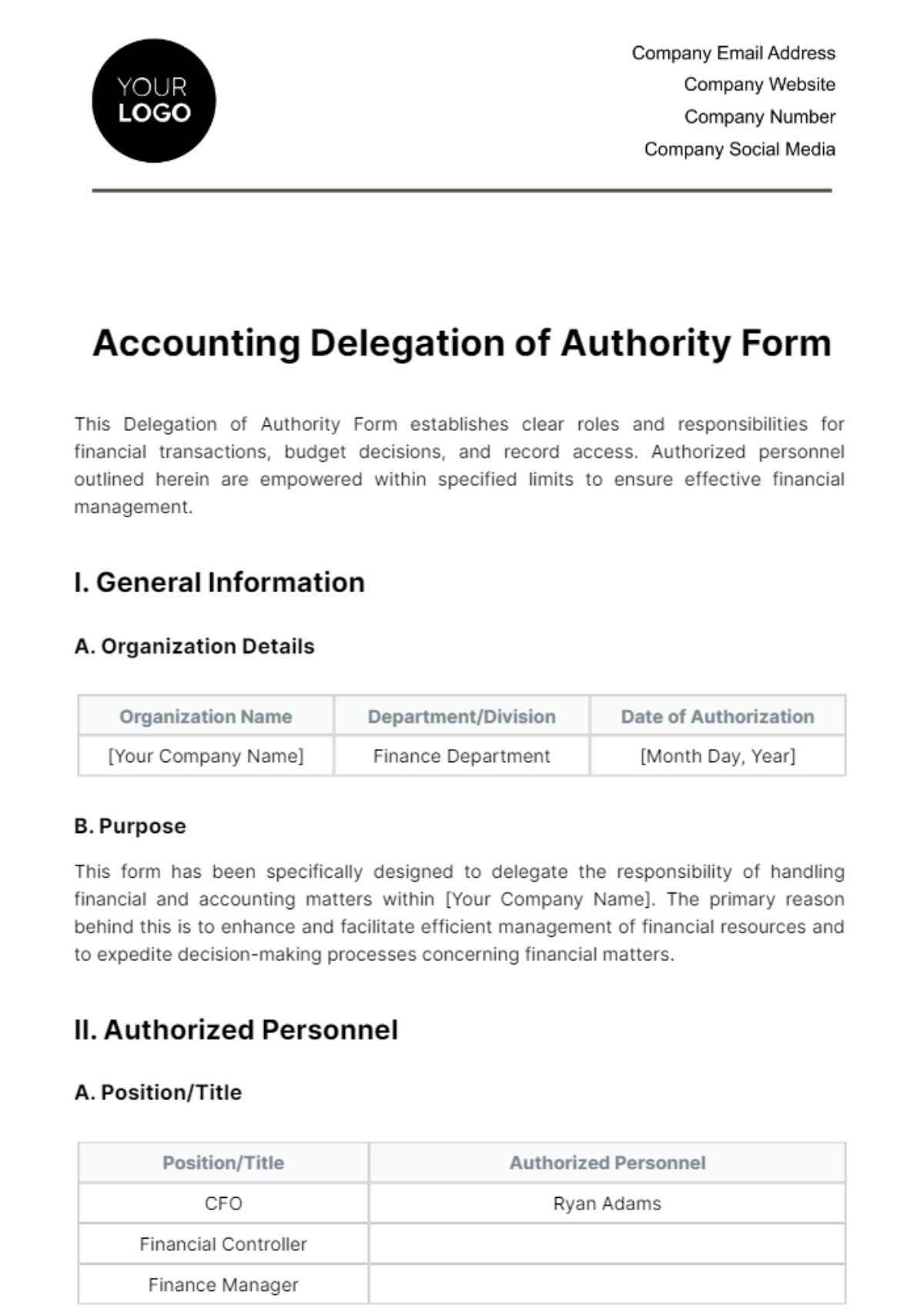

Free Accounting Delegation of Authority Form

This Delegation of Authority Form establishes clear roles and responsibilities for financial transactions, budget decisions, and record access. Authorized personnel outlined herein are empowered within specified limits to ensure effective financial management.

I. General Information

A. Organization Details

Organization Name | Department/Division | Date of Authorization |

|---|---|---|

[Your Company Name] | Finance Department | [Month Day, Year] |

B. Purpose

This form has been specifically designed to delegate the responsibility of handling financial and accounting matters within [Your Company Name]. The primary reason behind this is to enhance and facilitate efficient management of financial resources and to expedite decision-making processes concerning financial matters.

II. Authorized Personnel

A. Position/Title

Position/Title | Authorized Personnel |

|---|---|

CFO | Ryan Adams |

Financial Controller | |

Finance Manager |

III. Scope of Authority

A. Financial Transactions

Financial Transactions | Authorized Personnel |

|---|---|

Approval of expenditures up to $50,000 | Mae Hugh |

B. Budgetary Decisions

Budgetary Decisions | Authorized Personnel |

|---|---|

Approval of departmental budgets | Mae Hugh |

C. Access to Financial Records

Access to Financial Records | Authorized Personnel |

|---|---|

Access to bank statements | Mae Hugh |

IV. Limits and Restrictions

A. Monetary Limits

Individuals have been given the authority to grant approvals for transactions or expenditures, provided that these do not exceed the amounts that have been specifically outlined and predetermined. However, in instances where the transactions or expenditures surpass these predefined limits, it becomes essential that these are approved by those who preside over higher-level positions, as only they have been vested with the necessary authority to bestow approvals for transactions of greater amounts.

Items | Monetary Limits |

|---|---|

Approval of expenditures | $50,000 |

Authorization to sign checks | |

Approval of purchase orders |

B. Additional Approval Requirements

In the event that there are any transactions that could be classified as exceptional or that deviate from the standard procedures that have been set, it becomes a requirement to obtain approval from the Chief Financial Officer.

V. Duration of Authority

A. Start Date

The authorization provided through the means of this form officially comes into effect starting from the date of [Month Day, Year].

B. End Date

The authority that is mentioned here does not possess a specified date of termination. It will continue to stay in effect and exert its power until a subsequent notification indicates otherwise.

VI. Review and Renewal

A. Review Period

Every [Month], there will be a comprehensive annual review conducted specifically focusing on delegated authority.

B. Renewal Process

The process of renewal or modification of authority will proceed by following a review process which will involve chief financial officer (CFO) and the members of the senior management team.

VII. Reporting Requirements

A. Financial Reports

It is a requirement that individuals who are authorized personnel diligently submit their monthly financial reports to the Chief Financial Officer (CFO).

B. Notification of Exceptional Transactions

In the instance any transactions are deemed exceptional or deemed as not being within the regular flow and norm of business practices, it is of utmost importance that these are reported right away and without delay to the Chief Financial Officer.

VIII. Signatures and Approvals

By affixing their signatures below, the authorized personnel and reviewing authority acknowledge and affirm their understanding of the responsibilities outlined in this Delegation of Authority Form. These signatures serve as a commitment to adhere to the specified limits, procedures, and reporting requirements detailed within the document.

Authorized Personnel

Date: [Month Day, Year]

Date: [Month Day, Year]

Reviewing Authority

Position:

Date: [Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Empower your financial team with the Accounting Delegation of Authority Form Template from Template.net. This editable and customizable document ensures precision in delegating financial roles. Crafted with the user-friendly AI Editor Tool, streamline your organization's financial processes effortlessly and with unparalleled efficiency. Elevate your financial management game with this essential tool.