Free Finance Portfolio Diversification Survey

Prepared by | [Your Name] |

Date | [January 1, 2050] |

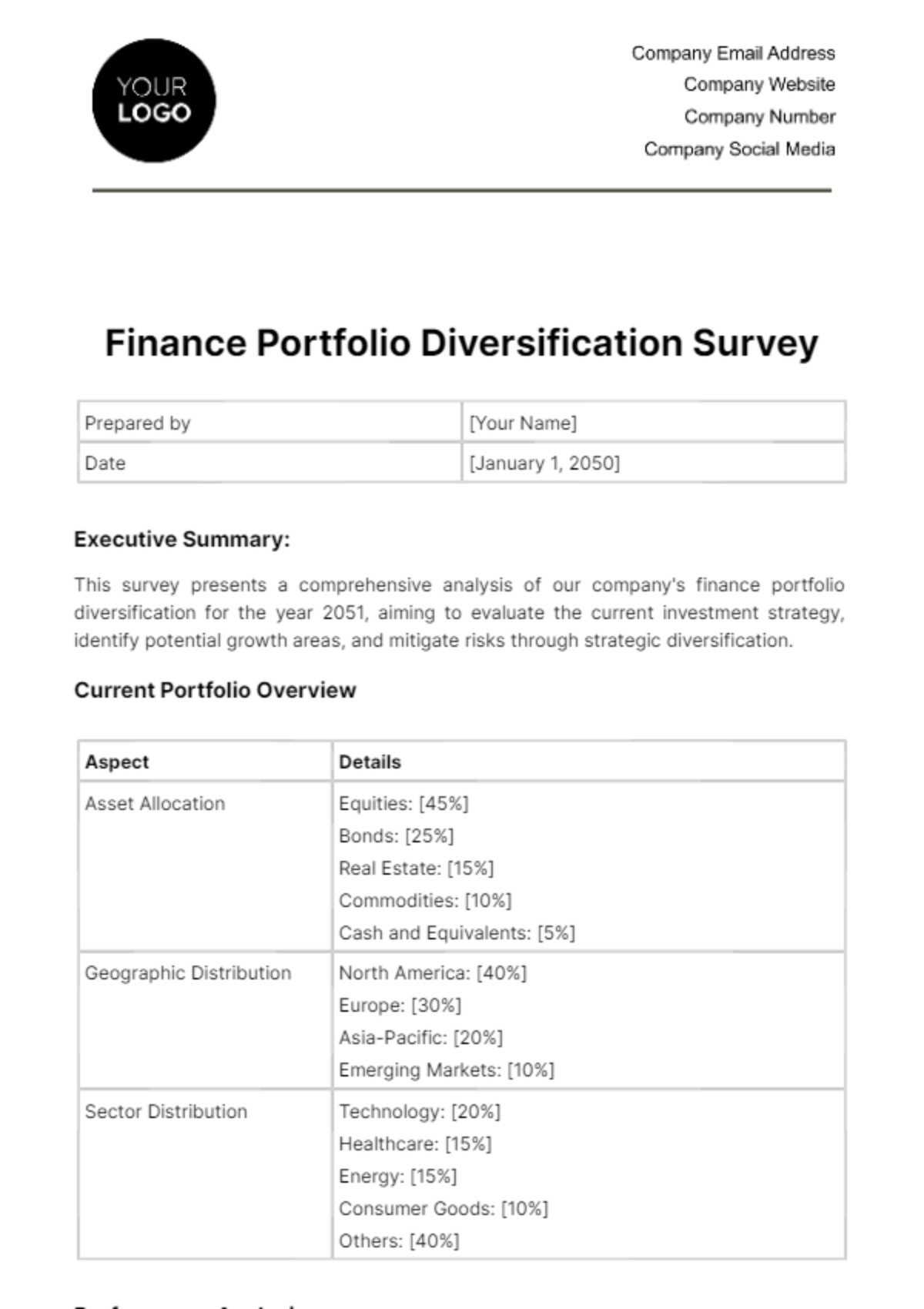

Executive Summary:

This survey presents a comprehensive analysis of our company's finance portfolio diversification for the year 2051, aiming to evaluate the current investment strategy, identify potential growth areas, and mitigate risks through strategic diversification.

Current Portfolio Overview

Aspect | Details |

Asset Allocation | Equities: [45%] |

Geographic Distribution | North America: [40%] |

Sector Distribution | Technology: [20%] |

Performance Analysis

Metric | Details |

Return on Investment (ROI) | 1-Year ROI: [8%], 5-Year ROI: [45%] |

Risk Analysis | Volatility Index: [12%], Diversification Effectiveness: [Evaluated through portfolio beta, correlation matrices, etc.] |

Recommendations for Diversification

Aspect | Suggestions |

Asset Reallocation | Proposed changes in asset allocation to balance risk and return. |

Geographic Expansion | Identifying underrepresented markets for potential investment. |

Sector Diversification | Investing in emerging sectors like [Artificial Intelligence, Renewable Energy, etc.] |

Environmental, Social, and Governance (ESG) Considerations

Aspect | Details |

ESG Compliance | Current ESG rating and ways to improve. |

Sustainable Investing | Opportunities in green bonds, ESG funds, etc. |

Conclusion and Future Outlook

Aspect | Summary |

Summary of Findings | Key takeaways from the current portfolio analysis. |

Long-term Strategy | Future investment strategies considering market trends and economic forecasts. |

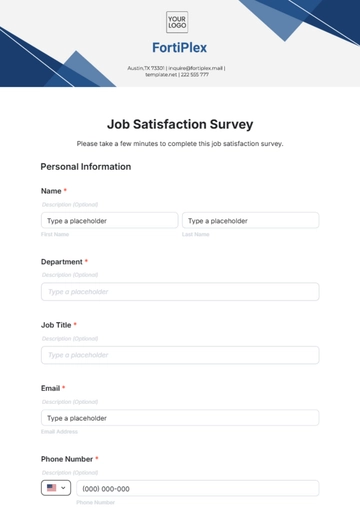

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

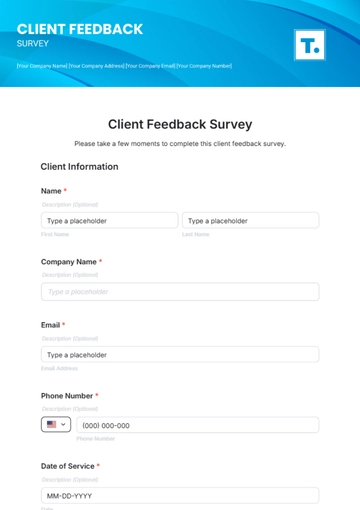

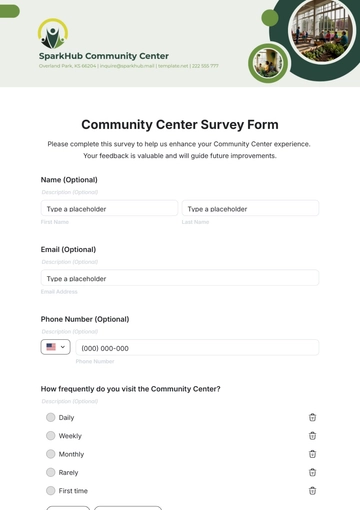

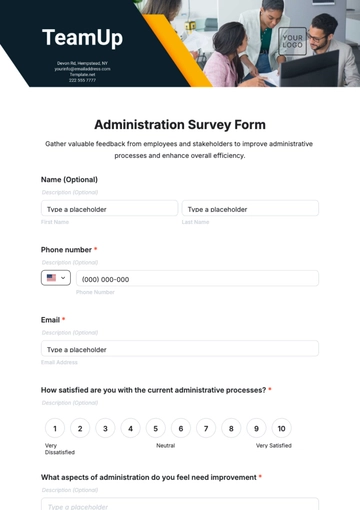

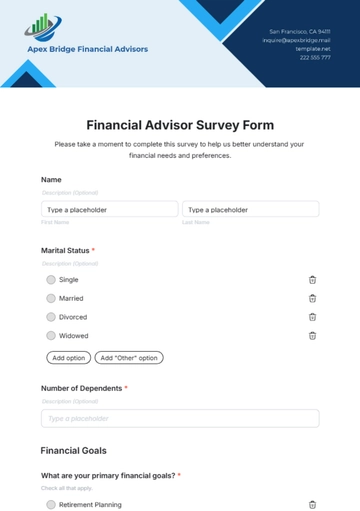

Optimize your investment portfolio with Template.net's Finance Portfolio Diversification Survey Template. This editable, customizable survey assesses investment diversification. It's an important tool for financial advisors and investors to evaluate portfolio spread across various assets, ensuring risk is managed effectively and investment strategies align with diversification principles.