Free Budget Schedule

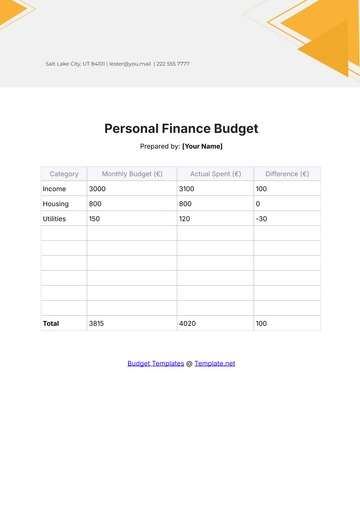

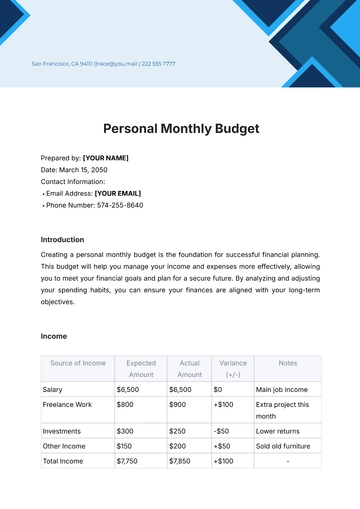

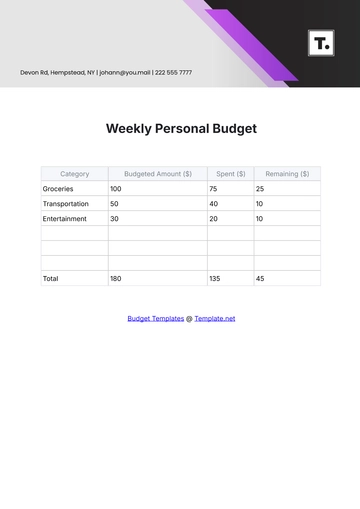

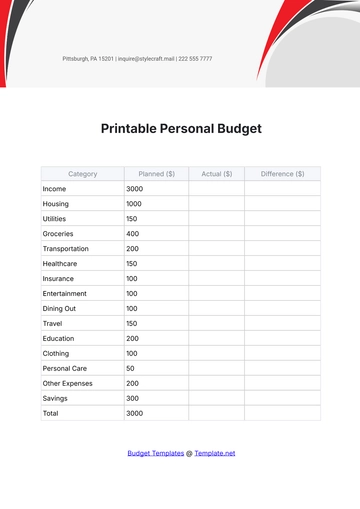

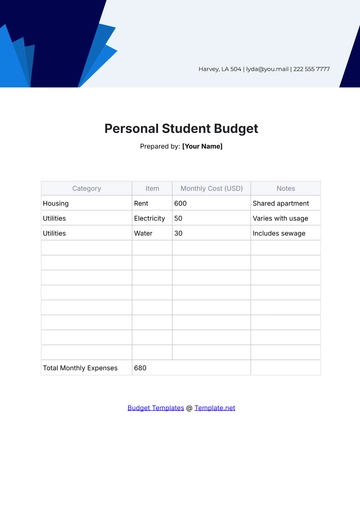

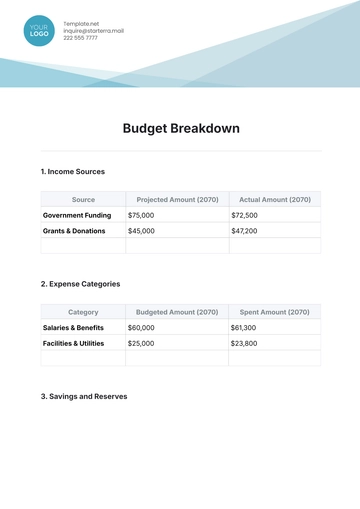

By tracking income, expenses, savings, and financial goals monthly, individuals can better control their financial health and work towards desired milestones. This proactive budgeting approach empowers informed decisions about spending, saving, and investing, leading to enhanced financial stability and security.

Month | Income | Expenses | Savings | Financial Goals |

|---|---|---|---|---|

January | $5000 | $1000 | $500 | Save $500 for an emergency fund |

February | $5000 | $1200 | $400 | Pay off credit card debt |

March | $5000 | $1000 | $500 | Save $300 for vacation |

April | $5000 | $1200 | $500 | Invest $200 in stocks |

May | $5000 | $1000 | $500 | Save $400 for home repairs |

June | $5000 | $1200 | $500 | Pay off student loan |

July | $5000 | $1000 | $500 | Save $600 for retirement |

August | $5000 | $1200 | $500 | Invest $300 in mutual funds |

September | $5000 | $1000 | $500 | Save $200 on car maintenance |

October | $5000 | $1200 | $500 | Pay off personal loan |

November | $5000 | $1000 | $400 | Save $500 for holiday expenses |

December | $5000 | $1000 | $400 | Contribute $400 to charity |

Additional Notes:

Review and adjust the budget regularly to accommodate changes.

Allocate funds to emergency savings and long-term goals.

Utilize budgeting tools for efficiency.

Adhere to the budget and avoid unnecessary expenses.

Seek guidance from financial experts if needed.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

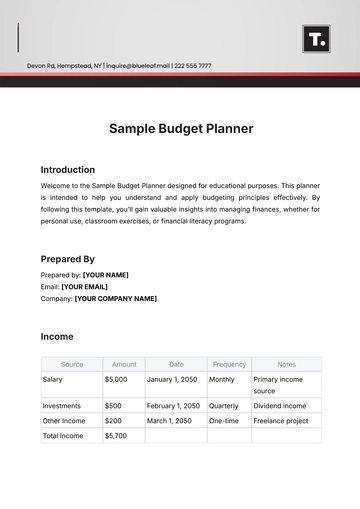

Introducing the Budget Schedule Template from Template.net. Crafted for individuals, businesses, and organizations, this customizable tool simplifies your budget planning effortlessly. With our user-friendly Ai Editor Tool, organize and track your income, expenses, and savings goals with precision, ensuring a well-structured and effective financial plan. Stay on top of your finances with this efficient template, exclusively designed to enhance efficiency and effectiveness in managing your budget schedule.

You may also like

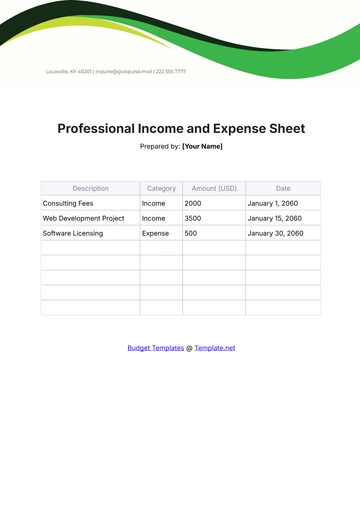

- Budget Sheet

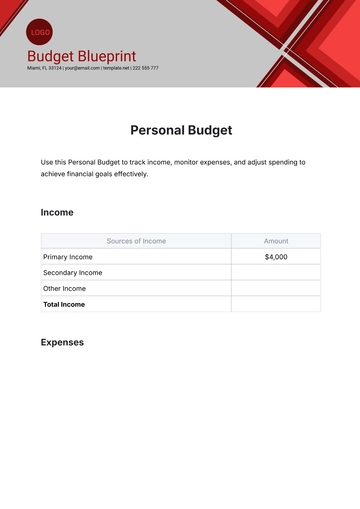

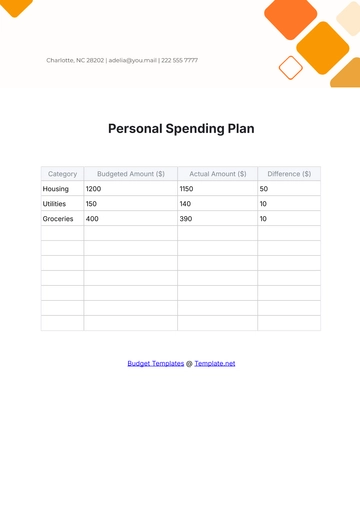

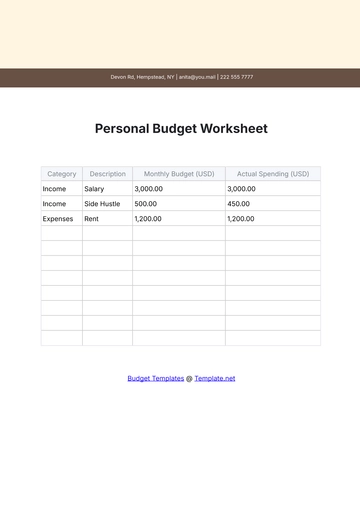

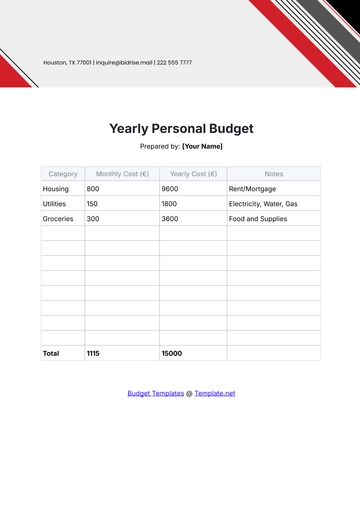

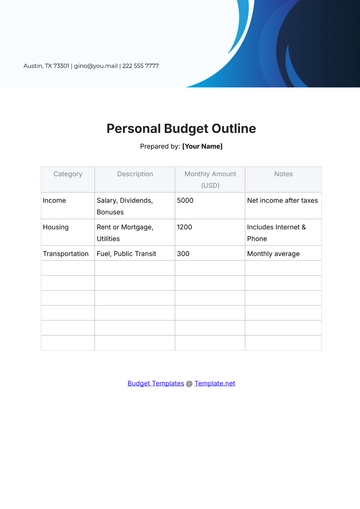

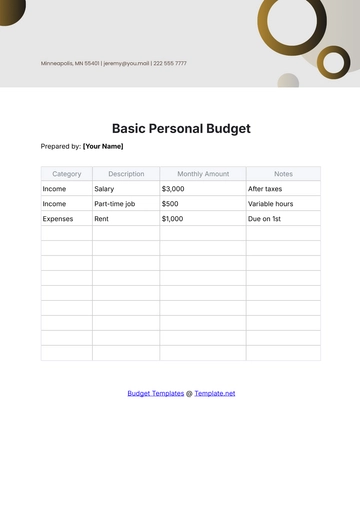

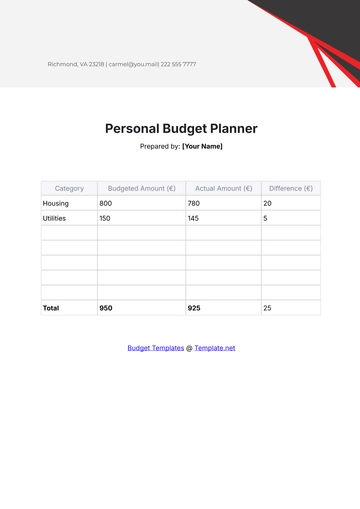

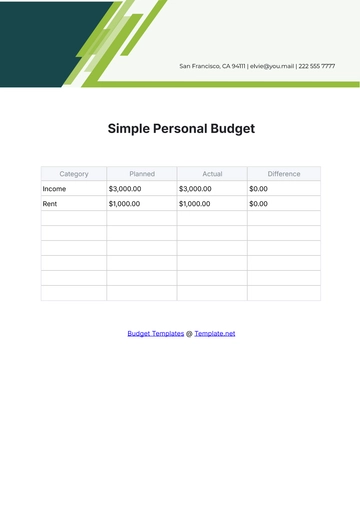

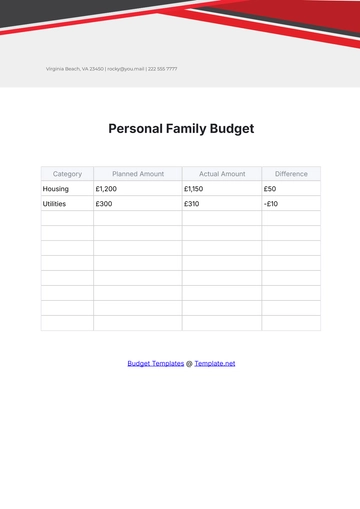

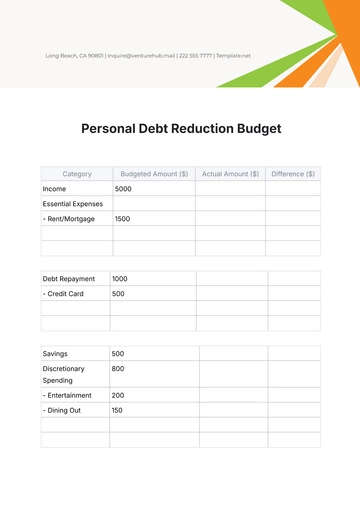

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

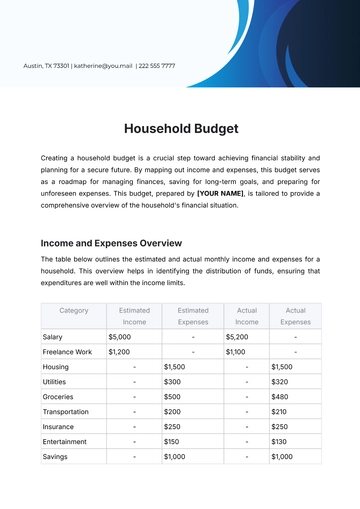

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

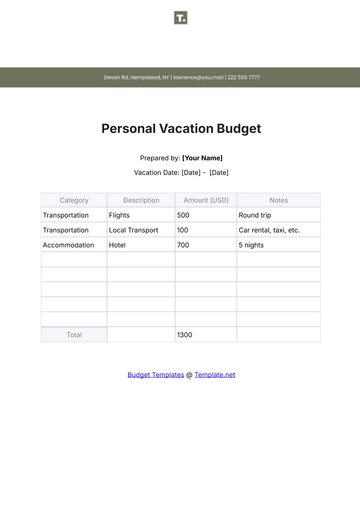

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising