Free Tax Planning Real Estate Meeting Minute

Date: October 15, 2053

Time: 10:00 AM - 11:30 AM

Location: Conference Room A, Main Office

Attendees

John Doe - Tax Advisor

Jane Smith - Real Estate Manager

Richard Roe - Financial Analyst

Emily Johnson - Legal Consultant

Michael Brown - Chief Financial Officer (CFO)

Agenda

Introduction and Objectives

Current Tax Legislation Overview

Strategic Tax Planning Opportunities

Risk Management and Compliance

Next Steps and Actions

Meeting Discussions

1. Introduction and Objectives

The primary goal of the meeting was to strategize effective tax planning specific to the real estate sector.

John Doe emphasized the significance of staying informed about the latest tax regulations to optimize savings and minimize liabilities.

2. Current Tax Legislation Overview

Emily Johnson provided a comprehensive overview of recent tax legislation changes. Key topics included:

Property tax reforms and their implications.

Capital gains tax updates affecting real estate transactions.

She highlighted the potential impacts of these changes on real estate investments and recommended proactive measures for compliance and cost reduction.

3. Strategic Tax Planning Opportunities

Richard Roe presented insights into potential tax-saving strategies, including:

Leveraging 1031 exchanges to defer taxes on property sales.

Utilizing tax credits for green building projects to reduce financial burdens.

Maximizing benefits from depreciation schedules to lower taxable income.

He stressed the importance of adopting a proactive and innovative approach to identifying and capitalizing on these opportunities.

4. Risk Management and Compliance

Jane Smith addressed concerns regarding adherence to local and federal tax regulations.

Michael Brown reassured attendees of ongoing audits and legal consultations to ensure full compliance.

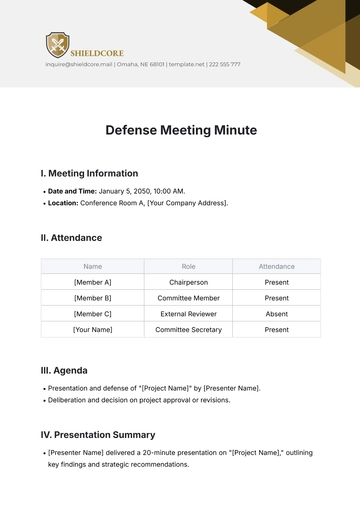

A detailed Compliance Checklist was distributed:

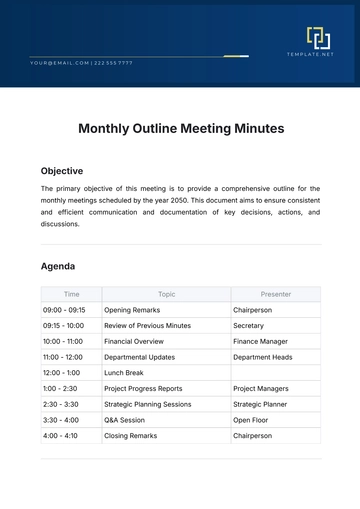

Compliance Area | Status | Comments |

|---|---|---|

Property Tax Assessments | Pending | Awaiting county review |

Federal Tax Filings | Completed | Filed before the deadline |

Local Tax Incentives | In Progress | Application submitted |

5. Next Steps and Actions

To refine the tax planning strategy, the following actions were agreed upon:

John Doe: Organize a seminar on advanced tax planning techniques by November 1, 2053.

Jane Smith: Follow up on pending property tax assessments and report findings.

Emily Johnson: Prepare a detailed report on the legal implications of recent tax reforms by October 31, 2053.

Conclusion

The meeting concluded with a shared commitment to continuous inter-departmental collaboration for achieving optimal tax efficiency.

Next Meeting:

Date: November 10, 2053

Focus: Review progress on action items and discuss additional strategies for year-end tax optimization.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

The Tax Planning Real Estate Meeting Minute Template, offered by Template.net, is a fully customizable and editable solution designed to streamline your meeting documentation. This downloadable and printable template allows for easy customization to fit your specific needs, ensuring accurate record-keeping for tax planning discussions. Effortlessly edit and tailor the template in our AI Editor Tool, making it a versatile tool for real estate professionals. Save time and enhance your workflow with this efficient meeting minute solution.