Free Startup Funding Statement

Executive Summary:

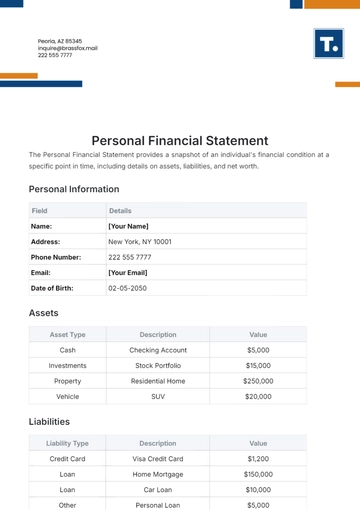

Our startup, [Your Company Name], is revolutionizing the education technology industry by providing innovative online learning platforms tailored for K-12 students. We have achieved significant milestones in product development and user acquisition, and are now seeking $2 million in funding to accelerate our growth and expand our market reach.

Company Overview:

[Your Company Name] was founded in January 2050 by John Doe and Jane Smith, both seasoned entrepreneurs with extensive experience in the education sector. Since our founding, we have developed a suite of interactive and engaging educational tools that have garnered widespread acclaim from educators and students alike.

Market Opportunity:

The global e-learning market is projected to reach $375 billion by 2056, driven by the increasing adoption of online education platforms and the growing demand for personalized learning experiences. [Your Company Name] is well-positioned to capitalize on this opportunity by offering cutting-edge solutions that cater to the evolving needs of modern learners.

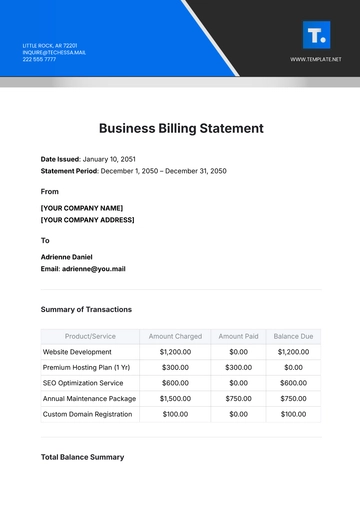

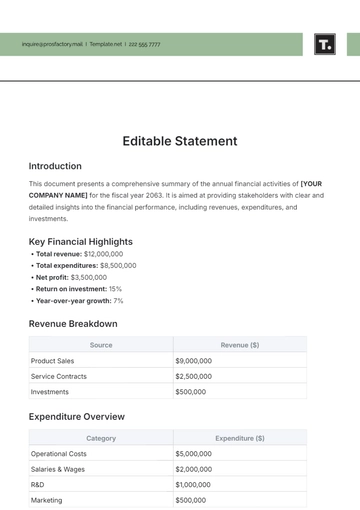

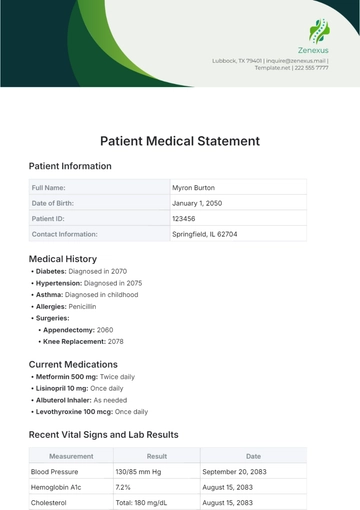

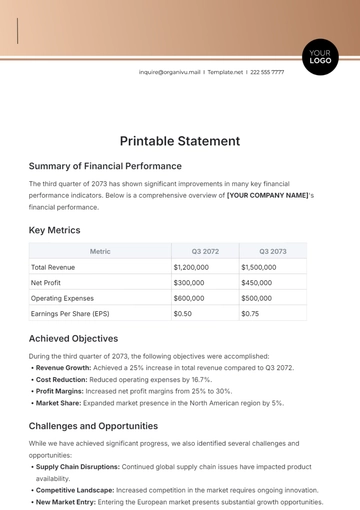

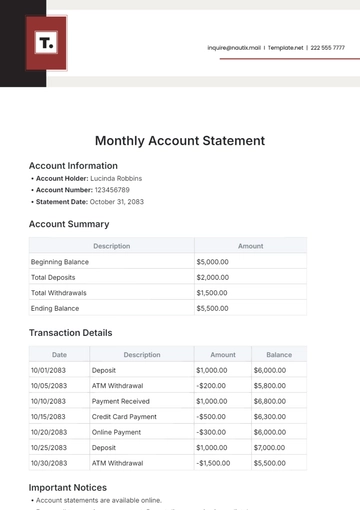

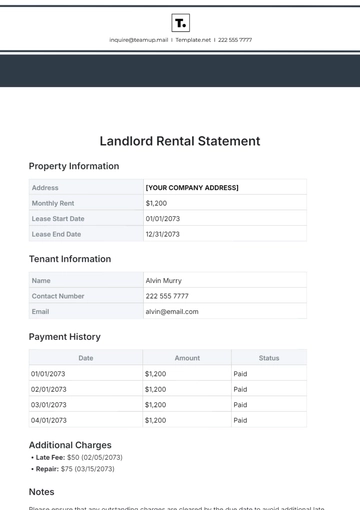

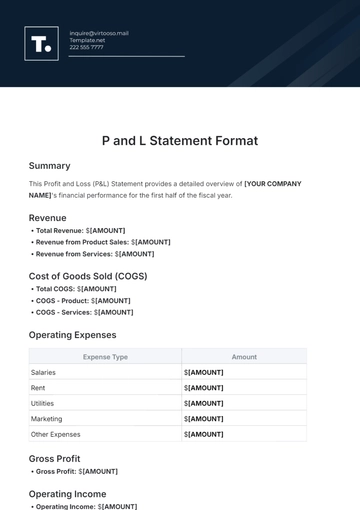

Financial Overview:

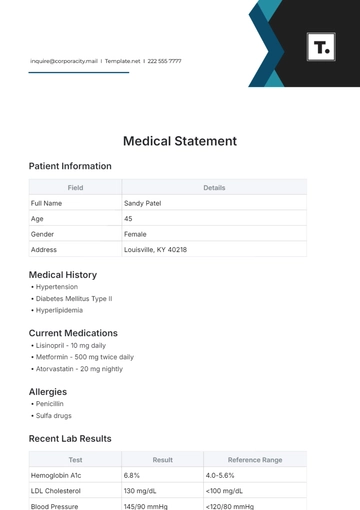

Metric | Current Status |

|---|---|

Total Revenue (2053) | $500,000 |

Total Expenses (2053) | |

Net Profit (2053) | |

Cash on Hand |

Use of Previous Funding:

The previous funding rounds totaling $1 million have been primarily allocated towards product development, marketing initiatives, and expanding our team of engineers and educators. As a result, we have successfully launched our flagship product and onboarded over 50,000 students across 200 schools.

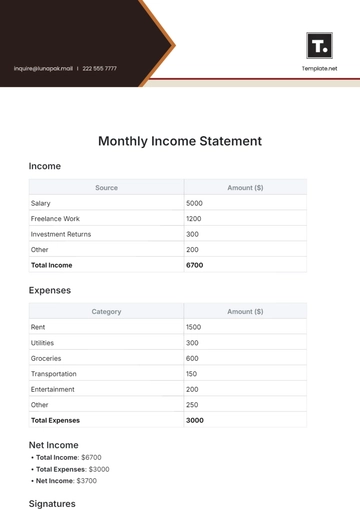

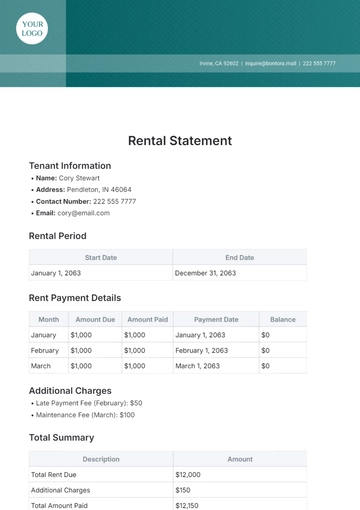

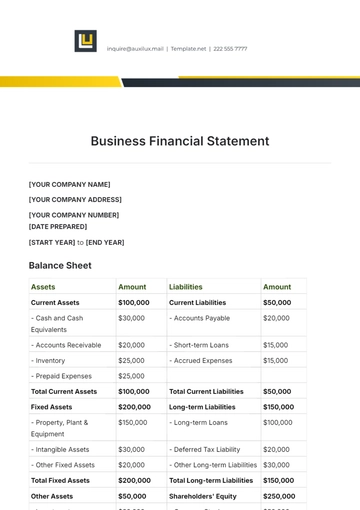

Financial Projections:

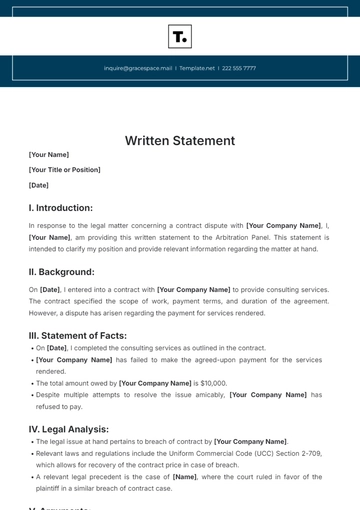

Metric | Year 1 (2054) | Year 2 (2055) | Year 3 (2056) |

|---|---|---|---|

Revenue | $1.5 million | $5 million | $10 million |

Expenses | |||

Net Profit | |||

Cash on Hand |

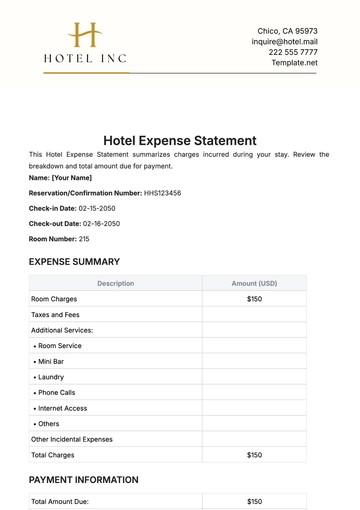

Funding Requirements:

We are seeking $2 million in funding to:

Scale our user acquisition efforts and onboard an additional 100,000 students.

Enhance our product features and develop new learning modules.

Expand our sales and marketing team to penetrate new markets and increase brand awareness.

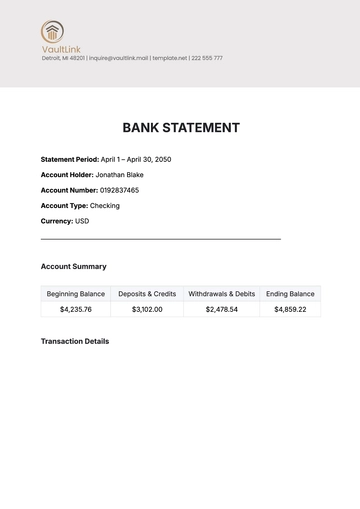

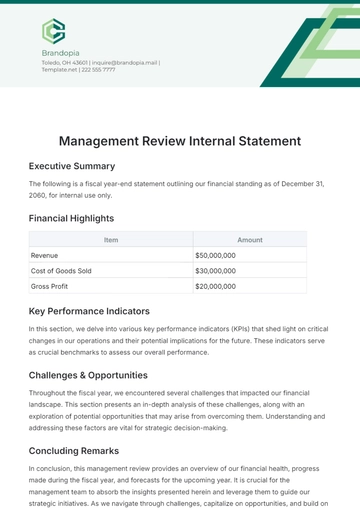

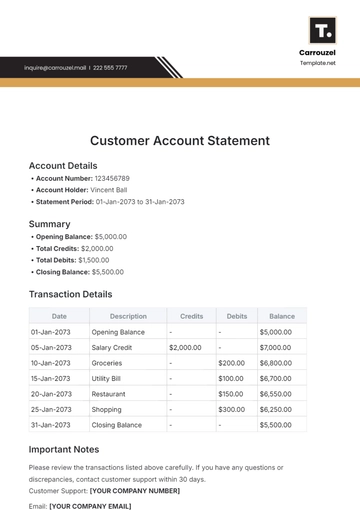

Valuation:

[Your Company Name], a leading technology firm, is presently assessed to have a net worth of $10 million. This financial evaluation is derived from a combination of two key methods: discounted cash flow analysis, which is a valuation technique that factors in the estimate of the company's future cash flow, and the usage of comparable company valuation methods, which involves comparing the firm to similar businesses to estimate its value.

Risk Assessment:

While we have experienced rapid growth and achieved significant traction in the market, there are inherent risks associated with the competitive nature of the education technology industry and potential regulatory challenges. However, we have implemented robust risk management strategies to mitigate these risks and ensure sustainable growth.

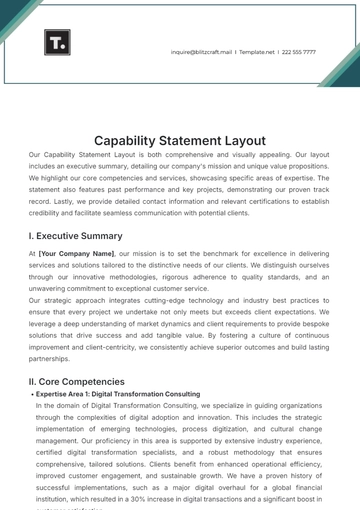

Team:

Our founding team comprises industry veterans with a proven track record of success in the education technology sector. Additionally, we have assembled a talented team of engineers, educators, and marketing professionals who are dedicated to driving the company's vision forward.

Exit Strategy:

As we look to the future, we are currently anticipating several potential exit scenarios that could come into play. One such scenario could be the acquisition of our company by another organization, specifically, a larger company within the education technology sector. Alternatively, another option we are considering is the execution of an initial public offering, or IPO, for the purpose of providing a return on investment and liquidity to those individuals who have invested in our organization. All these are possibilities that could happen within an estimated timeframe of the next 5 to 7 years.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Elevate your funding game with the Startup Funding Statement Template from Template.net. This editable and customizable tool streamlines the creation of compelling funding documents. With its intuitive AI Editor Tool, craft a polished presentation of your company's financial journey, ensuring clarity and professionalism. Empower your startup with the perfect pitch - download now and make your mark!