Free Investment Review Brief

[YOUR COMPANY NAME]

Executive Summary

This section offers a high-level overview of our investment strategy, performance, and the market trends that have influenced our recommendations. Key factors impacting our investment decisions include:

The performance of current investment holdings over the past quarter

Analysis of current market trends and predictions for the future

The financial performance of the investment portfolios

A comprehensive risk assessment, including potential mitigating factors

Strategic recommendations for future investment activities

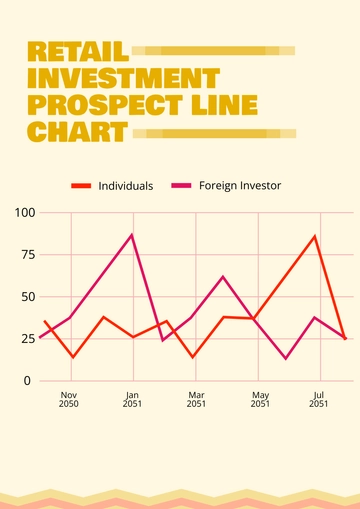

Market Trends

Market trends that have a direct impact on our investment portfolio and the prediction of future trends include:

Tech Sector Volatility: The tech sector has shown volatility with a potential rebound expected due to increased demand for cloud computing and AI technologies. This volatility requires close monitoring as it could present both risks and opportunities.

Green Energy Adoption: There's a significant shift towards green energy, impacting investments in traditional energy sectors. The growing demand for renewable energy sources is reshaping investment landscapes, offering long-term growth prospects.

Global Economic Recovery Post-Pandemic: The global economy is on a recovery path post-pandemic, influencing consumer behavior and market dynamics. Sectors like travel, hospitality, and services are expected to see a resurgence, impacting investment strategies.

Financial Performance

Our financial performance analysis incorporates factors such as portfolio return, risk-adjusted performance, and comparison with relevant benchmarks.

Portfolio Return:

The portfolio has returned 8% over the past year, outperforming our initial expectations given the market conditions.Risk-Adjusted Return:

On a risk-adjusted basis, the portfolio has performed well, with a Sharpe ratio of 1.2, indicating good return per unit of risk.Benchmark Comparison:

Compared to the S&P 500 benchmark, our portfolio has shown a resilient performance, outperforming the benchmark by 2% over the same period.

Risk Assessment

Our risk assessment evaluates potential risks to our investment strategy and portfolio value, incorporating both qualitative and quantitative analyses.

Risk Factor | Description | Mitigation Strategy |

|---|---|---|

Market Volatility | The portfolio is exposed to market volatility, particularly in the tech and energy sectors. | Diversification and strategic hedging. |

Interest Rate Changes | Potential interest rate hikes could adversely affect the bond portion of our portfolio. | Shift towards short-duration bonds. |

Geopolitical Tensions | Ongoing geopolitical tensions have the potential to disrupt market performance. | Maintain a geographically diversified portfolio. |

Future Investment Strategy Recommendations

Based on our analysis, we recommend the following strategies for future investments:

Diversify into Renewable Energy: Given the positive market trends in green energy, allocating a portion of the portfolio to renewable energy companies could offer long-term growth.

Technology Sector Caution: While the tech sector offers potential, its current volatility suggests a more cautious approach. Consider selectively investing in stable, high-growth potential tech firms.

Increase in Fixed-Income Securities: With potential interest rate changes, increasing the portfolio's allocation to short-duration fixed-income securities can offer stability.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Sharpen your investment strategies with Template.net's Investment Review Brief. This editable, customizable template provides a detailed analysis of investment portfolios, facilitating strategic decision-making. With the ability to tailor content through our AI Editor Tool, it's an invaluable resource for investors seeking to optimize portfolio performance and risk management.