Free Basic Budget

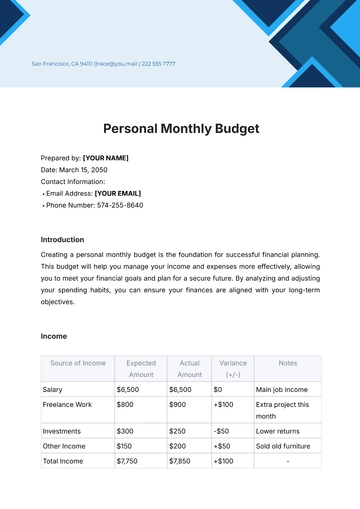

Introduction

Planning your household budget effectively is essential for maintaining financial stability and achieving your long-term goals. This Basic Budget will help you track your income and expenses, ensuring you stay on top of your finances while preparing for future needs. Prepared by [YOUR NAME], this budget will serve as a foundation for organizing your household finances efficiently.

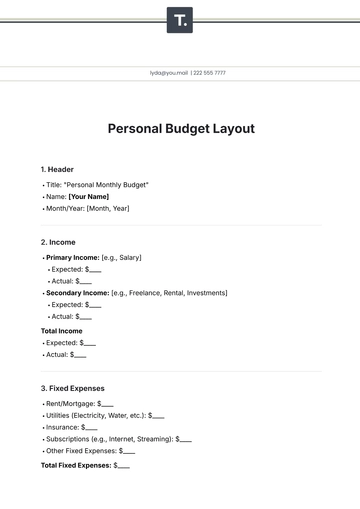

Personal Information

Prepared by: [YOUR NAME]

Email: [YOUR EMAIL]

Company Name: [YOUR COMPANY NAME]

Company Number: [YOUR COMPANY NUMBER]

Company Address: [YOUR COMPANY ADDRESS]

Company Website: [YOUR COMPANY WEBSITE]

Company Social Media: [YOUR COMPANY SOCIAL MEDIA]

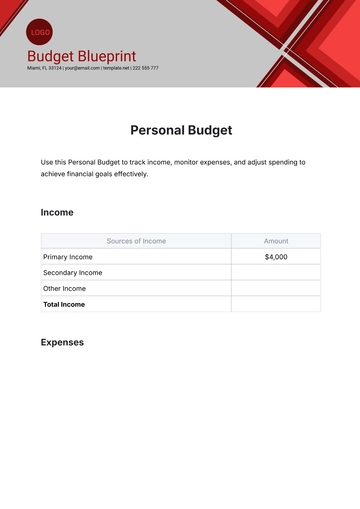

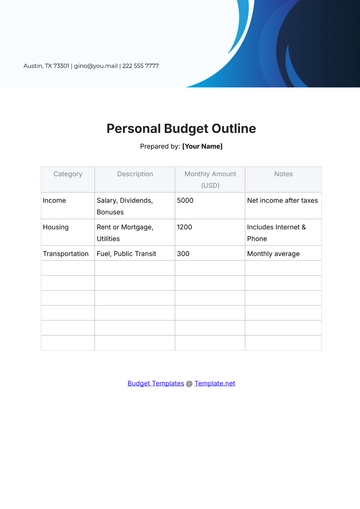

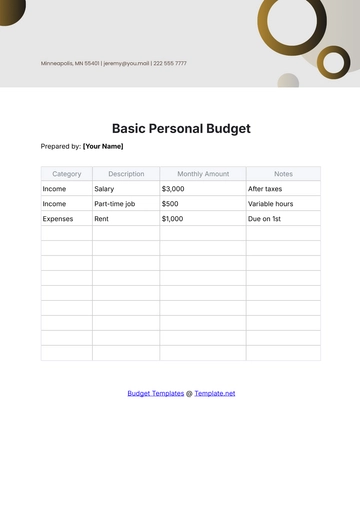

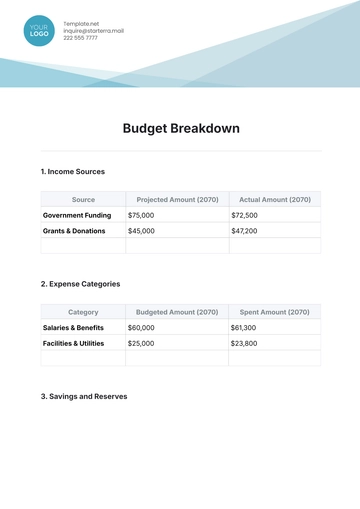

Income

Source | Amount | Frequency | Start Date | End Date |

|---|---|---|---|---|

Salary | $6,500 | Monthly | January 1, 2050 | December 31, 2050 |

Bonus | $1,200 | Quarterly | January 1, 2050 | December 31, 2050 |

Investment Income | $800 | Monthly | January 1, 2050 | December 31, 2050 |

Other Income | $500 | One-time | June 15, 2050 | June 15, 2050 |

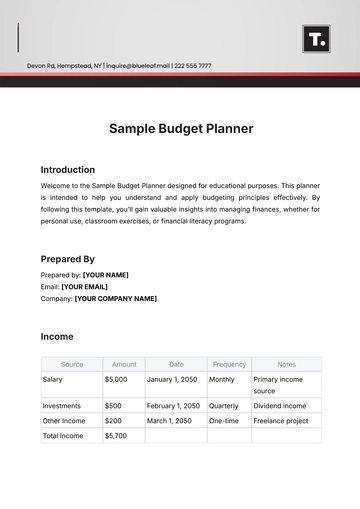

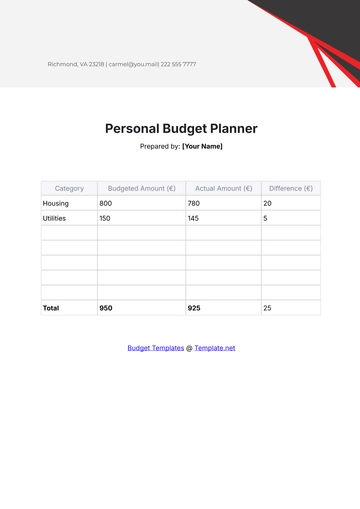

Fixed Expenses

Expense | Amount | Frequency | Start Date | End Date |

|---|---|---|---|---|

Mortgage/Rent | $1,500 | Monthly | January 1, 2050 | December 31, 2050 |

Utilities | $250 | Monthly | January 1, 2050 | December 31, 2050 |

Insurance | $200 | Monthly | January 1, 2050 | December 31, 2050 |

Car Payment | $400 | Monthly | January 1, 2050 | December 31, 2050 |

Loan Payments | $300 | Monthly | January 1, 2050 | December 31, 2050 |

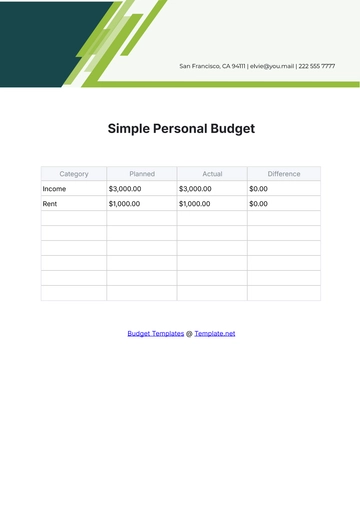

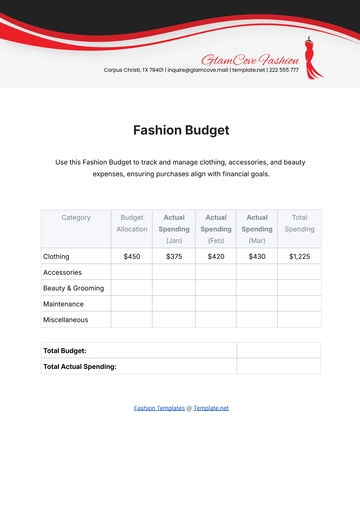

Variable Expenses

Expense | Amount | Frequency | Start Date | End Date |

|---|---|---|---|---|

Groceries | $600 | Monthly | January 1, 2050 | December 31, 2050 |

Dining Out | $150 | Monthly | January 1, 2050 | December 31, 2050 |

Entertainment | $100 | Monthly | January 1, 2050 | December 31, 2050 |

Transportation | $200 | Monthly | January 1, 2050 | December 31, 2050 |

Miscellaneous | $75 | Monthly | January 1, 2050 | December 31, 2050 |

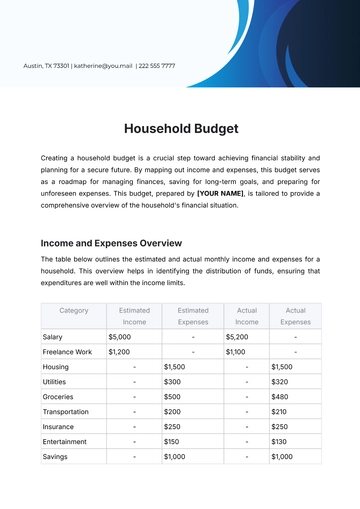

Savings and Investments

Account | Amount | Frequency | Start Date | End Date |

|---|---|---|---|---|

Emergency Fund | $500 | Monthly | January 1, 2050 | December 31, 2050 |

Retirement Savings | $700 | Monthly | January 1, 2050 | December 31, 2050 |

Education Savings | $300 | Monthly | January 1, 2050 | December 31, 2050 |

Other Investments | $250 | Monthly | January 1, 2050 | December 31, 2050 |

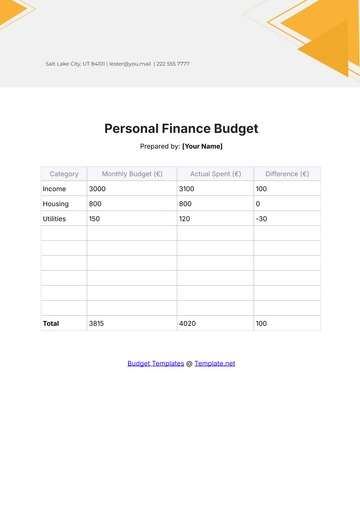

Conclusion

Effective household planning through budgeting helps in controlling your expenses and building a secure financial future. Regularly reviewing and adjusting your budget ensures that you stay aligned with your financial goals. Remember to revisit your budget periodically and make adjustments as needed.

Reminders

Review your budget monthly to track and adjust as necessary.

Save receipts and track all expenses to ensure accuracy.

Adjust your budget for any changes in income or expenses.

Set aside funds for unexpected expenses or emergencies.

Monitor your savings goals and adjust contributions as needed.

Avoid unnecessary expenses by prioritizing your needs.

Keep an eye on debt and plan for its reduction.

Regularly review your financial goals to stay on track.

This Basic Budget is designed to be a helpful tool in managing your household finances effectively.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Boost your financial planning with the Basic Budget Template from Template.net. This customizable and editable template makes managing expenses simple and efficient. Easily tailor it to your needs using the AI Editor Tool for a personalized budgeting experience. Stay on top of your finances and make budgeting a breeze with this template.

You may also like

- Budget Sheet

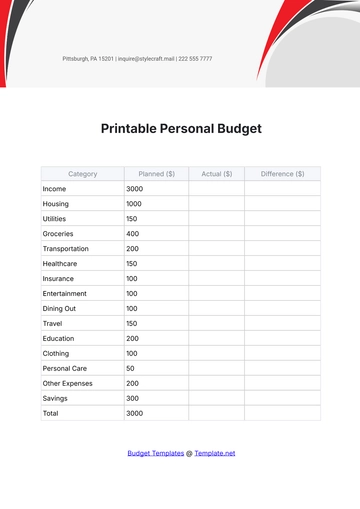

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

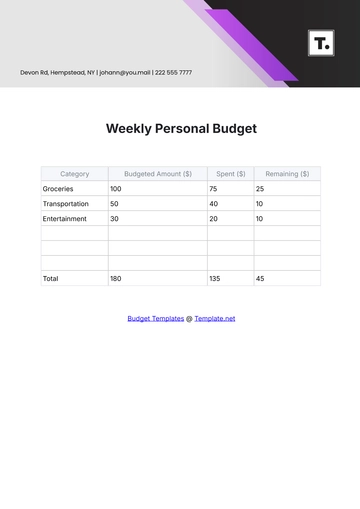

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

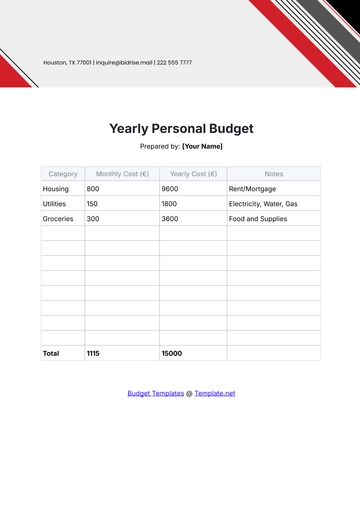

- Annual Budget

- Home Renovation Budget

- Household Budget

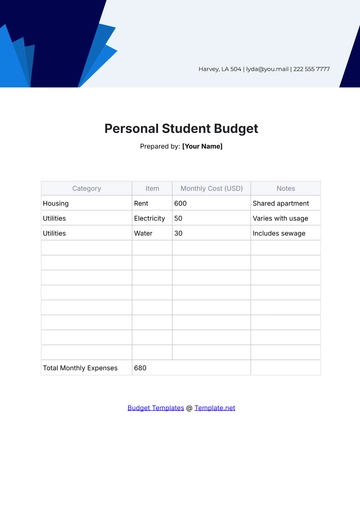

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising