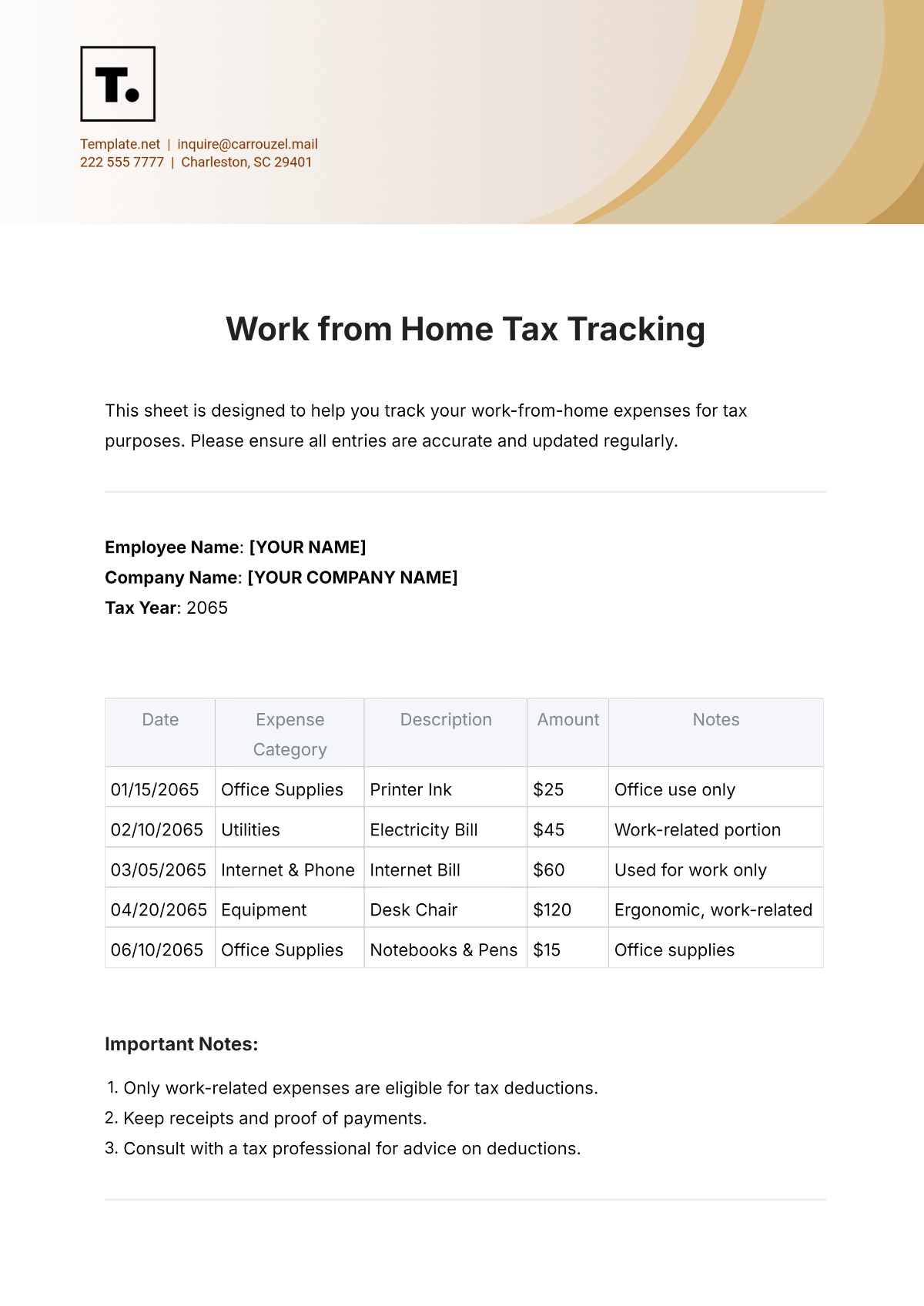

Free Work from Home Tax Tracking

This sheet is designed to help you track your work-from-home expenses for tax purposes. Please ensure all entries are accurate and updated regularly.

Employee Name: [YOUR NAME]

Company Name: [YOUR COMPANY NAME]

Tax Year: 2065

Date | Expense Category | Description | Amount | Notes |

|---|---|---|---|---|

01/15/2065 | Office Supplies | Printer Ink | $25 | Office use only |

02/10/2065 | Utilities | Electricity Bill | $45 | Work-related portion |

03/05/2065 | Internet & Phone | Internet Bill | $60 | Used for work only |

04/20/2065 | Equipment | Desk Chair | $120 | Ergonomic, work-related |

06/10/2065 | Office Supplies | Notebooks & Pens | $15 | Office supplies |

Important Notes:

Only work-related expenses are eligible for tax deductions.

Keep receipts and proof of payments.

Consult with a tax professional for advice on deductions.

Be sure to update this sheet regularly to keep track of eligible work-from-home expenses.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Simplify tax preparation with this Work from Home Tax Tracking Template, exclusively available at Template.net. Fully customizable and editable in our AI Editor Tool, this template allows users to track expenses, deductions, and income accurately. Perfect for remote workers and freelancers, it ensures compliance and efficiency in managing tax-related records.