Free Financial Statement Audit Report

I. Executive Summary

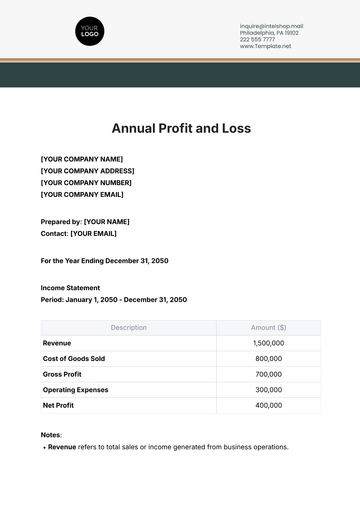

The audit of the financial statements of [YOUR COMPANY NAME] for the year ending December 31, 2050, has been completed. The audit was conducted to ensure that the financial statements are free from material misstatement and present a true and fair view of the financial position, performance, and cash flows of [YOUR COMPANY NAME].

II. Scope of the Audit

A. Objective

The primary objective of this audit was to verify the accuracy, completeness, and compliance of the financial statements with the applicable financial reporting framework.

B. Scope

Review and assess the internal controls relevant to the preparation of the financial statements.

Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management.

Ensure compliance with statutory and regulatory requirements.

III. Audit Methodology

A. Procedures Performed

The audit was performed in accordance with the relevant auditing standards. The techniques employed included, but were not limited to:

Test of details and substantive testing.

Analytical review procedures.

Inspection of documents.

Inquiry and observation.

B. Materiality and Risk Assessment

Materiality levels were determined based on professional judgment and the applicable auditing standards. Risk assessment procedures included identifying and assessing risks of material misstatement, whether due to fraud or error, at the financial statement and assertion levels.

Materiality Levels

Category | Materiality Level (USD) |

|---|---|

Overall Financial Statements | 500,000 |

Revenue | 300,000 |

Expenses | 200,000 |

Assets | 250,000 |

Risk Assessment Procedures

Inherent Risk: Assessed the likelihood of material misstatement without considering internal controls.

Control Risk: Evaluated the effectiveness of internal controls in preventing or detecting material misstatements.

Detection Risk: Determined the risk that audit procedures will not detect a material misstatement.

IV. Audit Findings

Finding | Impact | Recommendation |

|---|---|---|

Inconsistencies in revenue recognition | High | Align with revenue recognition policies |

Lack of supporting documents for expenses | Medium | Implement rigorous documentation controls |

V. Conclusion

The audit results indicate that the financial statements of [YOUR COMPANY NAME] provide a true and fair view of the company's financial performance and position as of December 31, 2050, in all material respects, in accordance with the relevant financial reporting framework.

VI. Signatures

[YOUR NAME], CPA

Position: Lead Auditor

Contact: [YOUR EMAIL]

Date: [DATE]

VII. Appendices

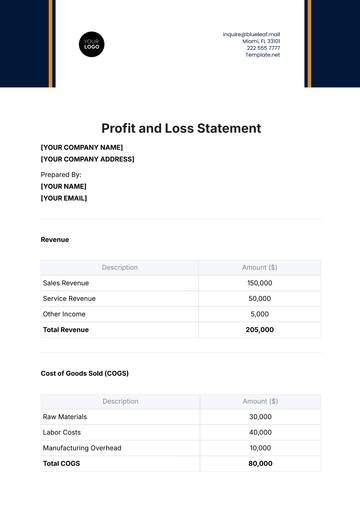

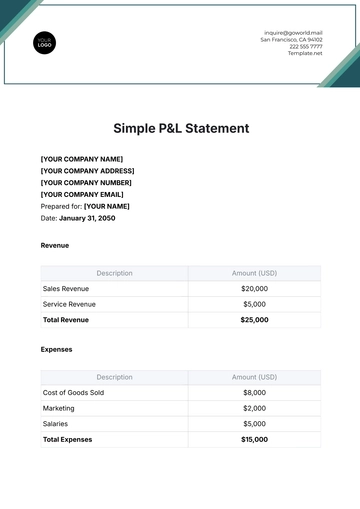

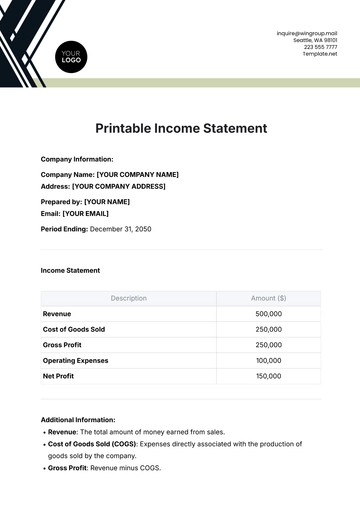

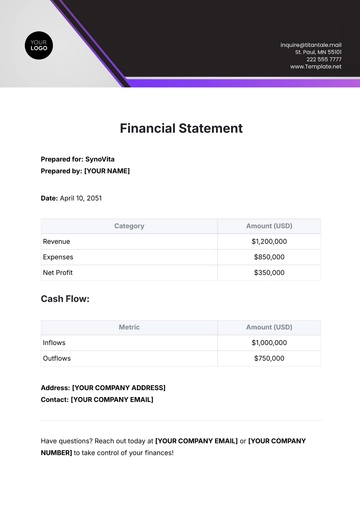

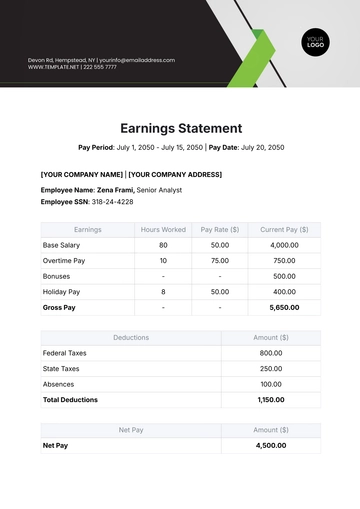

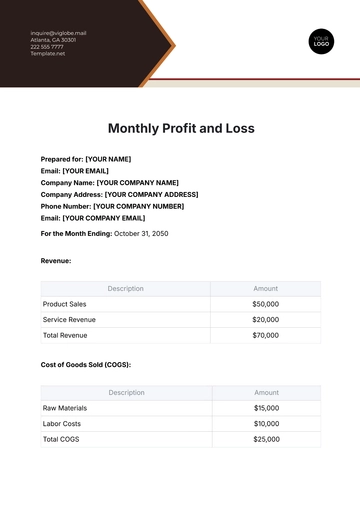

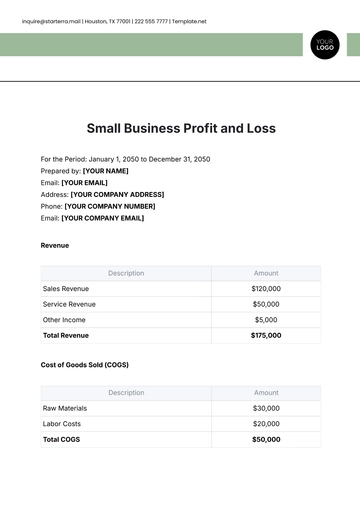

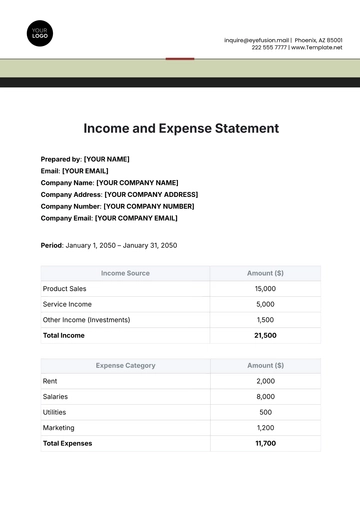

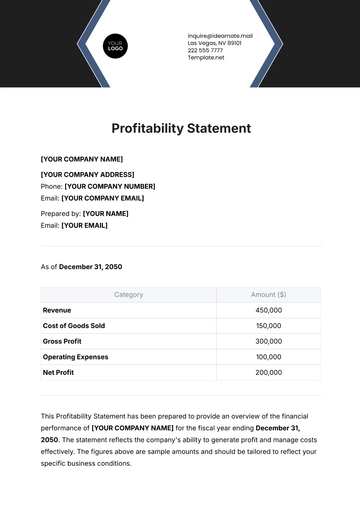

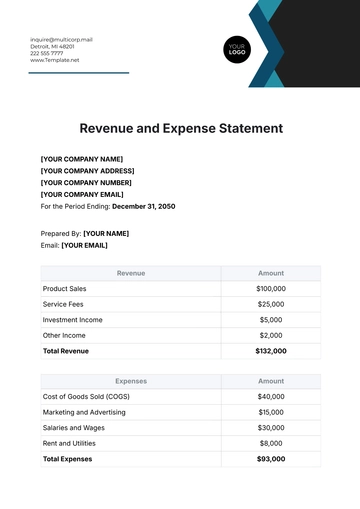

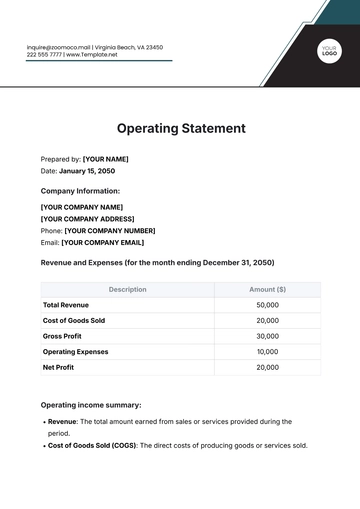

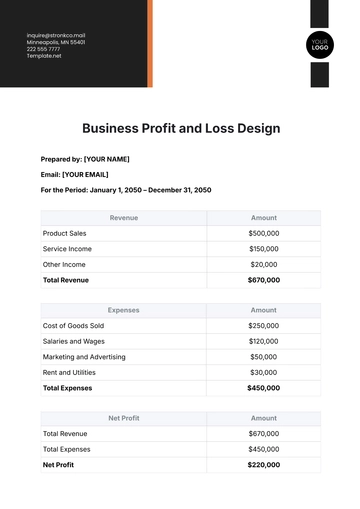

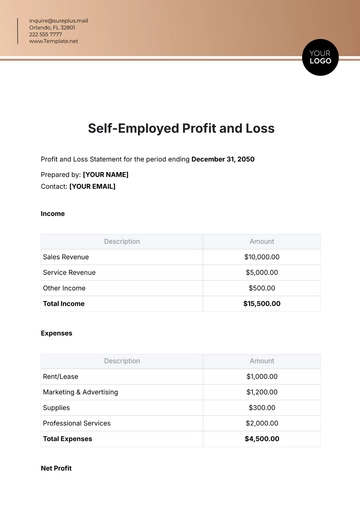

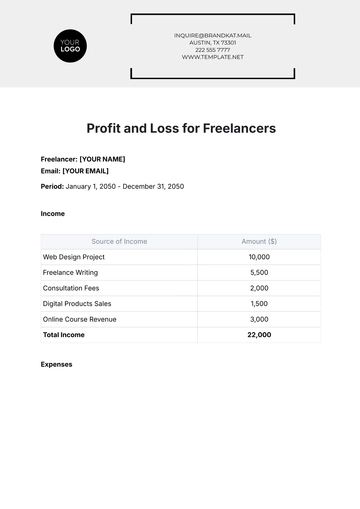

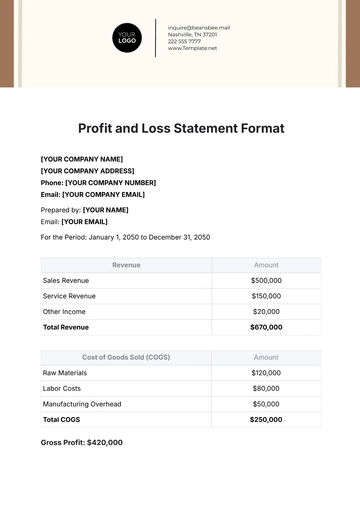

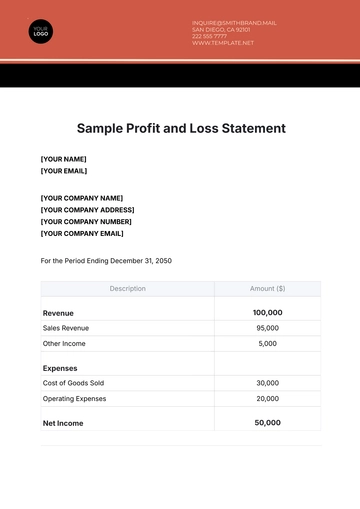

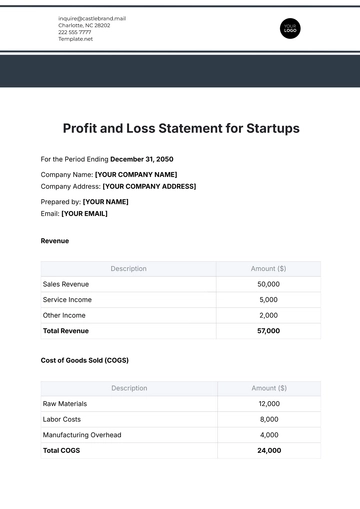

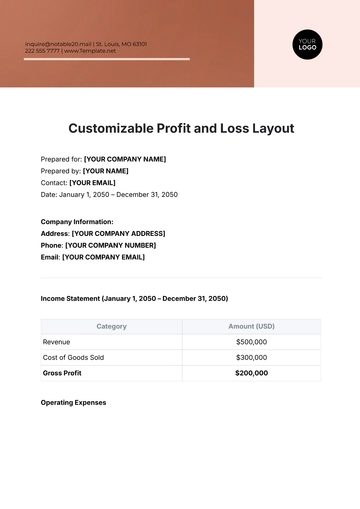

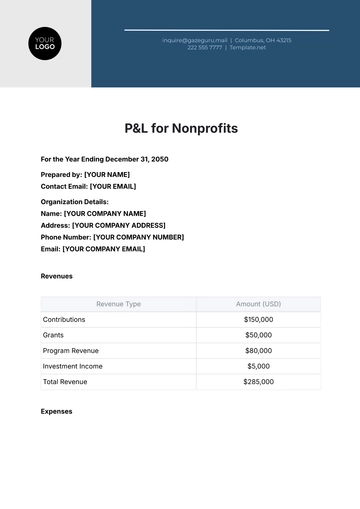

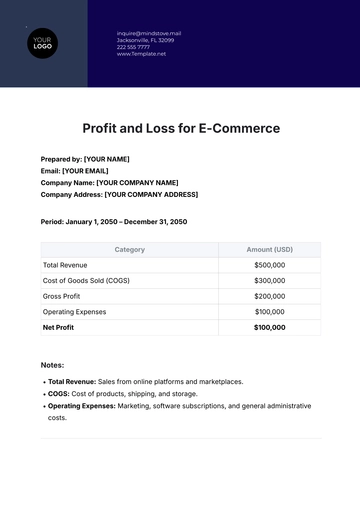

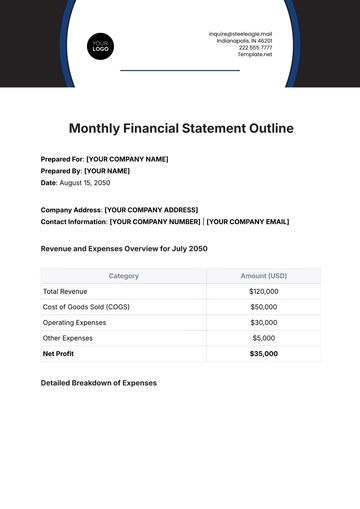

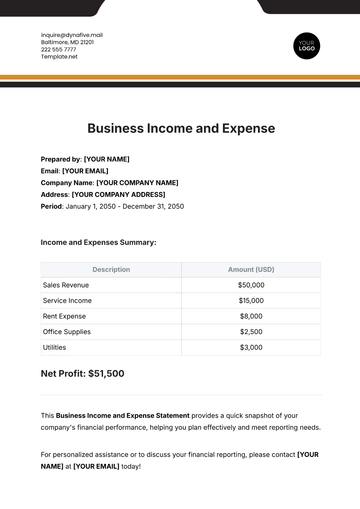

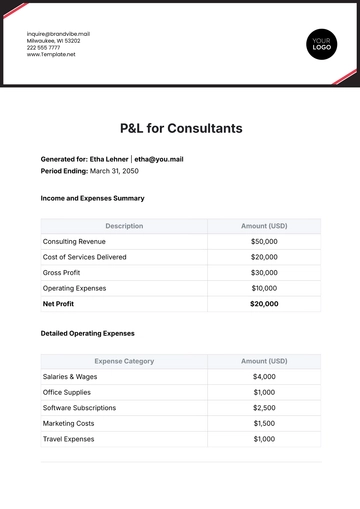

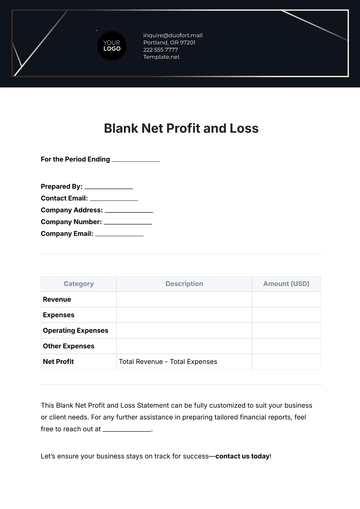

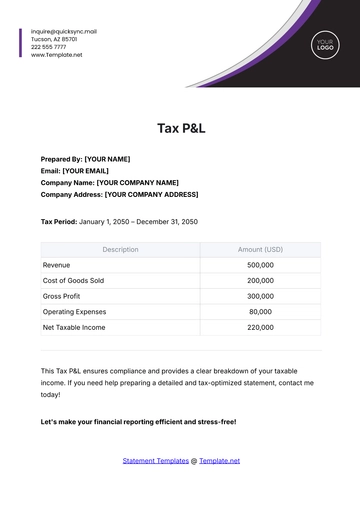

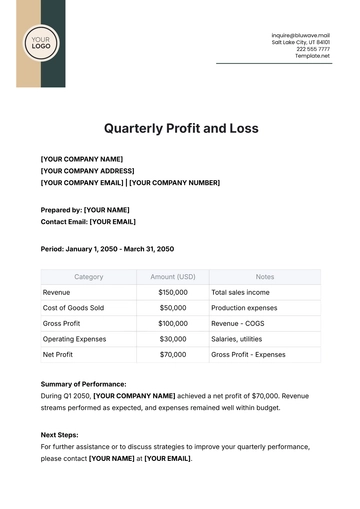

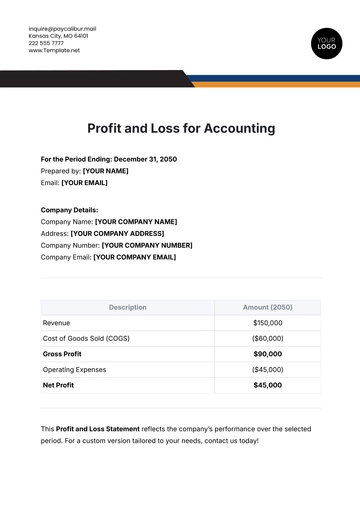

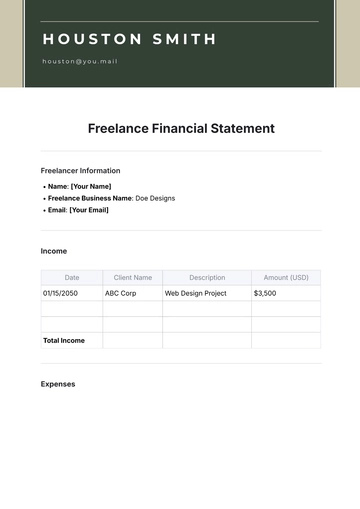

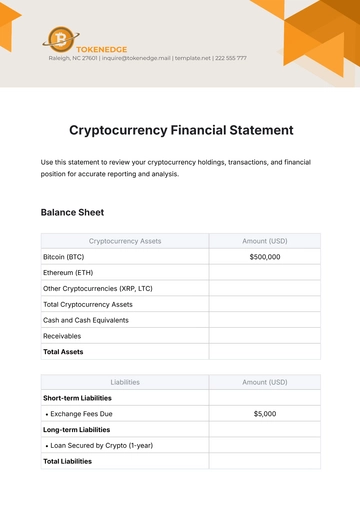

Appendix A: Financial Statements

Appendix B: Management's Response

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Template.net’s Financial Statement Audit Report Template is perfect for documenting financial accuracy. Customizable and fully editable in our AI Editor Tool, this template ensures clarity and precision in presenting audited financial statements. It includes sections for financial analysis, auditor’s opinions, and recommendations, making it a comprehensive tool for financial auditors and accountants.