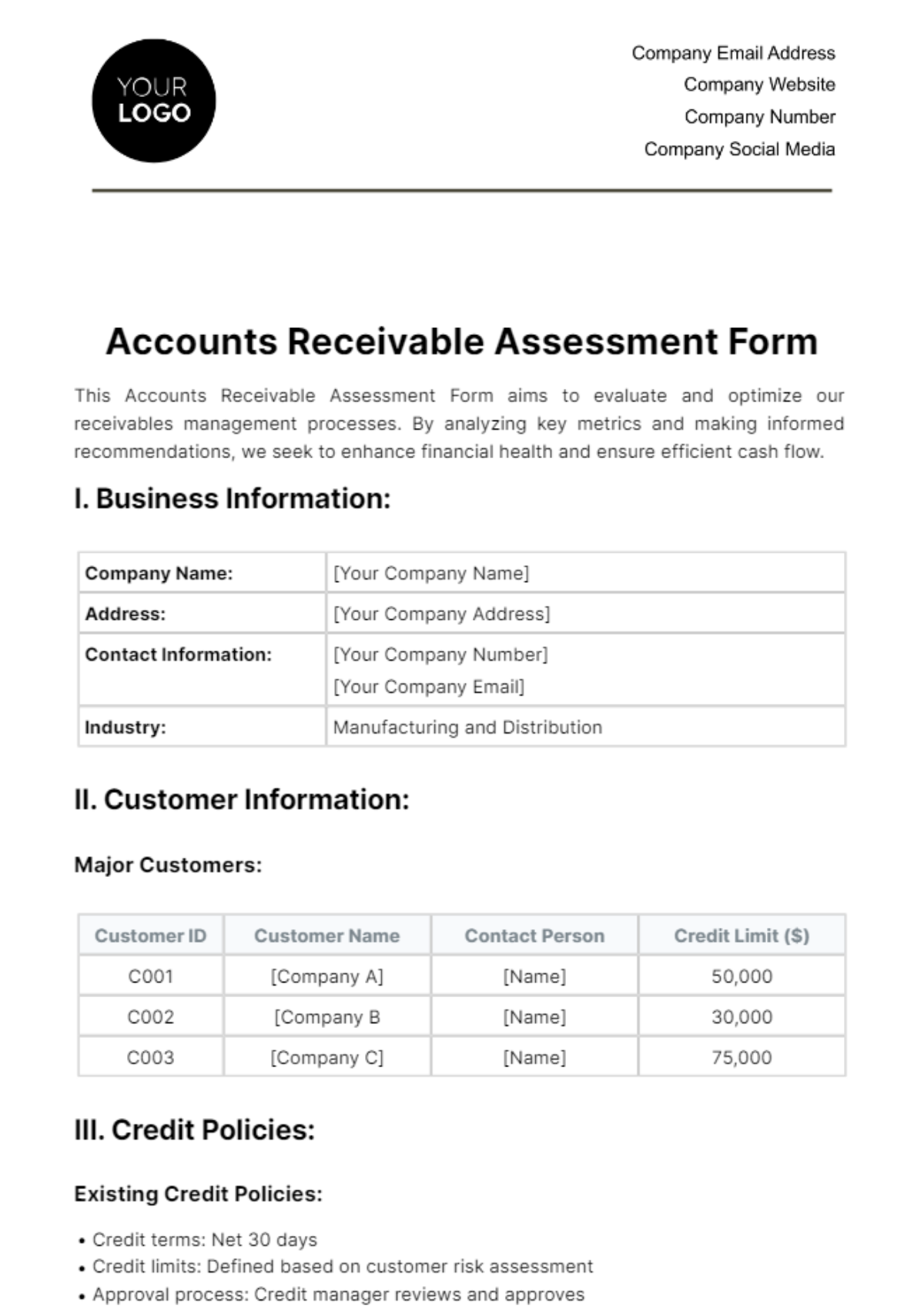

Free Accounts Receivable Assessment Form

This Accounts Receivable Assessment Form aims to evaluate and optimize our receivables management processes. By analyzing key metrics and making informed recommendations, we seek to enhance financial health and ensure efficient cash flow.

I. Business Information:

Company Name: | [Your Company Name] |

Address: | [Your Company Address] |

Contact Information: | [Your Company Number] [Your Company Email] |

Industry: | Manufacturing and Distribution |

II. Customer Information:

Major Customers:

Customer ID | Customer Name | Contact Person | Credit Limit ($) |

|---|---|---|---|

C001 | [Company A] | [Name] | 50,000 |

C002 | [Company B | [Name] | 30,000 |

C003 | [Company C] | [Name] | 75,000 |

III. Credit Policies:

Existing Credit Policies:

Credit terms: Net 30 days

Credit limits: Defined based on customer risk assessment

Approval process: Credit manager reviews and approves

Recommendations:

Review credit limits for major customers annually.

Implement credit insurance for high-risk customers.

IV. Invoicing and Billing:

Invoicing Processes:

Invoices are generated within 24 hours of product delivery.

Accuracy checks are performed before sending invoices.

Outstanding Balances:

Total Outstanding: $150,000

Overdue Invoices: $40,000

V. Aging Analysis:

Aging Categories:

Aging Period | Total Receivables ($) | Percentage (%) |

|---|---|---|

Current | 80,000 | 53% |

30 days | 40,000 | 27% |

60 days | 20,000 | 13% |

90+ days | 10,000 | 7% |

VI. Action Plan:

Immediate Actions:

Implement proactive collection calls for overdue accounts.

Initiate a credit policy review committee.

Short-Term Actions:

Upgrade automation tools for advanced collections.

Enhance customer communication channels.

Long-Term Actions:

Conduct an annual credit limit review.

Implement customer education programs on payment terms.

VII. Conclusion:

The Assessment Form for Accounts Receivable shines a spotlight on potential areas where the credit policies, collection processes, and the way we communicate with customers could be improved. Additionally, the action plan thoroughly lays out a series of steps that can be taken to boost the efficiency within the accounts receivable department while also working to reduce the potential risk factors that can have a negative effect on the department's operations.

Accounting Templates @ Templates.net

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover financial excellence with our Accounts Receivable Assessment Form Template, available on Template.net. This editable and customizable tool empowers your team to conduct a comprehensive analysis. With the integrated AI Editor Tool, effortlessly enhance credit policies, streamline collections, and fortify cash flow. Elevate your financial strategy and propel your business towards success.