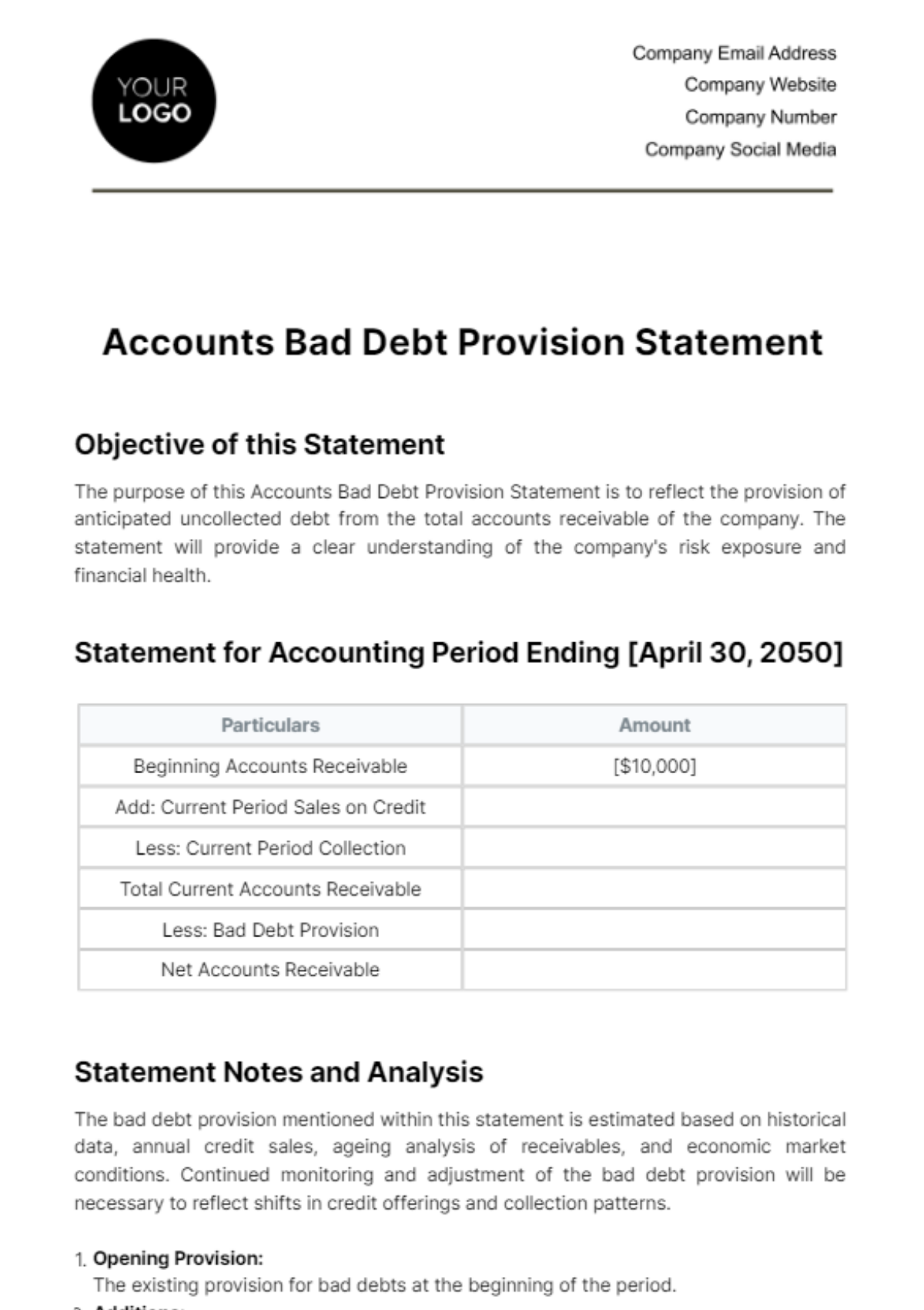

Free Accounts Bad Debt Provision Statement

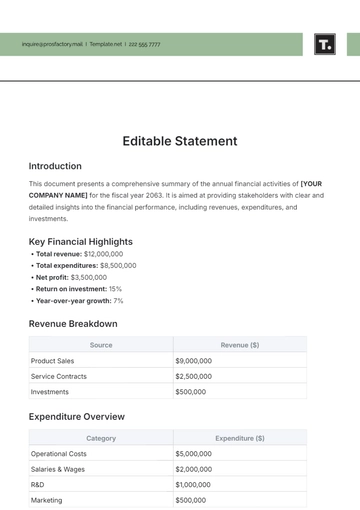

Objective of this Statement

The purpose of this Accounts Bad Debt Provision Statement is to reflect the provision of anticipated uncollected debt from the total accounts receivable of the company. The statement will provide a clear understanding of the company's risk exposure and financial health.

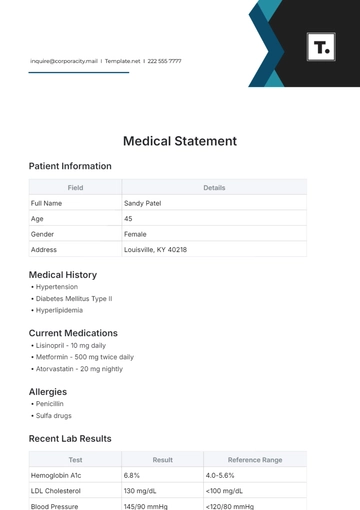

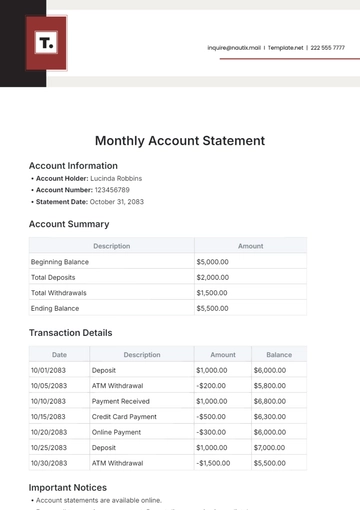

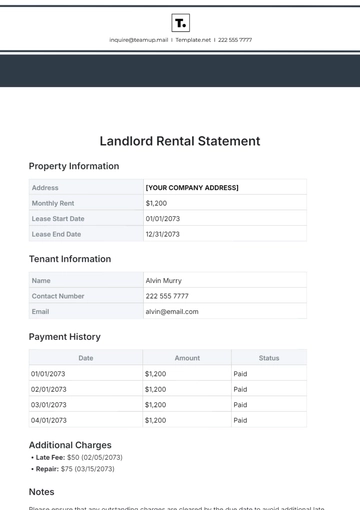

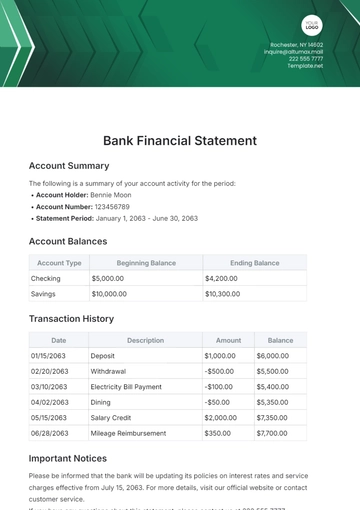

Statement for Accounting Period Ending [April 30, 2050]

Particulars | Amount |

|---|---|

Beginning Accounts Receivable | [$10,000] |

Add: Current Period Sales on Credit | |

Less: Current Period Collection | |

Total Current Accounts Receivable | |

Less: Bad Debt Provision | |

Net Accounts Receivable |

Statement Notes and Analysis

The bad debt provision mentioned within this statement is estimated based on historical data, annual credit sales, ageing analysis of receivables, and economic market conditions. Continued monitoring and adjustment of the bad debt provision will be necessary to reflect shifts in credit offerings and collection patterns.

Opening Provision:

The existing provision for bad debts at the beginning of the period.

Additions:

Additional provision made during the period based on the assessment of potential bad debts.

Utilizations:

Amount of provision utilized to cover specific bad debts during the period.

Adjustments:

Any adjustments made to the provision due to changes in the assessment of credit risks.

Closing Provision:

The revised provision for bad debts at the end of the period.

Prepared by:

[YOUR NAME]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore financial foresight with the Accounts Bad Debt Provision Statement Template from Template.net. This editable and customizable tool allows you to manage bad debt provisions seamlessly. Tailor it effortlessly to your needs using our Ai Editor Tool. Elevate your financial reporting with precision and flexibility, ensuring comprehensive insights into bad debt provisions.