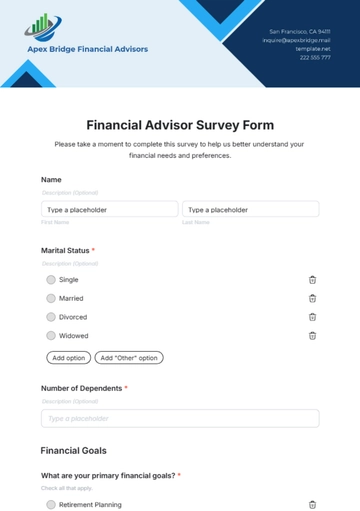

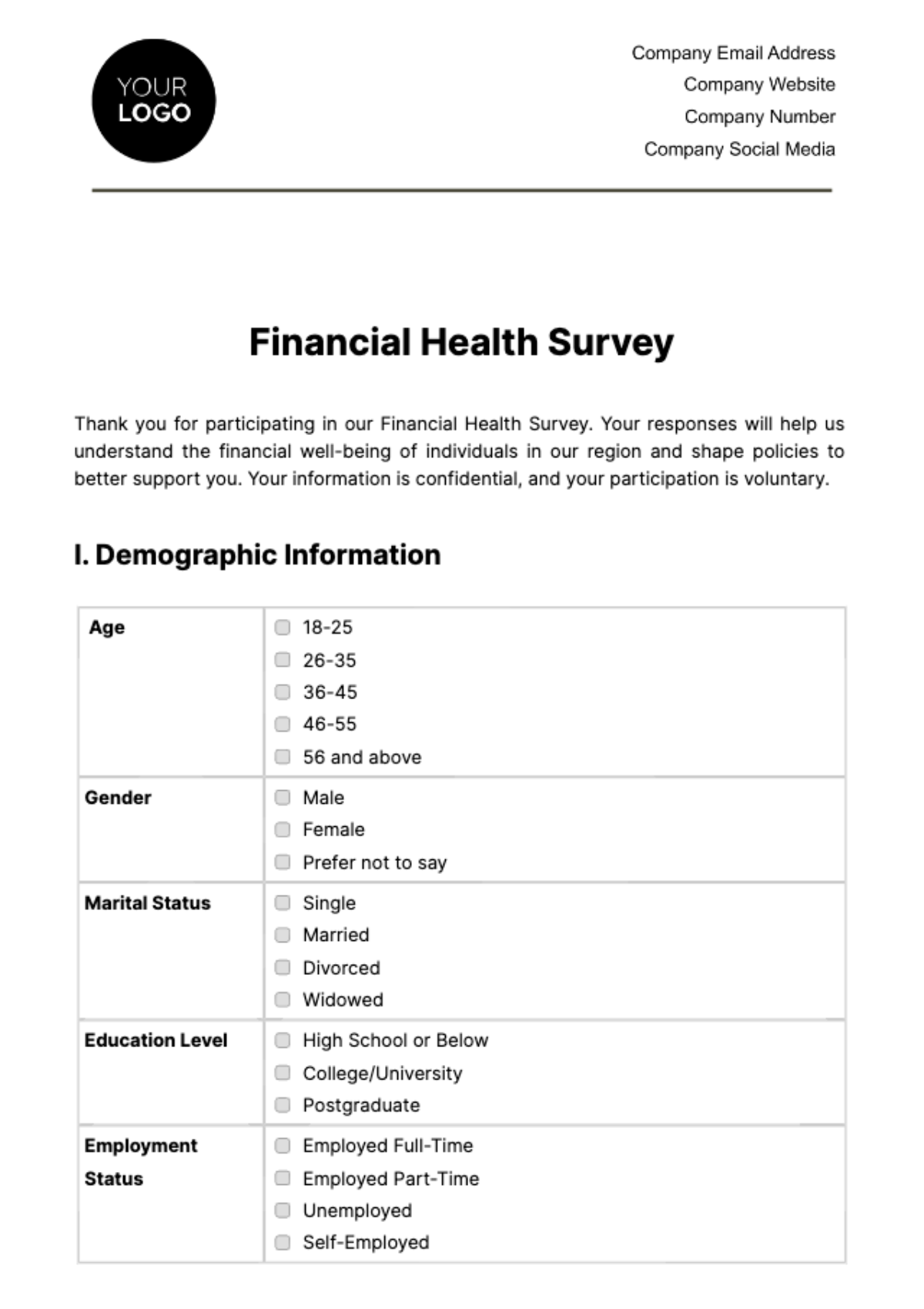

Free Financial Health Survey

Thank you for participating in our Financial Health Survey. Your responses will help us understand the financial well-being of individuals in our region and shape policies to better support you. Your information is confidential, and your participation is voluntary.

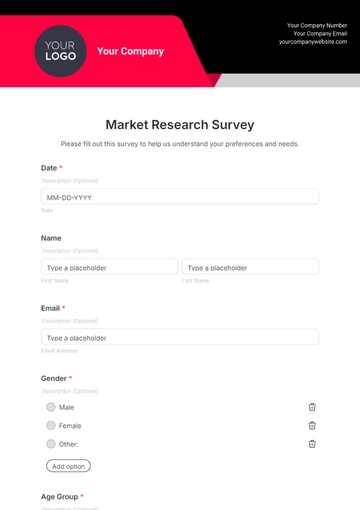

I. Demographic Information

Age |

|

Gender |

|

Marital Status |

|

Education Level |

|

Employment Status |

|

II. Income and Expenses

A. Household Income

Source | Monthly Amount ($) |

Employment | [0] |

Investments | [0] |

Other | [0] |

Total Income | [0] |

B. Monthly Expenses

Expense | Monthly Amount ($) |

Housing | [0] |

Utilities | [0] |

Food | [0] |

Transportation | [0] |

Entertainment | [0] |

Total Expenses | [0] |

C. Savings and Investments

Type | Presence |

Savings Account |

|

Investment Portfolio |

|

III. Debt Profile

Type | Amount ($) |

Mortgage | [0] |

Auto Loans | [0] |

Credit Cards | [0] |

Student Loans | [0] |

Total Debt | [0] |

Monthly Debt Payments: $1,500

IV. Financial Goals and Planning

A. Short-Term Financial Goals

Goal | Target Amount ($) |

Emergency Fund | [0] |

Vacation | [0] |

B. Long-Term Financial Goals

Goal | Target Amount ($) |

|---|---|

Homeownership | [0] |

Retirement | [0] |

C. Retirement Planning

Goal | Target Amount ($) |

Contributing to Retirement Accounts | [0] |

Estimated Retirement Age | [0] |

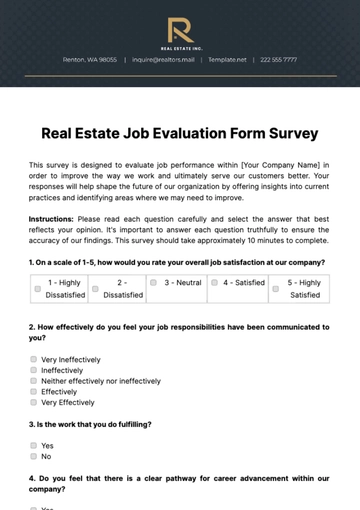

V. Financial Literacy

A. Basic Financial Knowledge:

1. Budgeting:

Beginner

Intermediate

Advanced

2. Understanding Interest Rates:

Beginner

Intermediate

Advanced

3. Investment Awareness:

Beginner

Intermediate

Advanced

B. Sources of Financial Information:

Financial News Websites

Books

Financial Advisors

Online Courses

VI. Financial Well-being Perceptions

A. Self-assessment of Financial Well-being:

Very Satisfied

Satisfied

Neutral

Dissatisfied

Very Dissatisfied

B. Factors Influencing Financial Satisfaction:

Job Security

Income Level

Budgeting Skills

VII. Emergency Preparedness

A. Emergency Savings:

Savings Goal | Current Progress ($) | Target Amount ($) |

Short-Term Emergencies | [0] | [0] |

Medical Expenses | [0] | [0] |

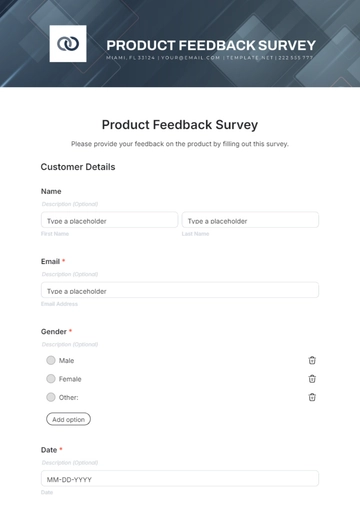

VIII. Access to Financial Services

A. Banking Services Utilized:

Checking Account

Savings Account

Credit Card

B. Access to Credit:

Easily Accessible

Somewhat Accessible

Difficult to Access

Economic Confidence

C. Perceptions of Economic Conditions:

Positive

Neutral

Negative

D. Confidence in Job Security:

Very Confident

Confident

Neutral

Not Confident

Not at all Confident

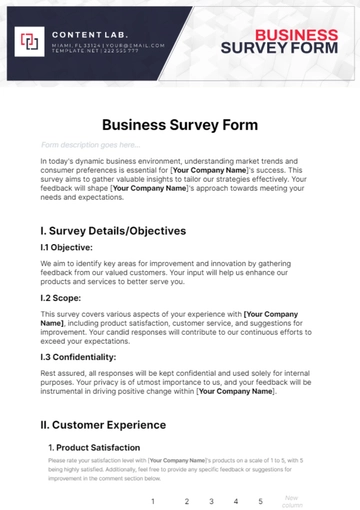

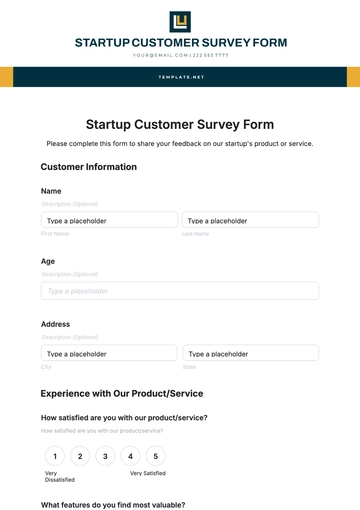

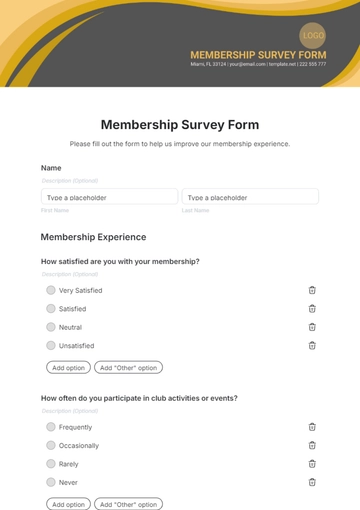

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Financial Health Survey Template from Template.net! Crafted with precision, it offers an editable and customizable design to suit your needs. Seamlessly assess your financial well-being with the aid of our user-friendly Ai Editor Tool. Elevate your financial planning effortlessly. Get yours today and thrive!