40+ Monthly Management Report Templates in PDF | Google Docs | Excel | Apple Pages

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Jan 08, 2026

To audit means to systematically and independently examine books, accounts, statutory records, documents, and vouchers of an organization. This is done to verify and ascertain how far the financial statements, as well as non-financial disclosures, show a correct and fair view of the said books, accounts, and other concerns. Furthermore, it also makes sure that the books of accounts are maintained properly following the requirements of the law. And so, we’ve prepared a guide on how to prepare documents for an inventory contractor, SAP checklist, internal auditor, store tracking, audit process, and more. You may also see report templates.

Creating a structured stock audit document becomes much easier when using an audit report maker, especially when handling large inventories or recurring audit cycles. It helps ensure that physical stock verification, accounting records, and audit findings are presented in a clear and standardized format.

camcode.com

camcode.com elpasotexas.gov

elpasotexas.govAuditing is essential especially in accounting due to the possibility of presenting a false financial statement in Word. Misstating financial information may bring with it strong incentives which include taxation, misselling, and other forms of fraud. As such, auditing has become a legal requirement for many entities that have the power to exploit financial information for personal gain. Audits were traditionally and mainly associated with procuring information about sample statements and financial records of a company or a business.

mca.dadeschools.net

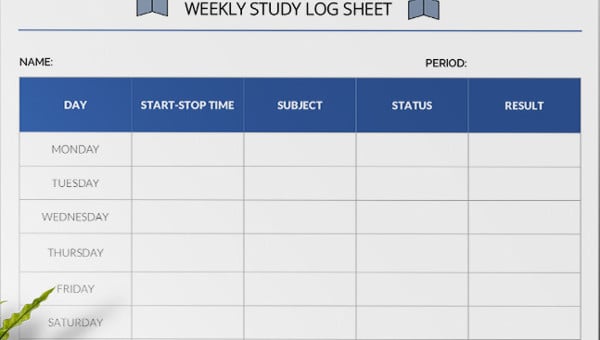

mca.dadeschools.netStock Auditing is a crucial auditing term that refers to the physical verification of stocks located in the sample inventory. It is an independent verification of the functions of the management and has value in the eyes of the law and the taxation authority. Stock auditing can be done simultaneously with stock-taking. Stocktaking, which is also called inventory checking, is the physical verification of the quantities and condition of items found in the company’s inventory list or warehouse.

The audit report is a document that shows the formal opinion of the audit findings. The audit report is the result of the editing process. It can be presented and used as a tool for financial reporting, investing accountability enforcement, altering operations, and decision-making by the owners of the company or organization. The audit report needs to be effective so that it can be a useful tool for the receiving part’s operations. As such, the information found in the audit sample report must be correct, certain, verifiable, and free of errors.

For organizations handling frequent audits, AI tools can assist in organizing stock data, identifying discrepancies, and maintaining consistency across audit documentation. This can be particularly useful when managing complex warehouse inventories or multi-location stock records.

sandiego.gov

sandiego.gov wpb.org

wpb.orgAs mentioned above, audits are considered as the official examination of stocks, simple inventories, and financials of a company to verify that correct policy and procedures were followed to a T. An audit, therefore, can take many forms. The type of audit report you will need to write will depend on the form of an audit. You may also read more about these laboratory report templates.

Some of these types include:

A financial audit refers to the systematic review of the financial services reporting of the company. This audit aims to make sure all the information found will be valid, verifiable, and will conform to that the GAAP standards. This type of audit is the most well-known sample form of auditing.

An operational report is the second type of auditing. It is a review of the organization’s usage of its resources. The purpose of doing so is to ensure that said resources are harnessed properly, efficiently, and effectively. An operational audit is the systematic review of the effectiveness, efficiency, and economy of operation. As such, it is future-oriented, systematic, and independent of organizational activities. You may also see audit reports in Word.

A company usually has guidelines to follow for the entirety of its duration. A company must comply with laws, policies, regulations, and procedures during its operation. A compliance audit is performed to make sure that the concerned company is indeed following the aforementioned guidelines. You may also see internal audit report templates.

An investigative audit is a special kind of audit done when there is a perceived violation of rules and guidelines. When there is an assumption of rules being broken in a company, an investigative audit is commissioned to examine the cause of this violation. An investigative audit usually blends the characteristics of all the previously mentioned audits.

http://meetings.derrycityandstrabanedistrict.com

http://meetings.derrycityandstrabanedistrict.com bac-lac.gc.ca

bac-lac.gc.caTaking Inventory Report Templates and auditing the layout inventory of your stock is very important for your company. It helps you keep track of all going in’s and out’s of your company. Stocks and inventory can easily be manipulated. The items found in your inventory are some of the easiest assets to manipulate. Constant vigilance is needed to ensure that you will not be cheated out of your inventory. Writing down your stock audit into a basic report is thus, important. Here are a few benefits of creating an audit report.

1. The stock audit is required to match the physical quantity of items in stock against those found in the accounting records. It also needs to adjust for differences and allows for shrinkage so that the ledger reflects accurate values. You may also see audit reports in Google Docs.

2. The stock audit can be a crucial tool in identifying which products in your inventory are under or overstocked. This information can allow you to effectively and properly decide which items to stock up on to help in maximizing your profits. You may also see quality report templates.

3. In line with identifying which physical goods are over and understocked, inventory or stock audits are imperative to reduce unnecessary investments in stocks. It also ensures that you have proper line balancing in the process. You may also read more about audit report in PDF.

4. The stock audit is also essential to indicate which accounts for any sort of loss in inventory due to wastage, pilferage, damage, obsolescence, and dormant stock. You may also see tax invoice templates.

5. You will need a stock audit to compare and match actual physical counts to those found in the record books of your business. When accurate, the stock audit will be able to provide a correct view of your current holdings as compared to what is written in the books. This will give you an understanding of the financial health of your company. Incorrect statement of inventory balances usually tends to have an immediate impact on reported profit. You may also see internal audit report in Word.

6. The stock audit can also provide you an effective view of your warehouse, warehouse procedures, and warehouse systems which will reveal any issues and inefficiencies and allow you to address said inefficiencies almost immediately. Be it a disorganized warehouse or problems during the packaging stage, a stock audit will allow you to examine these problems effectively. You may also see internal audit report in Google Docs.

7. Stock audits can also help reveal any failure that results from a lack of security which can lead to theft, loss, or misappropriation.

8. Stock audits help avoid unnecessary overstocking that may result in poor cash flow statements and financial loss. Furthermore, it can determine any obsolete inventory in stock or orders incorrectly supplied to customers. Such errors could lead not only to a financial loss on the company but also do irreparable damage to its reputation.

austintexas.gov

austintexas.gov dallasisd.org

dallasisd.orgIn writing an audit report, it is important to remember that there are four kinds of opinions that will result from the auditing process. The tone of your audit report will depend on what kind of opinion your audit report will be. You may also see compliance checklists.

The kinds of audit opinion are:

A clean opinion is used if the audited organization’s financial statements in Pages are a clear representation of an entity’s financial opinion. This type of opinion is also referred to as the unqualified opinion. Your audit report will usually show this type of opinion if the company has no discrepancies between its records and stocks and is under the Generally Accepted Accounting Principles (GAAP). All in all, a clean opinion indicates that the company’s financial activities and records are correct and acceptable like a clean bill of health.

A qualified opinion in an audit report indicates that the company’s financial records have not been presented following the GAAP. If the auditor concludes that individual or aggregate misstatements are material but not pervasive to financial sample statements, he or she will usually opt for a qualified opinion. A qualified opinion can also be used if there is no sufficient appropriate audit evidence on which to base the opinion and that the possible effects on the financial statement of undetected misstatements could be material but not pervasive. You may also see investigation reports.

An adverse opinion is the worse type of opinion that any company can receive from an auditor. It indicates that the financial reports of the company are grossly misstated or are not per the GAAP. An adverse opinion can be an indicator of fraud. Business entities that reserve this type of opinion are usually forced to correct their financial statements. These example statements will then be needed to be re-audited.

A disclaimer of opinion is the rarest type of opinion. Such an opinion is only seen when the auditor is not able to complete the audit due to a particular reason. Usually, if the auditor issues a disclaimer, it means that he or she is unable to obtain sufficient appropriate audit evidence on which to base an opinion. The auditor usually concludes that the possible effect on the financial statements of undetected misstatements could be both material and pervasive. You may also see incident report templates.

miamibeachfl.gov

miamibeachfl.gov bernco.gov

bernco.gov argyll-bute.gov.uk

argyll-bute.gov.ukUsing free templates allows auditors and businesses to document stock verification results efficiently without starting from scratch. These ready-made formats help record inventory counts, audit opinions, and compliance findings in a clear and professional manner.

Auditing is essential to any business to ensure that all their financial records are correct and by the guidelines. Stock Certificate auditing is the type of auditing that audits a company’s stock and Inventory sheet templates if they match with those that are indicated on the books. The results of a stock audit are usually indicated in the stock audit report. The results of the auditing process will tell what the auditor’s opinion will be. Regular stock auditing is beneficial to the company to make sure that they are not breaking any rules and also to ensure that all their stocks are in order. You may also see HR report templates.

Managers usually write reports, and they have to be submitted every month to the higher authorities of a company. These…

Have you ever tried sending a Report Outline for corrective action to a company about bad food, product, or service?…

Crafting an event report is an essential step in analyzing the success and impact of any event, whether it’s a…

A report card is one of the crucial elements of recording the results of an evaluation of a leaner. Many…

Getting ready with your inspection report? Not satisfied with your report’s format? Don’t you worry? We have here an array…

Every organization must be careful while creating a daily or weekly activity report as it is with the help of…

The audit report is the ending result of an audit and can be utilized by the receiver person or organization…

Audit committee reports present a periodic and annual picture of the financial reporting method, the audit process, data on the…

Timely reports are vital for any logistics industry as data is essential to help make decisions. Plus, the industry’s scope…