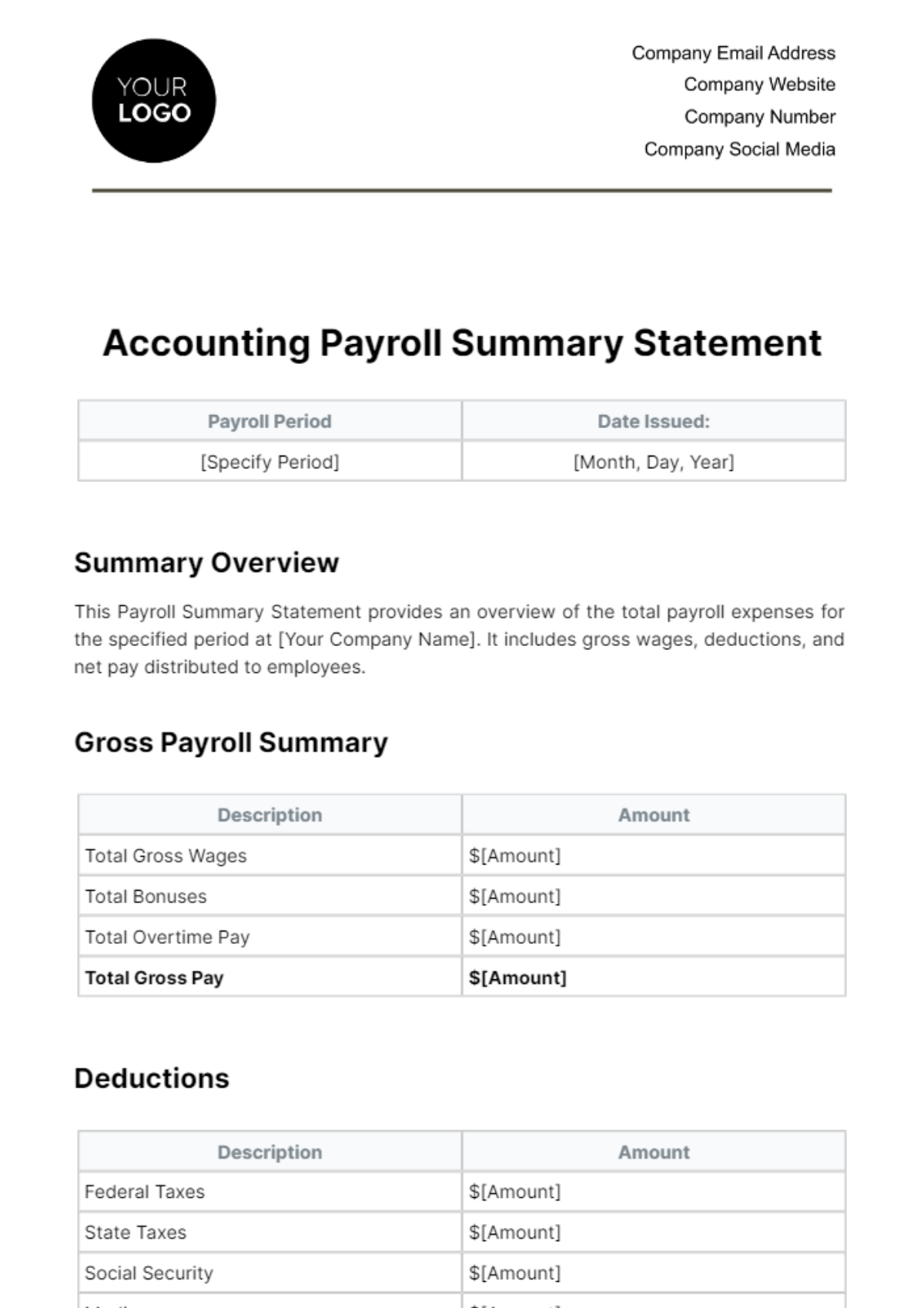

Free Accounting Payroll Summary Statement

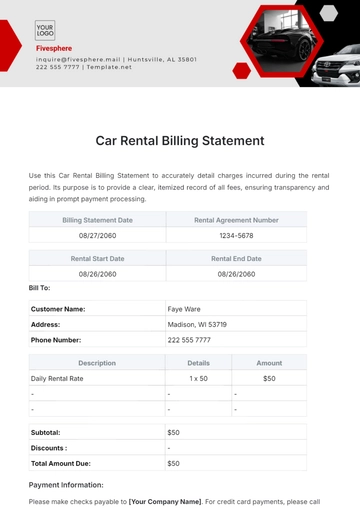

Payroll Period | Date Issued: |

|---|---|

[Specify Period] | [Month, Day, Year] |

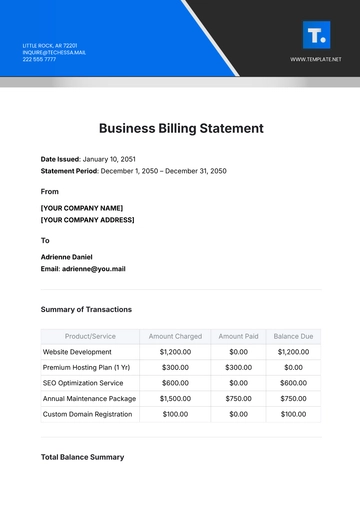

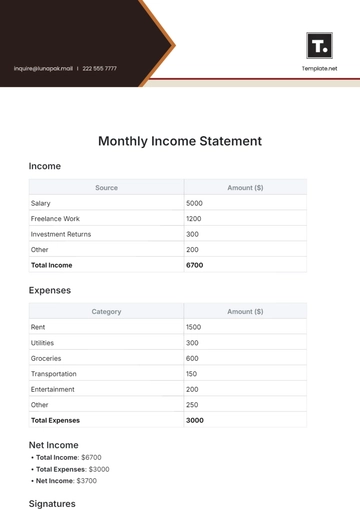

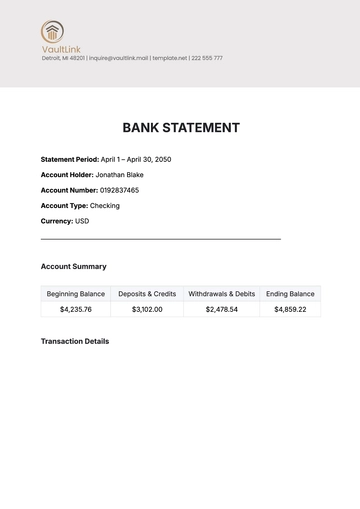

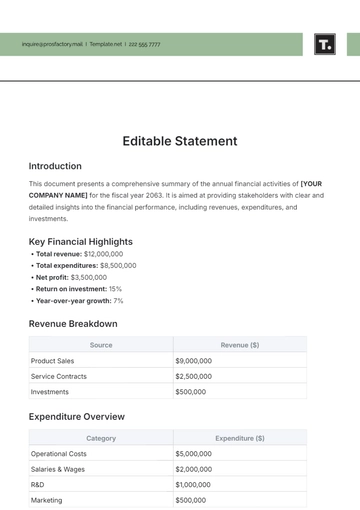

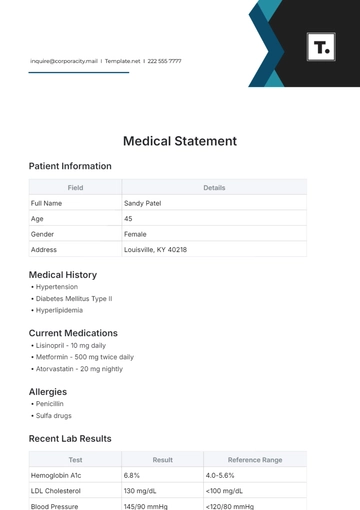

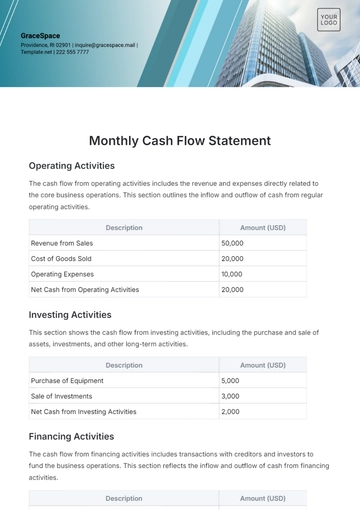

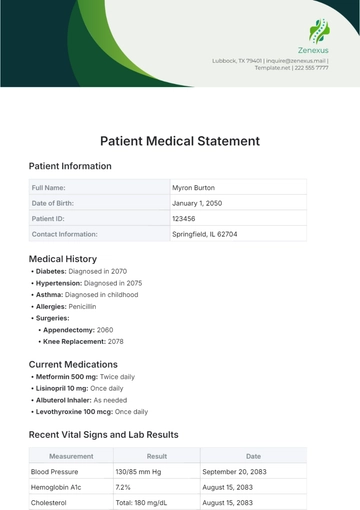

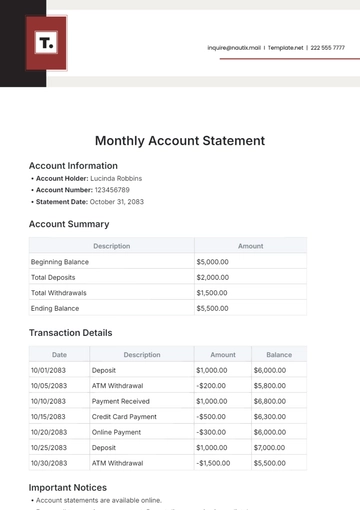

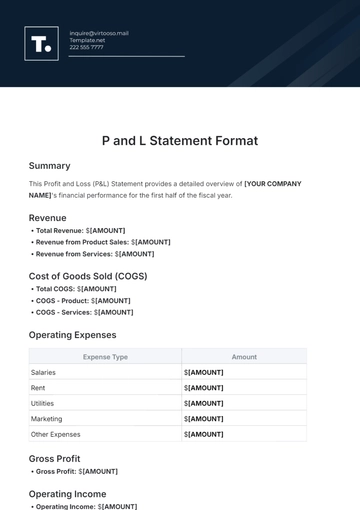

Summary Overview

This Payroll Summary Statement provides an overview of the total payroll expenses for the specified period at [Your Company Name]. It includes gross wages, deductions, and net pay distributed to employees.

Gross Payroll Summary

Description | Amount |

|---|---|

Total Gross Wages | $[Amount] |

Total Bonuses | $[Amount] |

Total Overtime Pay | $[Amount] |

Total Gross Pay | $[Amount] |

Deductions

Description | Amount |

|---|---|

Federal Taxes | $[Amount] |

State Taxes | $[Amount] |

Social Security | $[Amount] |

Medicare | $[Amount] |

Health Insurance | $[Amount] |

Retirement Contributions | $[Amount] |

Total Deductions | $[Amount] |

Net Payroll

Description | Amount |

|---|---|

Total Net Pay | $[Amount] |

Employer Contributions

Description | Amount |

|---|---|

Employer Social Security | $[Amount] |

Employer Medicare | $[Amount] |

Unemployment Taxes | $[Amount] |

Total Contributions | $[Amount] |

Payroll Distribution

Payment Method | Amount |

|---|---|

Direct Deposit | $[Amount] |

Paper Checks | $[Amount] |

Total Paid | $[Amount] |

Notes:

Any discrepancies in payroll amounts should be reported to the Payroll Department immediately.

The next payroll period will commence on [Next Period Start Date].

Prepared by:

[Your Name]

Payroll Department

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

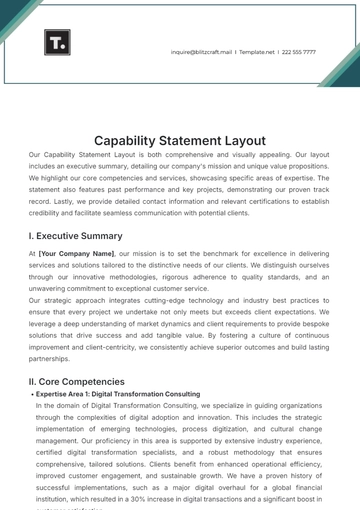

Optimize your payroll reporting with the Accounting Payroll Summary Statement Template from Template.net. Designed for accuracy and clarity, this professional template provides an organized format for presenting payroll data. It's fully editable and customizable, allowing seamless adaptation to your company’s specific needs, and ensuring effective payroll management with Template.net’s dependable Ai Editor Tool.