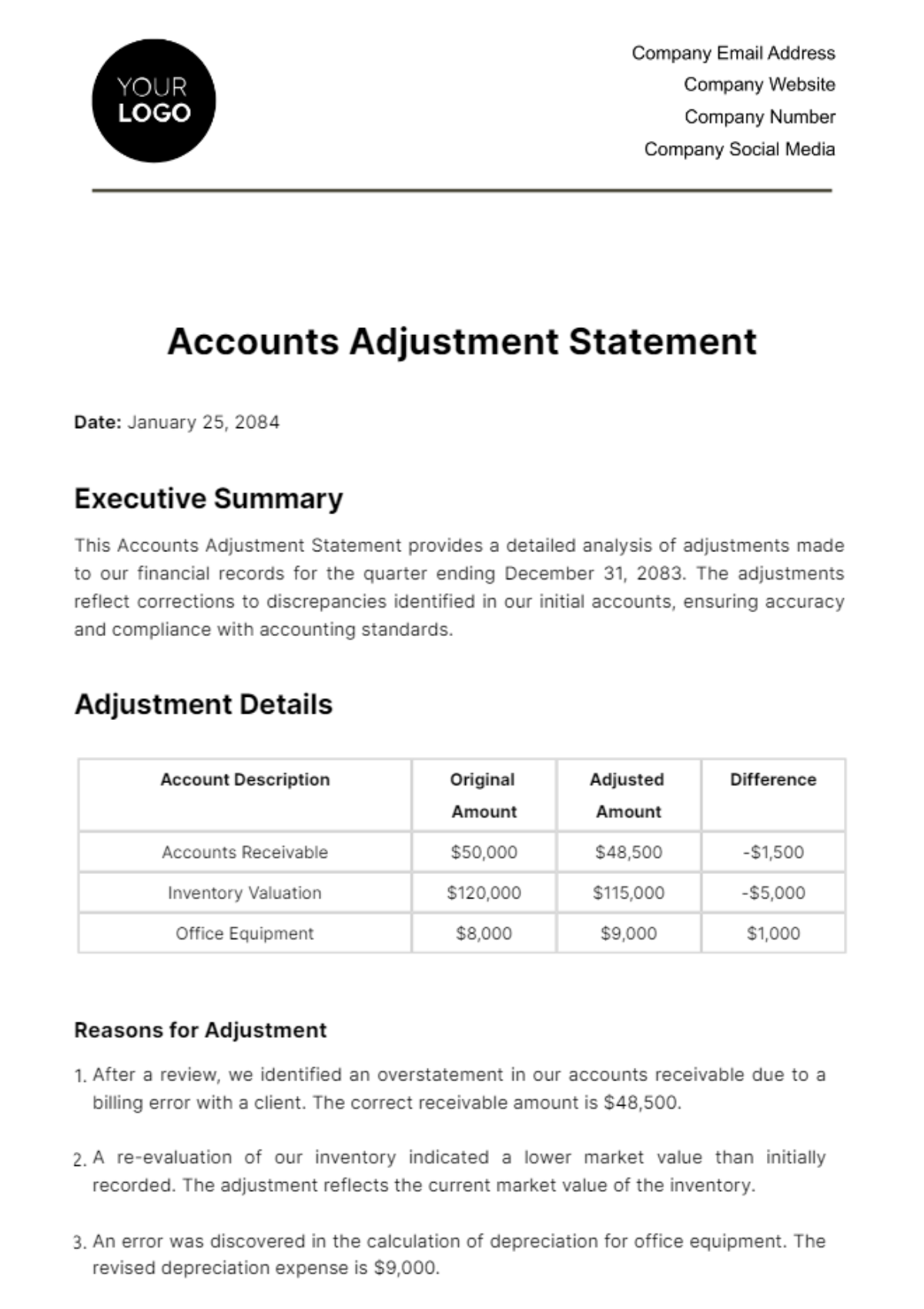

Free Accounts Adjustment Statement

Date: January 25, 2084

Executive Summary

This Accounts Adjustment Statement provides a detailed analysis of adjustments made to our financial records for the quarter ending December 31, 2083. The adjustments reflect corrections to discrepancies identified in our initial accounts, ensuring accuracy and compliance with accounting standards.

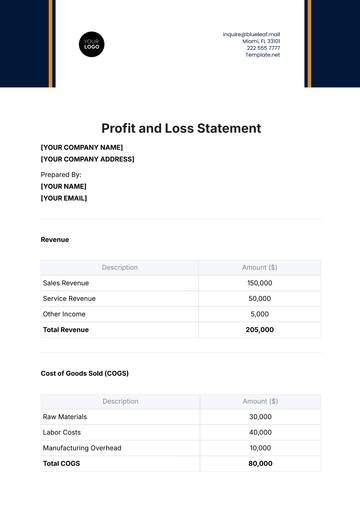

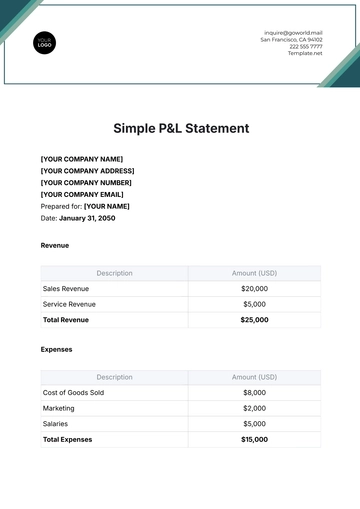

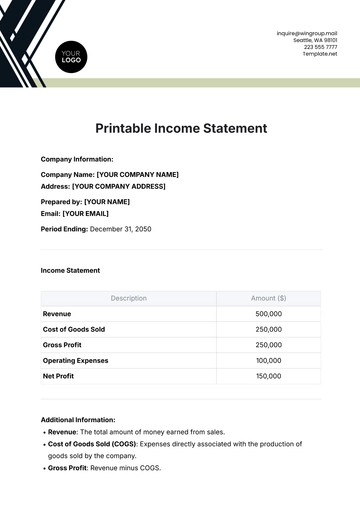

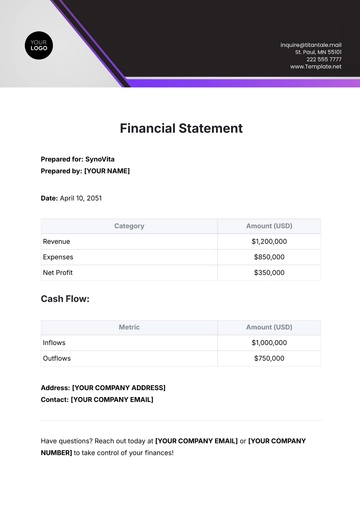

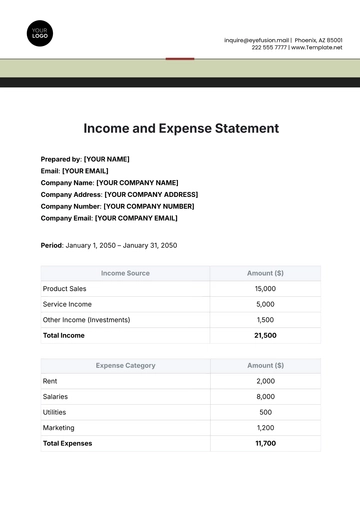

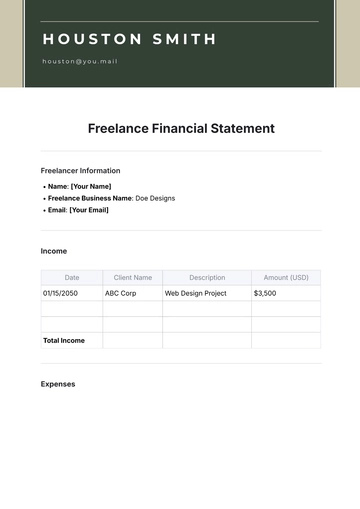

Adjustment Details

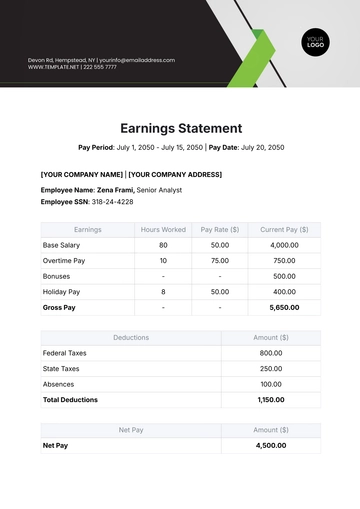

Account Description | Original Amount | Adjusted Amount | Difference |

Accounts Receivable | $50,000 | $48,500 | -$1,500 |

Inventory Valuation | $120,000 | $115,000 | -$5,000 |

Office Equipment | $8,000 | $9,000 | $1,000 |

Reasons for Adjustment

After a review, we identified an overstatement in our accounts receivable due to a billing error with a client. The correct receivable amount is $48,500.

A re-evaluation of our inventory indicated a lower market value than initially recorded. The adjustment reflects the current market value of the inventory.

An error was discovered in the calculation of depreciation for office equipment. The revised depreciation expense is $9,000.

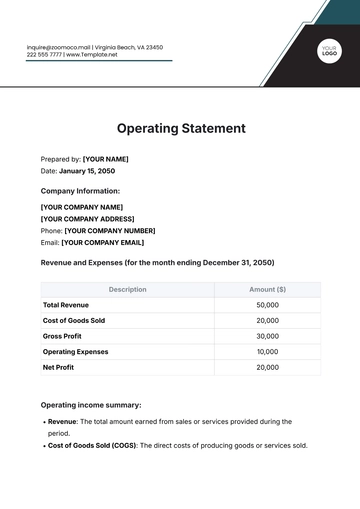

Total Impact on Financial Statements

Impact on Assets: A net decrease of $6,500.

Impact on Liabilities: No significant change.

Impact on Equity: A net decrease of $6,500, reflected in the retained earnings.

Conclusion

These adjustments are necessary to present a true and fair view of our financial position as of December 31, 2083. We have taken steps to ensure the accuracy of our accounting records and will continue to monitor and adjust as necessary to maintain the highest standards of financial integrity.

This statement is intended to provide transparency and reassurance to our stakeholders about the reliability of our financial reporting.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the Accounts Payment System Feasibility Study Template at Template.net, a strategic tool for evaluating payment system options. This template is remarkably editable and customizable, making it ideal for in-depth analysis tailored to your specific needs. Modify it conveniently using our AI Editor tool. Perfect for assessing the practicality of various payment systems. Rely on Template.net for thorough financial analysis tools.