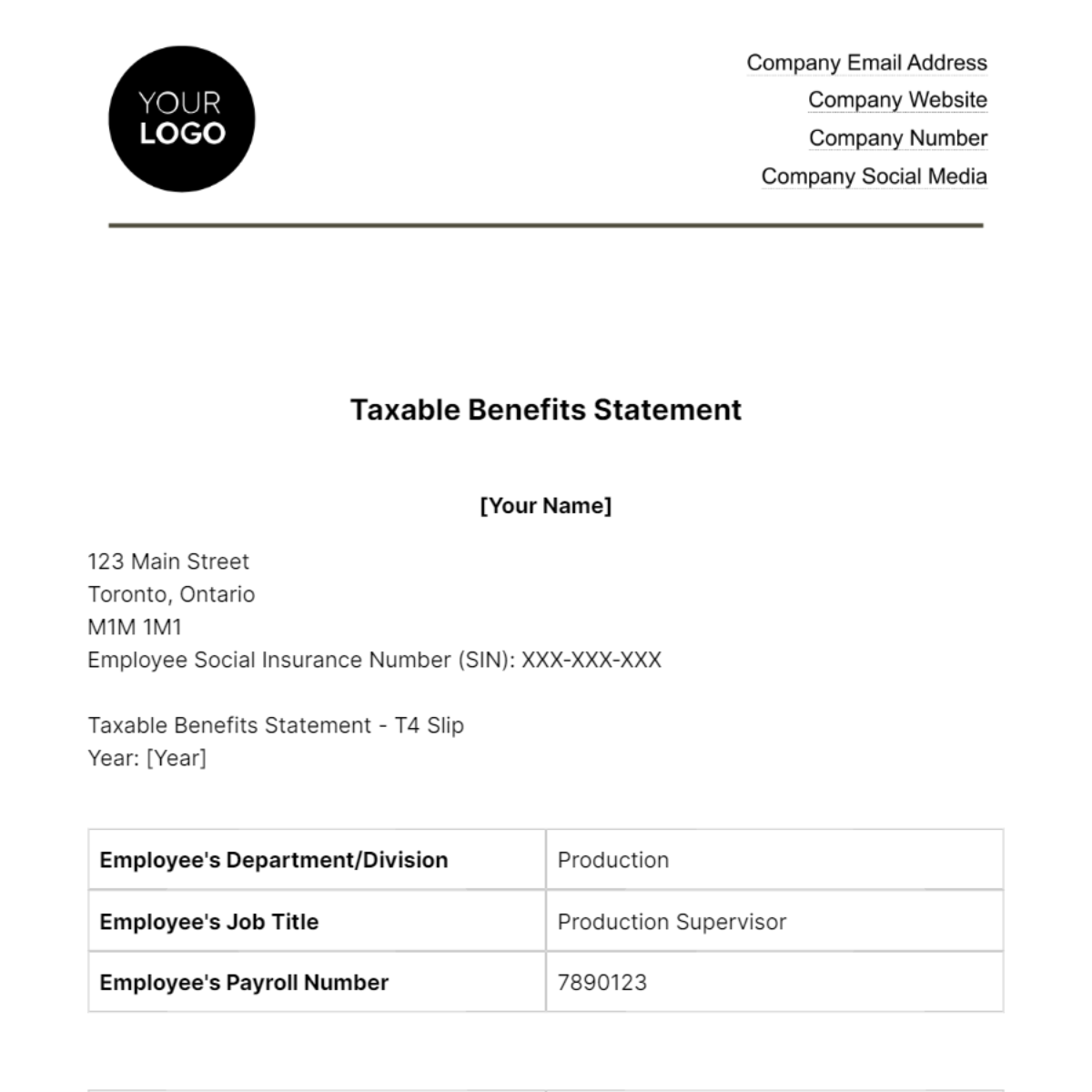

Free Taxable Benefits Statement HR

[Your Name]

123 Main Street

Toronto, Ontario

M1M 1M1

Employee Social Insurance Number (SIN): XXX-XXX-XXX

Taxable Benefits Statement - T4 Slip

Year: [Year]

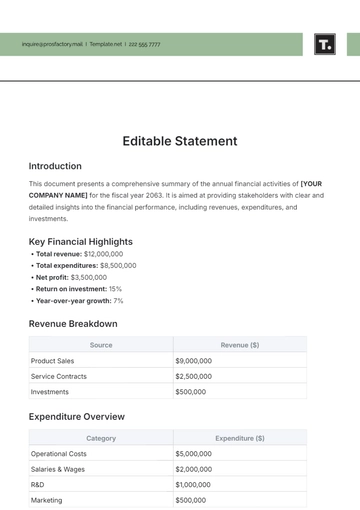

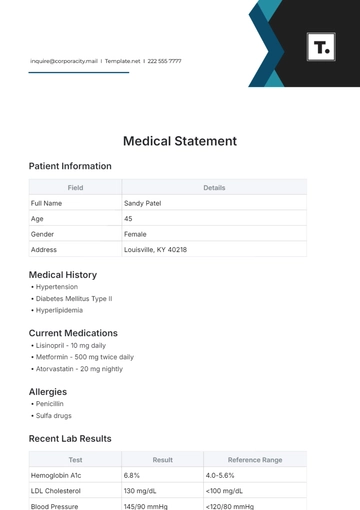

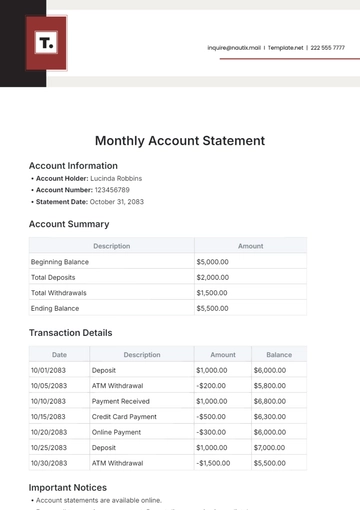

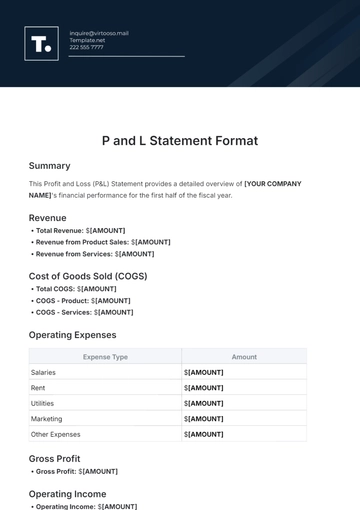

Employee's Department/Division | Production |

Employee's Job Title | Production Supervisor |

Employee's Payroll Number | 7890123 |

[Box 14 - Employment Income] | $52,500.00 |

This box represents your total employment income for the year, including salary, wages, and any other compensation. | |

[Box 22 - Income Tax Deducted] | $9,500.00 |

This box shows the total income tax deducted from your income during the year. | |

[Box 24 - Pension Plan (CPP) Contributions] | $2,500.00 |

This box displays the total CPP contributions deducted from your income. | |

[Box 18 - Union Dues] | $350.00 |

This box indicates the total union dues deducted from your pay. | |

[Box 26 - Employment Insurance (EI) Premiums] | $400.00 |

This box shows the total EI premiums deducted from your income. | |

[Box 32 - Other Information] | |

Company Vehicle Benefit | $2,000.00 |

(Value of the company vehicle provided for your use.) | |

Stock Option Benefit | $3,500.00 |

(Value of stock options exercised during the year.) | |

Meal Allowance | $1,200.00 |

(Value of meal allowances provided.) | |

[Box 38 - Employment Insurance (EI) Insurable Earnings] | $52,500.00 |

This box shows your insurable earnings for EI purposes. | |

[Box 52 - CPP Pensionable Earnings] | $52,500.00 |

This box displays your pensionable earnings for CPP purposes. | |

This statement is for your tax reporting and record-keeping purposes. Keep it in a secure place, and use the information provided when filing your income tax return with the CRA.

[Your Name]

[Month Day, Year]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

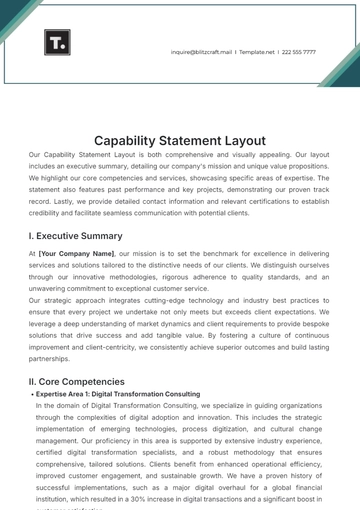

Our Taxable Benefits Statement HR Template simplifies the complexities of employee compensation reporting. With clear, customizable fields, this template streamlines the process of detailing taxable benefits, making compliance a breeze. Ensure accuracy, save time, and keep your workforce informed effortlessly with this essential HR tool.