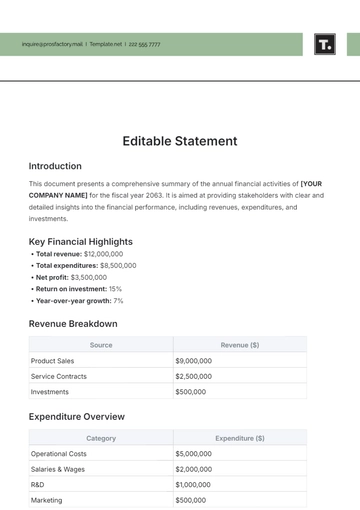

Free Real Estate Investment Statement

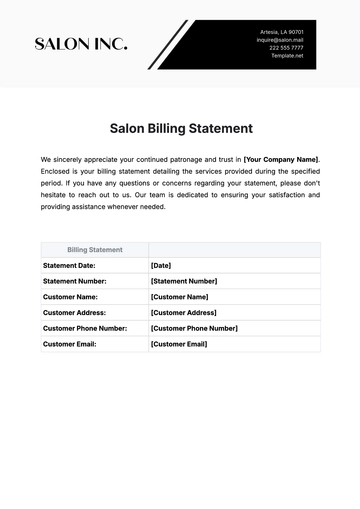

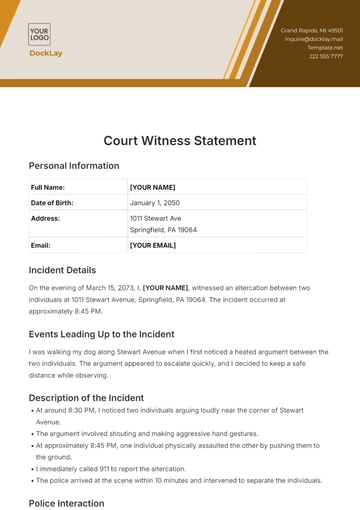

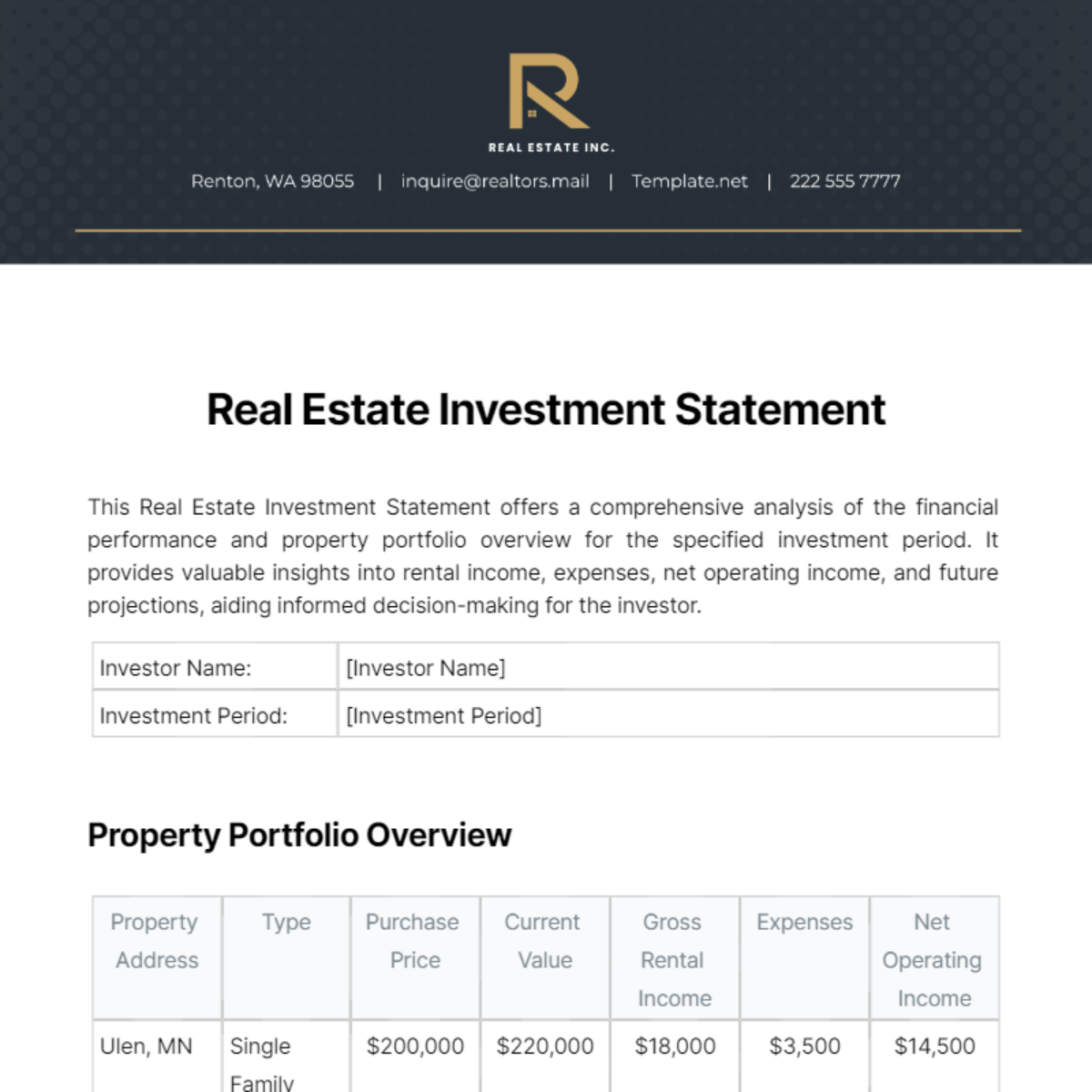

This Real Estate Investment Statement offers a comprehensive analysis of the financial performance and property portfolio overview for the specified investment period. It provides valuable insights into rental income, expenses, net operating income, and future projections, aiding informed decision-making for the investor.

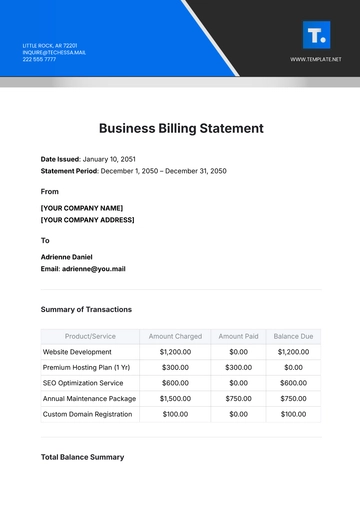

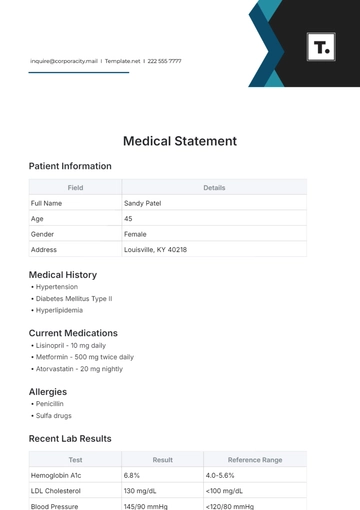

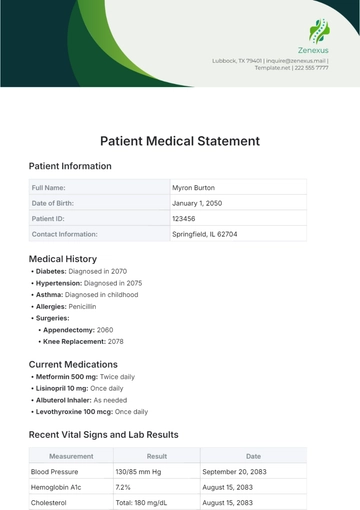

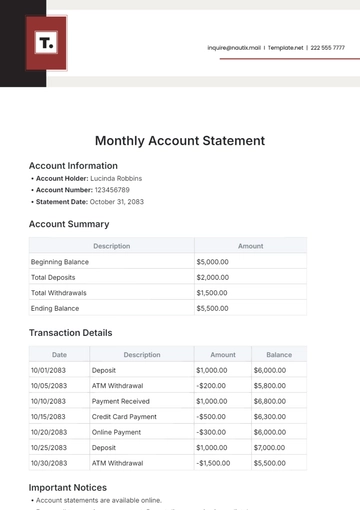

Investor Name: | [Investor Name] |

Investment Period: | [Investment Period] |

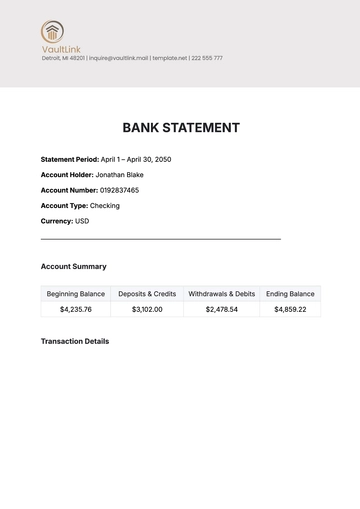

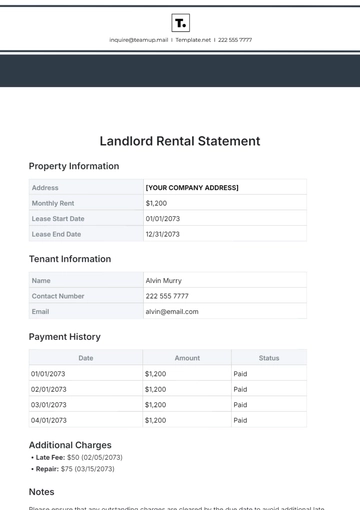

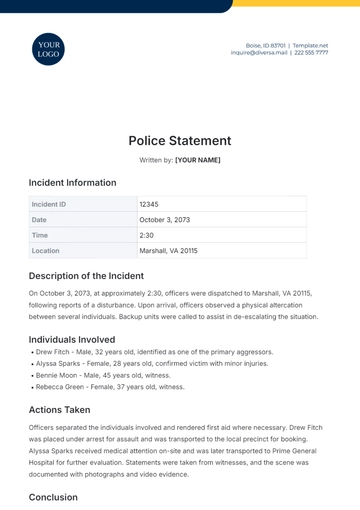

Property Portfolio Overview

Property Address | Type | Purchase Price | Current Value | Gross Rental Income | Expenses | Net Operating Income |

|---|---|---|---|---|---|---|

Ulen, MN | Single Family | $200,000 | $220,000 | $18,000 | $3,500 | $14,500 |

New York, NY | Duplex | $300,000 | $320,000 | $28,000 | $5,000 | $23,000 |

Seattle, WA | Apartment | $500,000 | $550,000 | $50,000 | $12,000 | $38,000 |

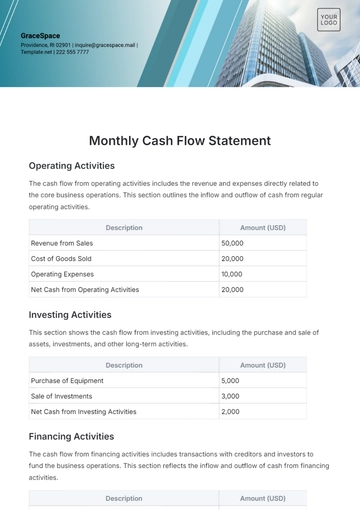

Total Portfolio Performance

Total Portfolio Value | $1,090,000 |

Total Gross Rental Income | $96,000 |

Total Expenses | $20,500 |

Total Net Operating Income | $75,500 |

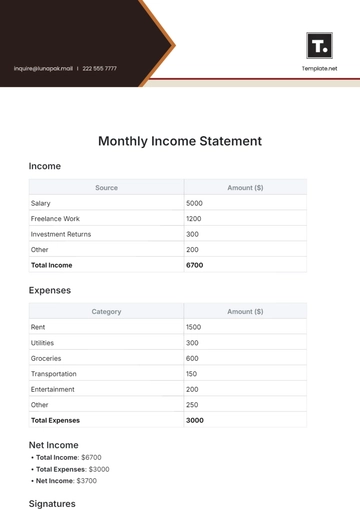

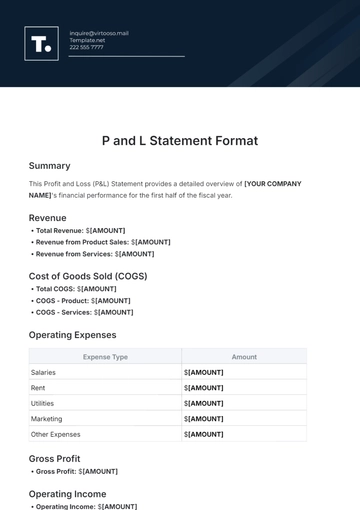

Financial Summary

Total Rental Income | $96,000 |

Total Expenses | $20,500 |

Net Operating Income | $75,500 |

Return on Investment | 7.55% |

Future Projections

Rental Income | 5% annually |

Expenses | 3% annually |

Notes

Property values are based on recent appraisals.

Rental income is gross income before deducting expenses.

Expenses include property taxes, insurance, maintenance, and management fees.

Net Operating Income is calculated by subtracting total expenses from gross rental income.

ROI is calculated based on the initial investment in the properties.

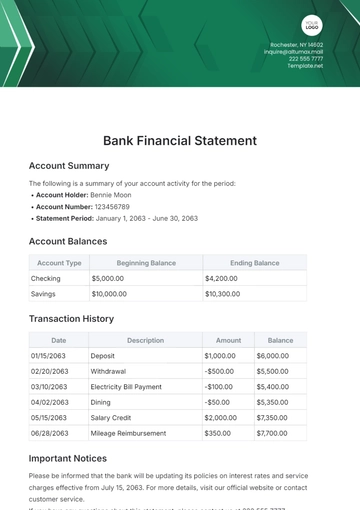

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Track real estate investments effectively with Template.net's Real Estate Investment Statement Template. Editable in our AI Editor Tool, this customizable template provides a structured format for summarizing investment portfolios, including property details, acquisition costs, market values, and returns. Streamline financial reporting, assess performance, and make informed investment decisions effortlessly with Template.net!