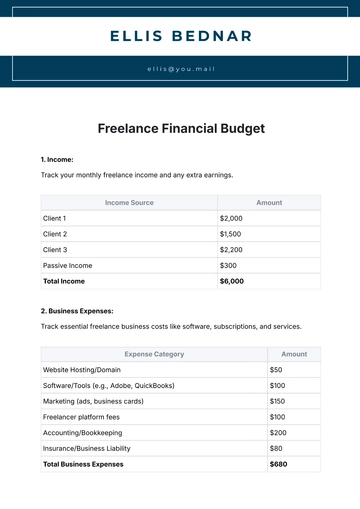

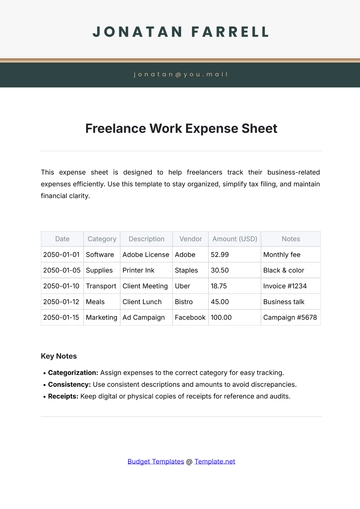

Freelance Financial Budget

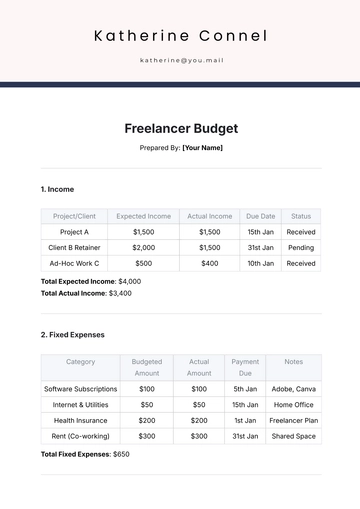

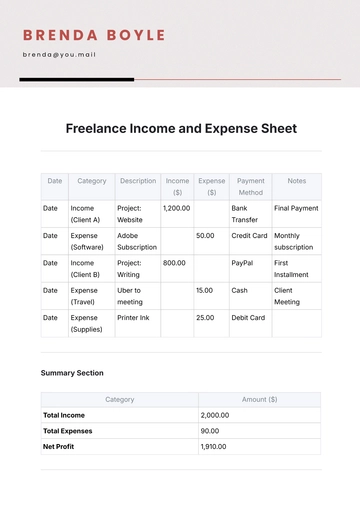

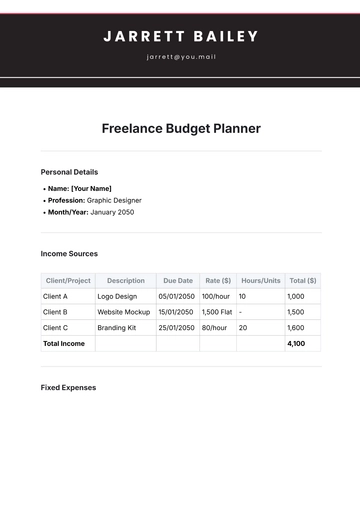

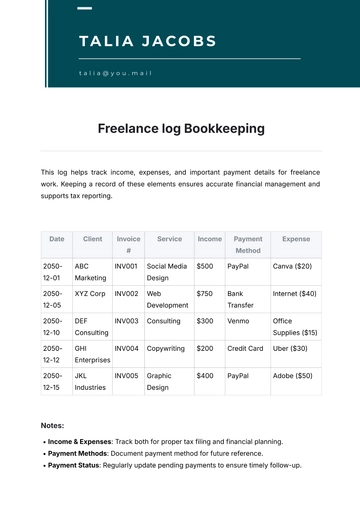

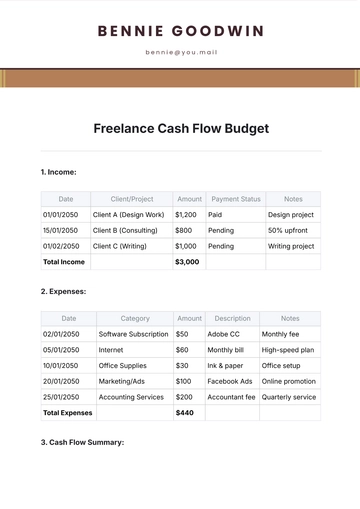

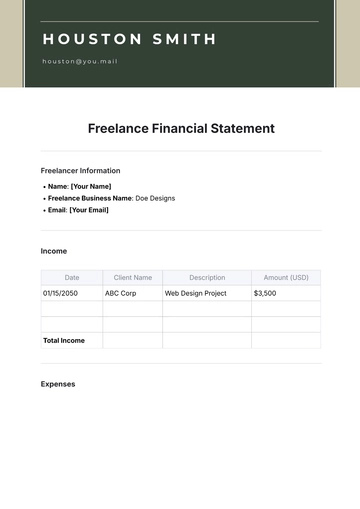

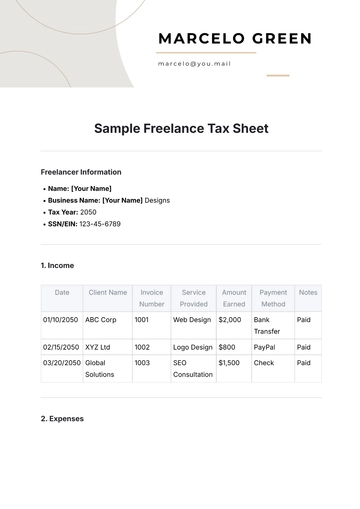

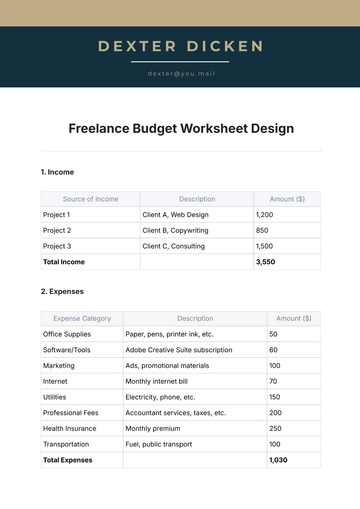

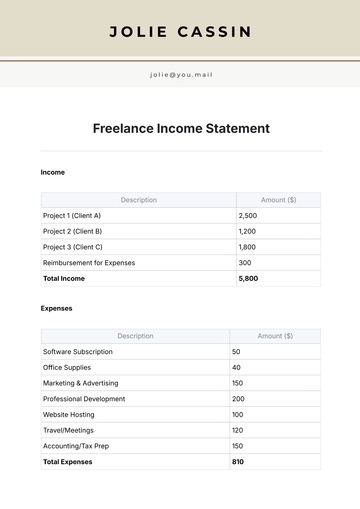

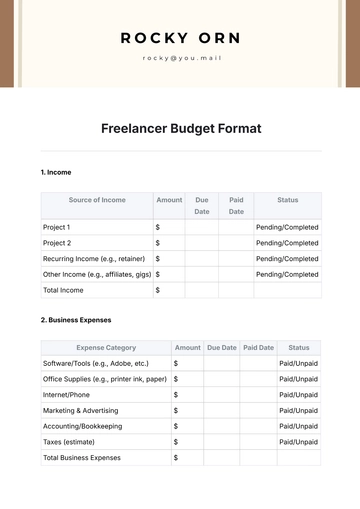

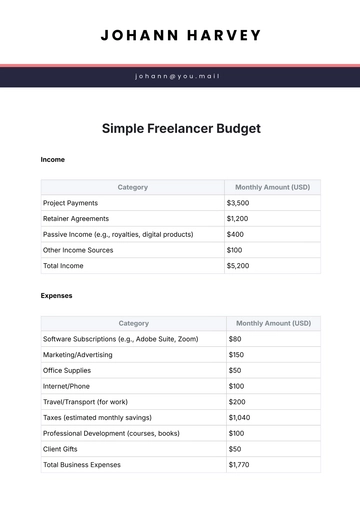

1. Income:

Track your monthly freelance income and any extra earnings.

Income Source | Amount |

|---|---|

Client 1 | $2,000 |

Client 2 | $1,500 |

Client 3 | $2,200 |

Passive Income | $300 |

Total Income | $6,000 |

2. Business Expenses:

Track essential freelance business costs like software, subscriptions, and services.

Expense Category | Amount |

|---|---|

Website Hosting/Domain | $50 |

Software/Tools (e.g., Adobe, QuickBooks) | $100 |

Marketing (ads, business cards) | $150 |

Freelancer platform fees | $100 |

Accounting/Bookkeeping | $200 |

Insurance/Business Liability | $80 |

Total Business Expenses | $680 |

3. Taxes & Savings:

As a freelancer, setting aside money for taxes and savings is crucial.

Category | Amount |

|---|---|

Estimated Tax Savings (20% of income) | $1,200 |

Emergency Fund Savings | $500 |

Retirement Savings | $400 |

Total Taxes & Savings | $2,100 |

4. Personal Expenses:

Include essential living expenses like rent, utilities, groceries, and transportation.

Expense Category | Amount |

|---|---|

Rent/Mortgage | $1,200 |

Utilities (electric, water, internet) | $150 |

Groceries | $300 |

Transportation (gas, public transit) | $100 |

Health Insurance | $250 |

Entertainment (movies, dining) | $150 |

Miscellaneous (gifts, etc.) | $100 |

Total Personal Expenses | $2,800 |

5. Profit:

Calculate the remaining amount after expenses, taxes, and savings.

Category | Amount |

|---|---|

Total Income | $6,000 |

Total Business Expenses | $680 |

Total Taxes & Savings | $2,100 |

Total Personal Expenses | $2,800 |

Net Profit | $420 |

Budget Summary:

Total Income: $6,000

Total Expenses (Business + Personal): $5,480

Total Taxes & Savings: $2,100

Net Profit: $420

Budget Notes:

Keep Detailed Records: For accurate tax filings, keep track of all invoices, receipts, and expense claims.

Tax Percentage: The tax rate (20%) is an estimate. Adjust according to your local tax laws or consult a tax professional.

Emergency Fund: Aim to save 3-6 months of living expenses in case of gaps between projects.

Retirement Savings: Freelancers don’t have employer-sponsored plans, so it’s important to save for retirement on your own.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

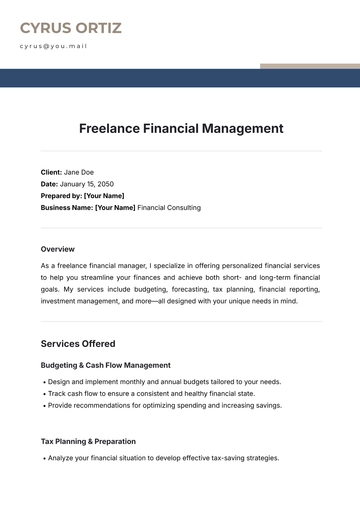

Manage your freelance finances with Template.net’s Freelance Financial Budget Template. Customizable and editable, it helps you plan and track your income, expenses, and savings goals. Editable in our AI Editor Tool, this template can be personalized to fit your needs. Perfect for freelancers, it helps ensure that you stay financially organized. Download today and take control of your freelance financial planning.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising