Free Financial Investment Crisis Management Protocol

Introduction

The capacity to adeptly navigate through crises is not just advantageous but essential for the sustainability and success of any business. Recognizing this critical need, [Your Company Name] has developed a comprehensive Financial Investment Crisis Management Protocol. This document serves as a strategic roadmap, specifically tailored to guide our organization through the multifaceted challenges posed by financial crises, which can significantly impact our investment portfolio.

The core objective of this protocol is to establish a proactive and structured framework that enables [Your Company Name] to efficiently identify, manage, and mitigate the risks associated with financial crises. In doing so, it aims to minimize potential losses, safeguard assets, and maintain investor confidence, even in the face of market volatility and economic downturns. This is achieved through a series of meticulously crafted strategies and action plans that are both responsive and adaptive to the evolving nature of financial emergencies.

At the heart of this protocol lies a dual focus: first, to provide immediate and effective responses to crisis situations, ensuring that our actions are swift, coordinated, and in line with the best interests of our stakeholders; and second, to foster long-term resilience and stability in our financial operations, thereby enhancing our capacity to withstand future financial shocks and upheavals.

The Financial Investment Crisis Management Protocol encompasses a comprehensive range of elements, from the initial identification and assessment of crisis indicators to the deployment of strategic response measures and post-crisis evaluations. It emphasizes the importance of clear communication, both internally within our organization and externally with our investors and regulatory bodies, thereby maintaining transparency and trust throughout the crisis management process.

In developing this protocol, [Your Company Name] acknowledges the unpredictable nature of financial markets and the need for a robust, adaptable approach to crisis management. This document is a testament to our commitment to not only protect but also strengthen our financial foundation, ensuring the long-term growth and prosperity of our organization. Regular reviews and updates to this protocol will be conducted to align with evolving market conditions and regulatory requirements, thereby ensuring its ongoing relevance and effectiveness.

Crisis Identification and Assessment

Crisis Identification

The first step in effective crisis management is the prompt identification of potential financial crises. This section outlines key indicators that [Your Company Name] will monitor to detect early signs of financial distress. Each indicator is accompanied by a specific threshold, which, when crossed, triggers a preliminary alert for potential crisis conditions.

Indicators and Thresholds:

Rapid Market Decline: This refers to a sudden and significant drop in market indices or the value of assets. A decline greater than 10% within a 24-hour period is considered a critical indicator, signaling a potential market crisis.

Liquidity Shortage: The ability to liquidate assets swiftly is crucial for financial stability. A liquidity ratio falling below 20% is indicative of a liquidity crisis, meaning the company may not be able to convert assets into cash quickly enough to meet its short-term obligations.

Credit Downgrade: The creditworthiness of [Your Company Name] is vital for maintaining investor confidence and access to capital. A downgrade in credit ratings by two or more levels by recognized agencies signals a significant decrease in the company's perceived financial stability.

Investor Panic: An essential aspect of crisis identification is monitoring investor behavior. A 50% increase over normal levels in investor inquiries and withdrawal requests can indicate growing investor panic, which can further destabilize the company’s financial position.

Monitoring these indicators allows [Your Company Name] to identify potential crises early and initiate the crisis management process swiftly and effectively.

Crisis Assessment

Upon the identification of one or more crisis indicators reaching their respective thresholds, [Your Company Name] will conduct an immediate and thorough assessment to determine the severity and potential impact of the situation on the company's financial portfolio.

Assessment Process:

Severity Analysis: This involves evaluating the intensity of the crisis. For instance, determining whether a market decline is a temporary fluctuation or indicative of a broader economic downturn.

Impact Analysis: Here, the focus is on understanding how the identified crisis could affect the company's current investments, liquidity, and overall financial health. This includes assessing potential losses, the effect on cash flow, and the impact on future investment strategies.

Stakeholder Impact: Assessing the impact on stakeholders, including investors, employees, and partners, is crucial. This involves evaluating the potential for investor withdrawal, loss of trust, and overall market reputation.

Regulatory Implications: The assessment will also consider any regulatory implications, such as non-compliance risks or new reporting requirements triggered by the crisis.

Scenario Planning: Various scenarios will be analyzed to anticipate possible outcomes and prepare for different contingencies. This includes worst-case, best-case, and most likely scenarios.

The outcome of this crisis assessment will guide the decision-making process and the formulation of appropriate response strategies, ensuring that [Your Company Name] responds to the crisis in a manner that is both strategic and measured.

Crisis Management Team

The establishment of a dedicated Crisis Management Team (CMT) is a pivotal component of [Your Company Name]'s approach to navigating financial crises. This team is tasked with the responsibility of spearheading the implementation of the Financial Investment Crisis Management Protocol, ensuring a coordinated and effective response to any financial crisis situation.

The CMT is composed of key personnel, each bringing specialized skills and knowledge crucial for managing different aspects of a crisis. This multidisciplinary team ensures that all critical areas of the company's operations are considered and addressed during a crisis.

Team Lead: The linchpin of the CMT, responsible for overall leadership, strategy, and coordination. This role involves decision-making, delegating responsibilities, and ensuring effective communication within the team and with external stakeholders.

Financial Analyst: Plays a vital role in monitoring financial markets, assessing the financial impact of the crisis, and advising on financial decisions and strategies to mitigate risks.

Legal Advisor: Ensures that all crisis management actions comply with relevant laws and regulations. This role also involves managing legal risks and advising on legal implications during the crisis.

PR Manager: Responsible for managing all communications, both internal and external. This includes crafting messages for stakeholders, coordinating with media, and maintaining the company's public image during the crisis.

IT Specialist: Ensures the security and functionality of technological systems, which are crucial for continuous operation and communication during a crisis.

The synergy of this team is critical for a comprehensive and effective crisis response. Each member of the CMT is expected to work collaboratively, bringing their expertise to the forefront to guide [Your Company Name] through the complexities of a financial crisis. Their combined efforts are instrumental in mitigating the impact of the crisis, preserving the company's financial integrity, and maintaining stakeholder trust.

Communication Plan

Effective communication is a cornerstone of successful crisis management. [Your Company Name]'s Communication Plan is structured to ensure clear, timely, and transparent information flow both within the organization and to external stakeholders during a financial crisis. The plan is divided into two main components: Internal Communication and External Communication.

Internal Communication

Objective:

The primary goal of internal communication during a crisis is to keep all employees informed and aligned with the company's crisis response strategies and actions. It aims to ensure that every team member understands their role and responsibilities in managing the crisis.

Strategy:

Daily Updates: During a crisis, regular updates are crucial. Daily briefings will be provided to all staff members, outlining the current status of the crisis, actions taken, and any anticipated changes or developments.

Channels of Communication:

Email: Official updates and detailed instructions will be communicated through email.

[Your Company Website]: A dedicated section on the company’s internal website will be used for ongoing updates and resources.

[Your Social Media]: For quick, real-time updates, the company's internal social media channels will be utilized.

Responsibilities:

The PR Manager will oversee the internal communication process, ensuring consistency and accuracy in the messages being disseminated.

Department heads will be responsible for cascading information to their respective teams and gathering feedback.

External Communication

Objective:

The aim of external communication is to maintain trust and transparency with investors, clients, regulatory bodies, and the public. It is crucial to manage perceptions and provide reassurance during times of crisis.

Strategy:

Frequency and Timing: Communications to external parties will be issued as required by the evolving situation and in compliance with legal and regulatory requirements. This ensures that all stakeholders receive accurate and up-to-date information.

Channels of Communication:

Press Releases: Official statements and updates will be released to the media to ensure the public receives accurate information directly from the company.

[Your Company Website]: The company’s external website will feature a dedicated section for crisis updates, accessible to investors and the public.

[Your Social Media]: Social media platforms will be used for broader outreach and real-time updates, helping to manage public perception and investor concerns.

Responsibilities:

The PR Manager will lead the external communication efforts, crafting messages that are clear and consistent with the company’s stance and strategy.

The Legal Advisor will review all external communications to ensure compliance with legal and regulatory standards.

The Crisis Management Team Lead will approve all major communications before release, ensuring alignment with the overall crisis management strategy.

In both internal and external communications, the key is to maintain a balance between transparency and discretion, providing enough information to manage expectations and maintain confidence without causing undue alarm. The communication plan is designed to be flexible, allowing [Your Company Name] to adapt to the rapidly changing dynamics of a financial crisis.

Financial Assessment and Impact Analysis

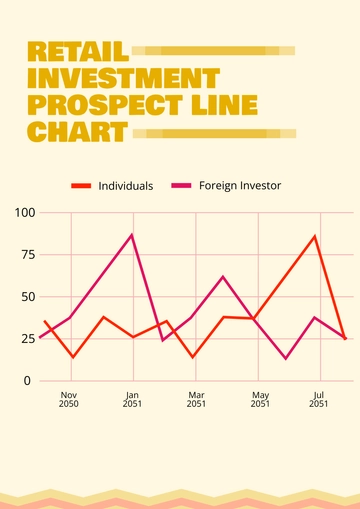

Current Portfolio Status

To effectively manage a financial crisis, it is crucial for [Your Company Name] to have a clear understanding of its current investment portfolio status. This section provides a snapshot of the portfolio, focusing on major asset categories, the amount invested in each, their current market value, and the percentage change, indicating their performance over time.

Portfolio Overview:

Asset Type | Amount Invested | Current Value | %Change |

|---|---|---|---|

Stocks | $1,000,000 | $900,000 | -10% |

Bonds | $500,000 | $520,000 | +4% |

Real Estate | $800,000 | $880,000 | +10% |

Analysis:

Stocks: The portfolio shows a 10% decrease in the value of stocks, indicating a significant impact possibly due to market volatility or economic downturns.

Bonds: Bonds have shown a moderate increase in value, suggesting they are serving their role as a stabilizing factor in the portfolio.

Real Estate: The real estate investments have appreciated, which may offset some of the losses seen in other areas.

Impact Analysis

The impact analysis involves evaluating how the current state of the portfolio affects [Your Company Name]'s financial standing both in the short and long term.

Short-term Impact:

Immediate Financial Losses: The analysis will focus on quantifying the immediate monetary losses, particularly from the decreased value of stocks. This includes assessing the impact on cash flow, liquidity, and the company's ability to meet its short-term financial obligations.

Market Reaction: The reaction of the market to the company's current portfolio status will also be assessed, as it can influence investor confidence and stock prices.

Long-term Impact:

Growth and Investment Strategy: The long-term implications include evaluating how the current portfolio status will affect the company's future growth prospects. This may lead to a reassessment of the company's investment strategies, including potential diversification or reallocation of assets.

Risk Management: The crisis provides an opportunity to analyze the effectiveness of the current risk management strategies and to make necessary adjustments for future resilience.

The financial assessment and impact analysis are critical in guiding [Your Company Name]'s strategic decisions during a crisis. It allows the company to not only address immediate financial concerns but also to plan effectively for post-crisis recovery and growth. Regular updates and reviews of the portfolio status and impact analysis will be conducted to ensure ongoing awareness and responsiveness to changing market conditions.

Crisis Response Strategies

The effectiveness of [Your Company Name]'s approach to managing financial crises is significantly determined by the strategies it employs. This section outlines the response strategies, categorized into short-term and long-term approaches, to effectively navigate and mitigate the impacts of a financial crisis.

Short-term Strategies

Cash Flow Management

Objective: To ensure the company maintains adequate liquidity to meet its immediate obligations.

Action Steps:

Prioritize liquidating assets that can be converted to cash quickly and with minimal loss.

Reassess and possibly defer non-urgent expenditures.

Explore short-term financing options if necessary, to bridge any temporary cash shortfalls.

Cost Reduction

Objective: To minimize operational costs and preserve financial resources.

Action Steps:

Conduct a thorough review of all operational expenses.

Identify and eliminate or reduce non-essential spending.

Implement cost-saving measures across departments, such as energy conservation, renegotiating contracts, and optimizing supply chains.

Stakeholder Communication

Objective: To maintain trust and confidence among investors and other key stakeholders.

Action Steps:

Provide regular, transparent updates regarding the company's financial status and crisis management efforts.

Engage in open dialogue with investors, addressing their concerns and expectations.

Utilize all available communication channels effectively, ensuring consistent and accurate messaging.

Long-term Strategies

Portfolio Diversification

Objective: To reduce risk by spreading investments across various asset classes.

Action Steps:

Assess the current investment portfolio and identify areas with concentrated risk.

Reallocate investments to include a broader mix of asset types, sectors, and geographies.

Continuously monitor and adjust the portfolio to align with changing market conditions and risk appetite.

Regulatory Compliance

Objective: To ensure ongoing compliance with all financial regulations, minimizing legal and reputational risks.

Action Steps:

Stay informed about new and existing financial regulations at both national and international levels.

Regularly review and update internal policies to ensure compliance.

Conduct compliance training for staff to reinforce the importance of adherence to financial regulations.

Market Analysis

Objective: To inform decision-making with up-to-date market insights and trends.

Action Steps:

Regularly gather and analyze data on market trends, economic indicators, and geopolitical events.

Utilize this analysis to anticipate market movements and adapt investment strategies accordingly.

Leverage insights from market analysis to identify potential opportunities for growth and expansion post-crisis.

By implementing these short-term and long-term strategies, [Your Company Name] aims to not only effectively manage the current crisis but also strengthen its resilience against future financial challenges. These strategies will be periodically reviewed and refined to ensure they remain aligned with the company's evolving objectives and the external economic environment.

Post-Crisis Evaluation

After navigating through a financial crisis, it is crucial for [Your Company Name] to engage in a comprehensive Post-Crisis Evaluation. This process is integral to understanding the efficacy of the crisis response, extracting valuable lessons, and refining the crisis management protocol for future incidents. This evaluation ensures that the company not only recovers from the current crisis but also fortifies its strategies against potential future crises.

Review: Assessing the Effectiveness of the Crisis Response

Objective: To evaluate how effectively the Crisis Management Team and the implemented strategies addressed the crisis.

Approach: This involves a detailed analysis of the crisis timeline, the decisions made, and the outcomes of those decisions. Key performance indicators will be reviewed, including the speed of response, the accuracy of crisis assessment, financial impact mitigation, and stakeholder communication effectiveness.

Lessons Learned: Documenting Key Takeaways

Objective: To capture insights and learnings that emerged during the crisis.

Approach: The team will conduct a debriefing session to discuss what worked well and what could have been done better. This includes examining the initial crisis identification, the appropriateness of the response strategies, and the efficiency of internal and external communication. Key learnings will be documented for future reference and training purposes.

Update Protocol: Revising the Protocol Based on Recent Experience

Objective: To update the Financial Investment Crisis Management Protocol incorporating insights and improvements identified during the post-crisis review.

Approach: The Crisis Management Team, in collaboration with relevant departments, will revise the protocol to reflect the lessons learned. This might involve updating the crisis identification thresholds, refining communication plans, adjusting financial strategies, or enhancing team roles and responsibilities. The updated protocol will ensure the company is better prepared for future financial crises.

Through this Post-Crisis Evaluation, [Your Company Name] commits to continuous learning and improvement in its crisis management capabilities, reinforcing its resilience and adaptability in the face of financial uncertainties.

Appendix: Contact Information and Resources

Company Contact: [Your Company Phone Number], [Your Company Email]

Website: [Your Company Website]

Address: [Your Company Address]

Emergency Contacts: List of relevant regulatory and emergency contacts.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing Template.net's Editable Financial Investment Crisis Management Protocol Template. In today's unpredictable financial landscape, preparedness is paramount. Our meticulously crafted template offers a comprehensive framework to navigate investment crises effectively. Easily customizable with our AI editor tool, it empowers businesses to plan, strategize, and mitigate risks. With this tool, safeguard your financial future with confidence. Download now and fortify your investment strategy.