforts, helping to drive breakthrough discoveries that can lead to the next generation of products and services.

4.3 Production Efficiency

Optimizing production processes is a key driver of operational performance at [Your Company Name]. The company has leveraged cutting-edge technologies such as robotics and 3D printing to improve production efficiency, reduce waste, and lower manufacturing costs.

4.3.1 Automation in Manufacturing

In 2050, approximately [35]% of [Your Company Name]'s manufacturing processes were automated. This automation has allowed the company to increase production capacity by [15]%, reduce labor costs by [20]%, and cut production time by [10]%. By 2070, automation is expected to account for [70]% of the company’s manufacturing processes, resulting in further cost reductions and faster production cycles.

4.3.2 Energy-Efficient Production

As part of its sustainability goals, [Your Company Name] has invested heavily in energy-efficient manufacturing facilities. The company’s global manufacturing plants are now running at [25]% energy efficiency, and it aims to increase this figure to [50]% by 2070. These improvements will not only reduce operational costs but also help the company meet its carbon neutrality targets for 2050.

5. Strategic Risks and Opportunities

This section explores the key risks and opportunities that [Your Company Name] must navigate in the coming decades to ensure its continued growth and market dominance. With a rapidly changing global landscape, understanding potential risks and identifying opportunities is crucial for sustainable success.

5.1 Risks

5.1.1 Technological Disruption

Technological disruption remains one of the biggest risks for companies in the tech industry. Rapid advancements in areas like artificial intelligence, machine learning, and blockchain could outpace [Your Company Name]'s ability to adapt. As competitors continue to innovate, the risk of falling behind is significant if [Your Company Name] does not continually invest in cutting-edge technologies.

However, by allocating $[1] billion annually to R&D and forming strategic partnerships with technology innovators, the company is preparing to address this risk head-on. Furthermore, [Your Company Name] is building a culture of innovation internally, ensuring that all employees are empowered to contribute to new ideas and technologies.

5.1.2 Regulatory Changes

With global regulations becoming stricter, particularly around data privacy, environmental standards, and corporate governance, [Your Company Name] faces a growing risk of non-compliance. However, the company is actively engaging with regulators and investing in compliance measures to stay ahead of potential changes. In 2050, [Your Company Name] spent $[30] million on compliance-related initiatives, and this budget is expected to grow to $[100] million by 2070, ensuring the company can meet all evolving regulatory standards.

5.1.3 Economic Uncertainty

Global economic fluctuations, such as recessions or market downturns, pose a risk to [Your Company Name]'s growth. However, by diversifying its revenue streams across multiple regions and industries, the company has been able to mitigate some of this risk. [Your Company Name] is focused on strengthening its presence in emerging markets, where growth is expected to outpace that of mature economies in the coming decades.

5.2 Opportunities

5.2.1 Expansion into Emerging Markets

As emerging markets in Asia, Africa, and Latin America continue to grow, [Your Company Name] sees significant potential for expansion. The company plans to increase its revenue from these regions by [15]% annually over the next [20] years. With a young, tech-savvy population driving consumption growth, these markets will be key to [Your Company Name]'s continued success.

5.2.2 Technological Leadership

With its ongoing investment in AI, automation, and sustainability-focused innovations, [Your Company Name] has the opportunity to position itself as an industry leader in digital transformation. By embracing these technologies, the company will not only enhance operational efficiency but also create new product offerings that cater to evolving consumer demands. [Your Company Name] expects to generate $[10] billion in additional revenue from its technology-driven initiatives by 2070.

5.2.3 Strategic Acquisitions

[Your Company Name] has identified a number of potential acquisition targets in emerging markets and high-growth industries such as AI, clean energy, and digital services. Strategic acquisitions are expected to contribute up to $[5] billion in annual revenue by 2070, as the company strengthens its position in new markets and enhances its technological capabilities.

6. Conclusion

[Your Company Name] is well-positioned to thrive in the coming decades, with a strong operational foundation, strategic investments in technology, and a keen eye for emerging opportunities. By continuing to innovate and adapt to global changes, the company will remain a leader in its industry. As the company moves toward 2070, it is essential to maintain a focus on sustainability, operational efficiency, and strategic growth to ensure long-term success in an increasingly competitive and dynamic market.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Drive informed decisions with the CEO Business Analysis Template from Template.net. This editable and customizable tool provides a framework to evaluate performance and growth opportunities. Personalize it using the AI Editor Tool. Download now to support data-driven leadership.