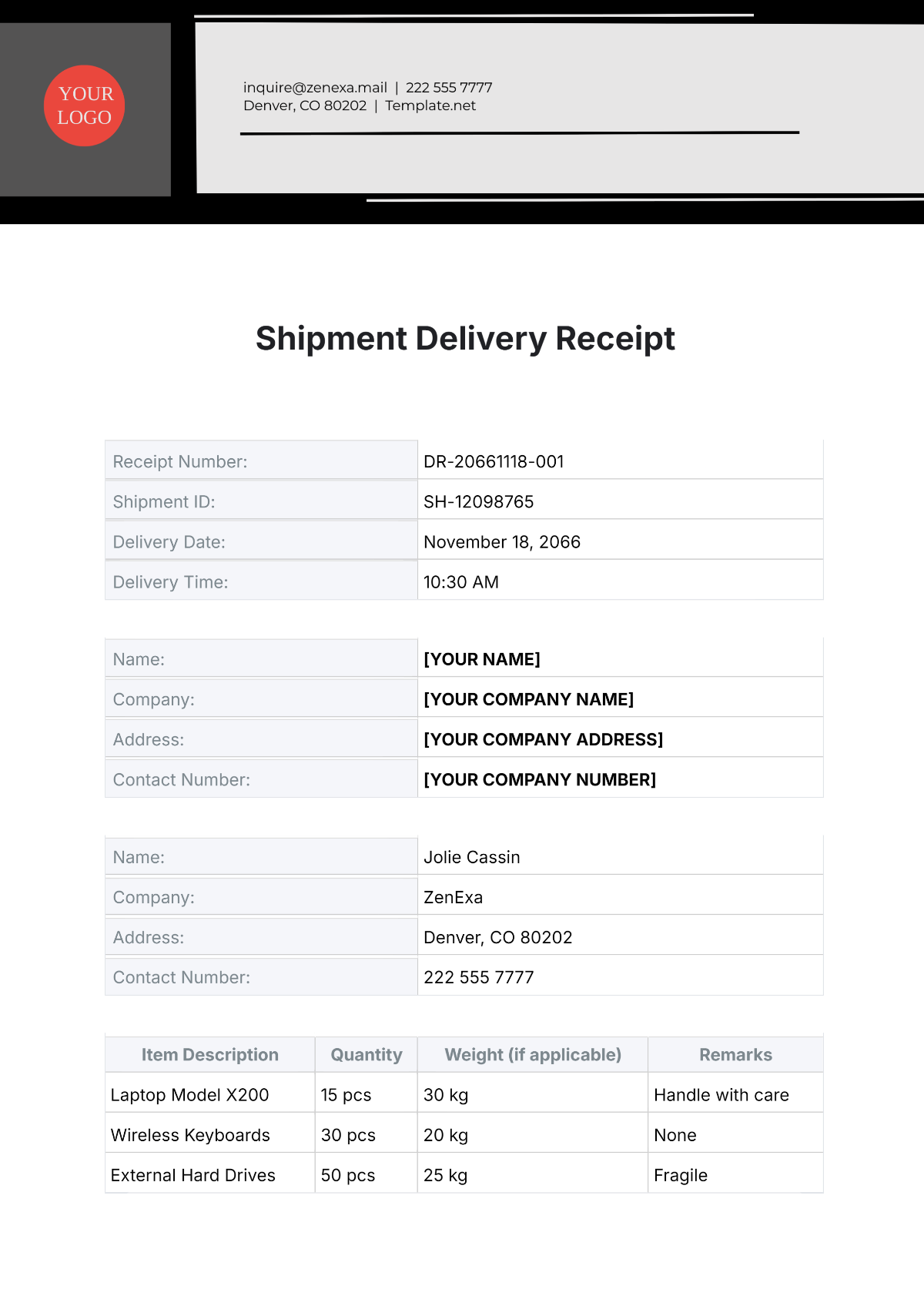

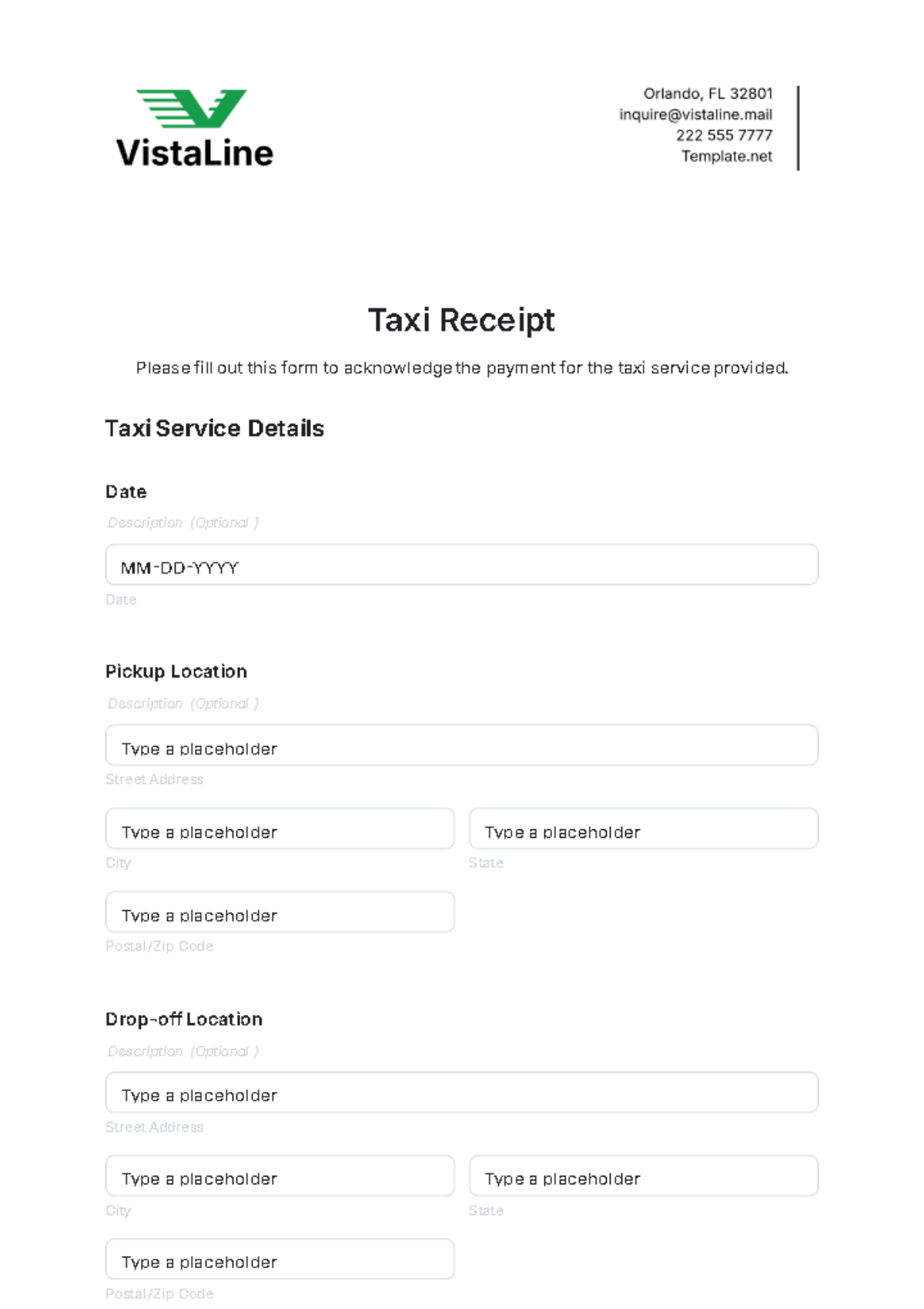

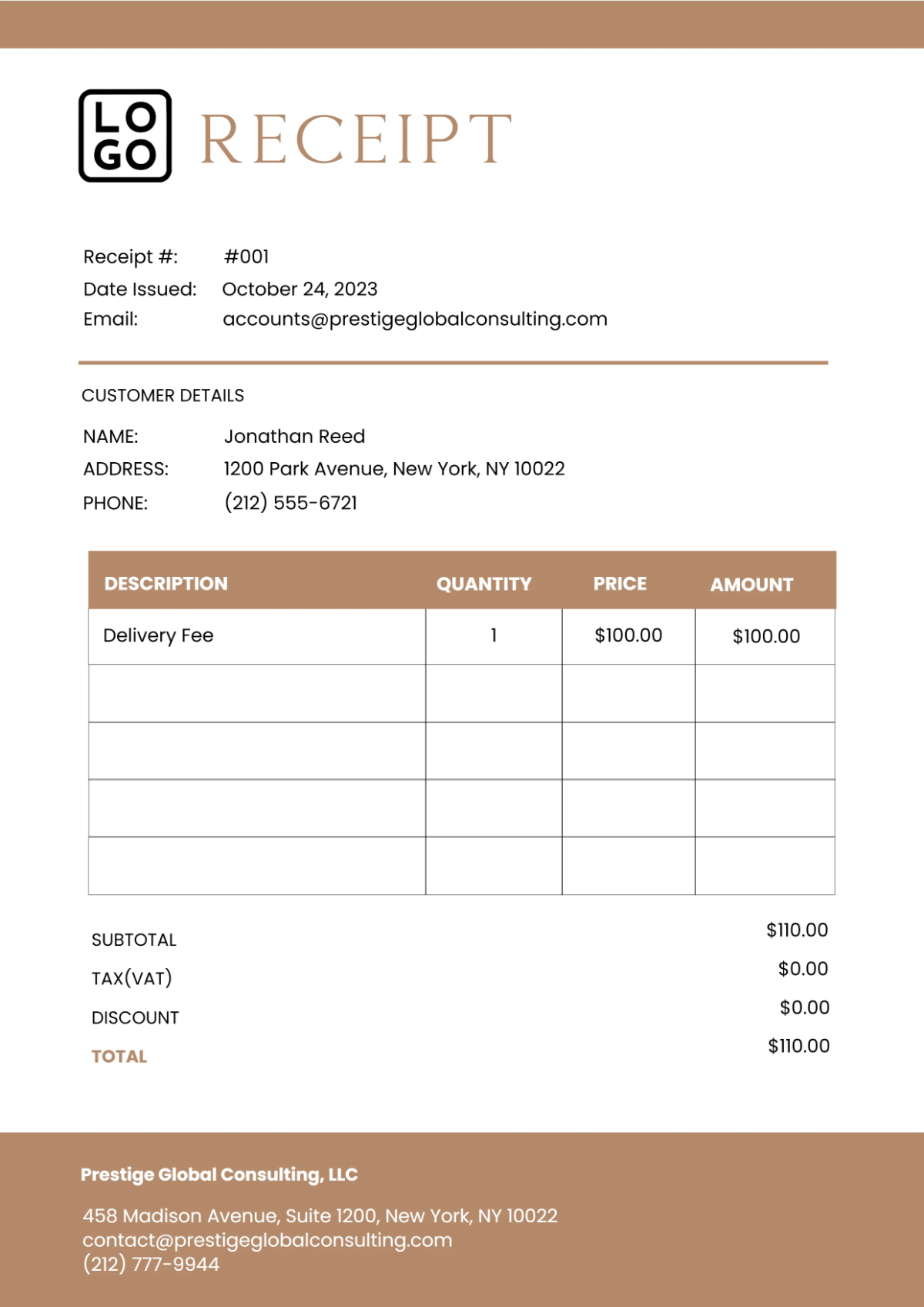

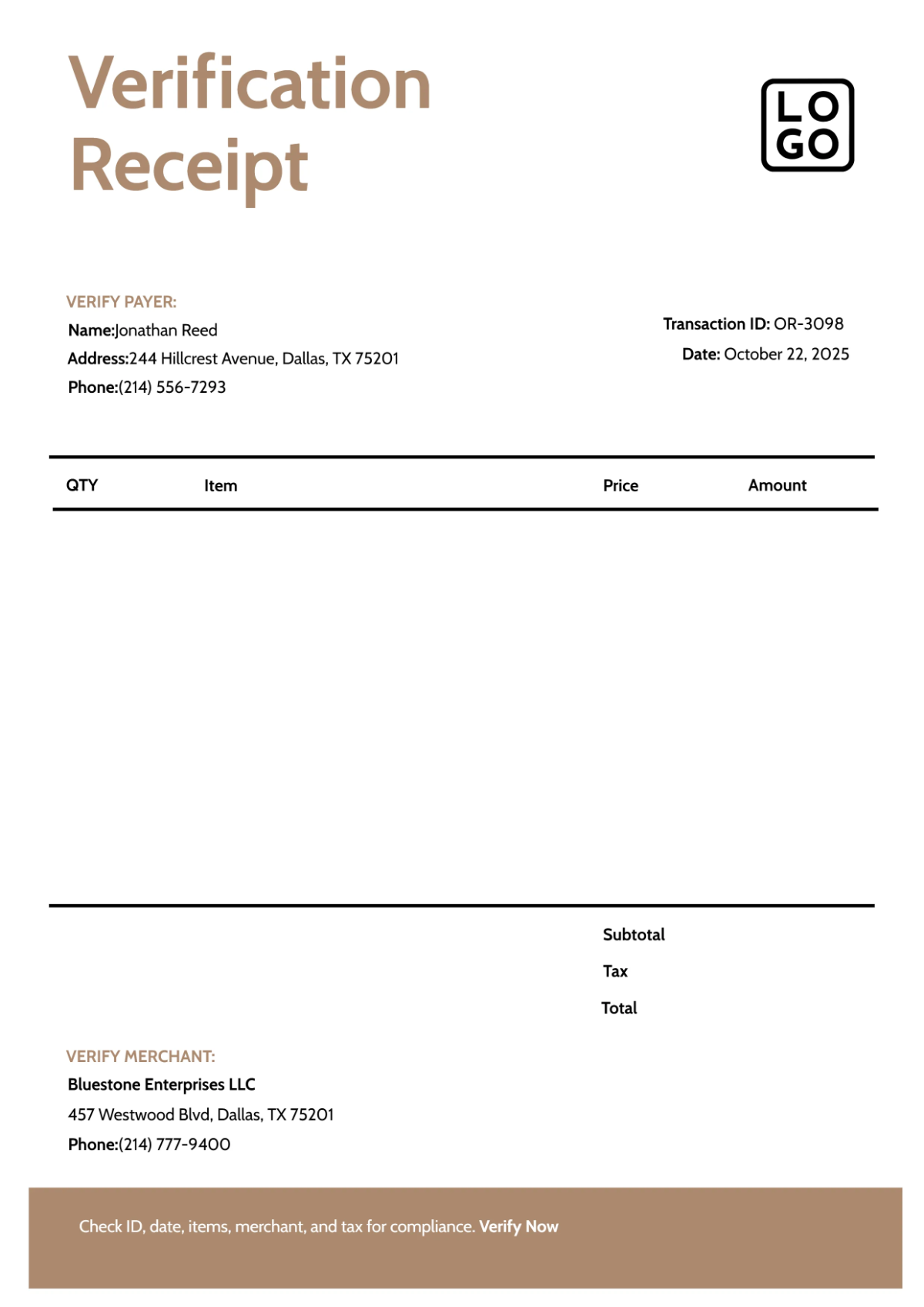

Make Your Financial Documentation Clear and Professional with Receipt Templates from Template.net

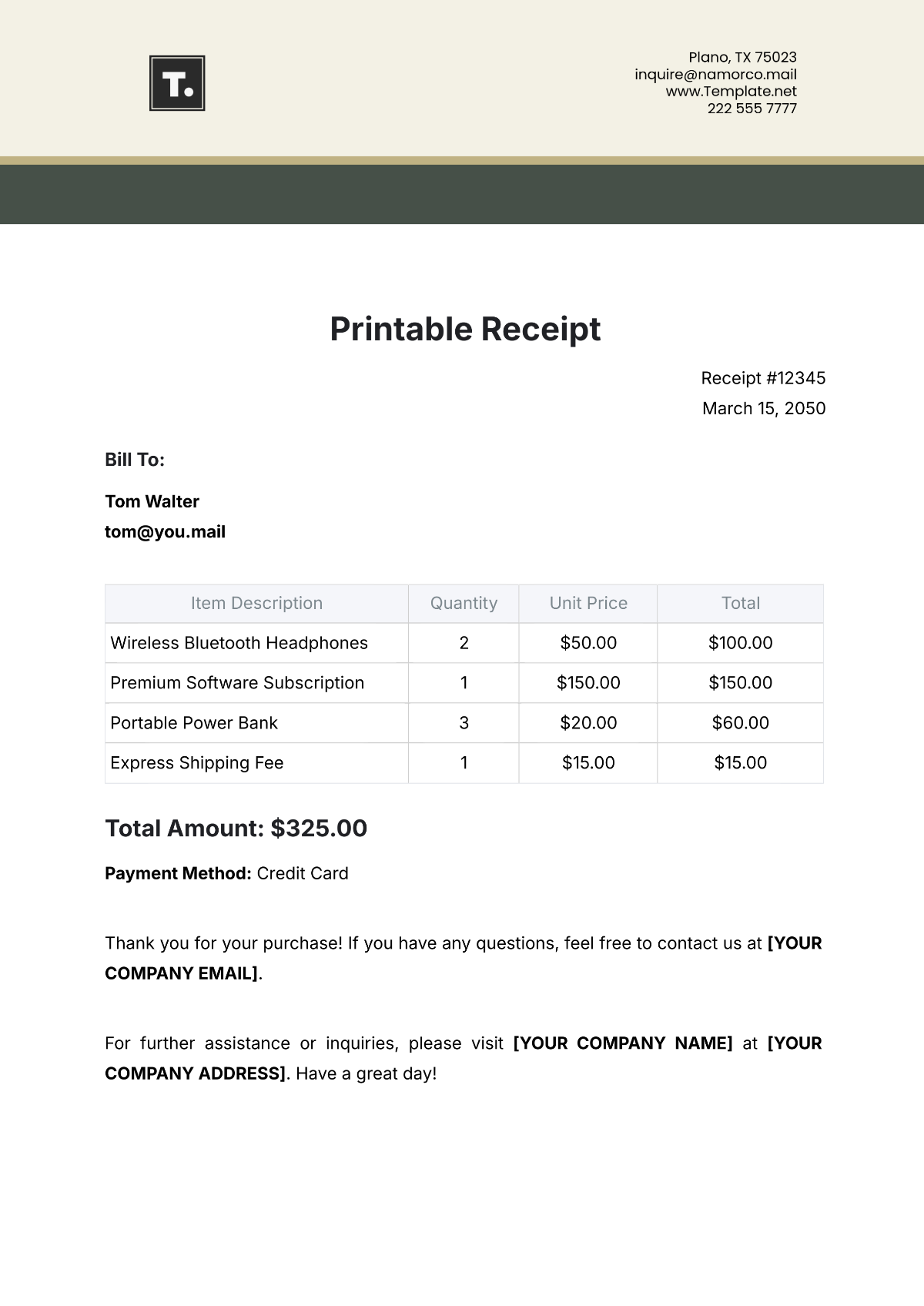

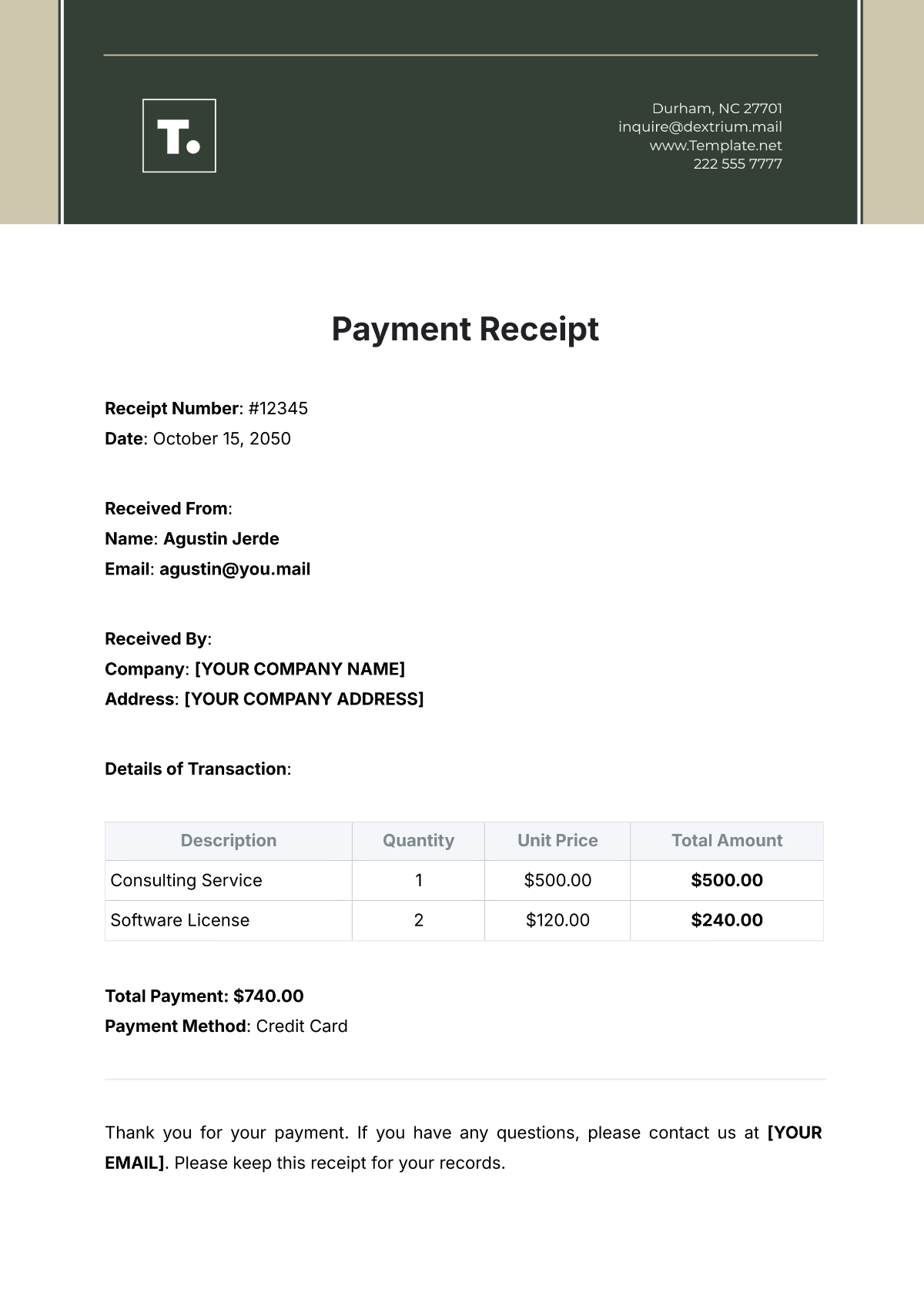

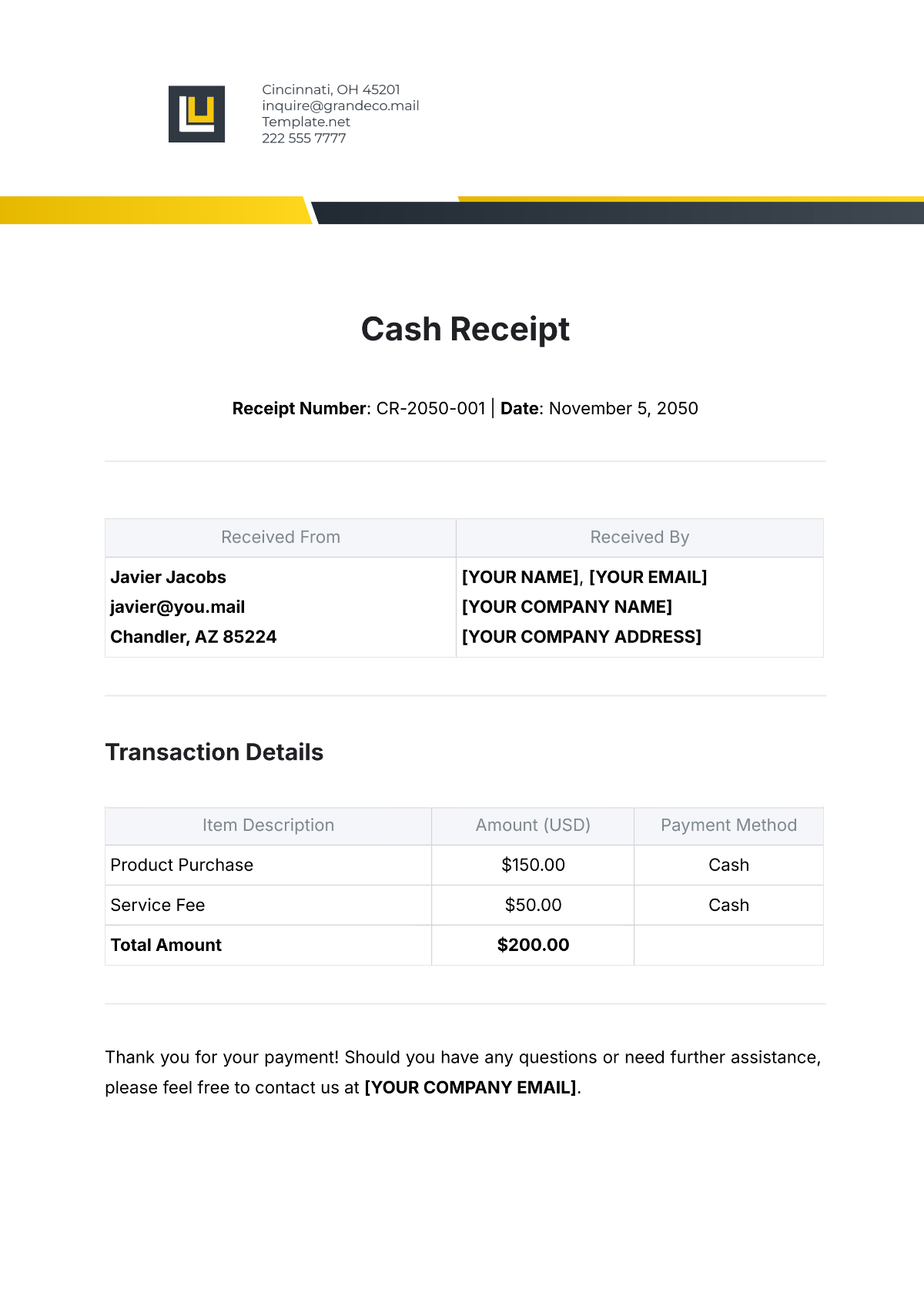

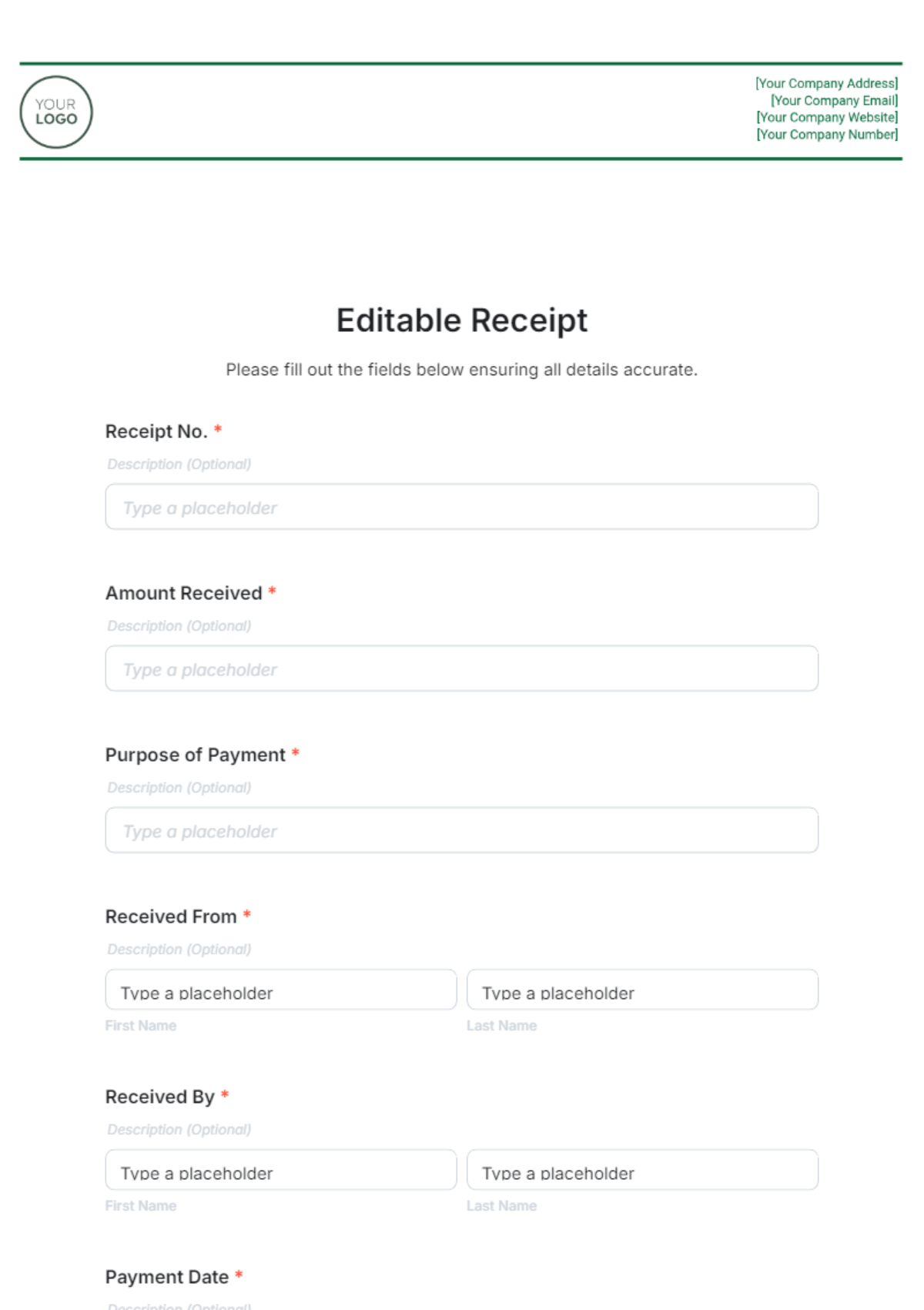

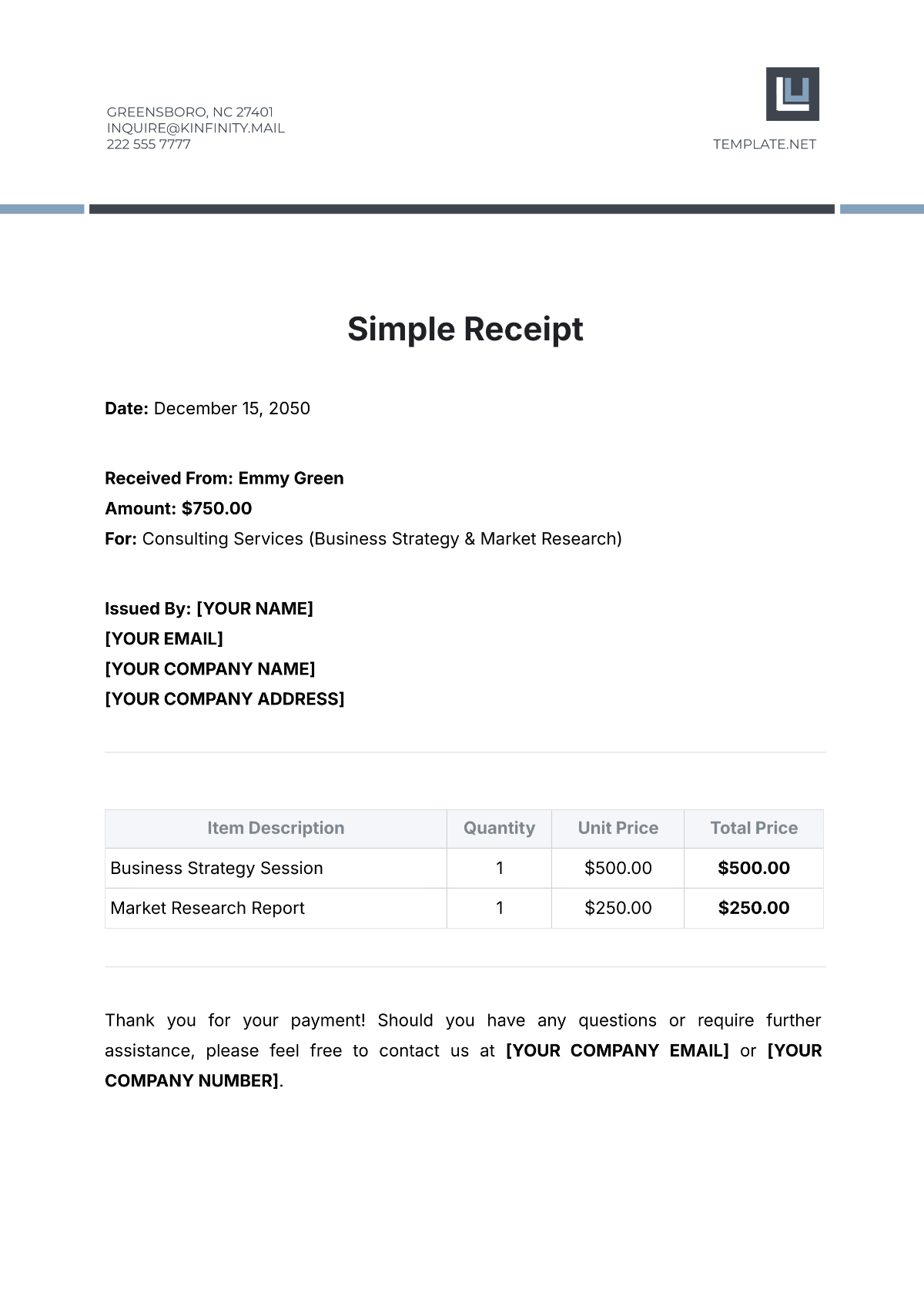

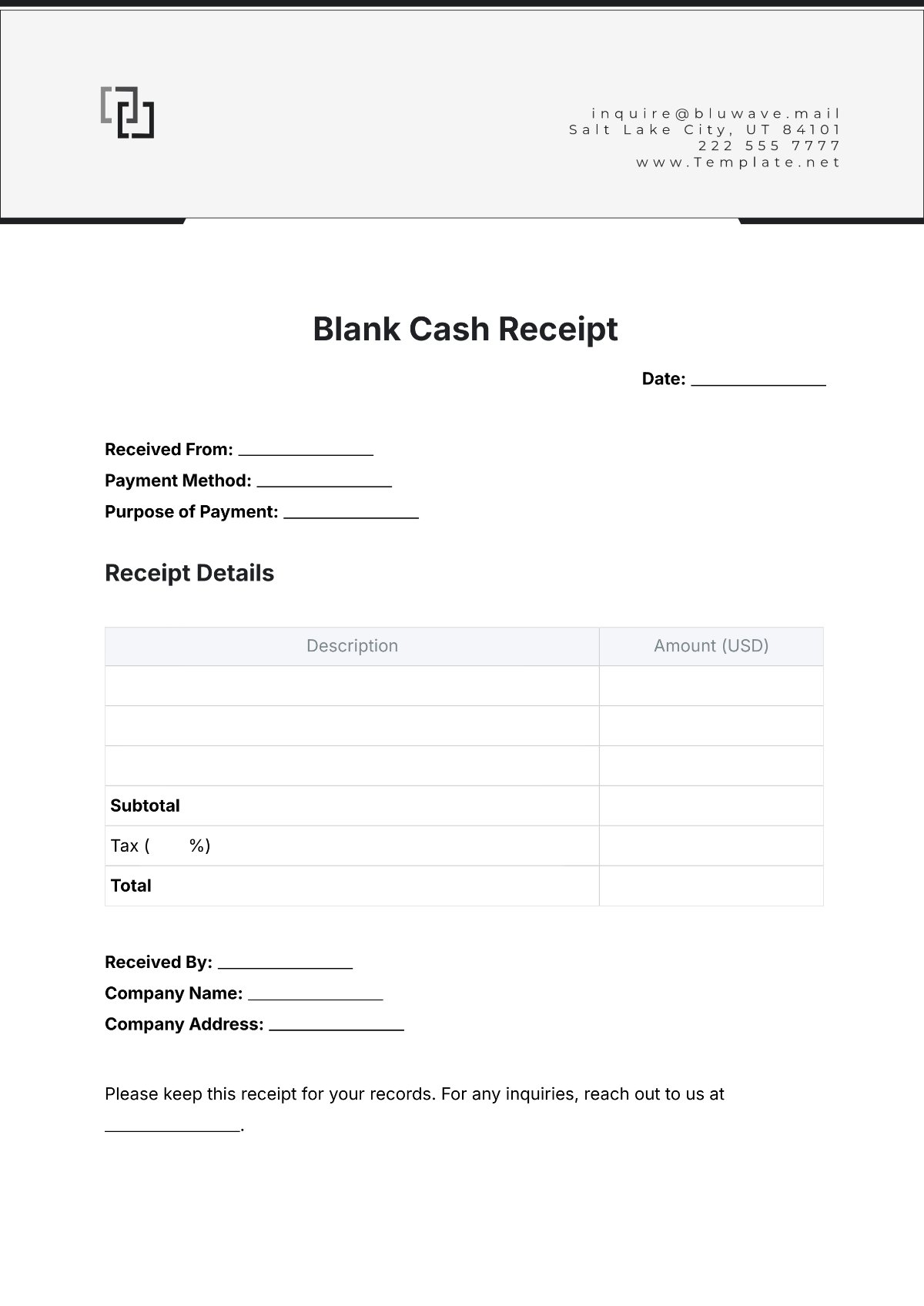

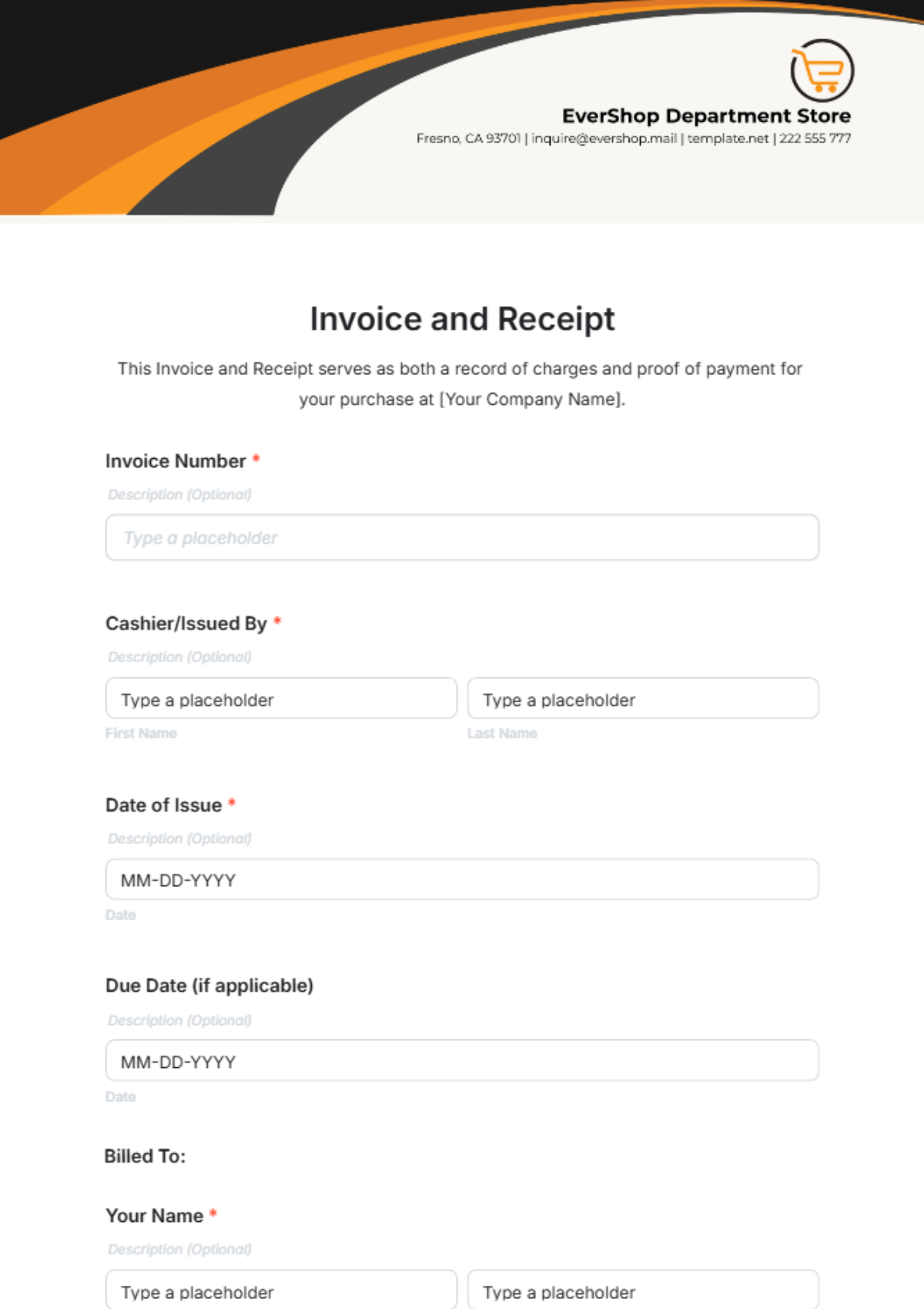

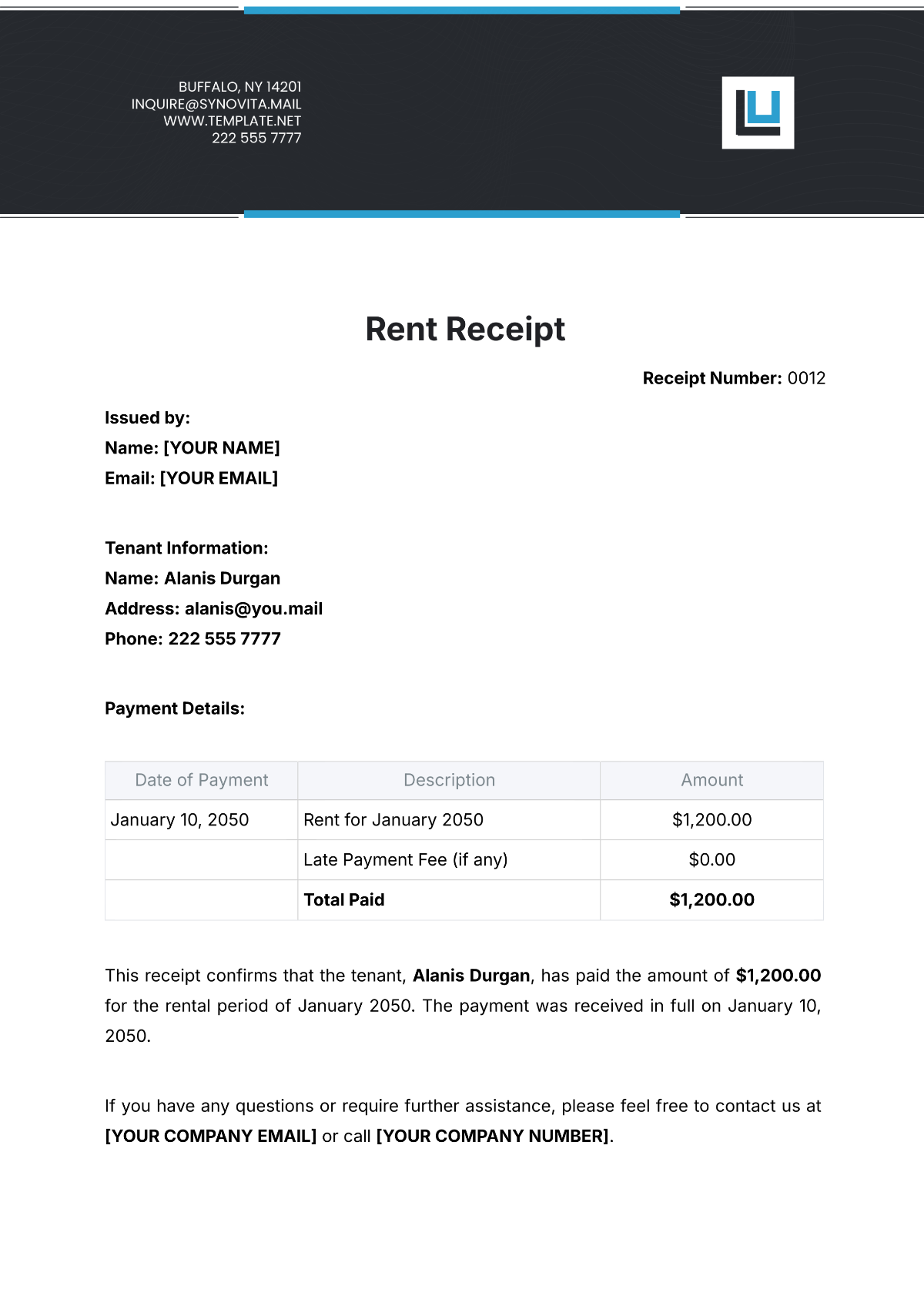

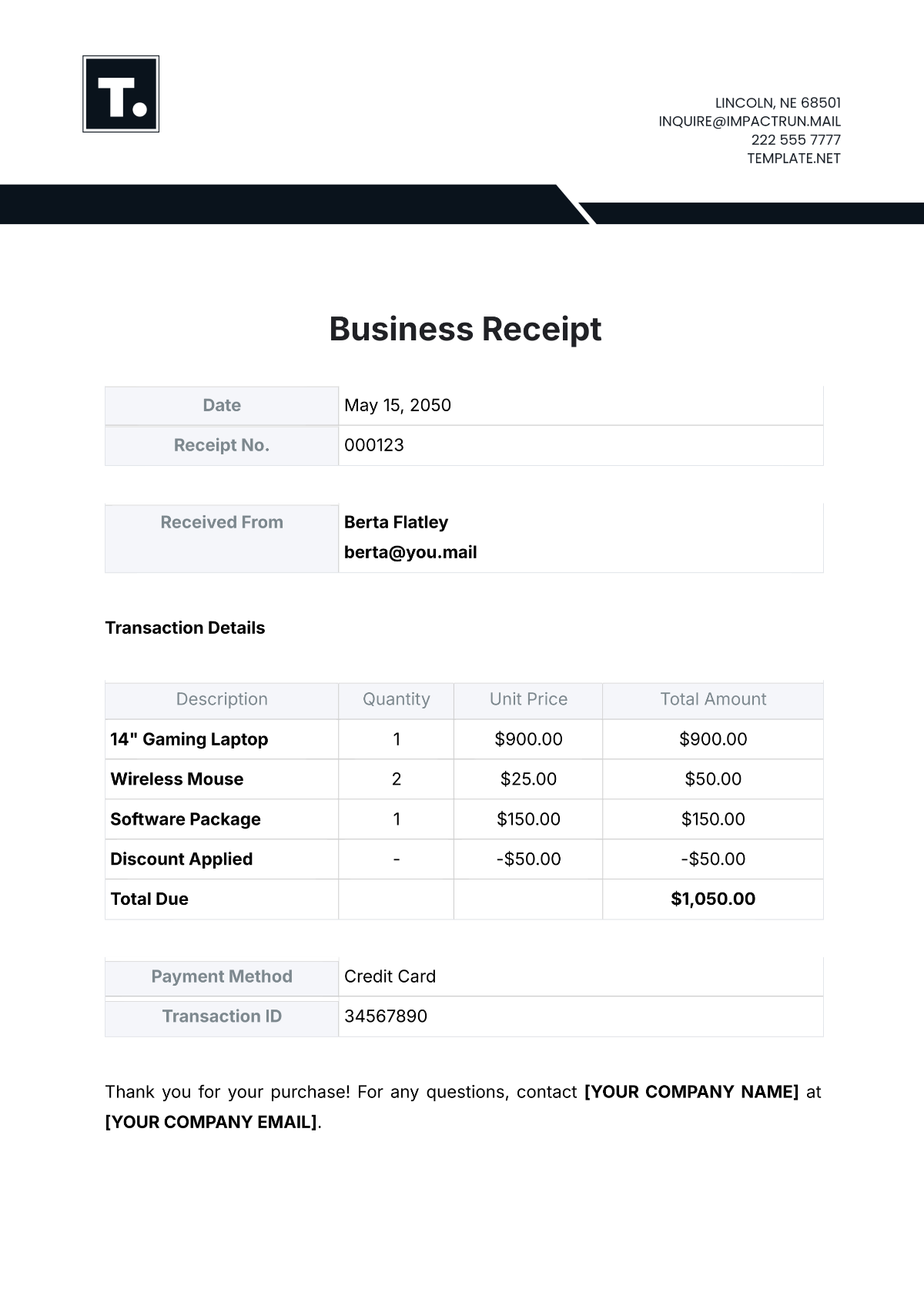

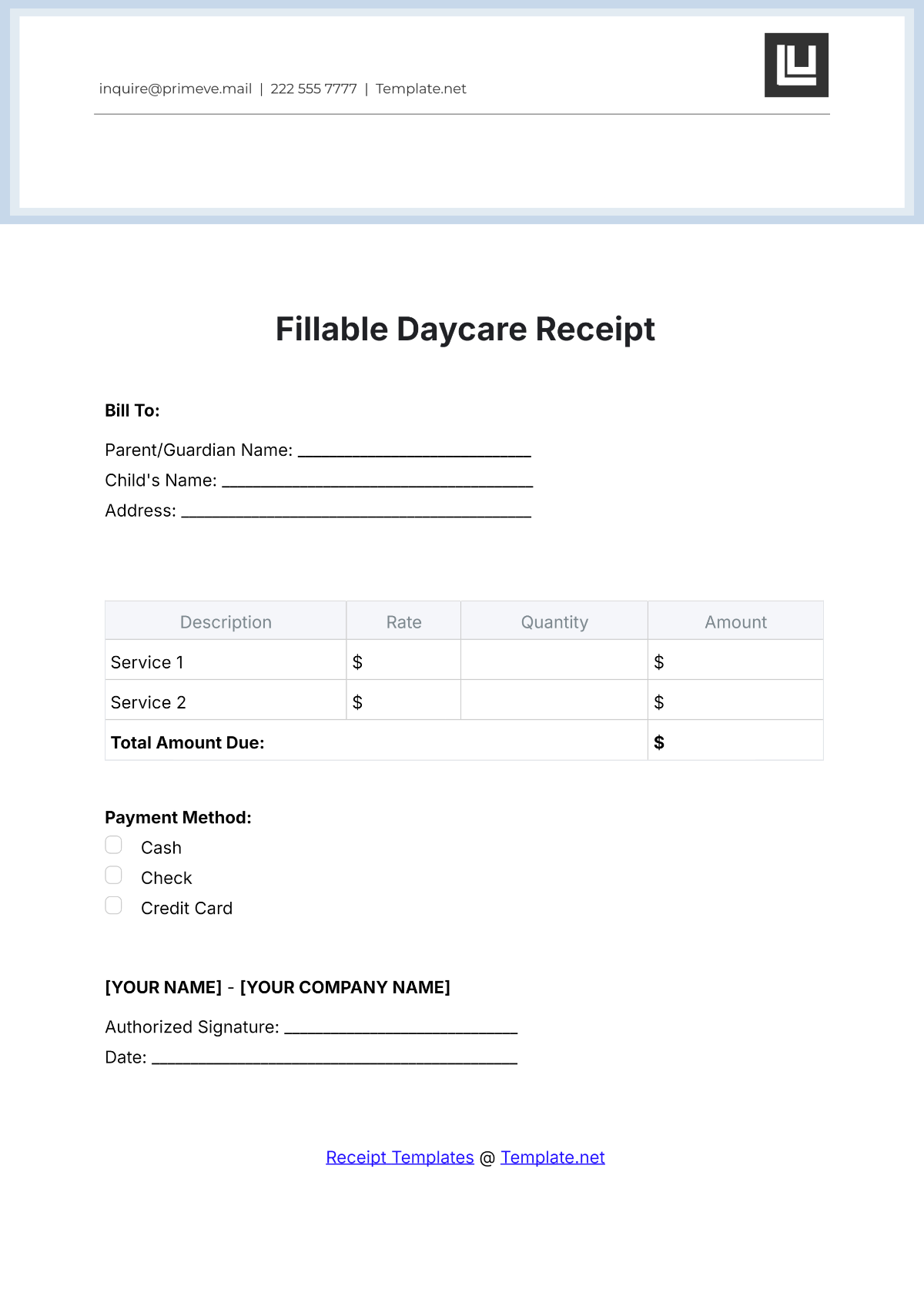

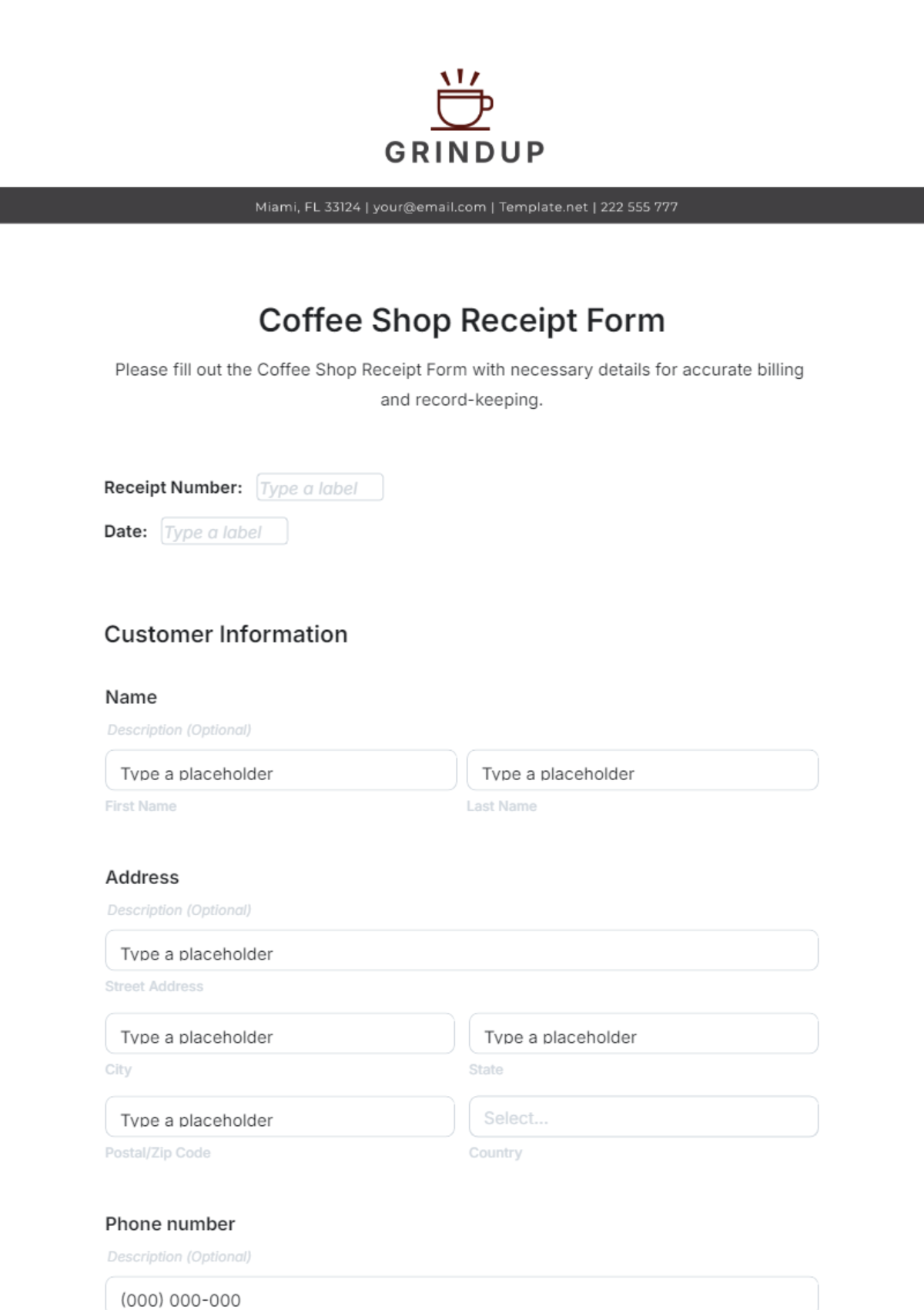

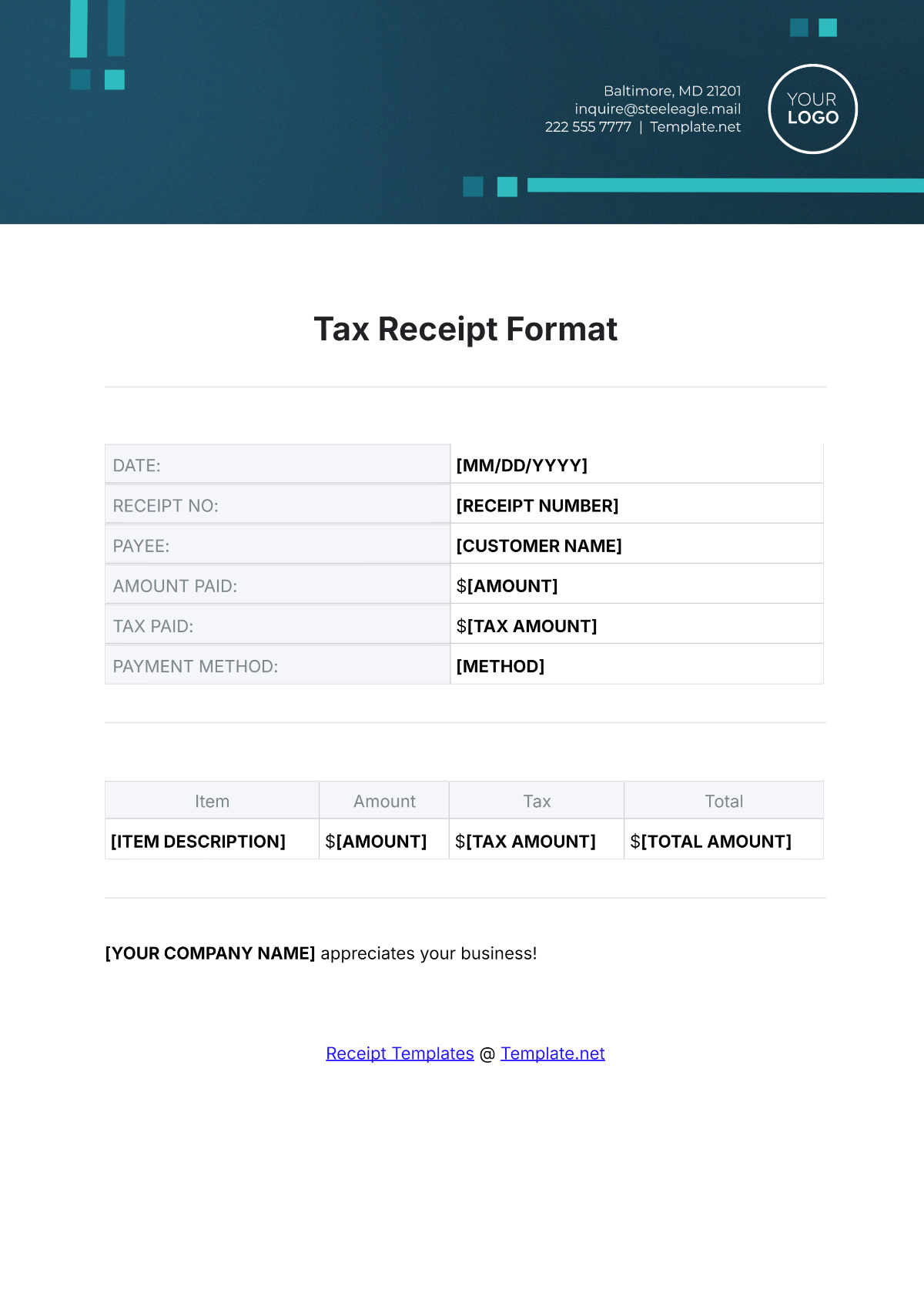

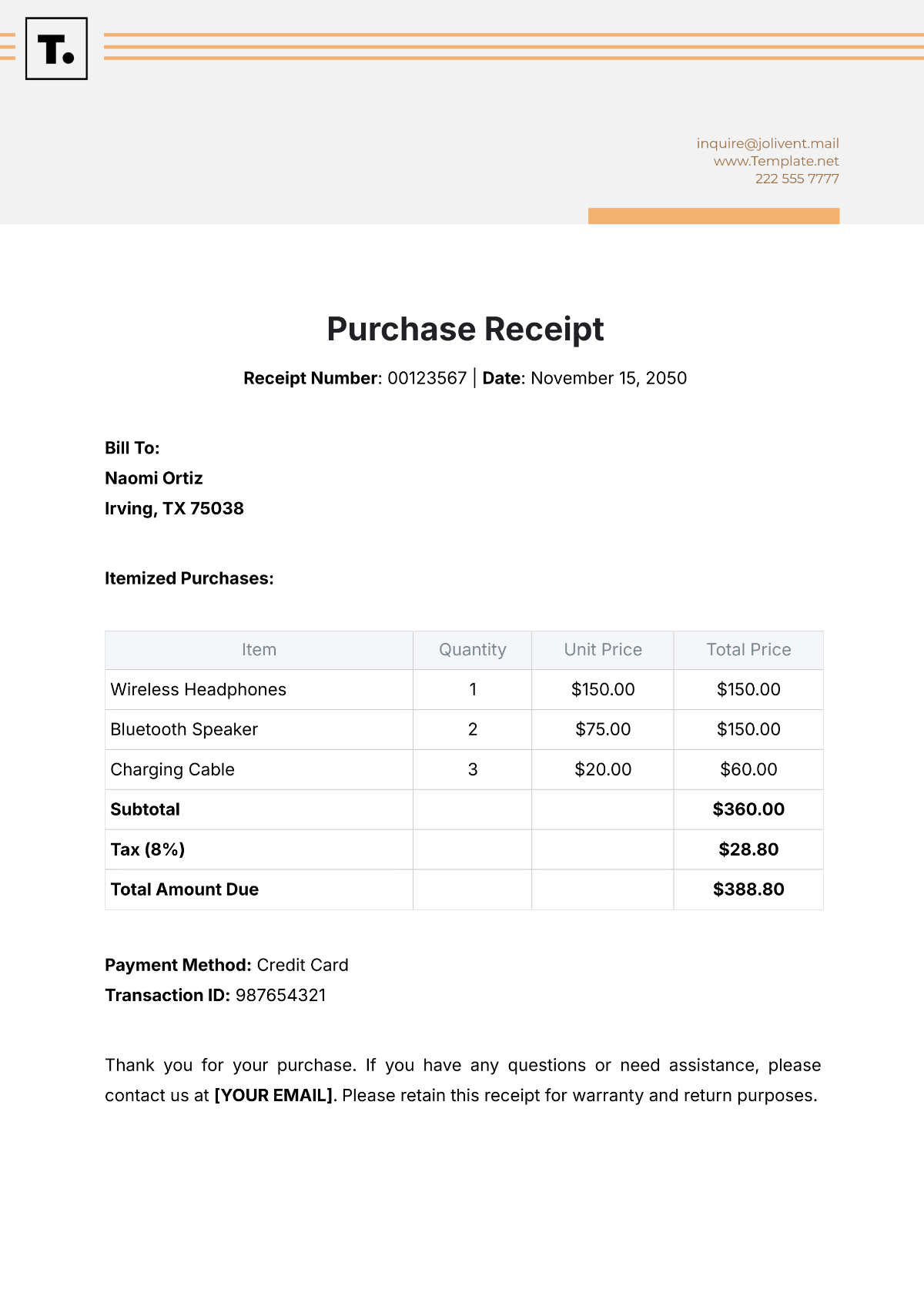

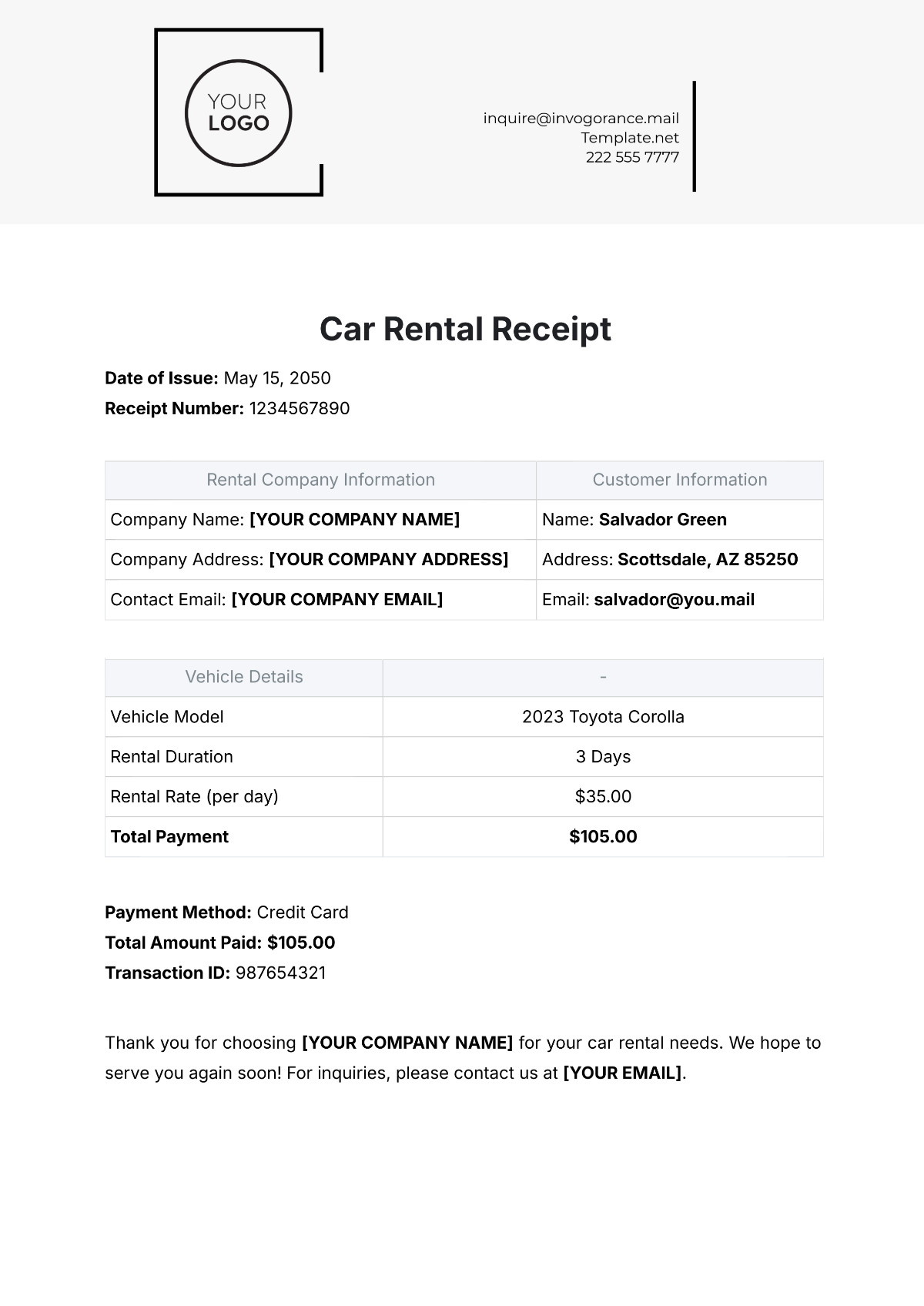

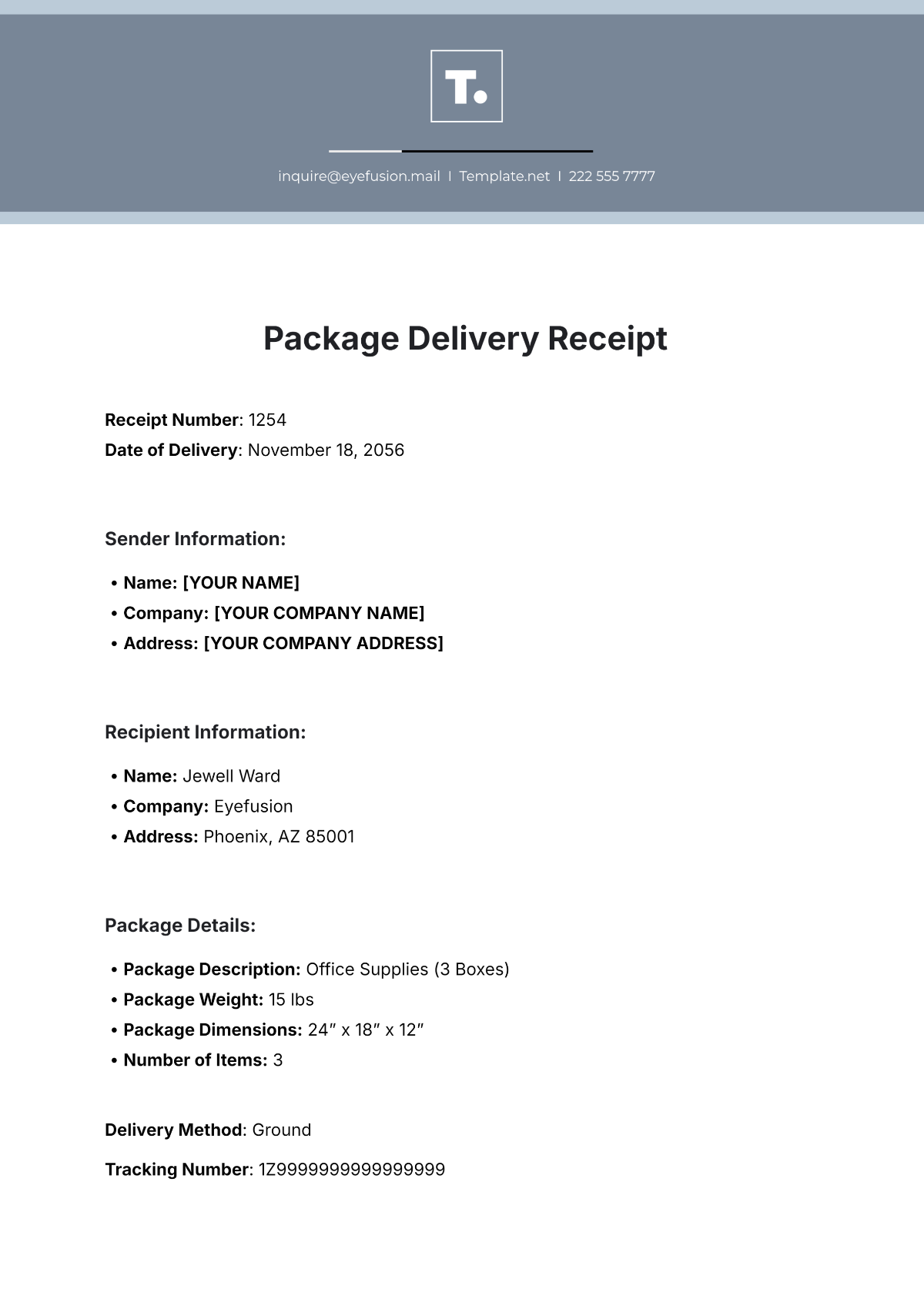

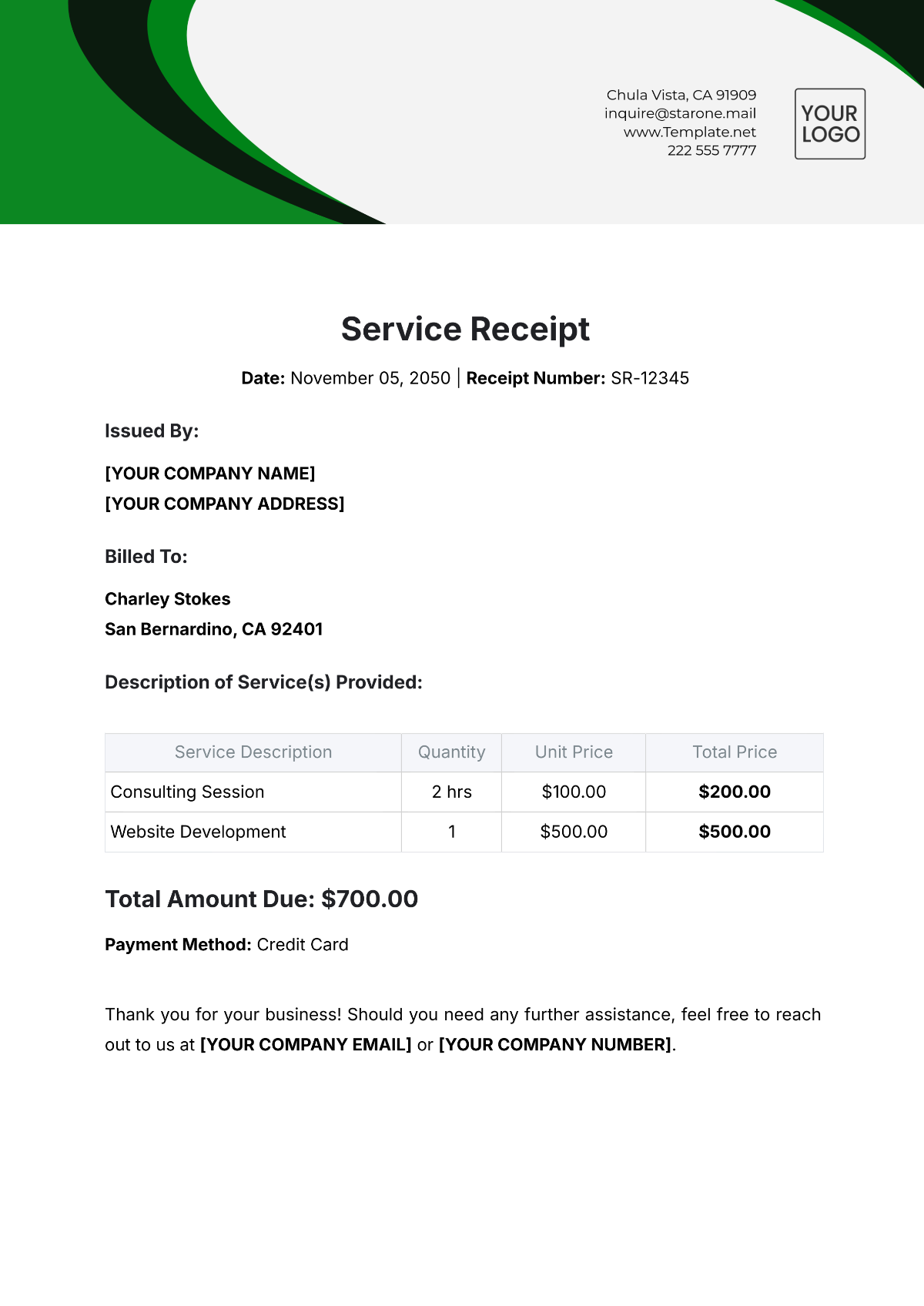

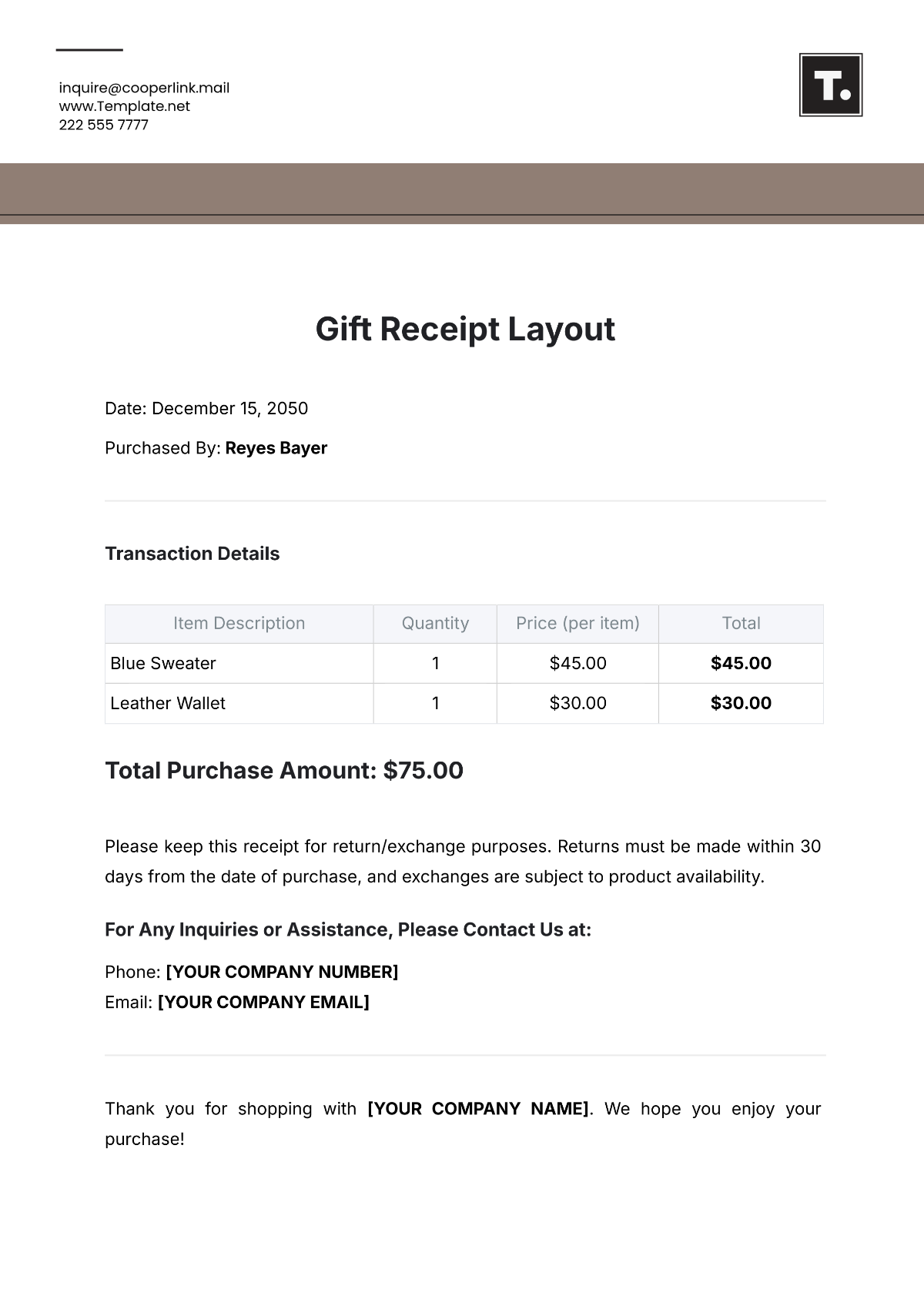

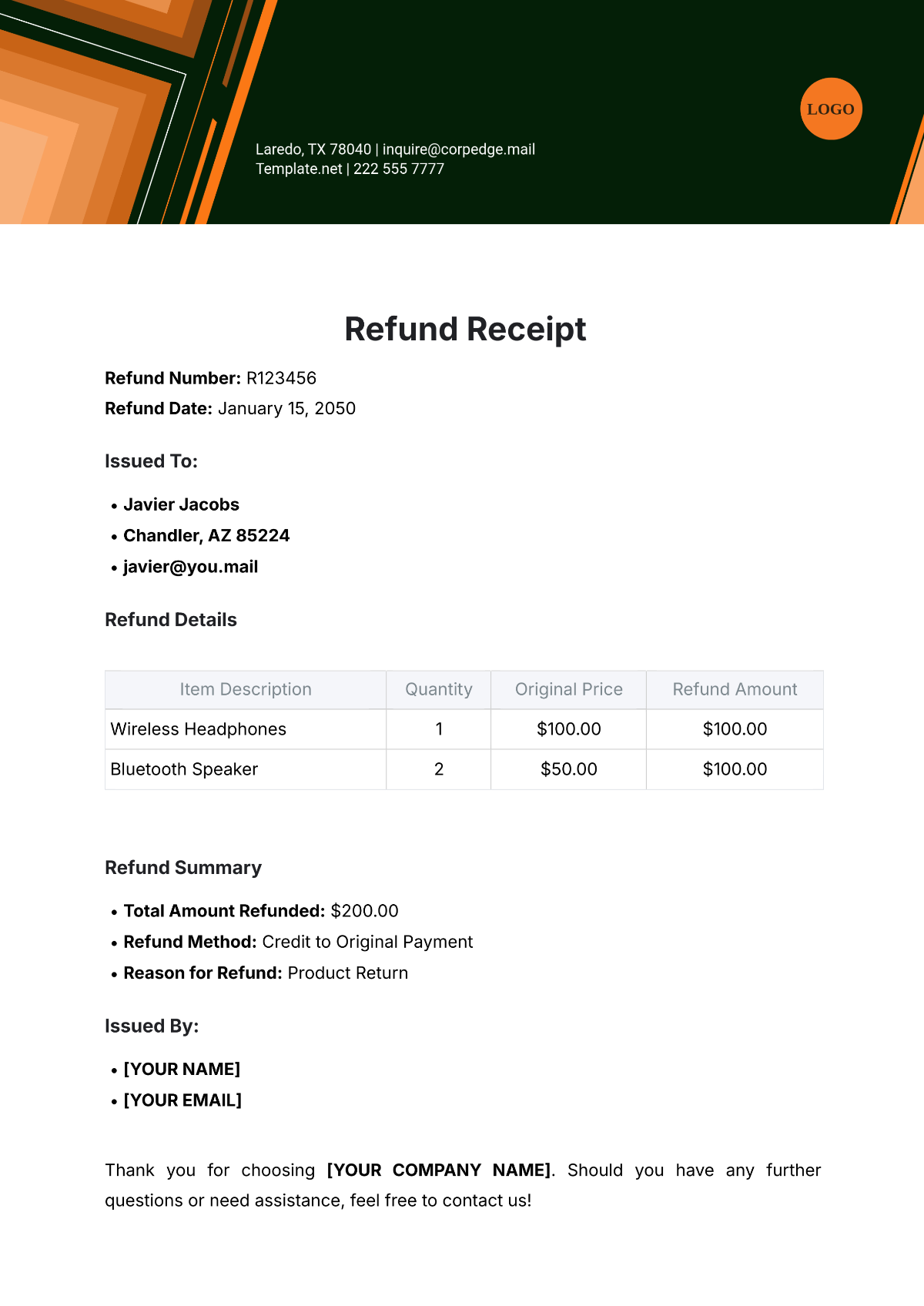

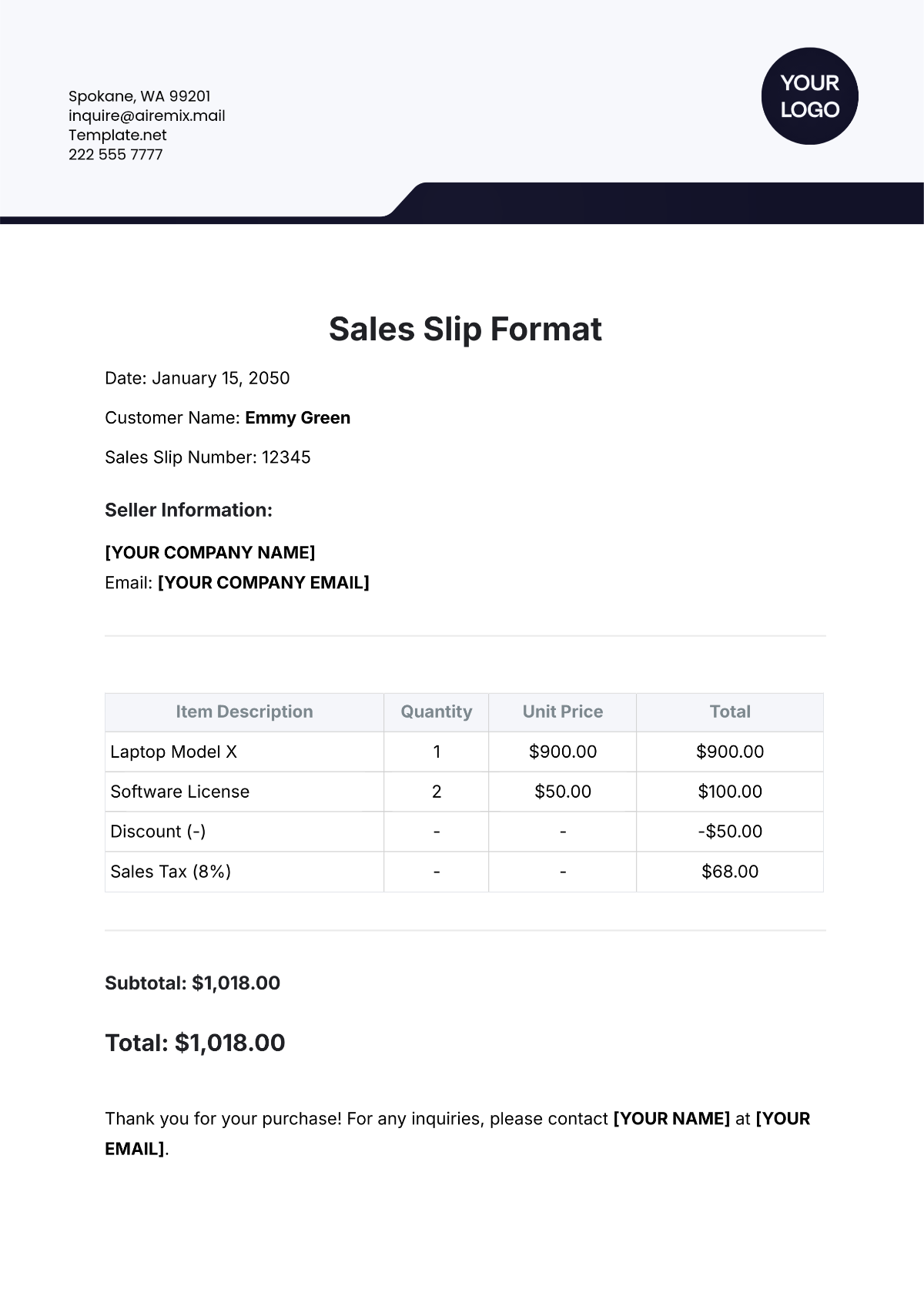

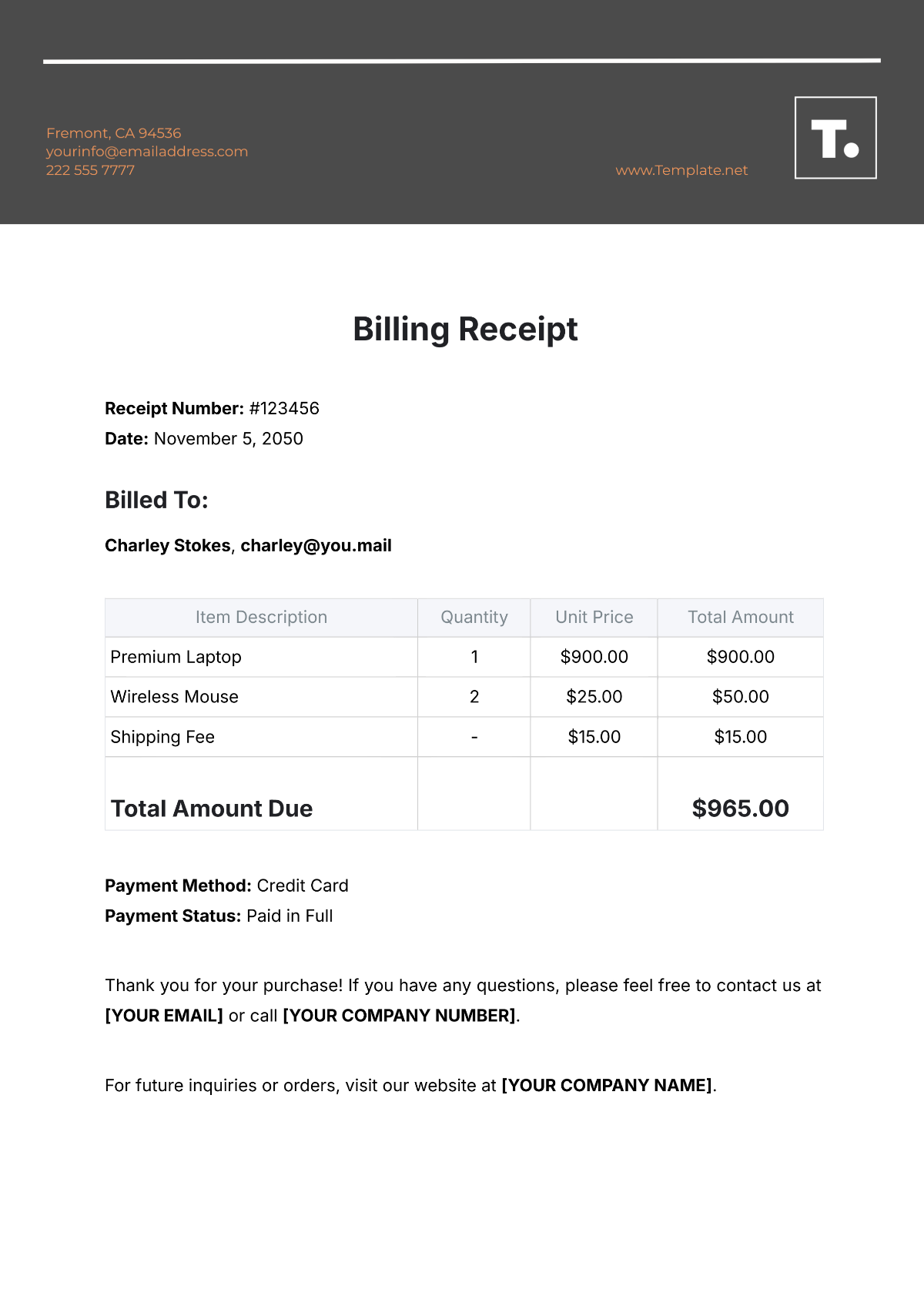

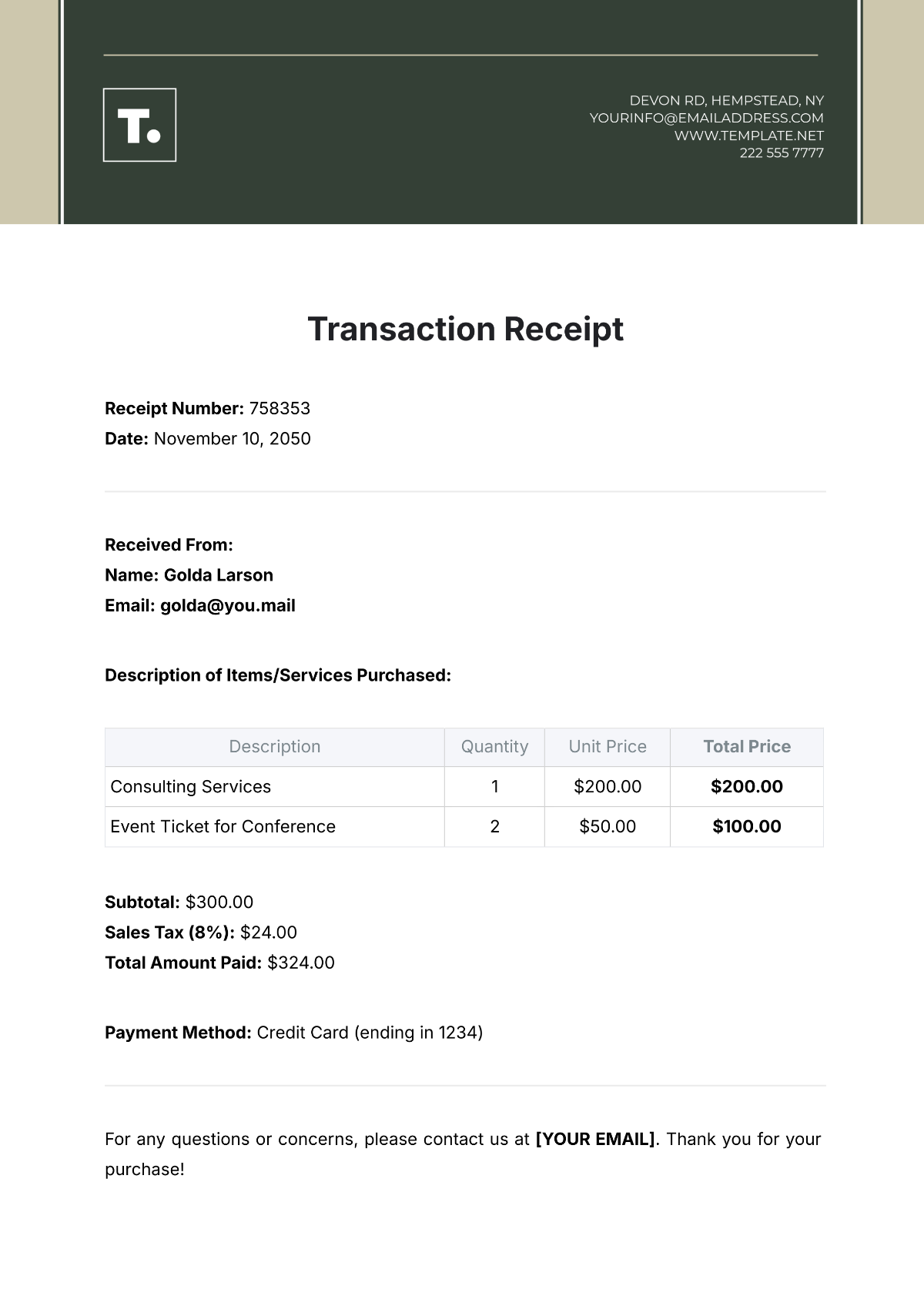

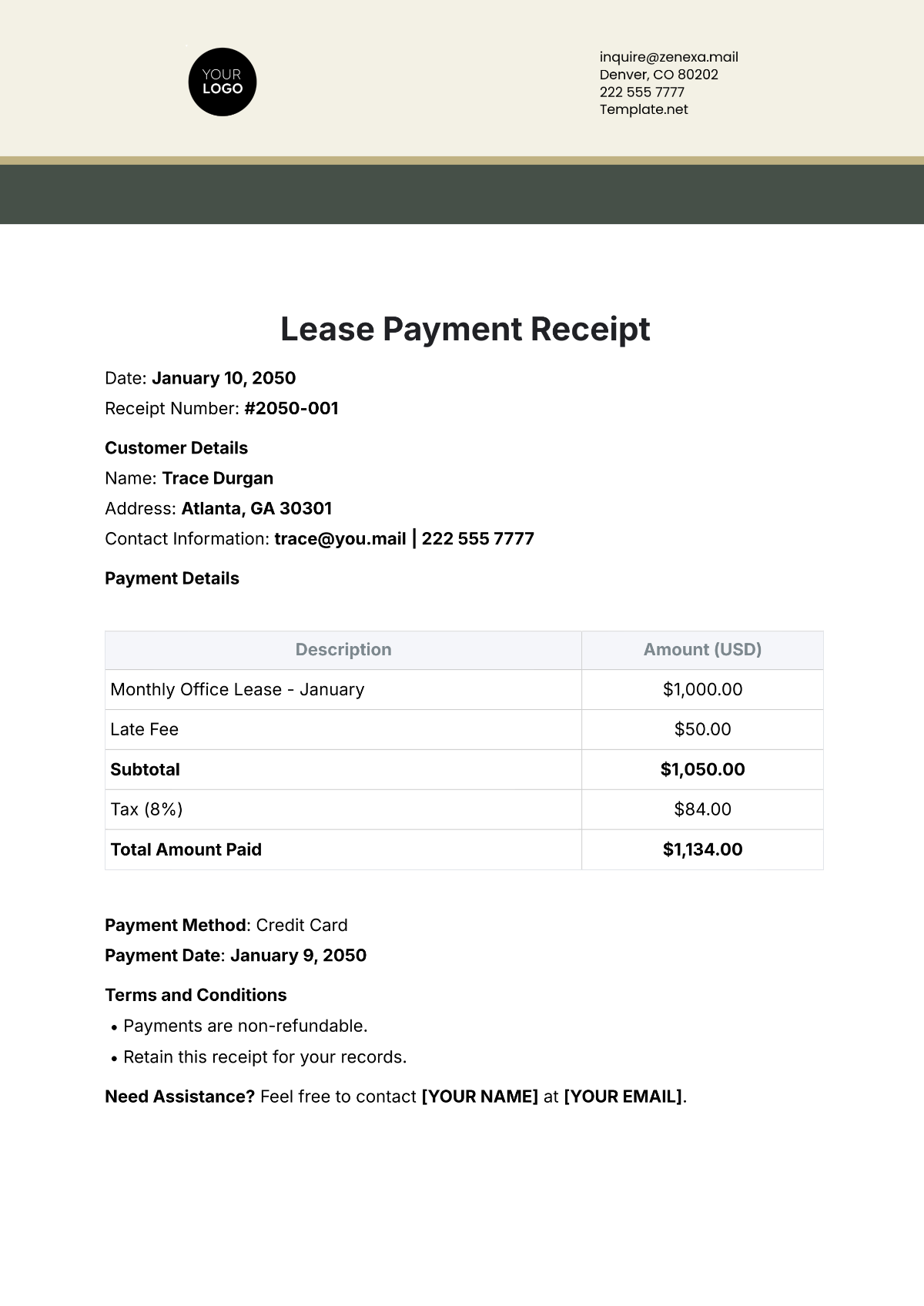

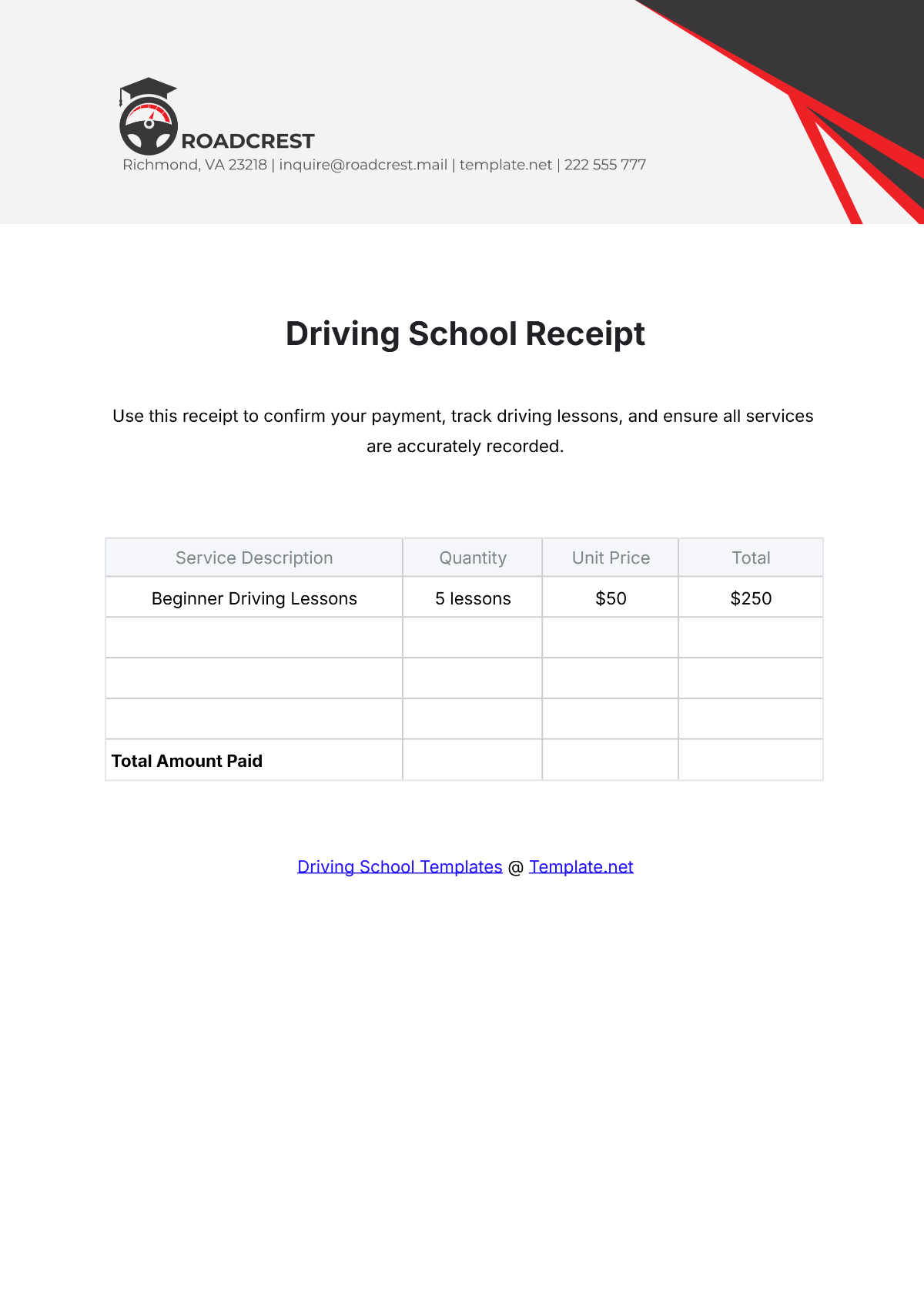

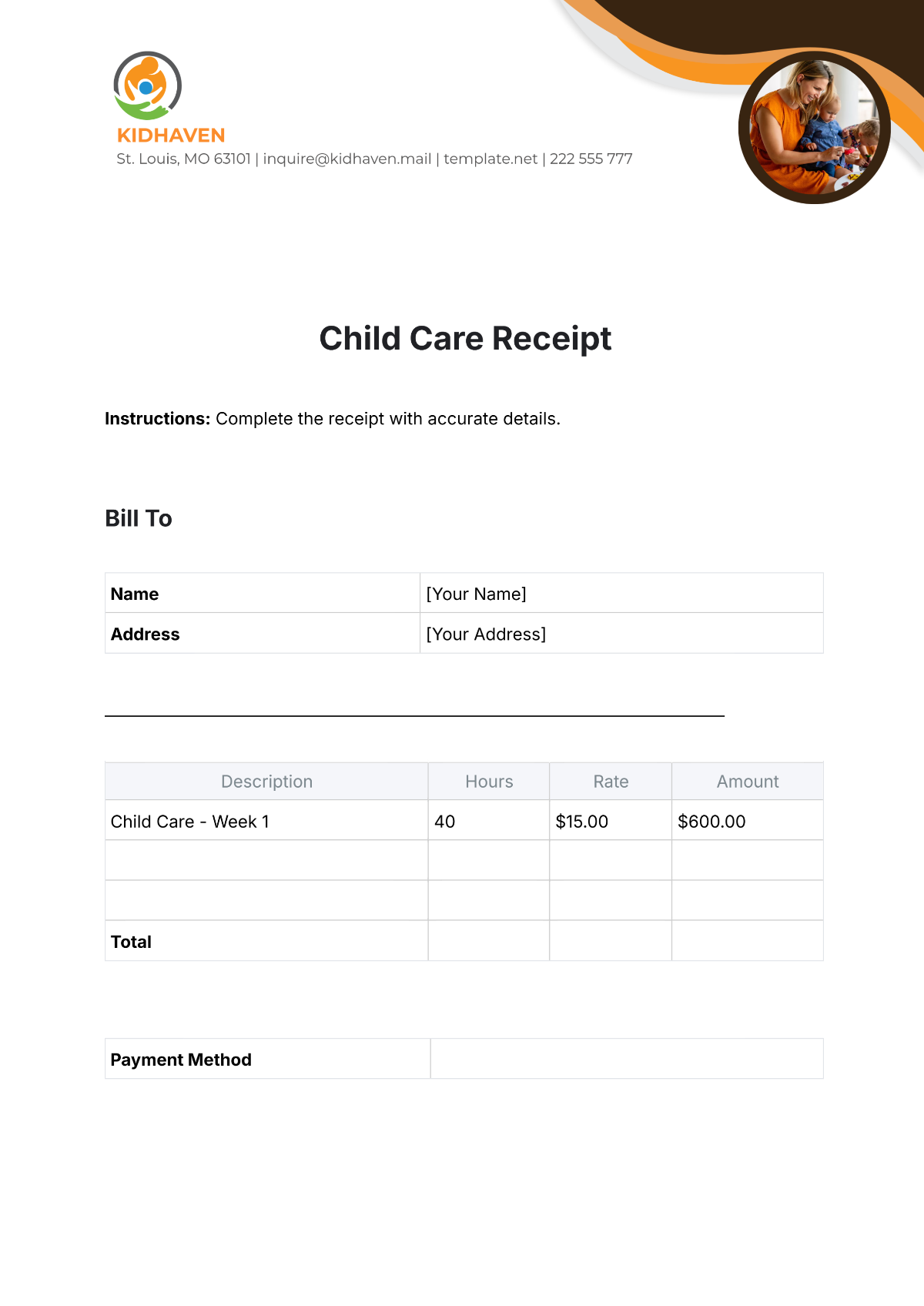

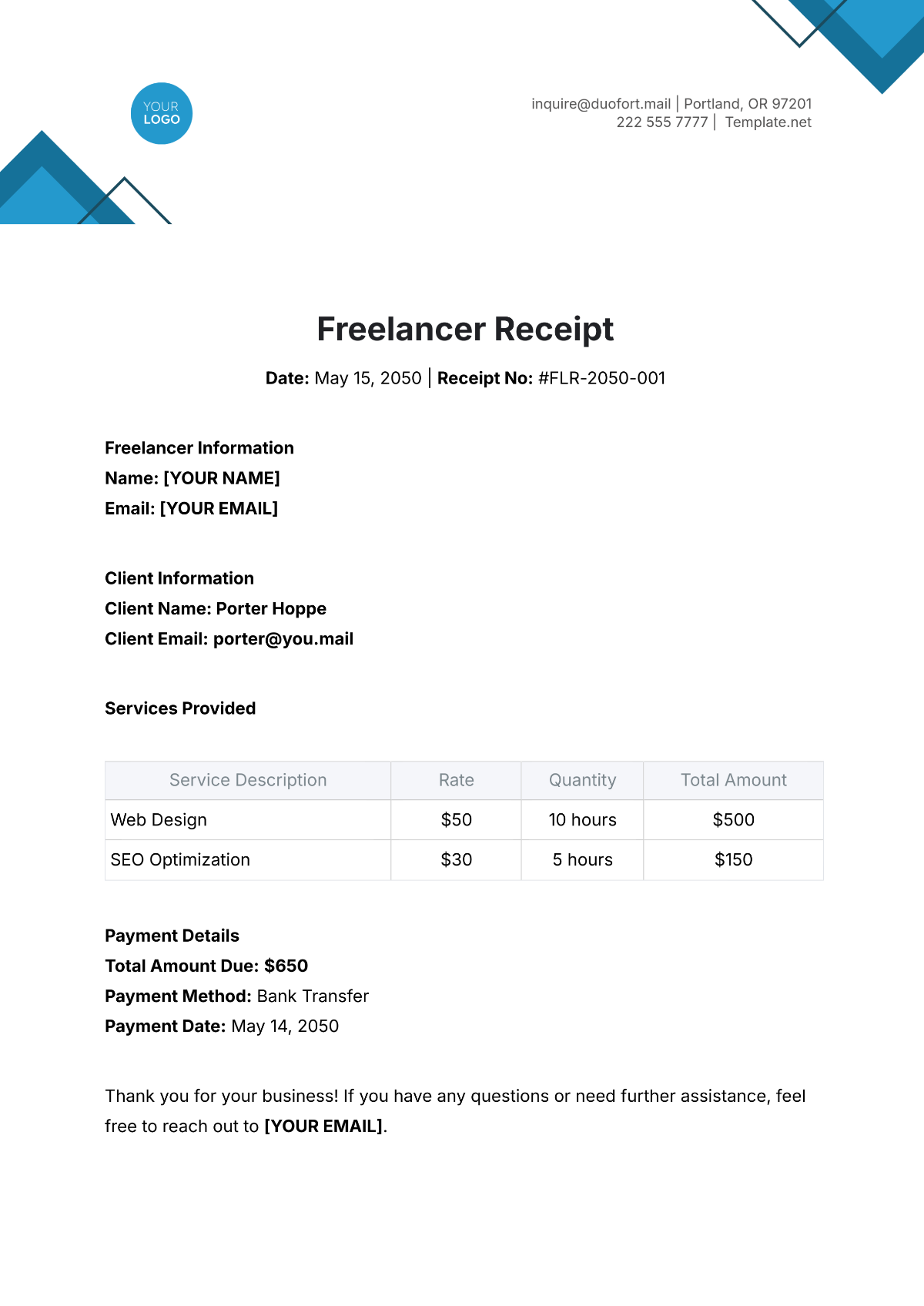

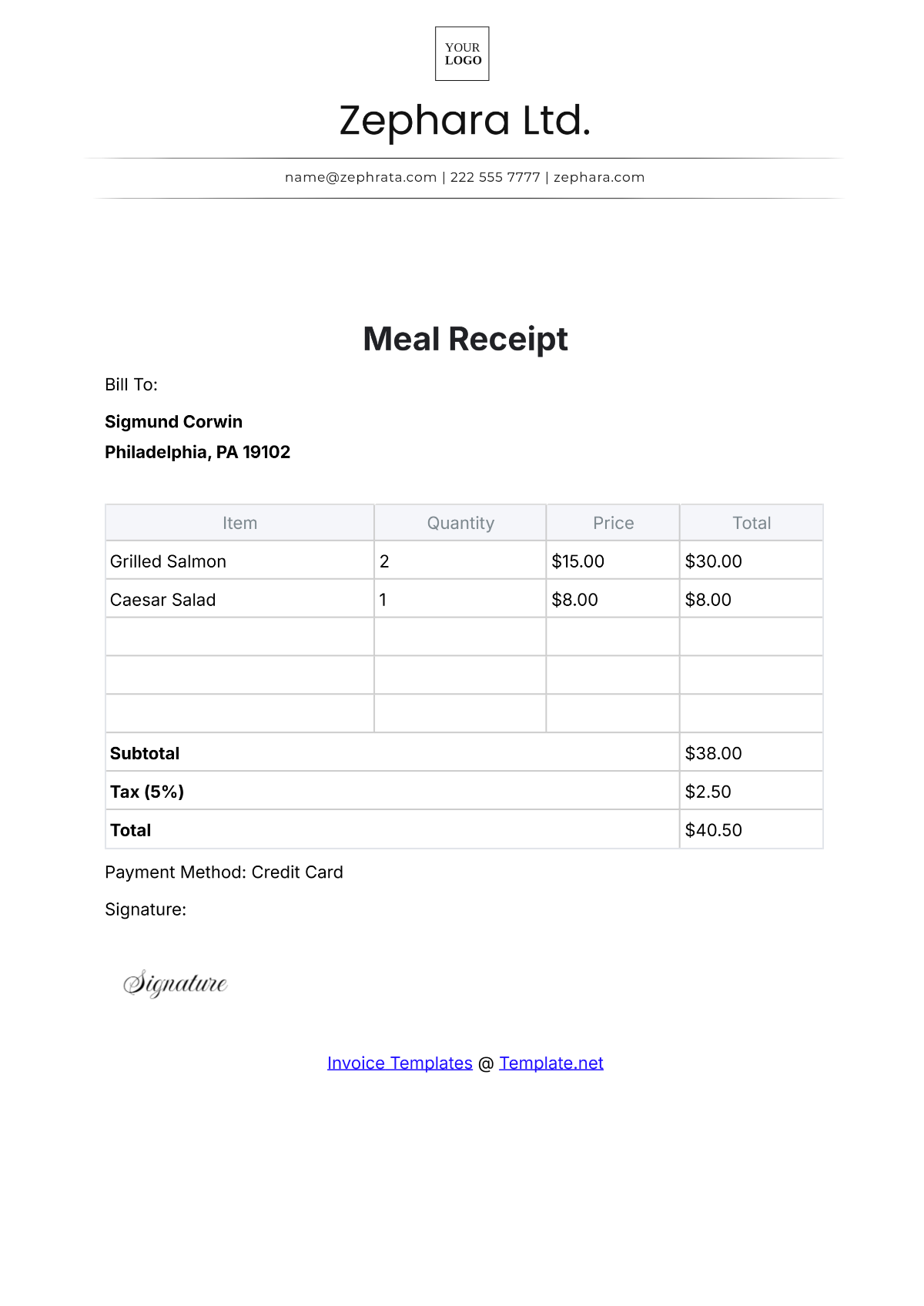

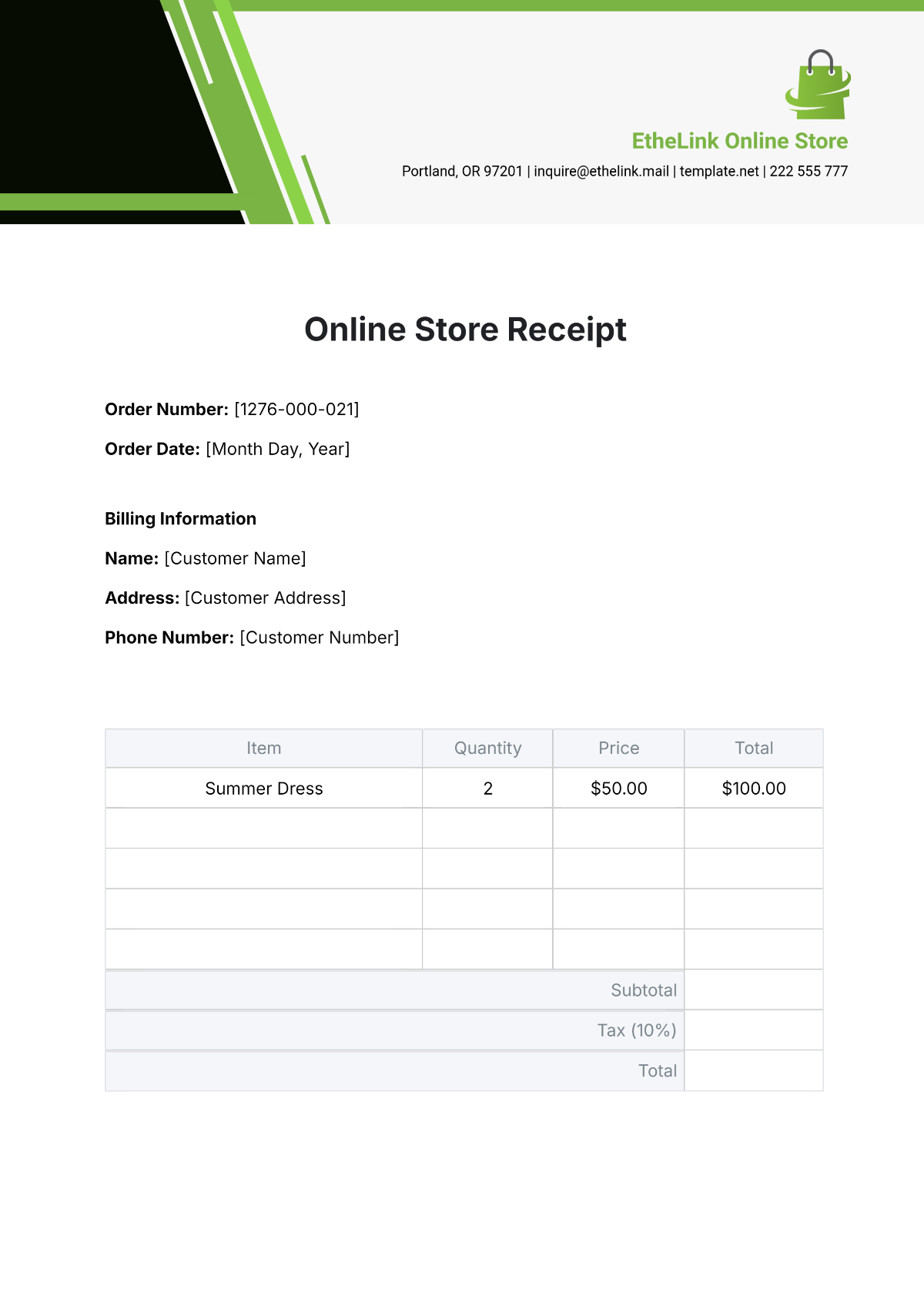

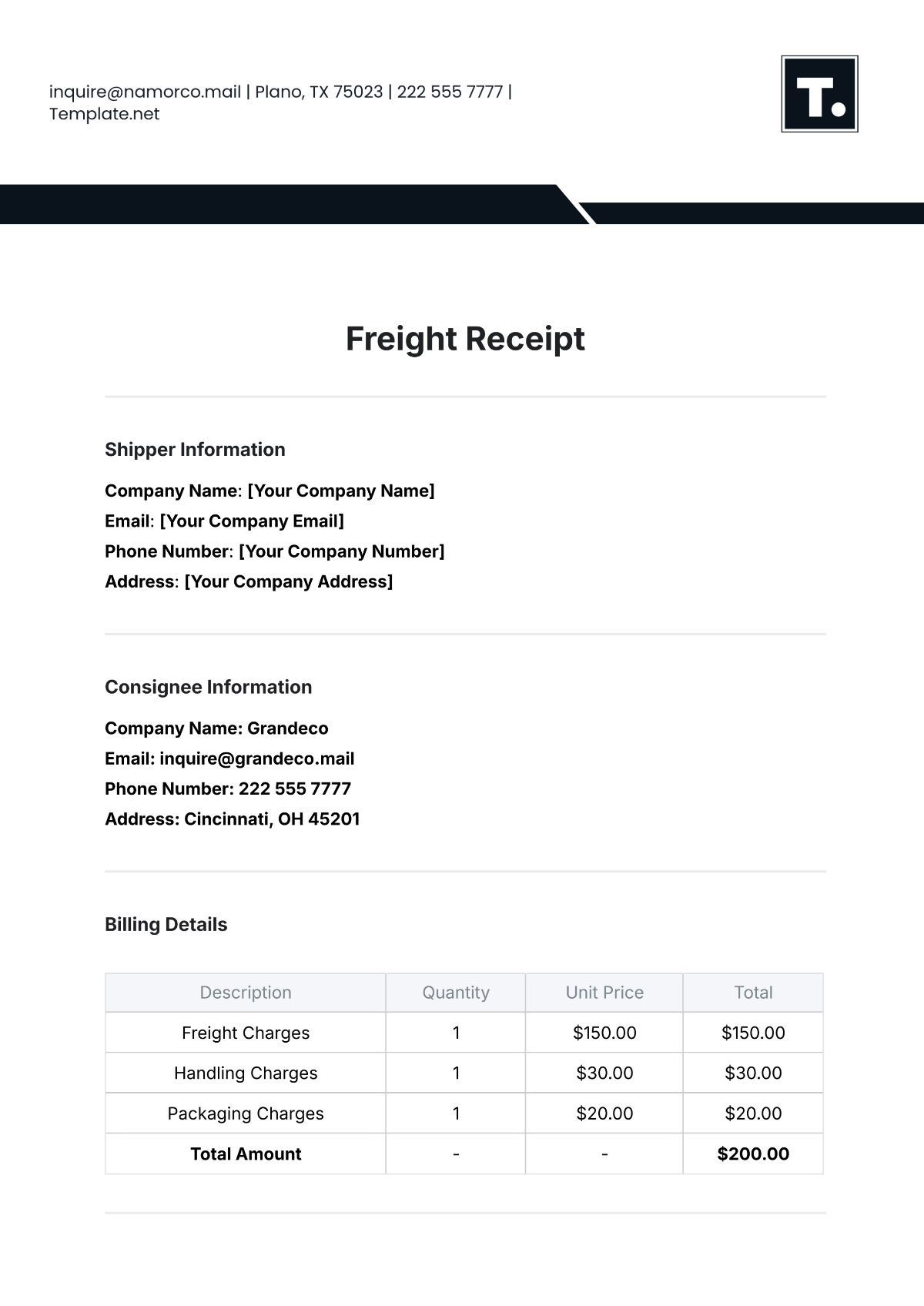

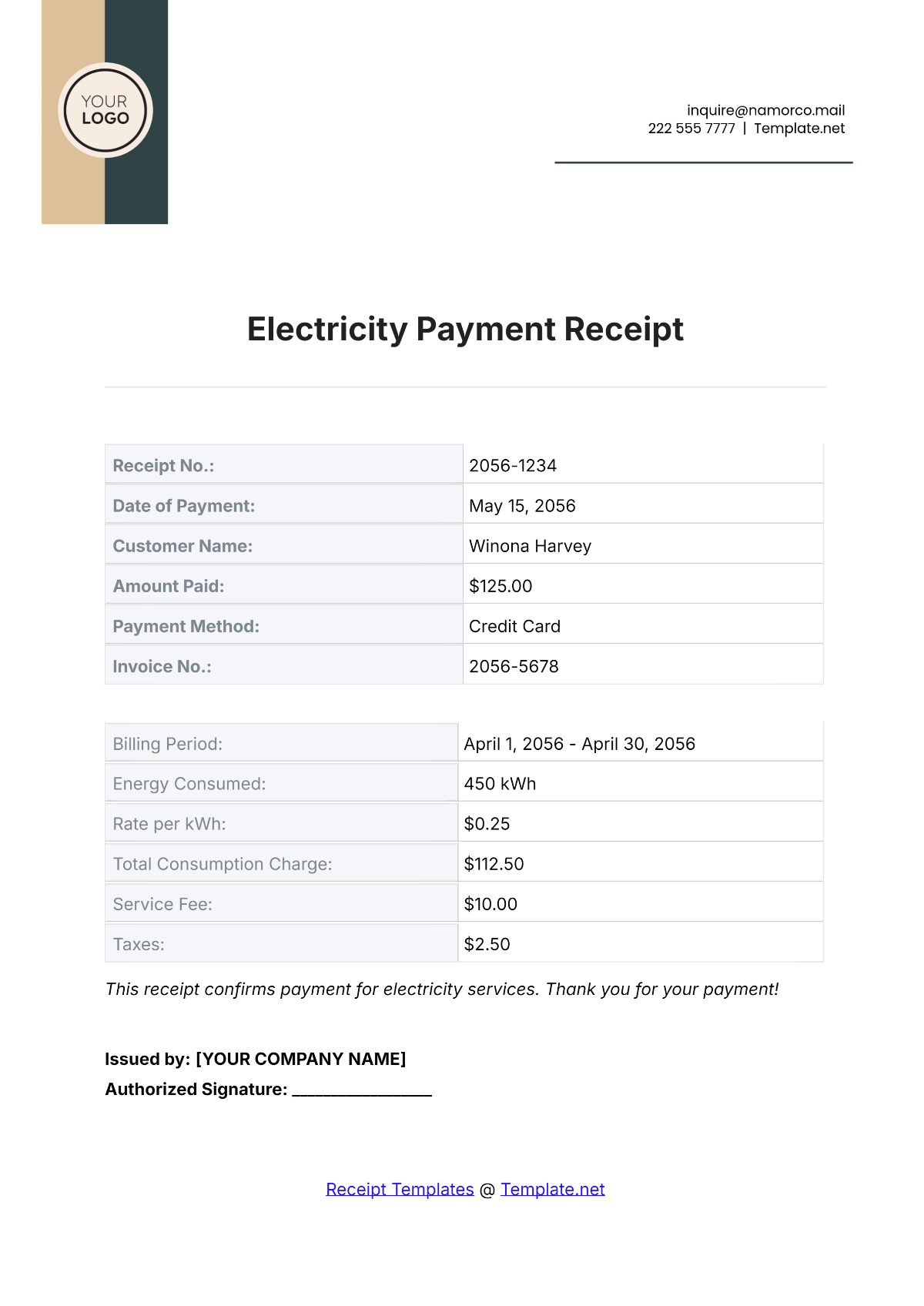

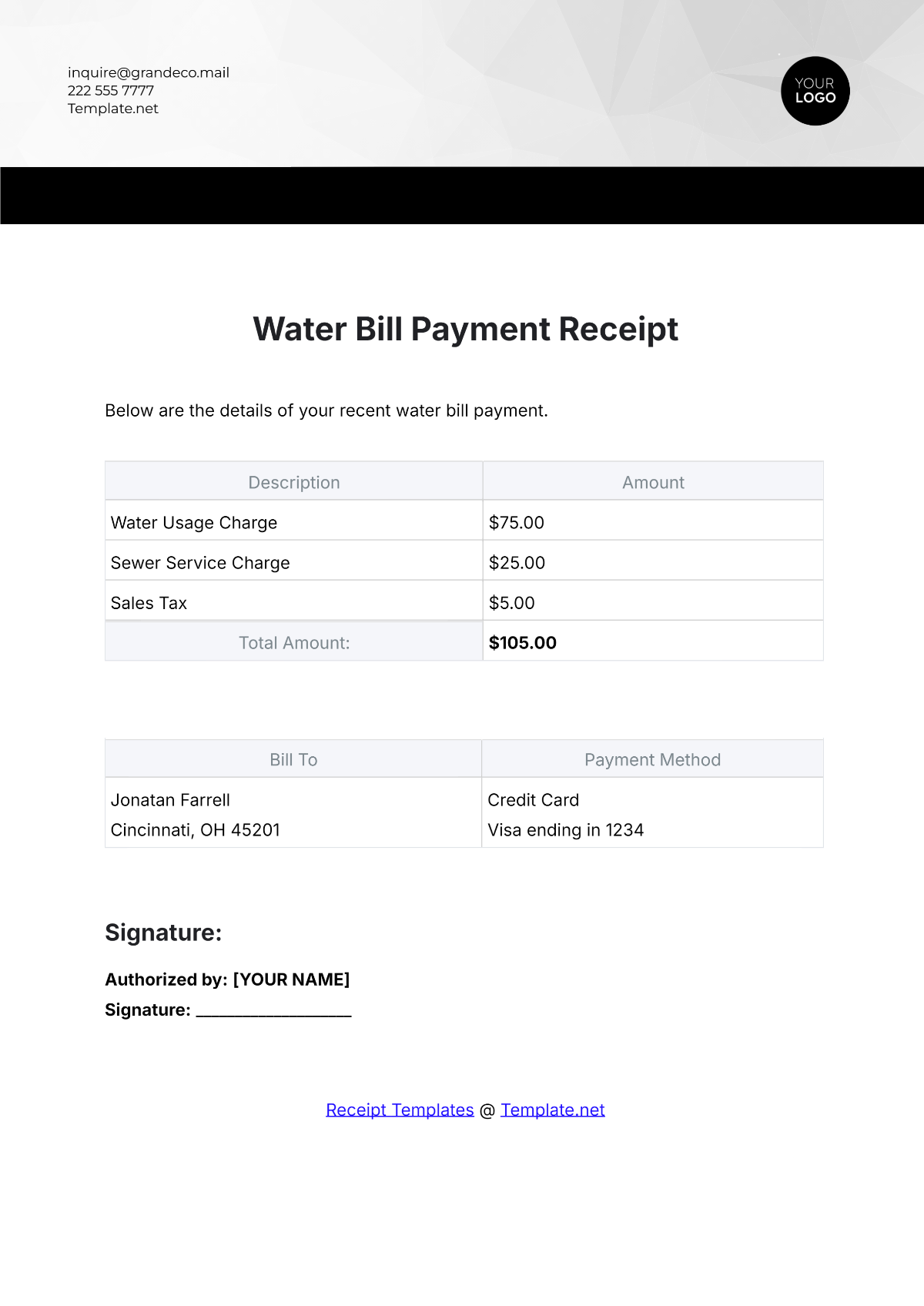

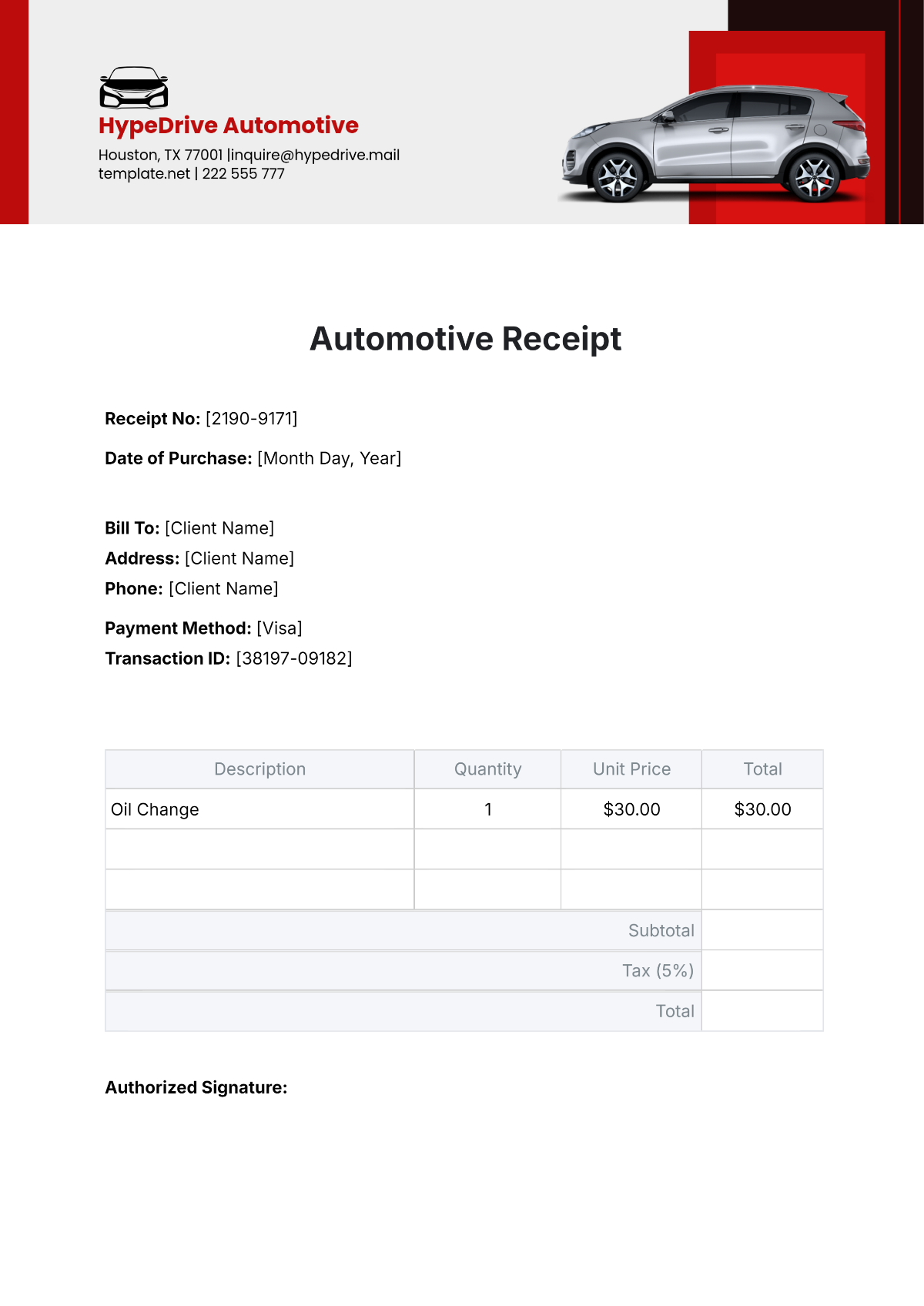

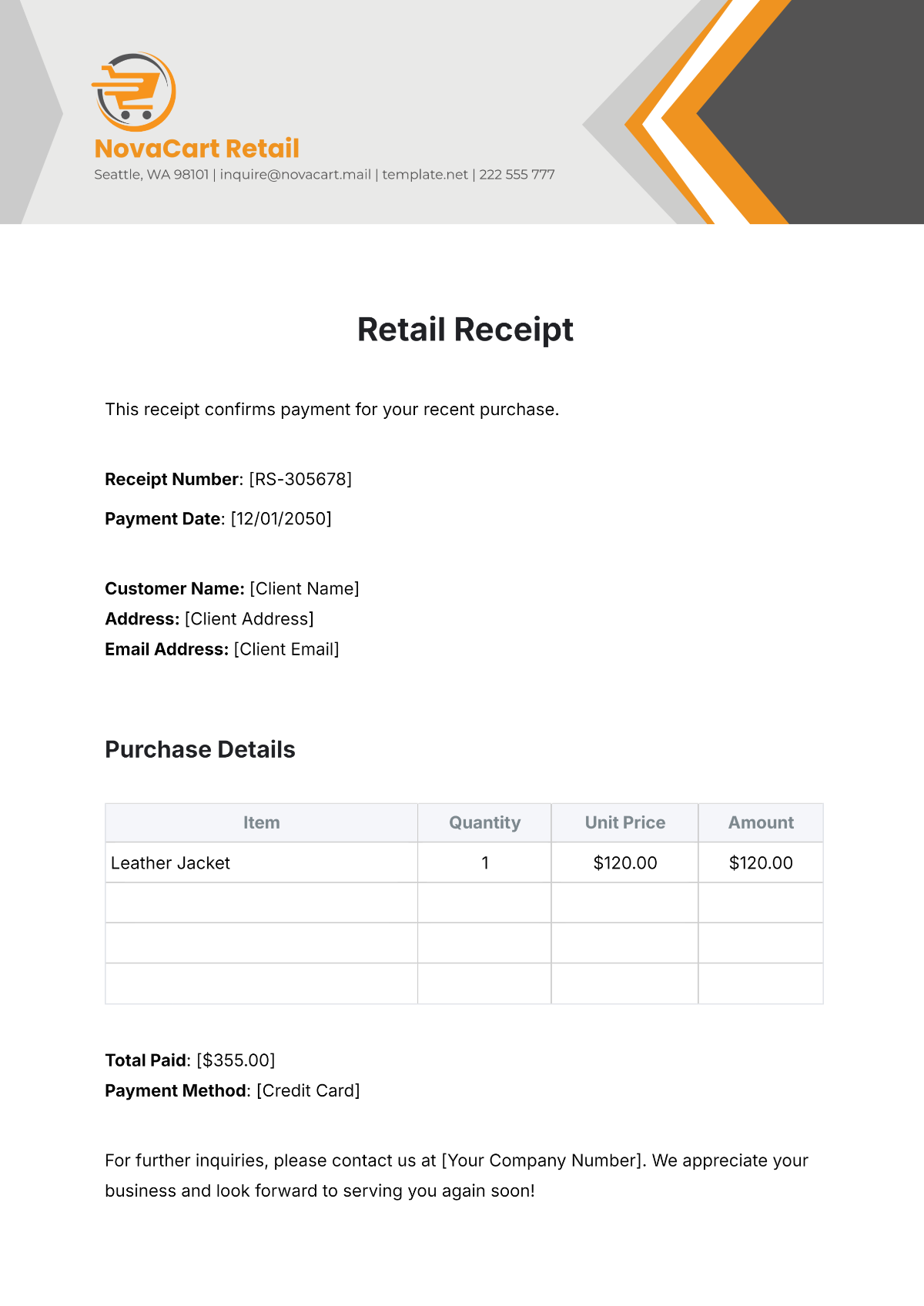

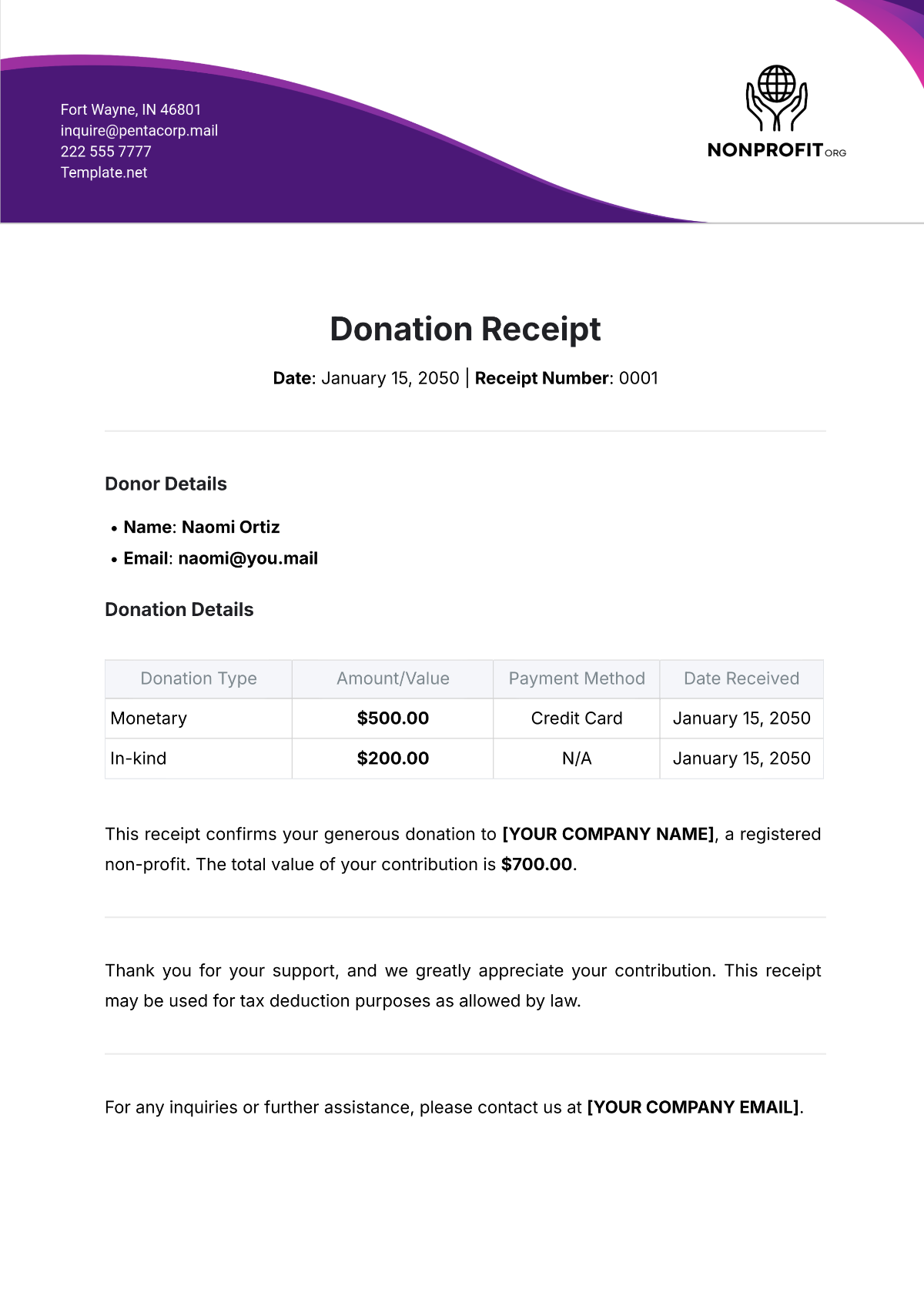

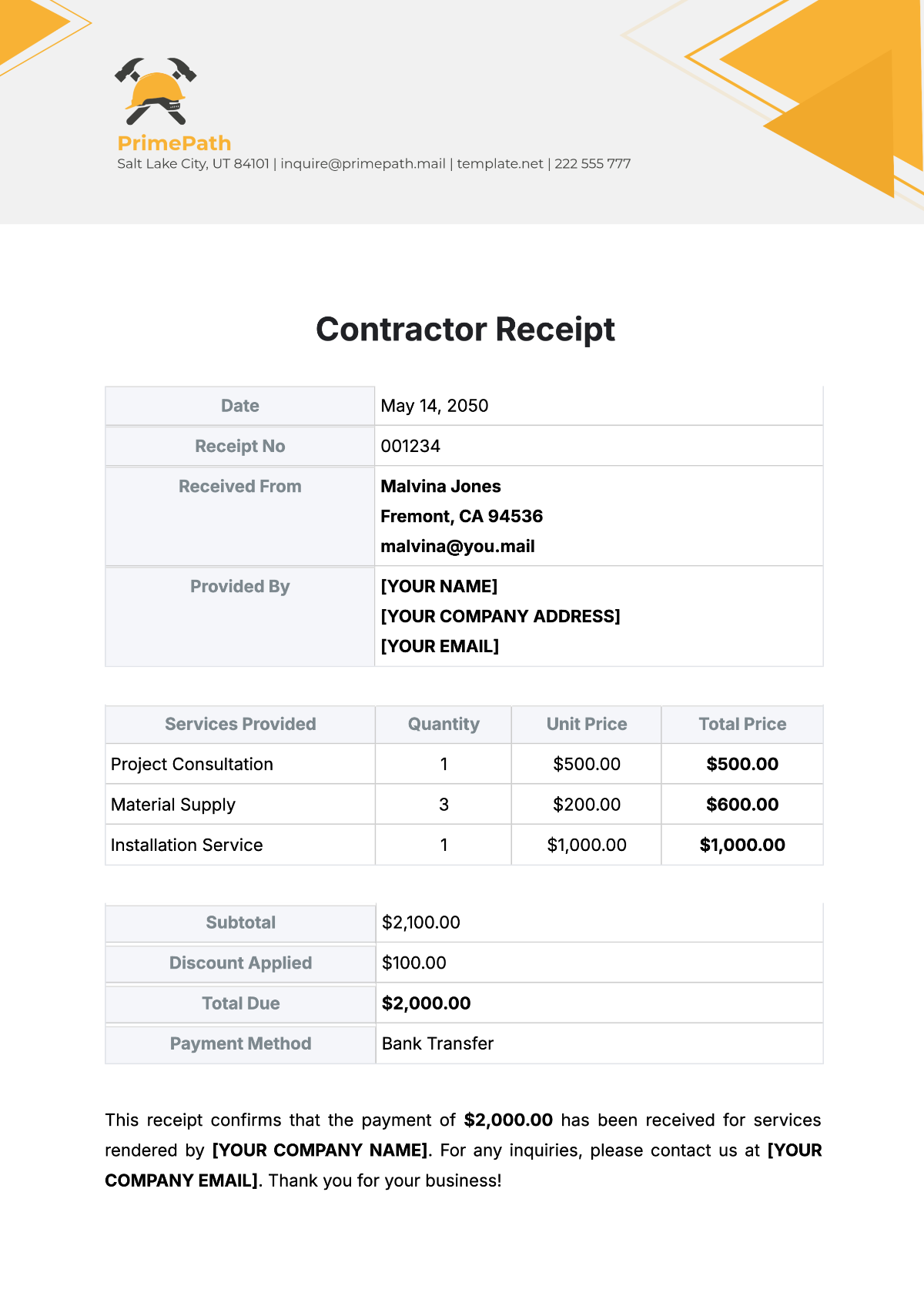

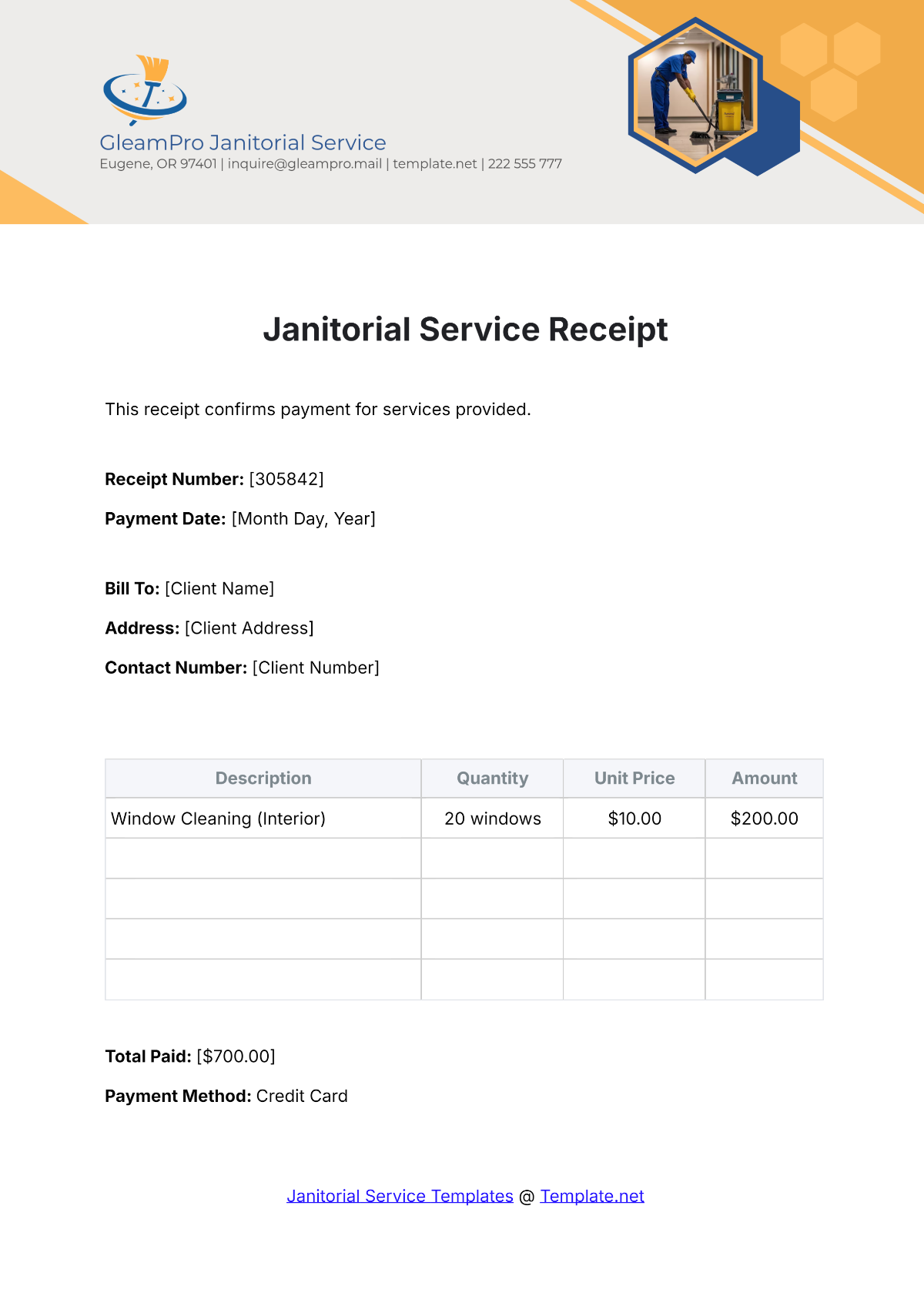

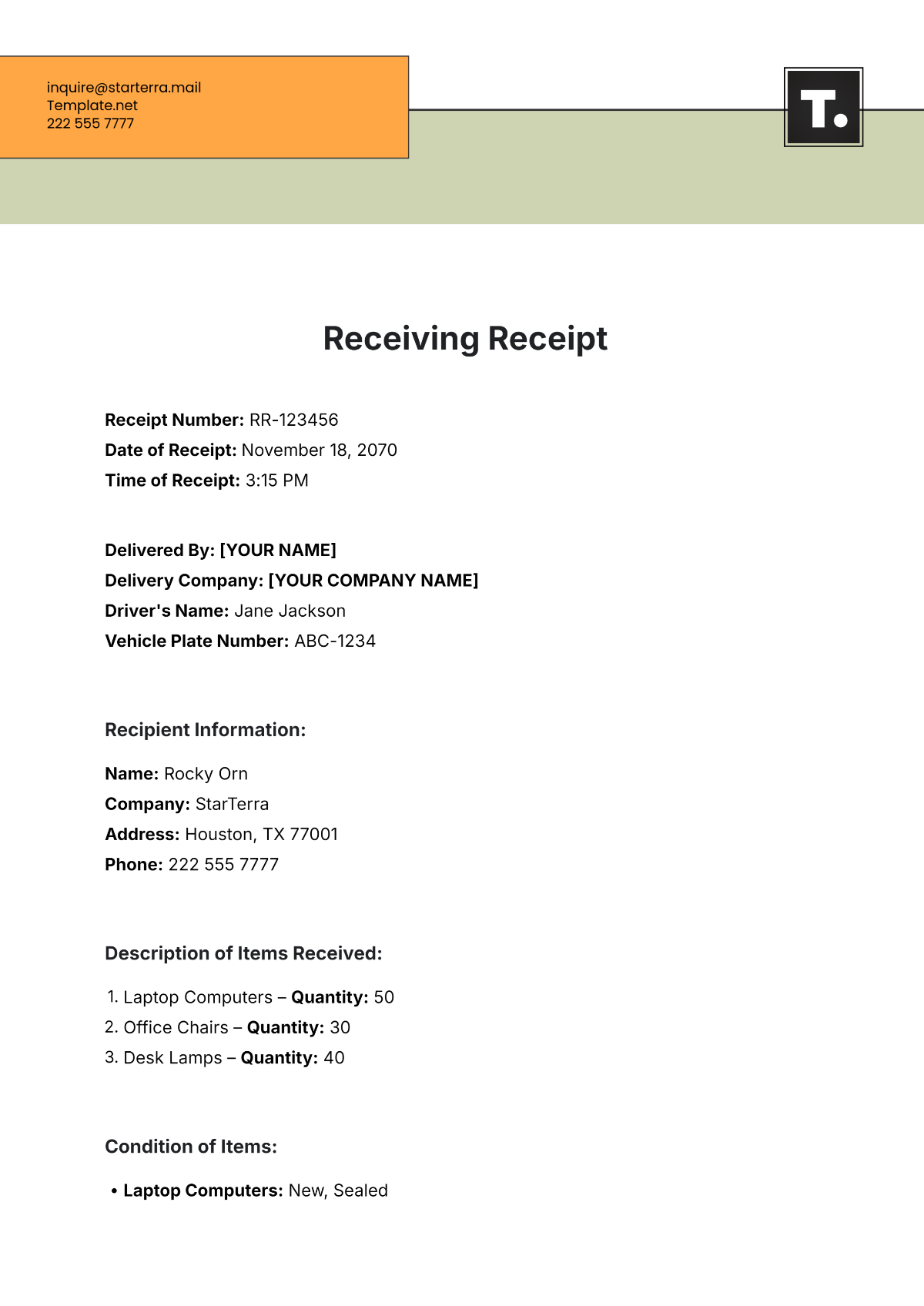

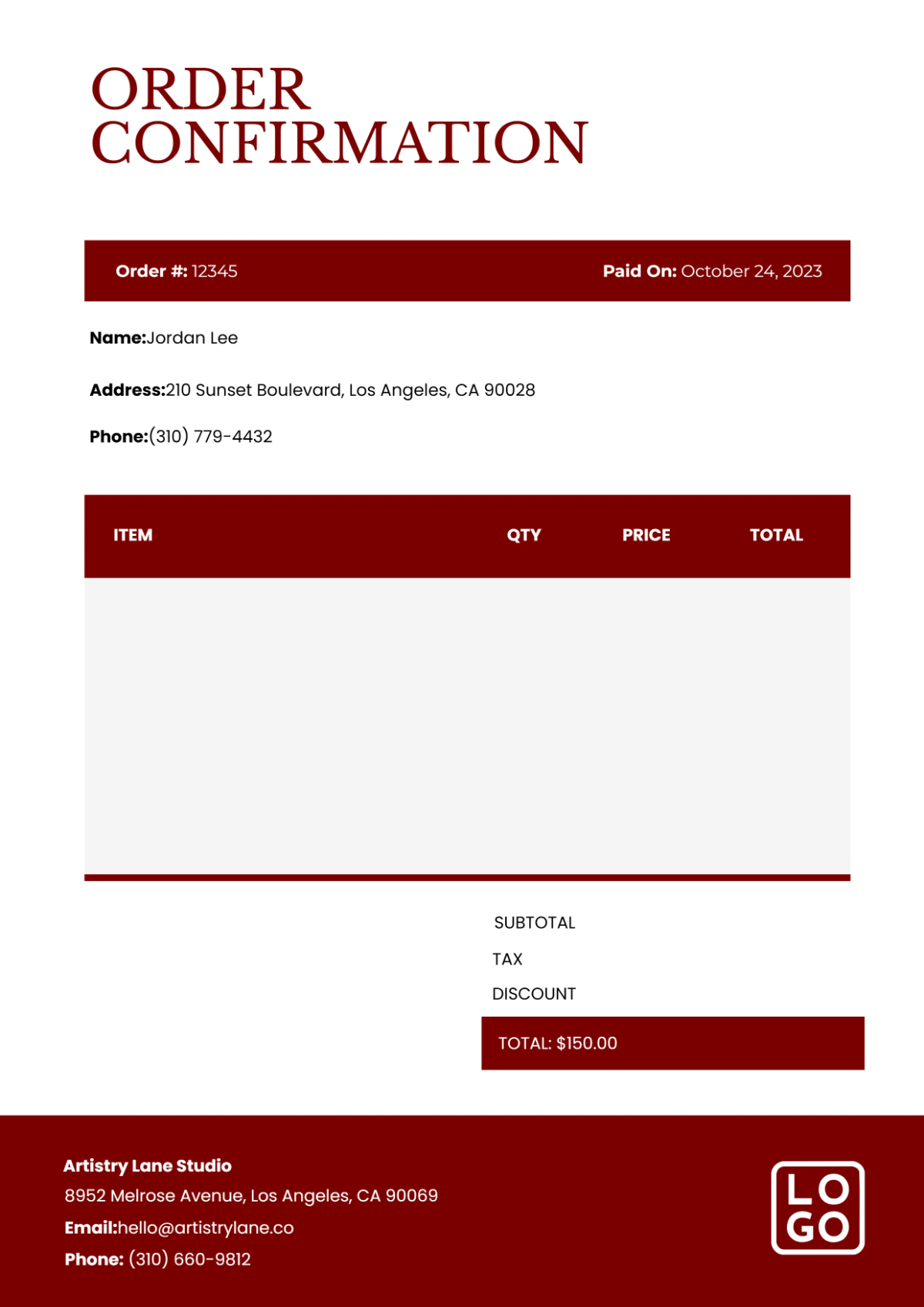

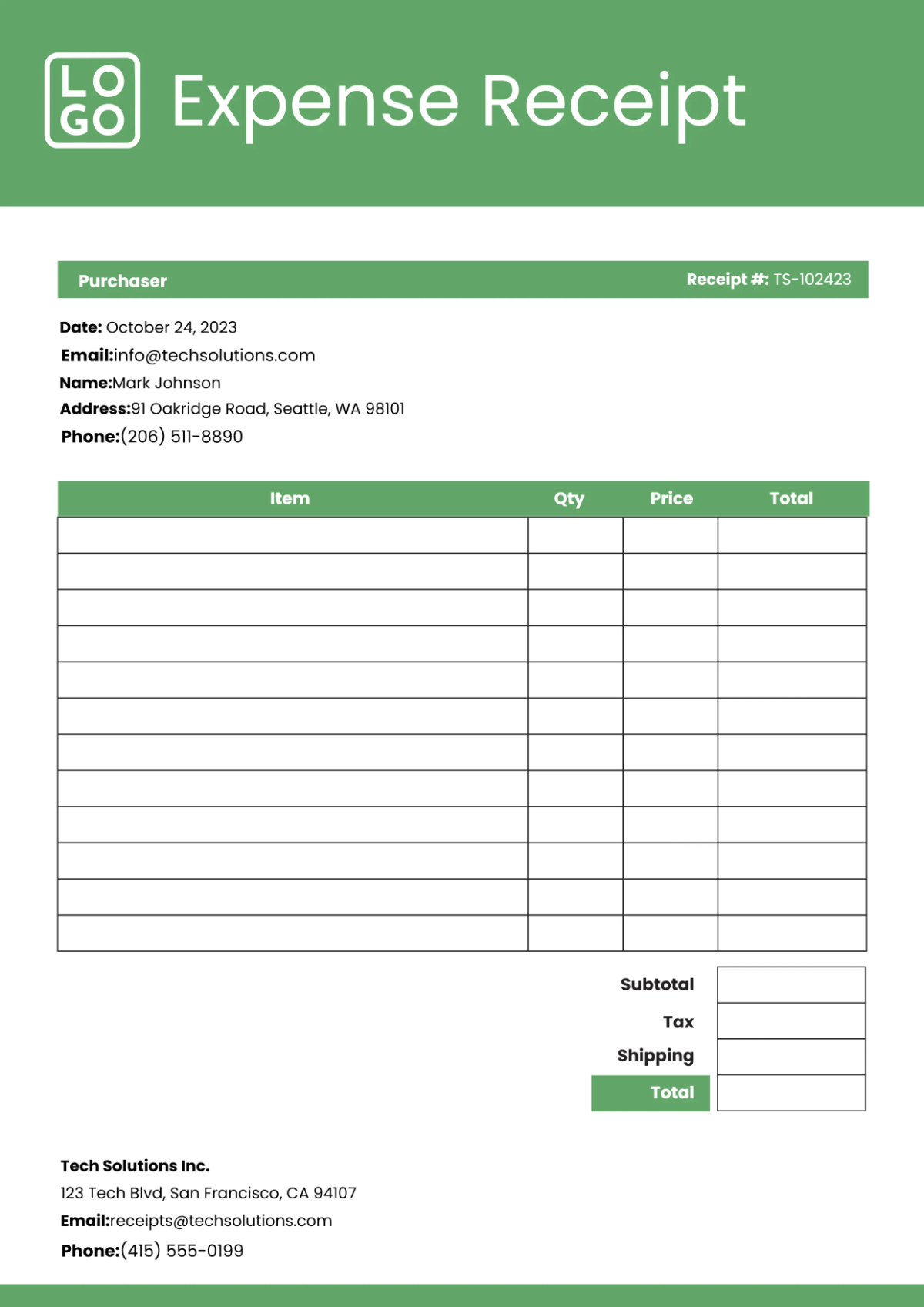

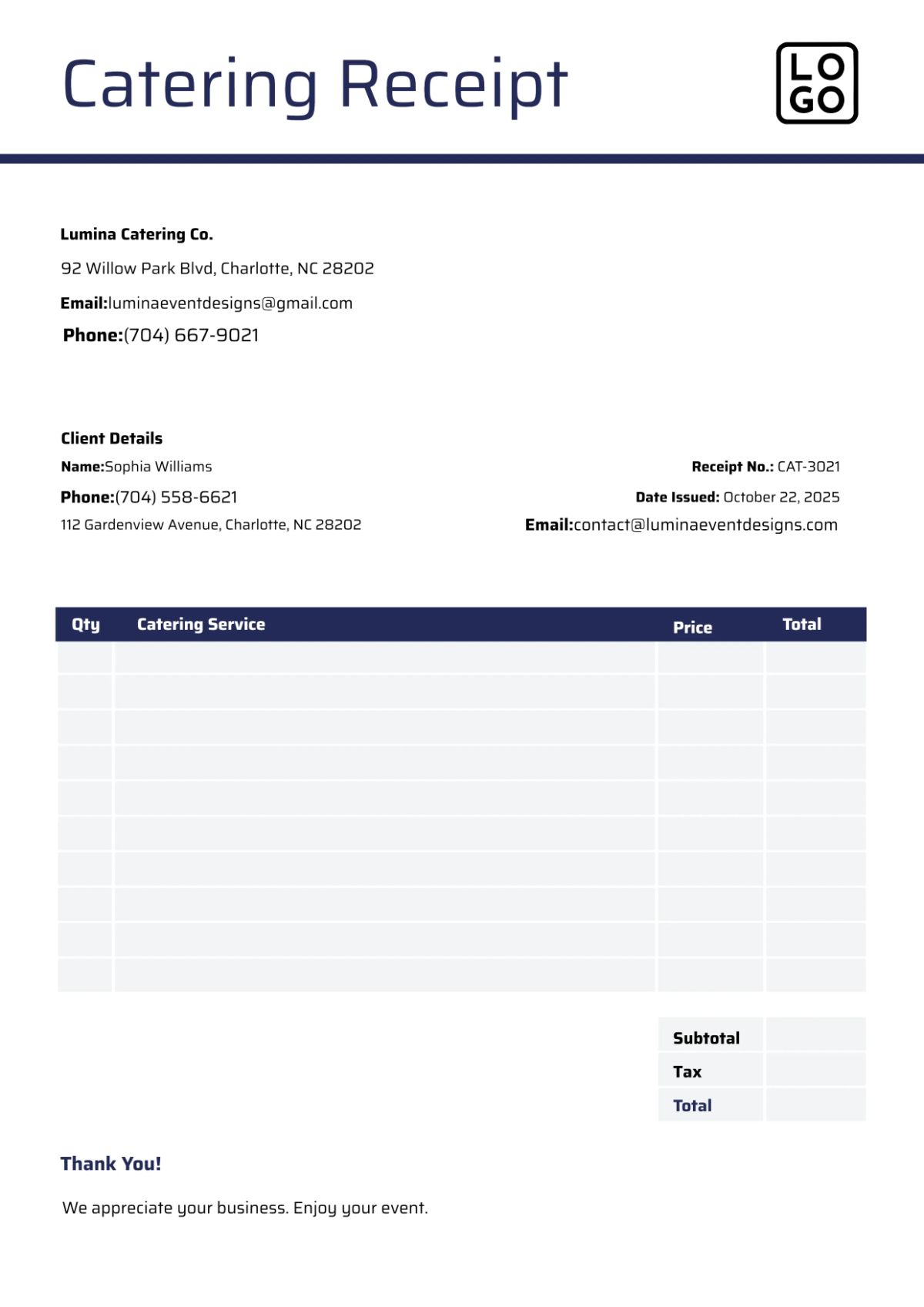

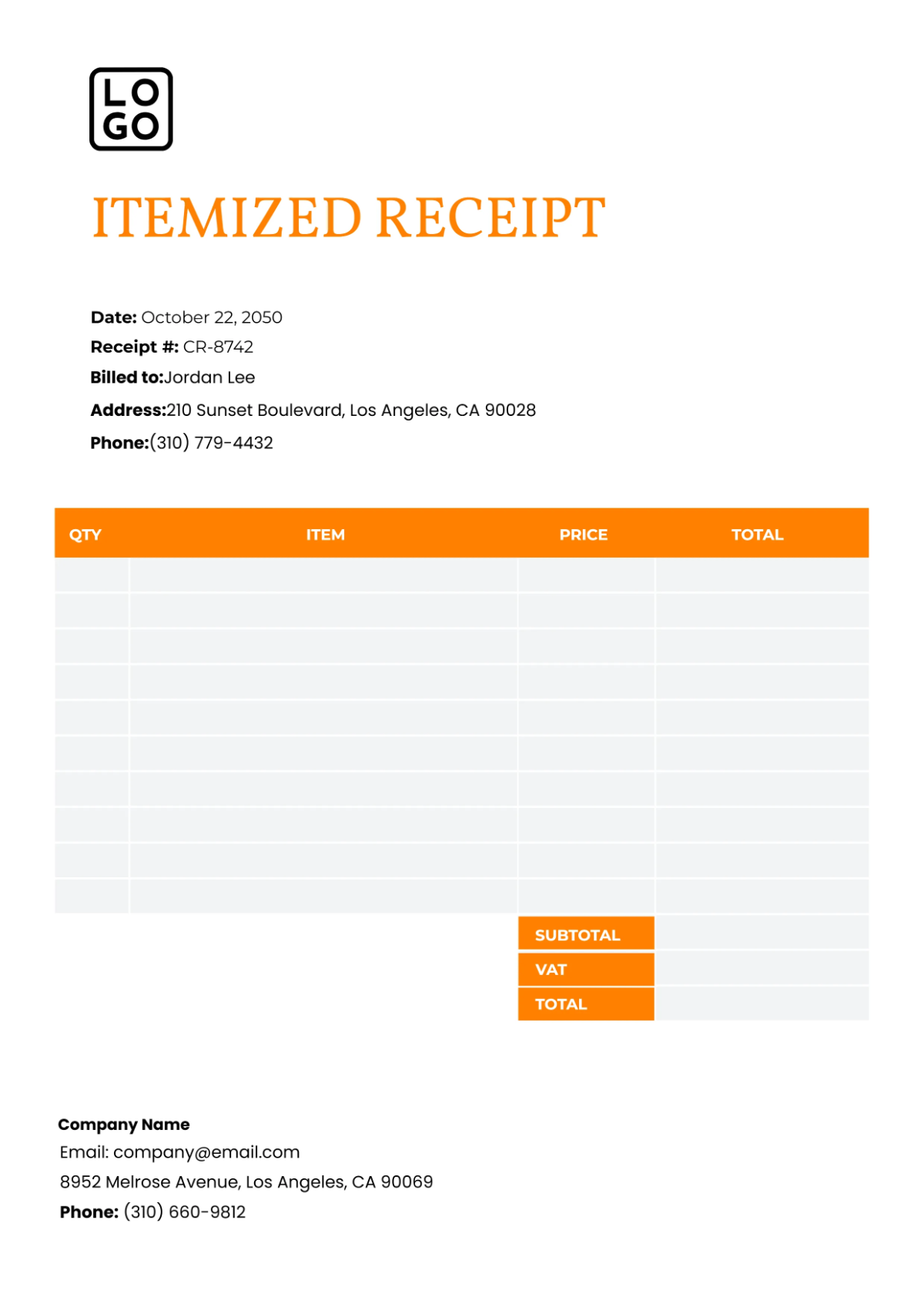

Keep your business operations smooth and organized with Receipt Templates from Template.net. These templates are ideal for small business owners, freelancers, and startups who want to maintain professionalism while simplifying their invoicing processes. Whether you need to Receipt Maker to promote a sale with accurate transaction records or provide detailed receipts for a workshop event, these templates cater to all your needs. With ready-to-use layouts, you can include essential details such as date, location, amounts, and your contact information effortlessly. The designs are user-friendly with no graphic design skills required, and they offer free professional-grade quality for both print and digital distribution. Additionally, enjoy the benefit of customizable layouts that seamlessly integrate with social media platforms, ensuring broad reach across various channels.

Discover the many Receipt Templates we have on hand, each designed to cater to diverse business requirements. Start by selecting a template that suits your style, then effortlessly swap in your brand assets and logos, and tweak colors and fonts to match your business identity. Enhance your receipts with advanced touches such as dragging-and-dropping icons or graphics, and even adding animated effects. Our AI-powered text tools make customizing text a breeze, ensuring the possibilities are endless and without any skill barrier. With regularly updated templates, you'll always find fresh designs to choose from. Once your receipt is ready, download it in a chosen format or share it via email, link, or on social media platforms. This flexibility supports collaboration in real time, making it ideal for managing multiple channels efficiently.