Free Profitability Gap Assessment Analysis

Prepared By: [YOUR NAME]

Date: July 1, 2050

I. Executive Summary

This Profitability Gap Assessment Analysis provides a comprehensive evaluation of the company's current financial performance, focusing on the gaps that impact profitability. The key findings reveal specific areas that hinder optimal financial outcomes, alongside recommended strategies to enhance profitability. The analysis underscores critical gaps in both revenue generation and cost management, providing a roadmap for future financial success.

II. Current Profitability Metrics

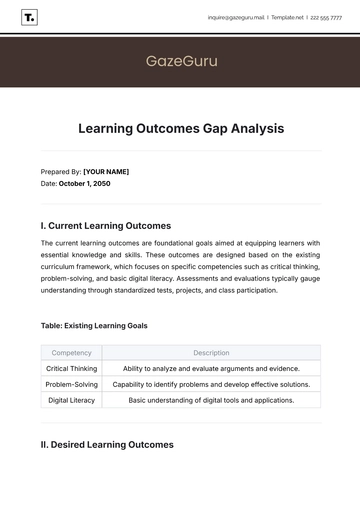

The current profitability metrics offer insights into the company's financial performance. The core components analyzed include:

Revenue: The total income generated from sales and other income sources.

Costs: Operating expenses, including cost of goods sold, administrative costs, and other overheads.

Profit Margins: The difference between revenues and costs, expressed as a percentage of revenue.

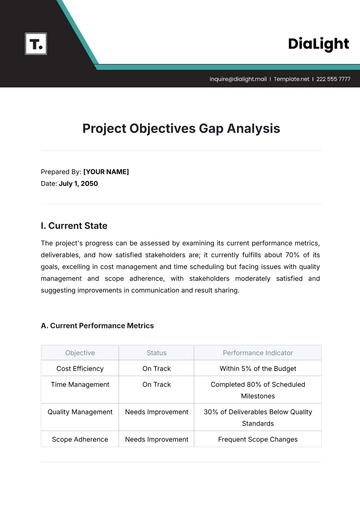

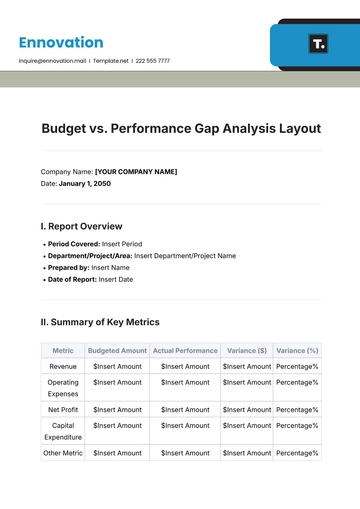

Metric | Current Value |

|---|---|

Revenue | $1,000,000 |

Total Costs | $800,000 |

Profit Margin | 20% |

III. Identified Gaps

The analysis has identified key gaps in profitability, categorized into revenue-related and cost-related issues:

A. Revenue-Related Gaps

Insufficient sales growth in key markets.

Limited diversification of revenue streams.

Underperformance in digital marketing initiatives.

B. Cost-Related Gaps

High production costs due to outdated technology.

Excessive operational expenses in logistics and supply chain management.

Suboptimal labor cost management.

IV. Root Cause Analysis

The underlying causes for the identified gaps are examined to provide a clearer understanding of the issues:

Market Penetration: Ineffective entry and growth strategies in emerging markets have restricted potential revenue growth.

Technology: Reliance on old machinery and systems has led to inefficiencies and increased operational costs.

Management Policies: Inefficiencies in cost control and demand forecasting contribute to higher-than-expected expenses.

V. Recommendations for Improvement

To bridge the profitability gaps, the following strategies are proposed:

Market Expansion: Develop targeted marketing campaigns to penetrate high-growth markets and diversify revenue streams.

Technological Upgrades: Invest in modern production technologies to enhance efficiency and reduce costs.

Operational Optimization: Implement cost control measures and streamline supply chain processes to better manage expenses.

VI. Action Plan and Timeline

Outlined below are the steps to implement the recommendations effectively, with an estimated timeline for each phase:

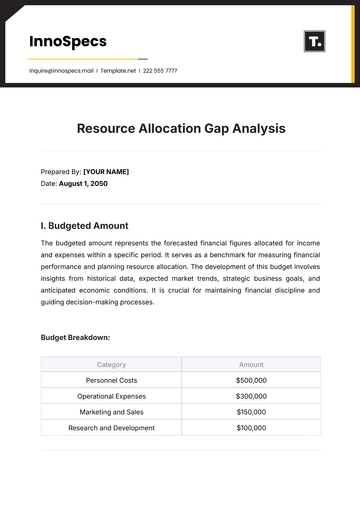

Action Step | Timeline |

|---|---|

Launch targeted marketing campaigns | Q1 2024 |

Upgrade production technology | Q2-Q3 2024 |

Streamline supply chain processes | Q4 2024 |

VII. Financial Impact Analysis

By addressing the identified gaps, the potential financial impact on the company's bottom line includes:

Revenue Growth: Projected increase of 15% through enhanced market strategies.

Cost Reduction: Estimated cost savings of 10% from operational efficiencies.

Profit Margin Improvement: Expected increase in profit margins from 20% to 30%.

The successful implementation of these recommendations is anticipated to significantly enhance the company's profitability and competitive position in the market.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize profitability with the Profitability Gap Assessment Analysis Template from Template.net. This fully editable and customizable tool enables you to analyze profit discrepancies and uncover areas for growth. With our Ai Editor Tool, you can make real-time adjustments to suit your business model. Whether you're seeking ways to enhance revenue or minimize expenses