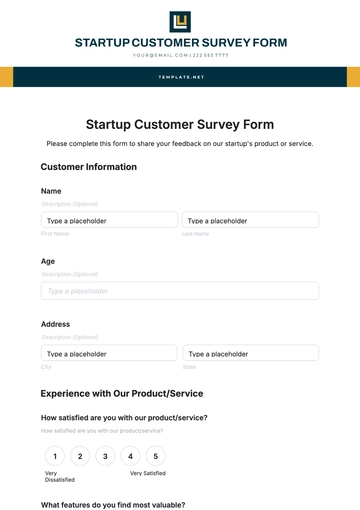

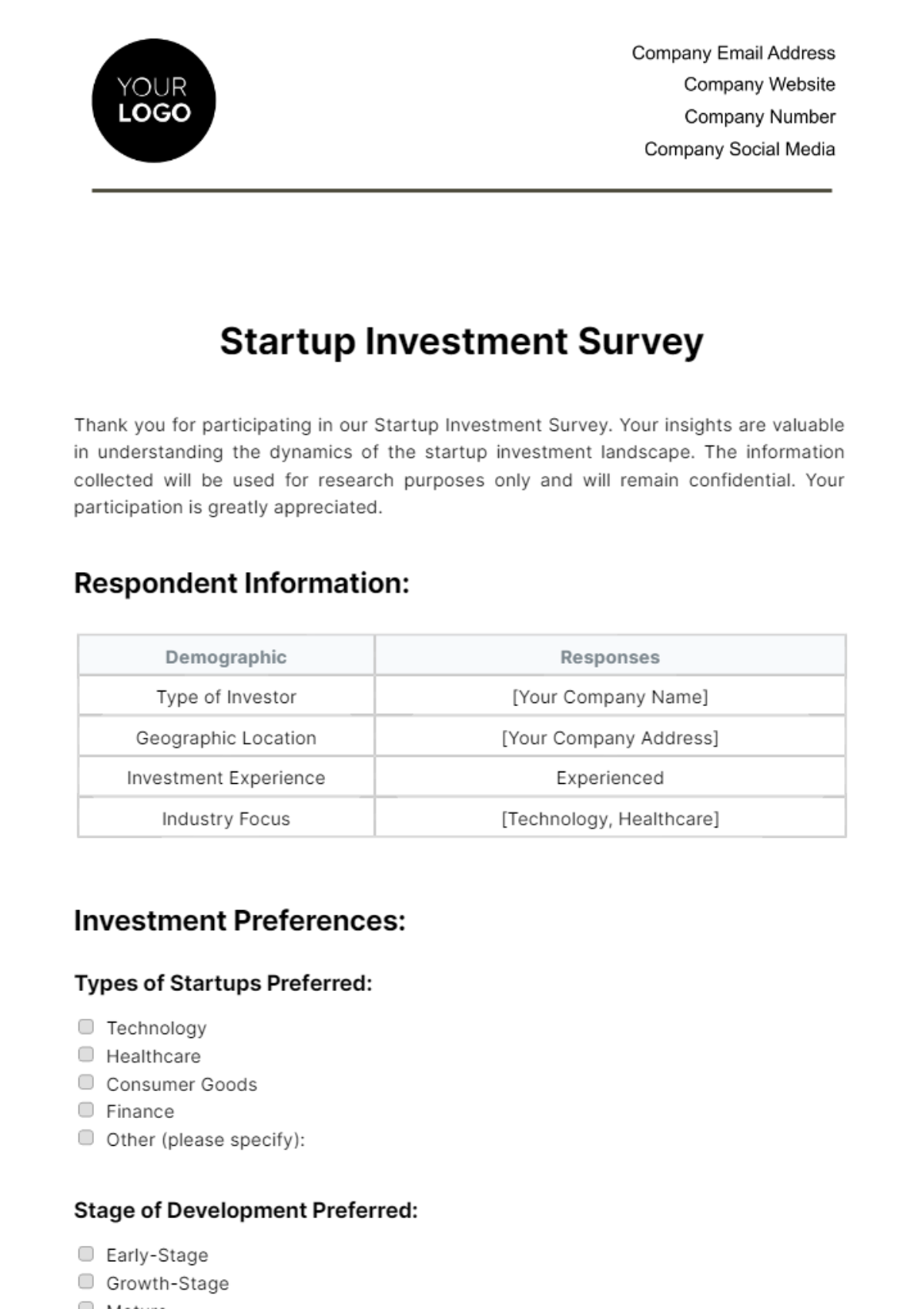

Free Startup Investment Survey

Thank you for participating in our Startup Investment Survey. Your insights are valuable in understanding the dynamics of the startup investment landscape. The information collected will be used for research purposes only and will remain confidential. Your participation is greatly appreciated.

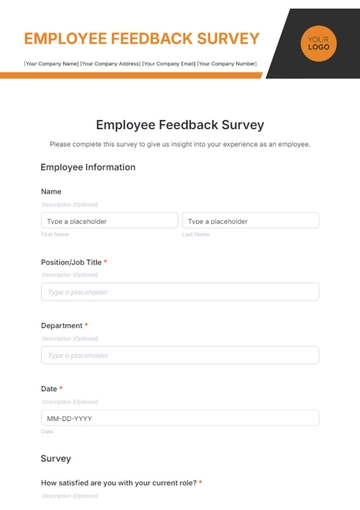

Respondent Information:

Demographic | Responses |

|---|---|

Type of Investor | [Your Company Name] |

Geographic Location | [Your Company Address] |

Investment Experience | Experienced |

Industry Focus | [Technology, Healthcare] |

Investment Preferences:

Types of Startups Preferred:

Technology

Healthcare

Consumer Goods

Finance

Other (please specify):

Stage of Development Preferred:

Early-Stage

Growth-Stage

Mature

Investment Criteria:

Factors Considered:

Team: Founder experience and expertise

Market Potential: Size, growth, trends

Traction: Customer base, revenue, user engagement

Technology/Product Differentiation: Innovation, uniqueness

Competitive Landscape: Positioning, barriers to entry

Scalability and Growth Potential

Investment Strategies:

Sourcing of Investment Opportunities:

Networking Events

Referrals

Online Platforms (e.g., AngelList, Crunchbase)

Other (please specify):

Evaluation Process:

Due Diligence: Market analysis, financial review, team assessment

Decision-Making Timeline: 3-6 months

Key Decision-Makers: Partners, analysts, investment team

Investment Trends:

Emerging Trends:

Healthcare Technology

B2B SaaS

Fintech

Artificial Intelligence

Other (please specify):

Geographic Regions of Interest:

Silicon Valley

Emerging Tech Hubs (please specify):

Observations on Funding Rounds:

More seed-stage opportunities

Increase in late-stage investments

Growth in pre-seed funding

Other (please specify):

Challenges and Opportunities:

Challenges:

High competition for attractive investments

Deal flow quality and quantity

Due diligence process complexity

Portfolio management challenges

Other (please specify):

Opportunities:

Digital Health Innovations

Remote Work Technologies

Emerging Market Opportunities

Collaboration Opportunities

Other (please specify):

Thank you once again for your participation in our Startup Investment Survey. Your insights are invaluable in shaping our understanding of the startup investment landscape. If you have any further questions or would like to discuss potential collaboration opportunities, please don't hesitate to contact us.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the ultimate tool for navigating the dynamic startup investment landscape with ease! Introducing the Startup Investment Survey Template from Template.net. Crafted by experts, this editable and customizable template offers a comprehensive framework to gather insights seamlessly. Utilize our intuitive AI Editor Tool to tailor your survey to perfection. Elevate your investment strategy today!