Free Finance Mergers & Acquisitions Asset Evaluation Form

Ensure accurate and detailed information is provided in each section, including essential details about the target company and its financial statements. Check appropriate check boxes whenever necessary.

TRANSACTION DETAILS

Transaction Name: [Acquisition Deal]

Transaction Date: [March 10, 2054]

Transaction Value: [$75,000,000]

TARGET COMPANY INFORMATION

Company Name: [Target Company Name]

Industry: [Target Company Industry]

Location: [Target Company Location]

Website: [Target Company Website]

FINANCIAL STATEMENTS

Balance Sheet

Assets | Amount |

Current Assets | $30,000,000 |

- Cash and Equivalents | |

- Accounts Receivable | |

- Inventory | |

Non-Current Assets | |

- Property, Plant & Equipment | |

- Intangible Assets | |

Total Assets |

Liabilities and Equity

Liabilities | Amount |

Current Liabilities | $20,000,000 |

- Short-term Debt | |

- Accounts Payable | |

- Accrued Liabilities | |

Long-term Debt | |

Equity | |

Total Liabilities & Equity |

Income Statement

Aspect | Amount |

Revenue | $35,000,000 |

- Software Sales | |

- Service Contracts | |

Expenses | |

- Operating Expenses | |

- Cost of Goods Sold | |

Profit |

Cash Flow Statement

Cash Flows | Amount |

Cash Inflows | $18,000,000 |

- Operating Activities | |

- Investing Activities | |

- Financing Activities | |

Cash Outflows | |

Net Cash Flow |

ASSET VALUATION

Tangible Assets

Property

Equipment

Inventory

Land

Vehicles

Buildings

Other (pls. Specify): ________________

Intangible Assets

Patents

Trademarks

Goodwill

Intellectual Property

Software

RISK EVALUATION

Financial Risks

Currency Exchange Fluctuations

Interest Rate Volatility

Market Price Risk

Credit Risk

Liquidity Risk

Inflation Risk

Operational Risks

Supply Chain Disruptions

Regulatory Compliance

Cybersecurity Threats

Operational Efficiency

Technology Risks

Human Resource Risks

PROJECTIONS AND FORECASTS

Aspect | Details |

Future Revenue Projections | [$45,000,000 by 2026] |

Forecasted Expenses | [$28,000,000 by 2026] |

Profit Margin | [15%] |

Capital Expenditure Forecast | [$5,000,000] |

Return on Investment (ROI) | [20%] |

LEGAL AND COMPLIANCE REVIEW

Compliance Aspect | Details |

Legal Compliance | [Up to date with regulations.] |

Ongoing Legal Issues | [None] |

Compliance with Industry Standards | [Yes] |

Regulatory Compliance | [Fully compliant] |

Intellectual Property Compliance | [All IP properly documented] |

SYNERGY ASSESSMENT

Synergy Type | Active | In Progress | Planned | Not Applicable | Deferred |

Cost Synergies | |||||

Revenue Synergies | |||||

Operational Synergies | |||||

Strategic Synergies | |||||

Cultural Synergies |

REVIEWER'S NOTES

[Overall, positive financial health and strategic fit for our organization.]

REVIEWER/EVALUATOR DETAILS

Reviewer | Position | Date of Evaluation |

[Reviewer Name] | [Position] | [MM/DD/YYYY] |

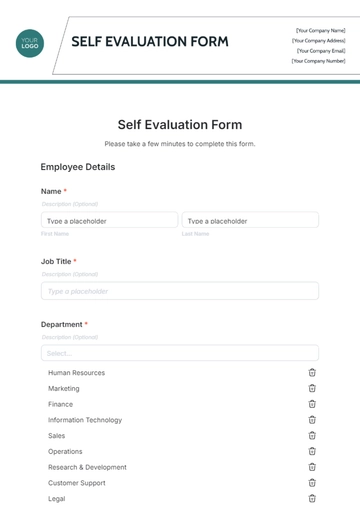

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Evaluate assets seamlessly with Template.net's customizable Finance Mergers & Acquisitions Asset Evaluation Form Template! This editable tool streamlines the process for accurate and informed decision-making. Tailor easily with our AI Editor Tool, speeding up evaluations and enhancing financial outcomes in mergers and acquisitions. Streamline the evaluation process, ensuring thorough assessments immediately!