Elevate Your Financial Planning with Easy-to-Use Personal Budget Templates in Google Docs by Template.net

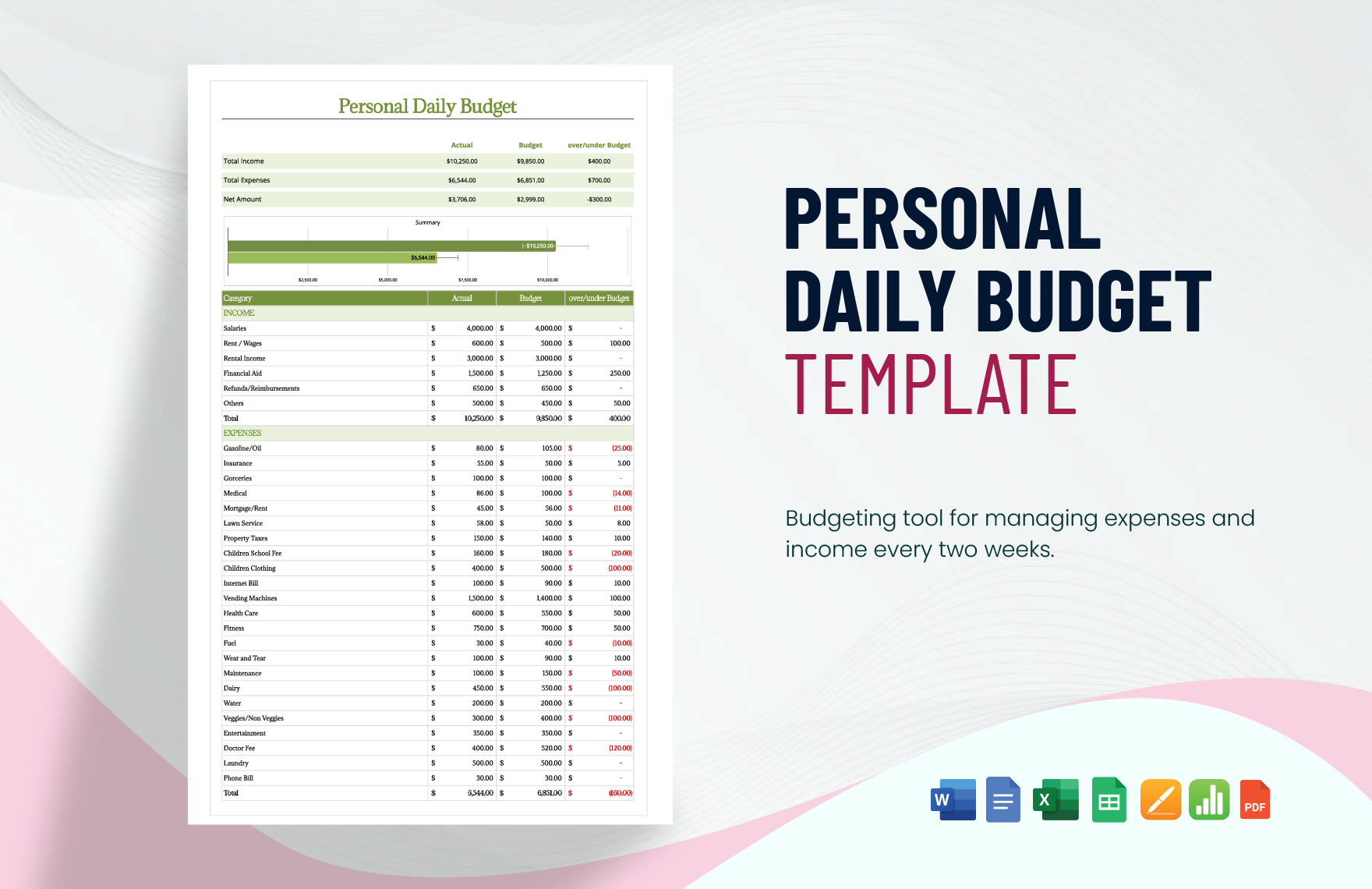

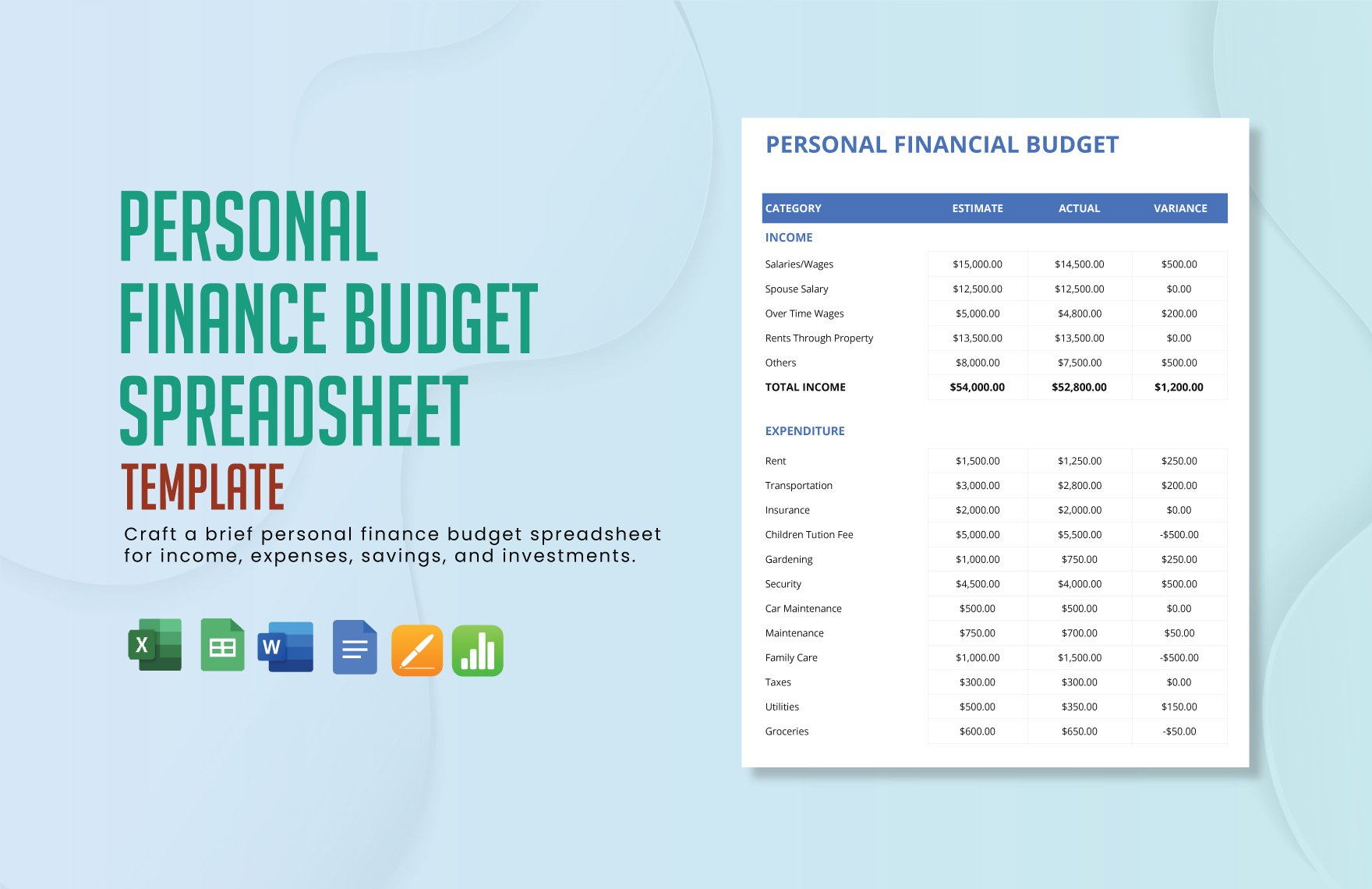

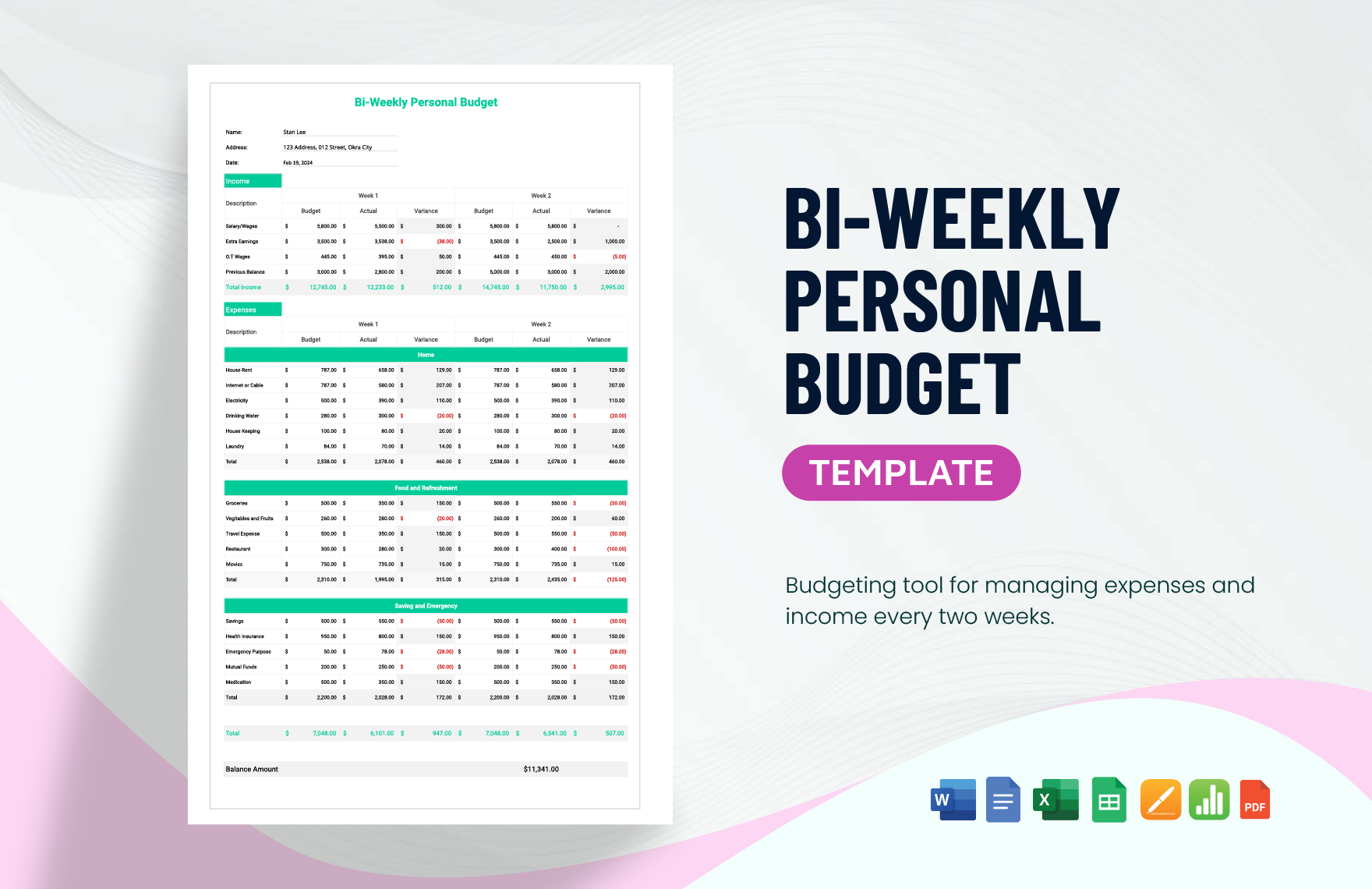

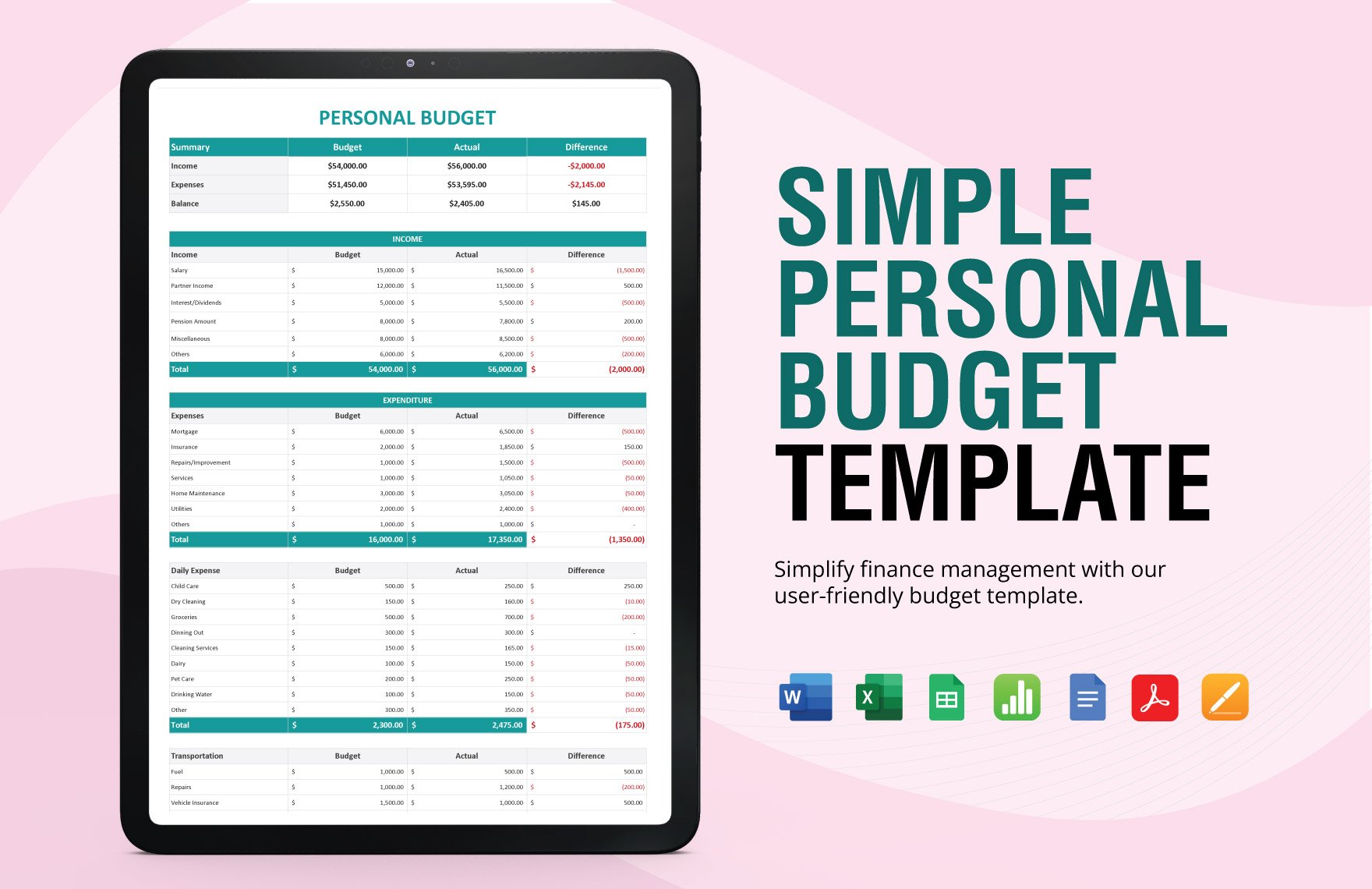

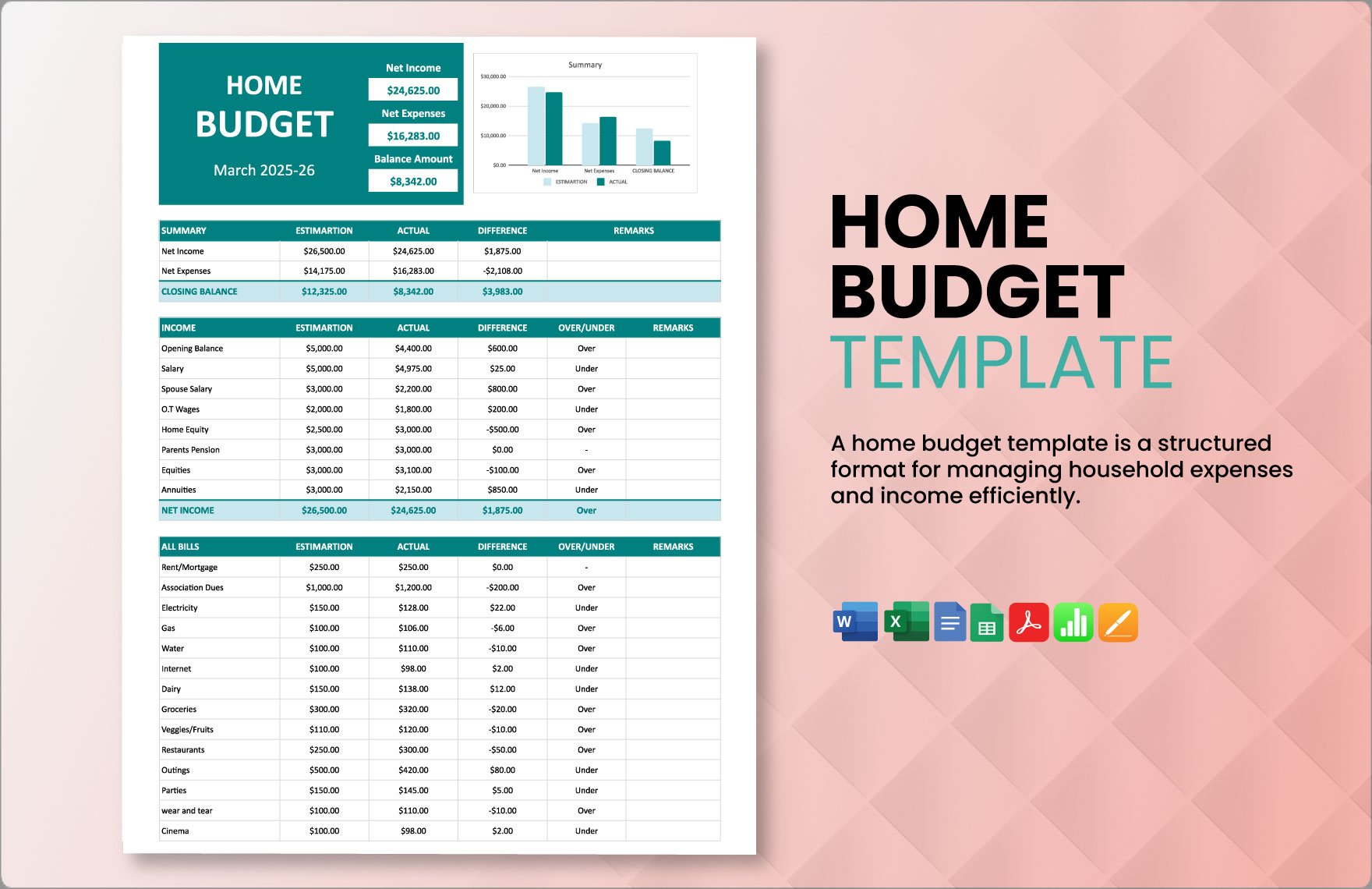

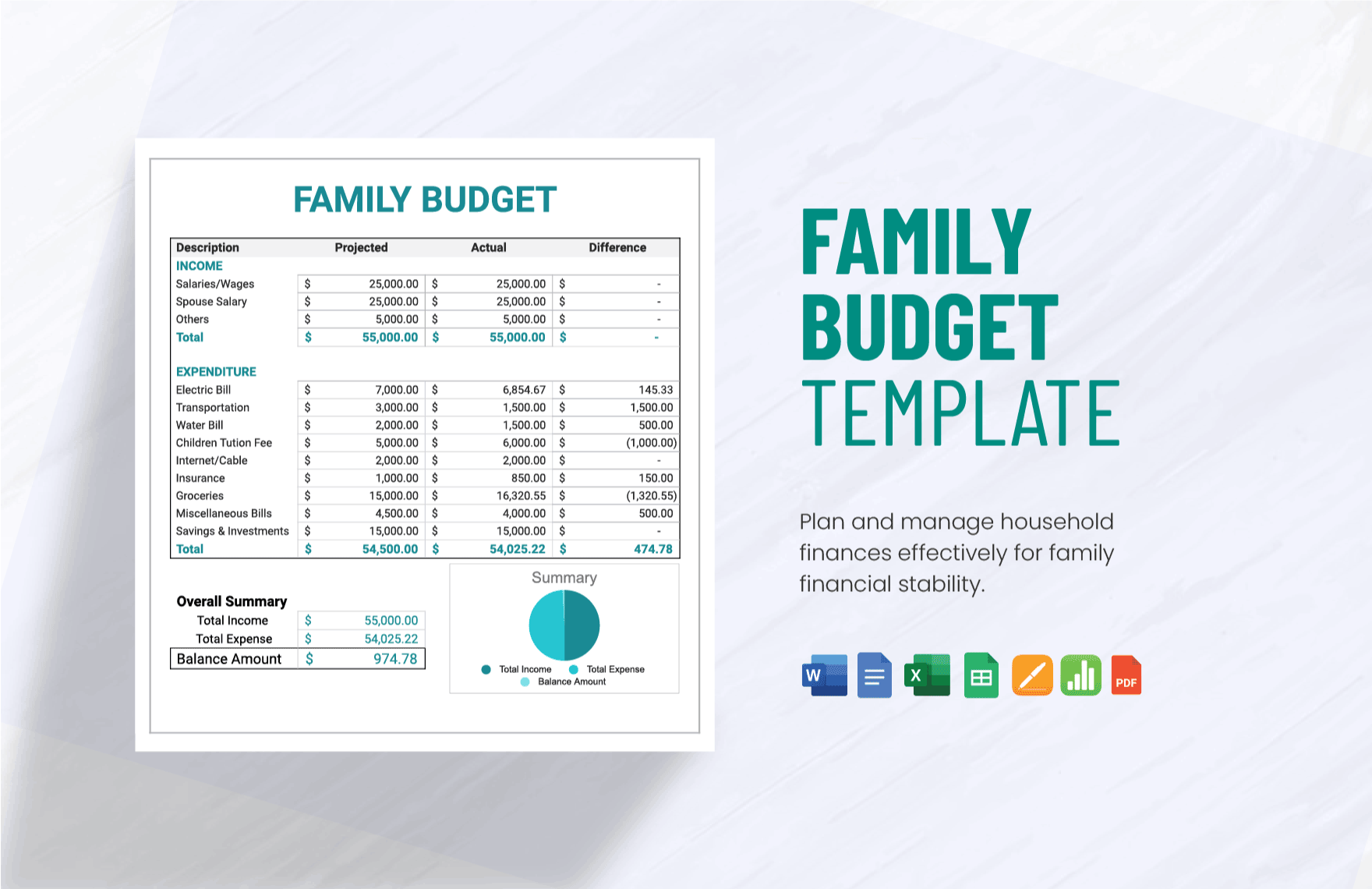

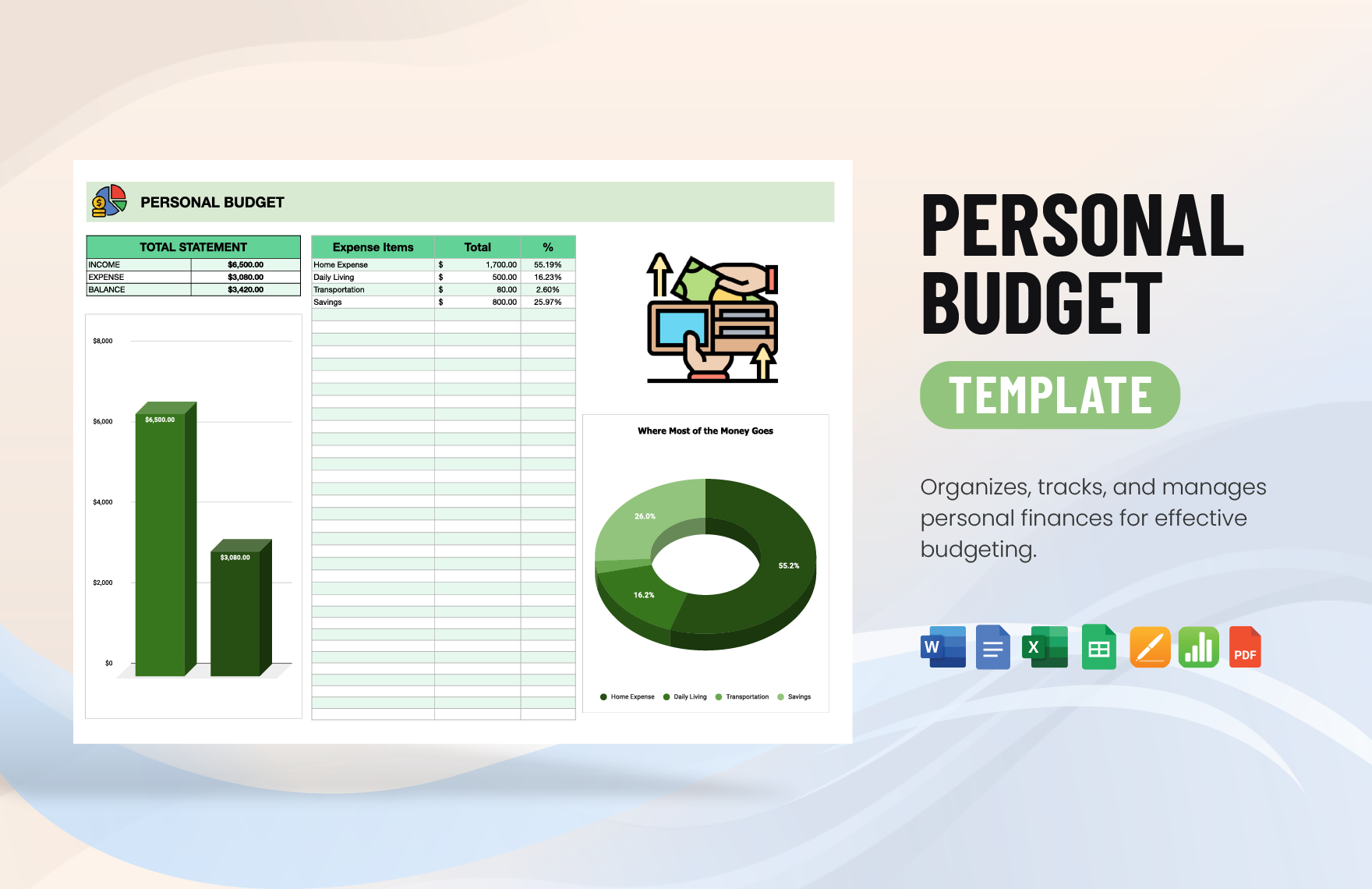

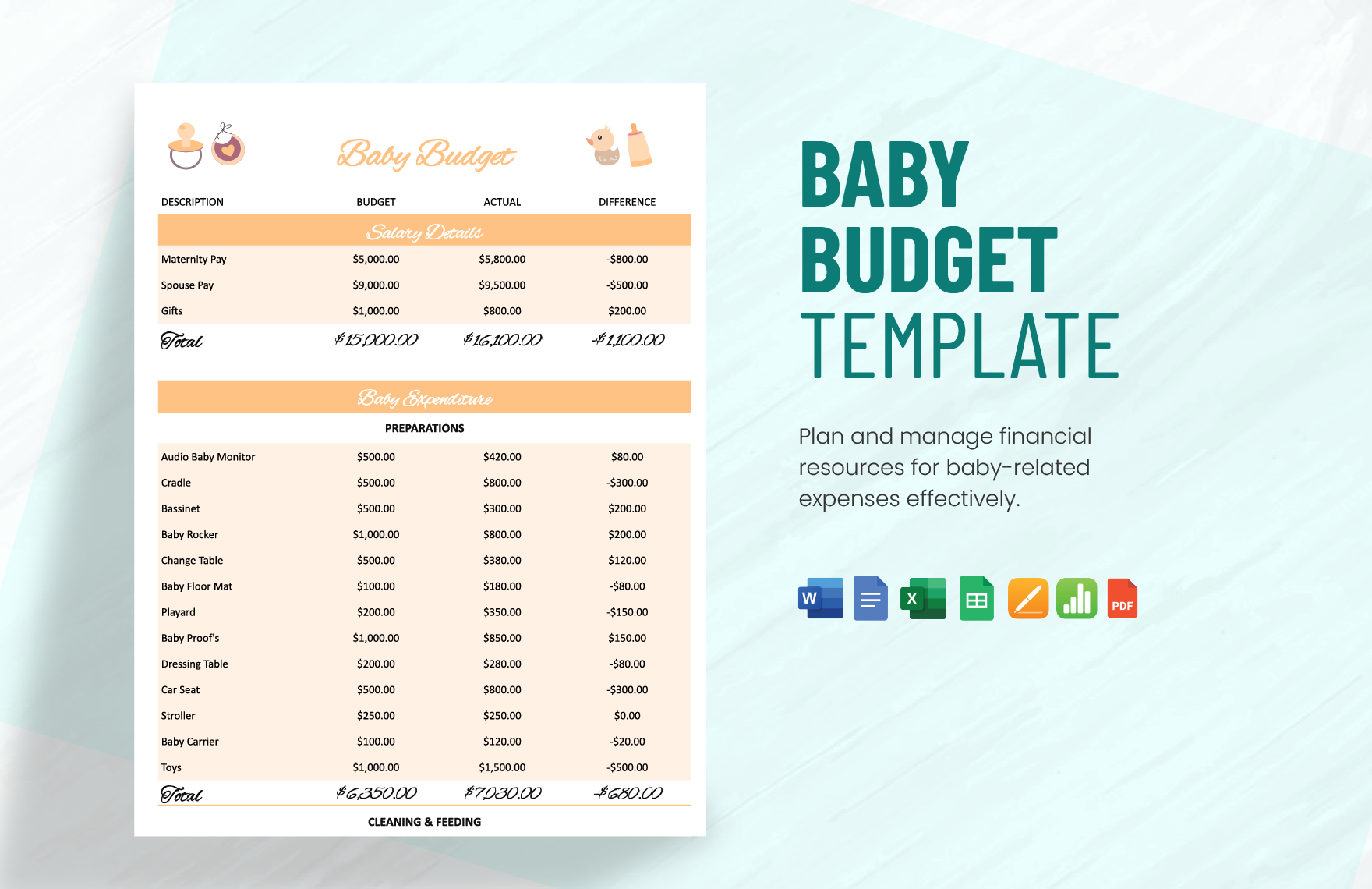

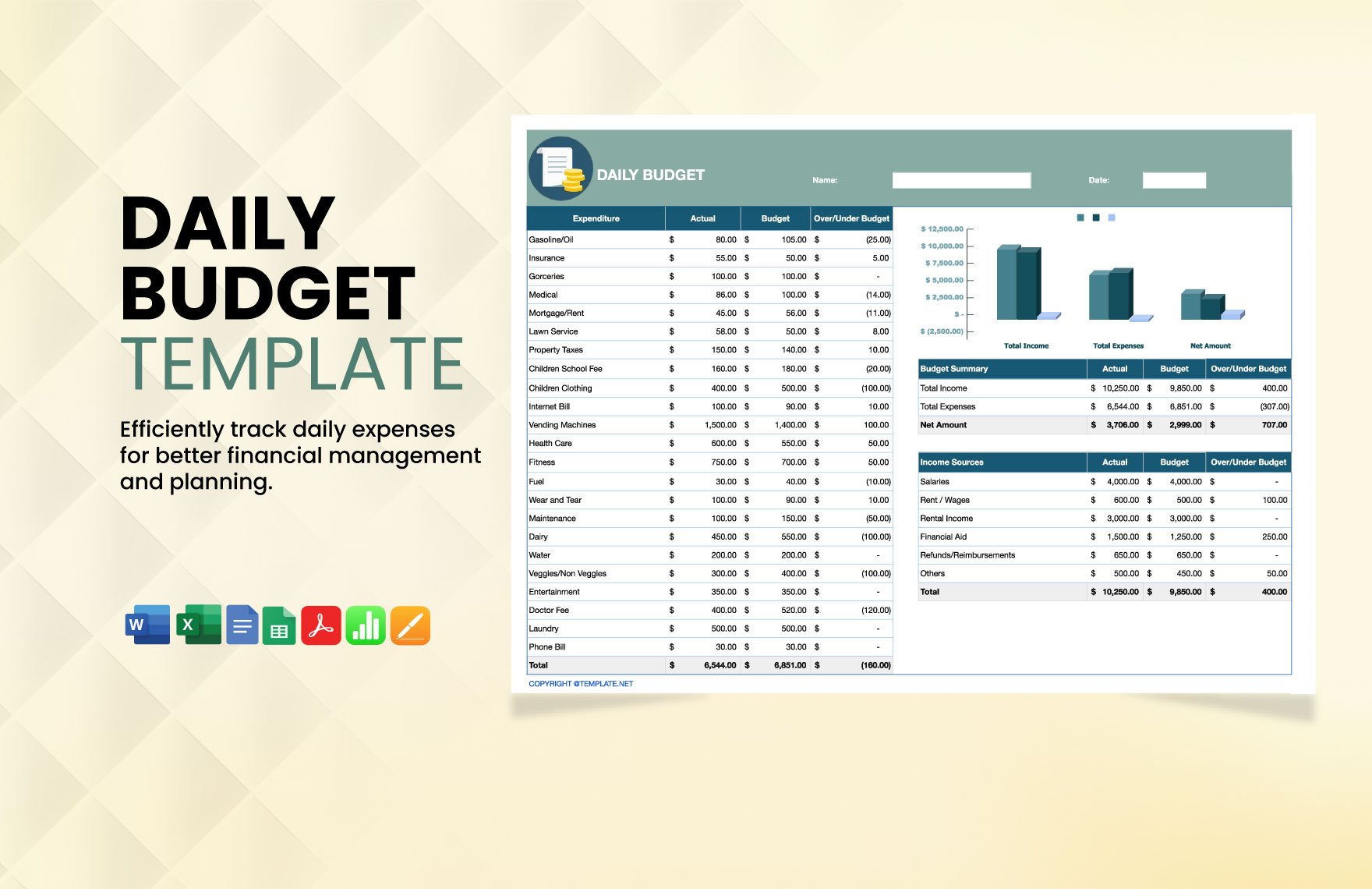

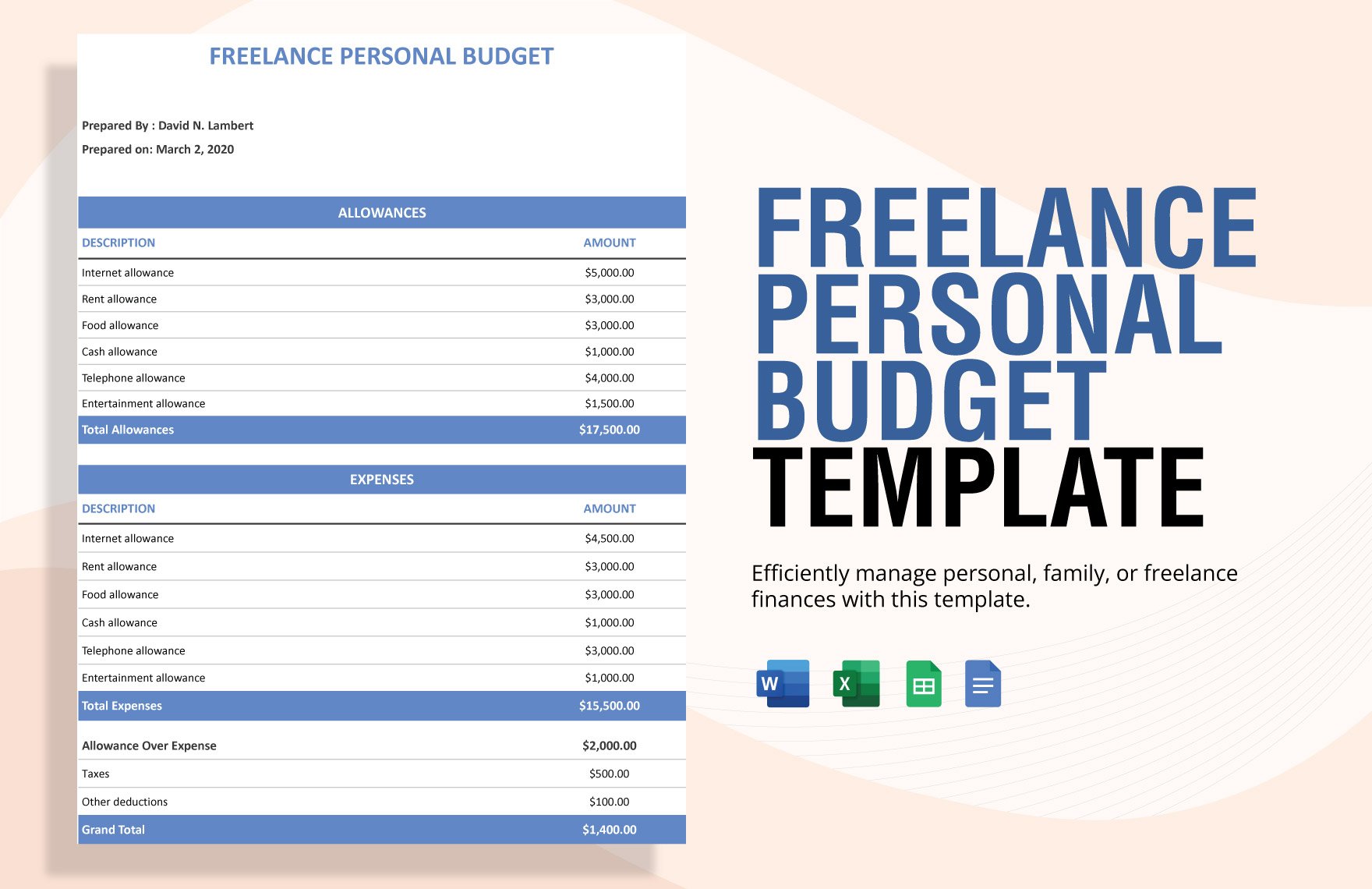

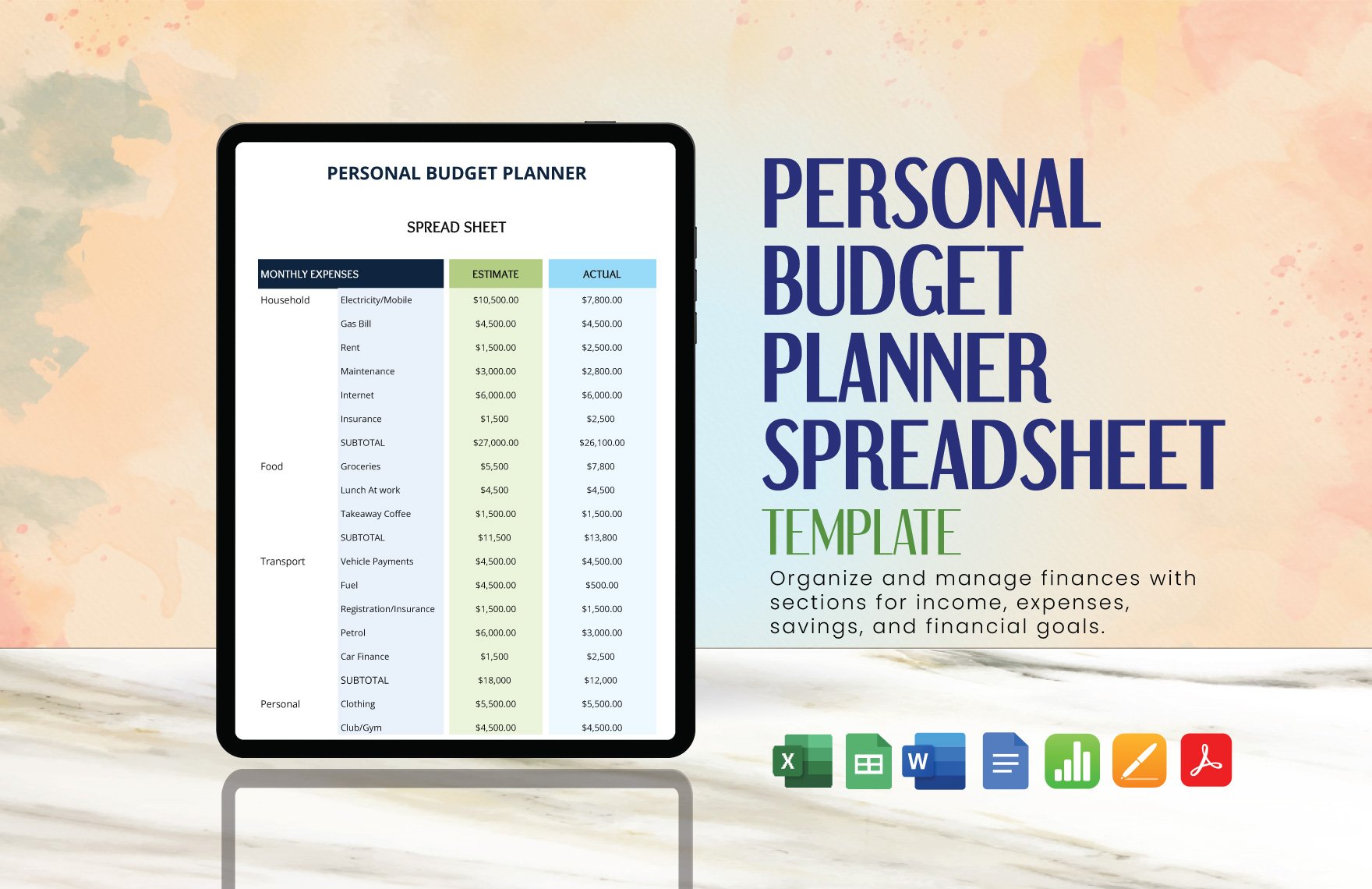

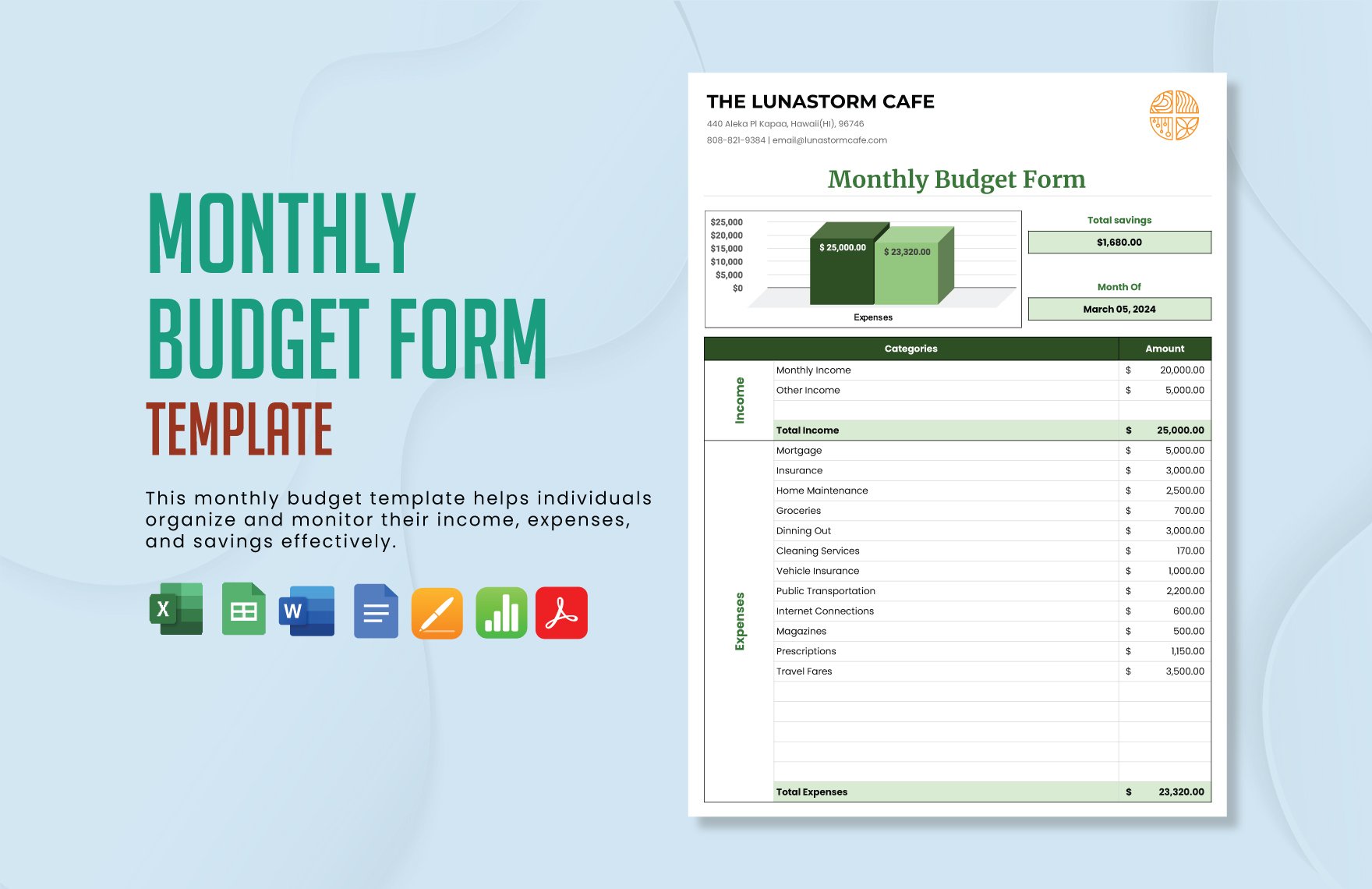

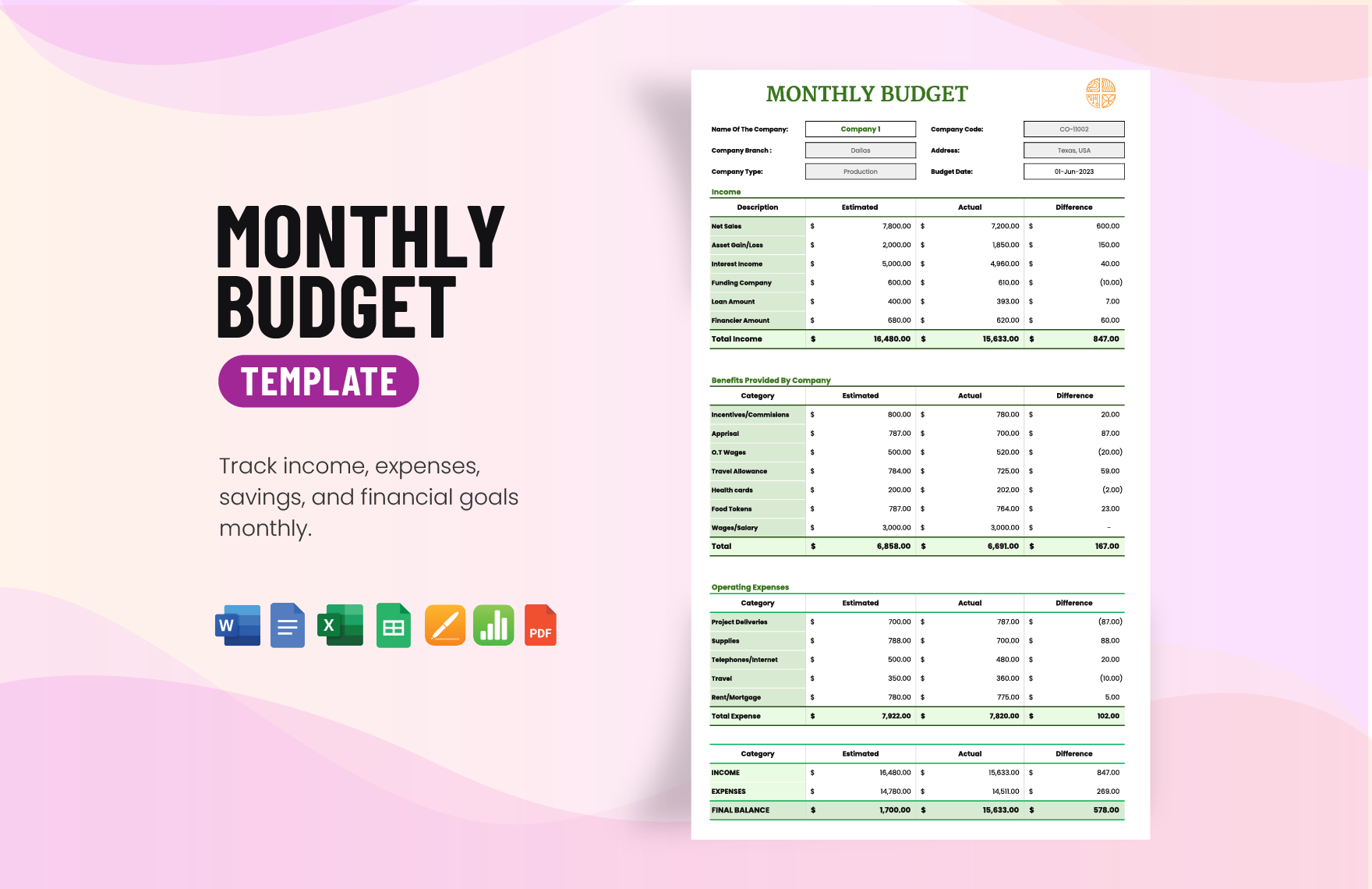

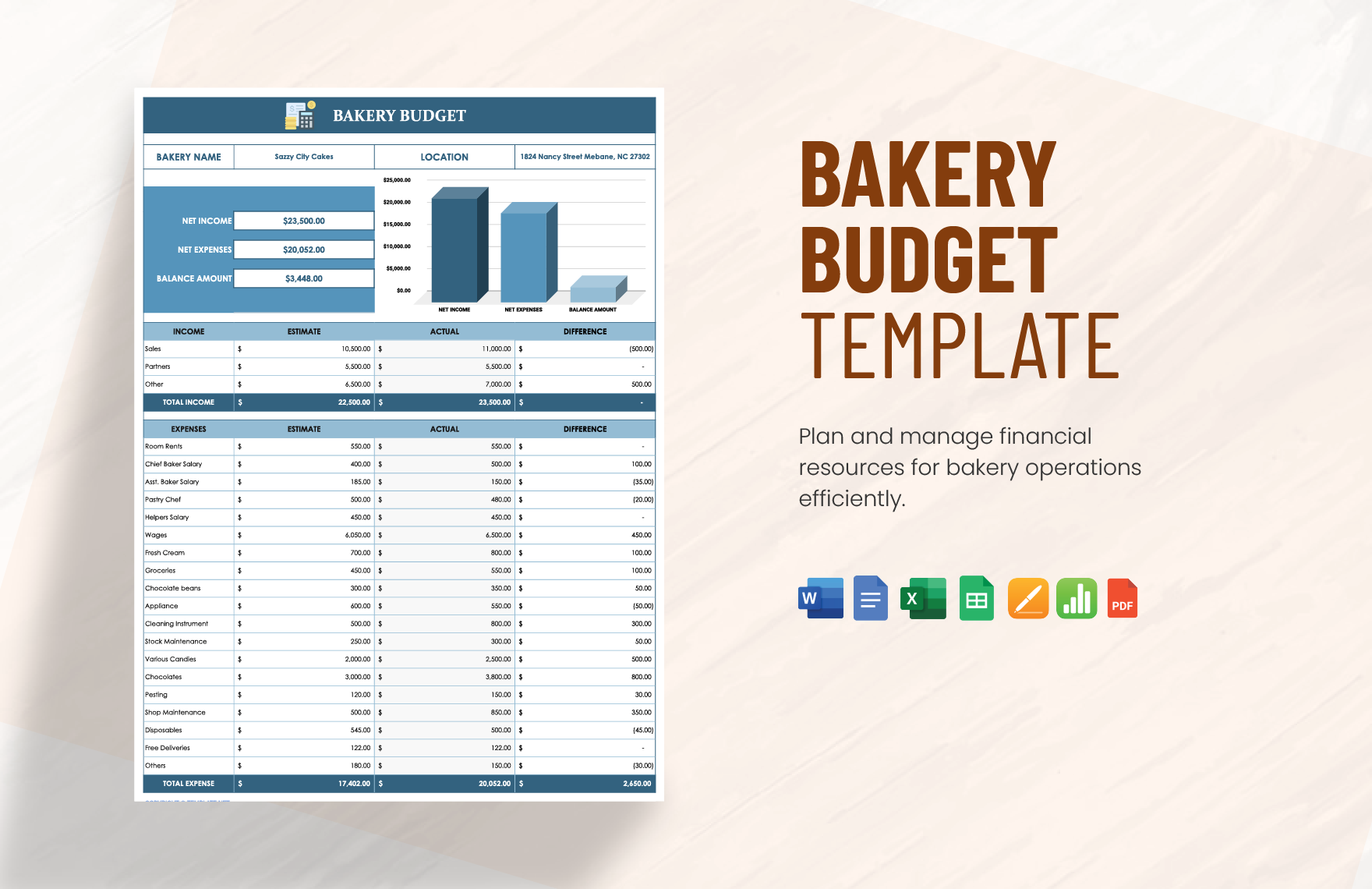

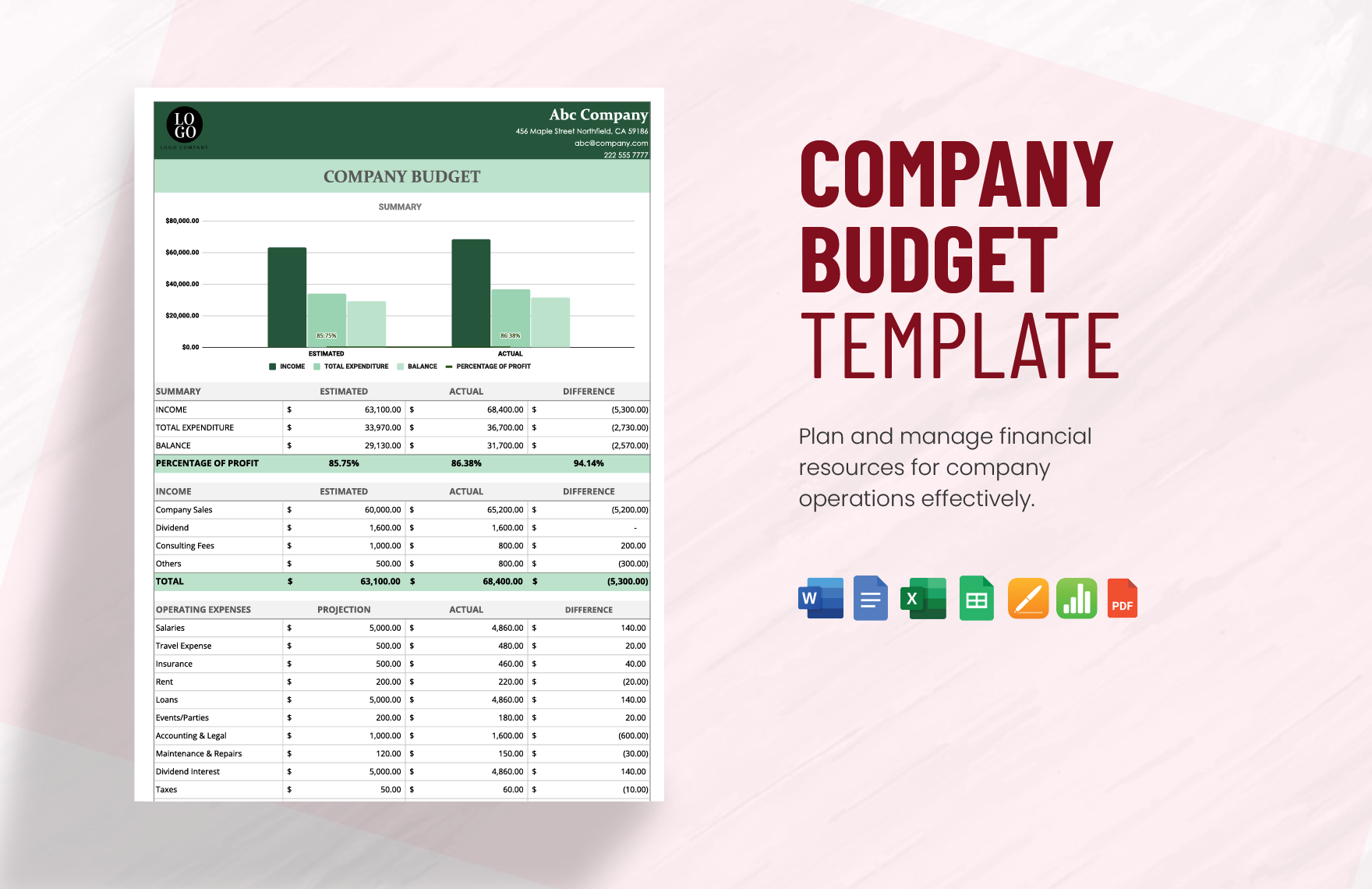

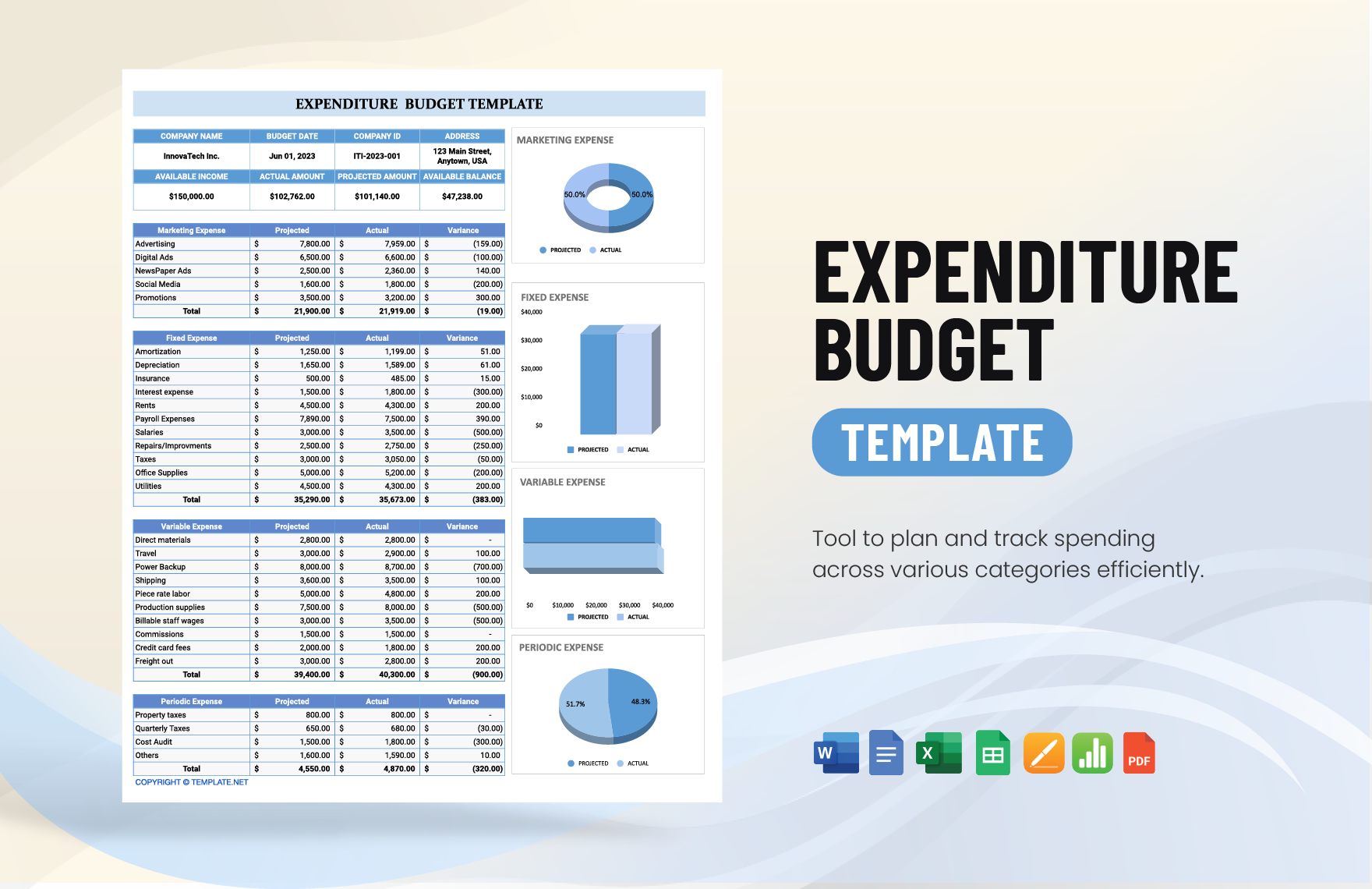

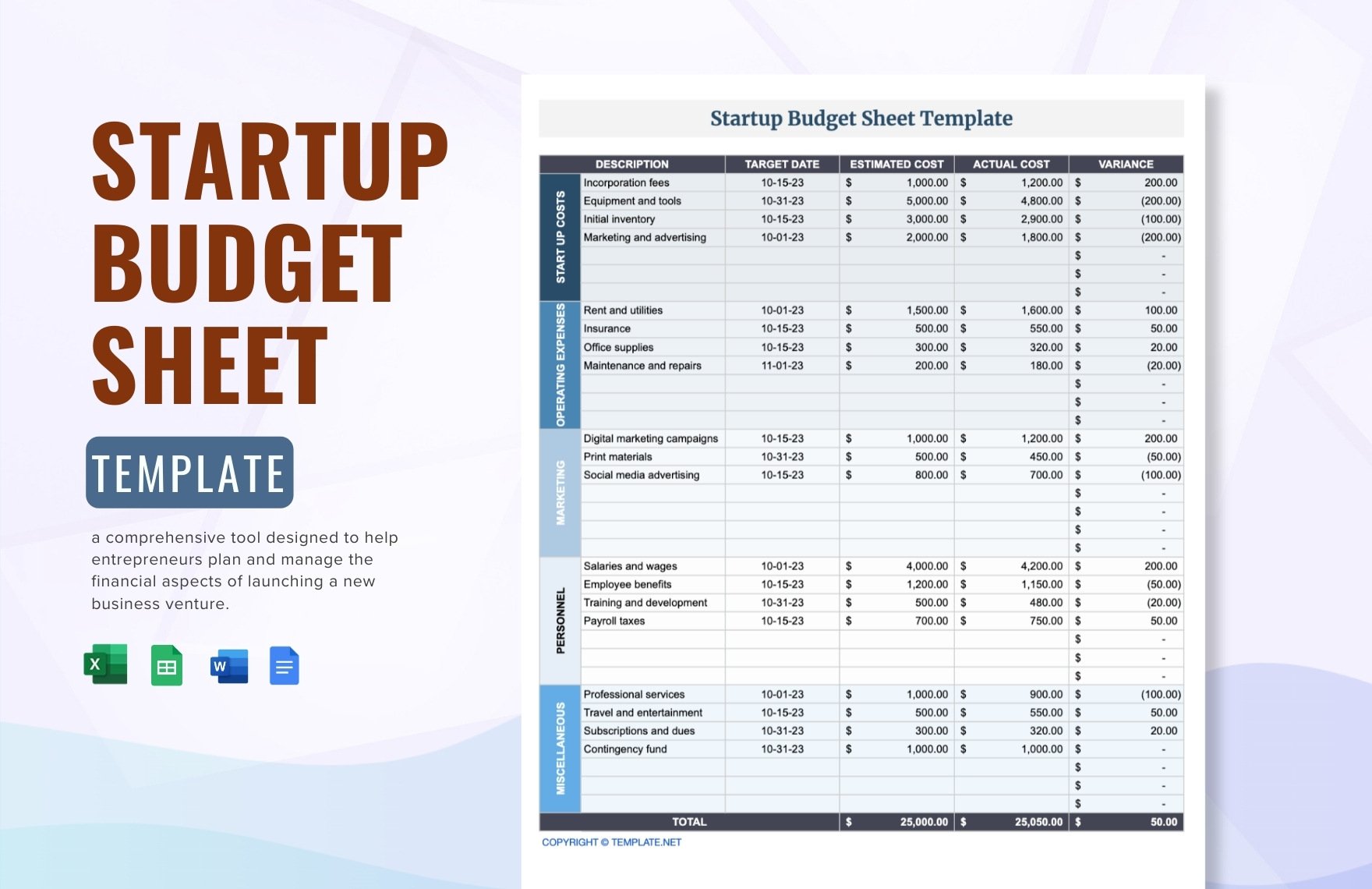

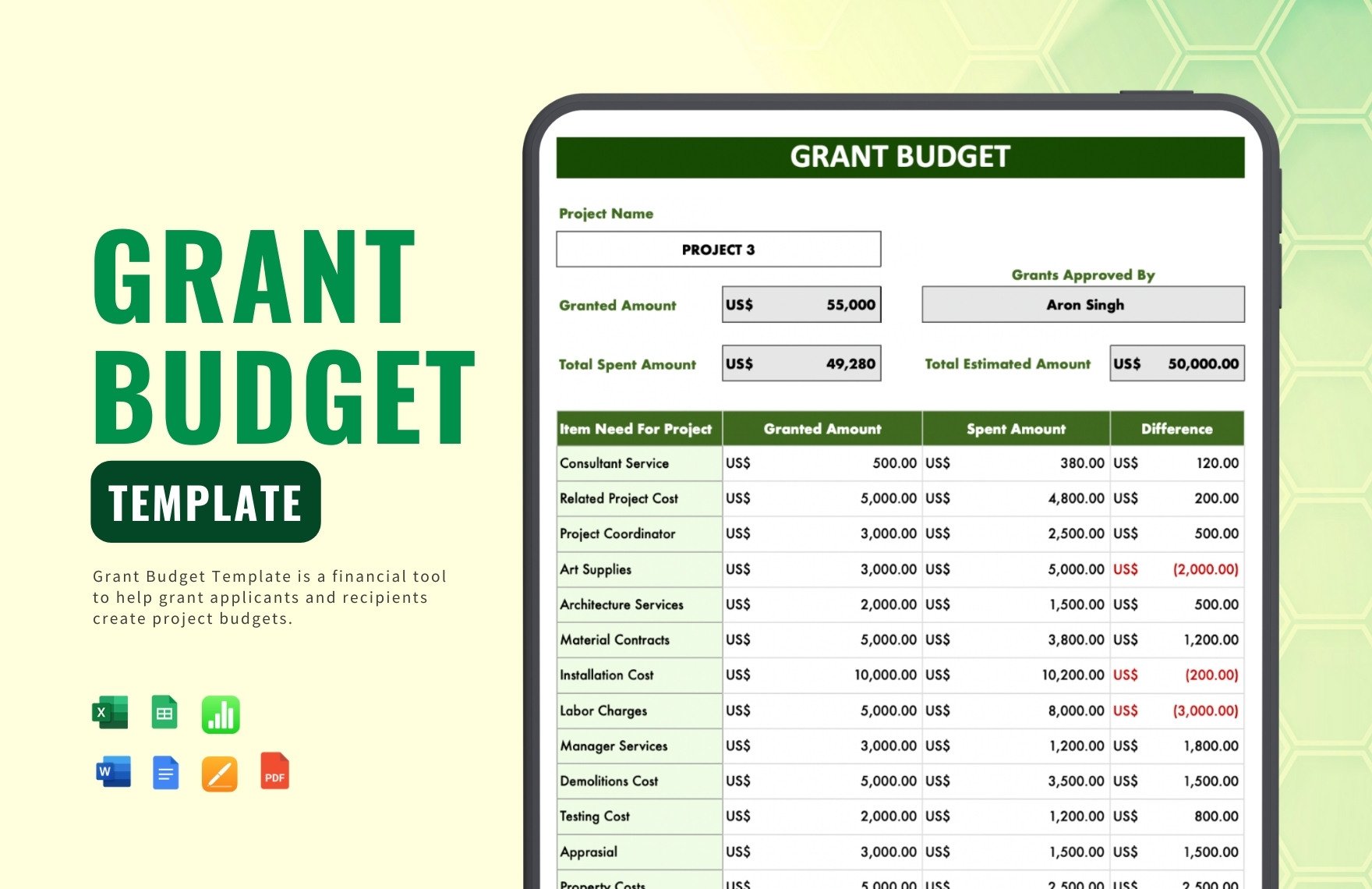

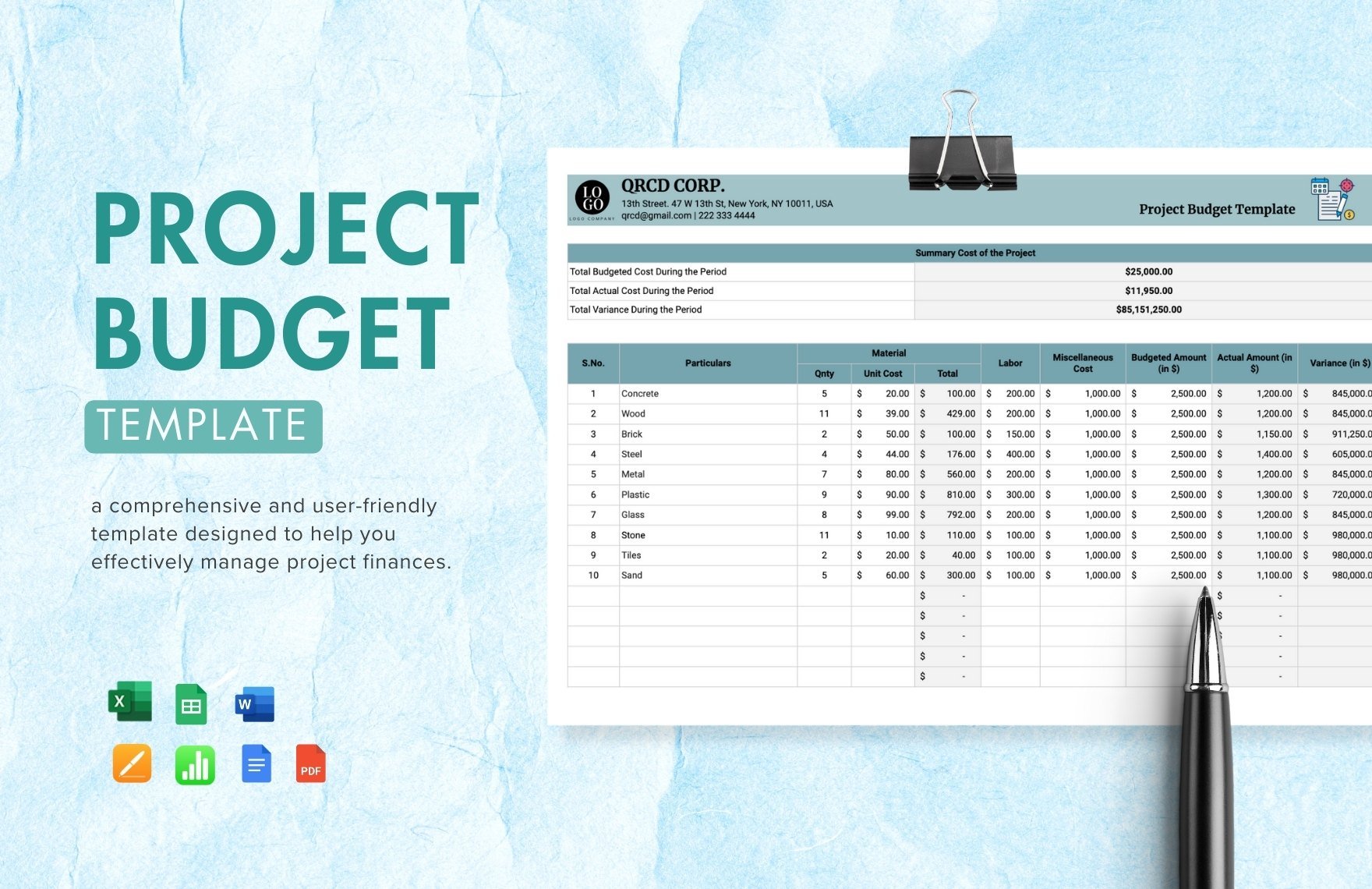

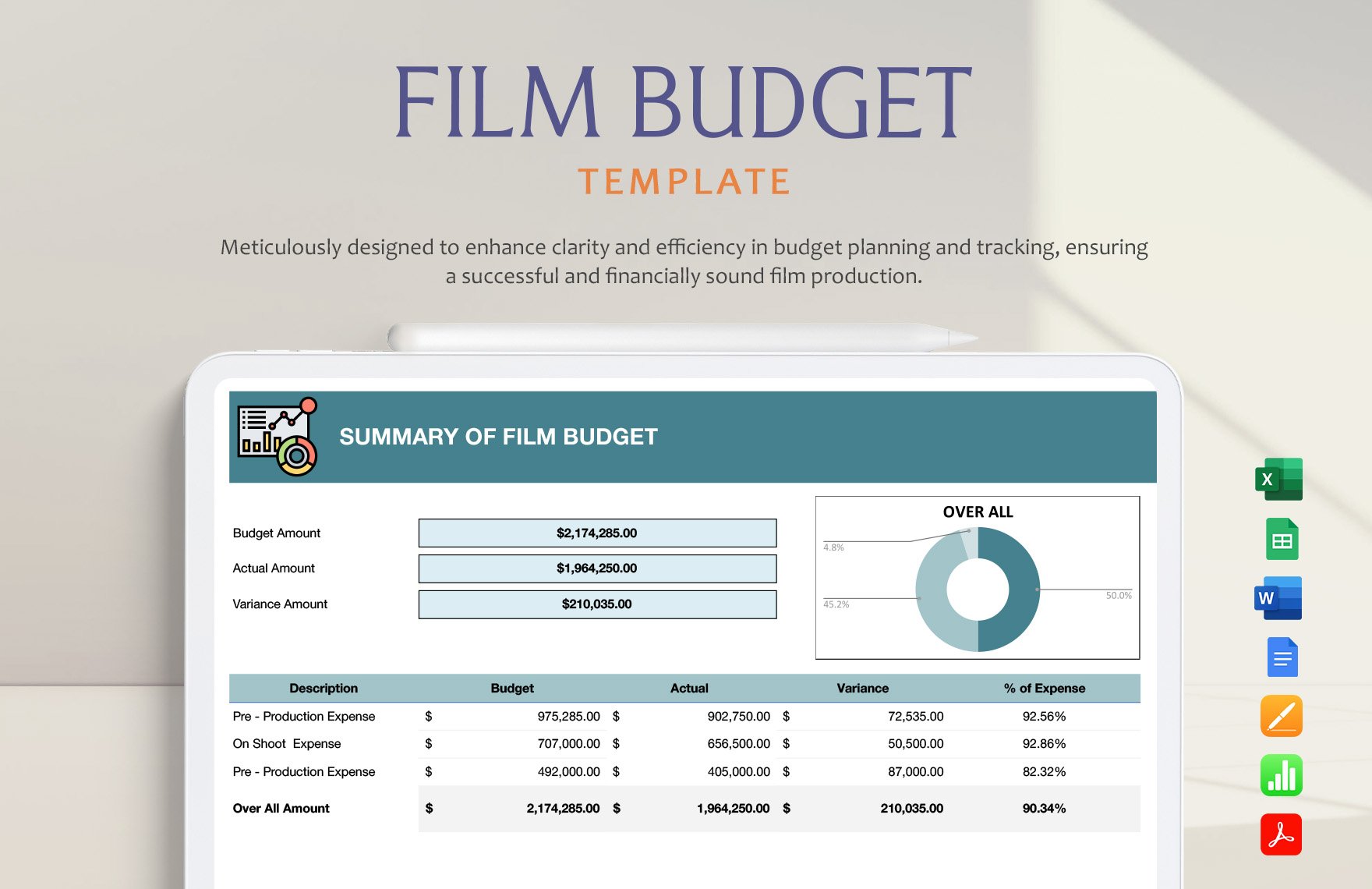

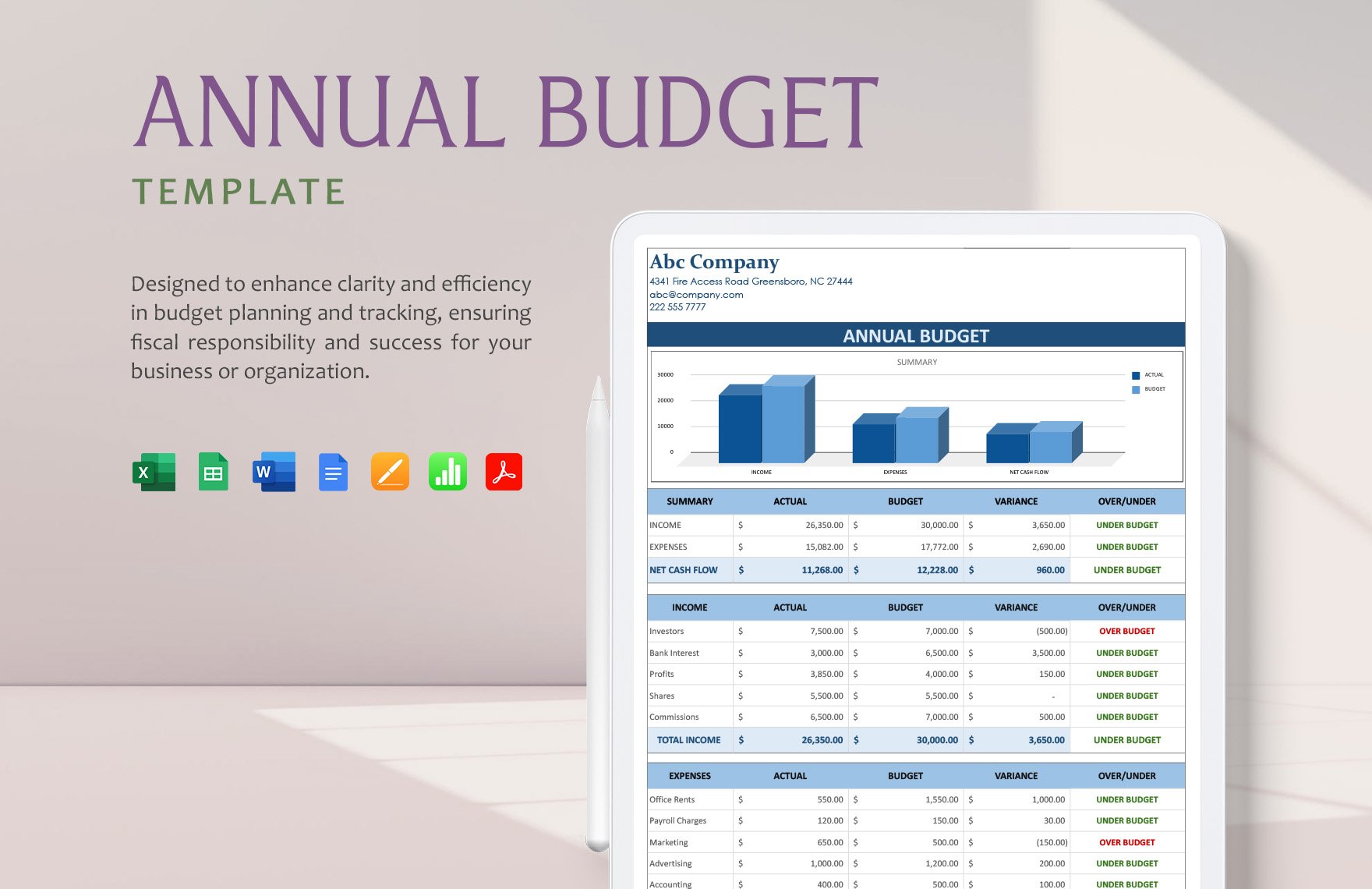

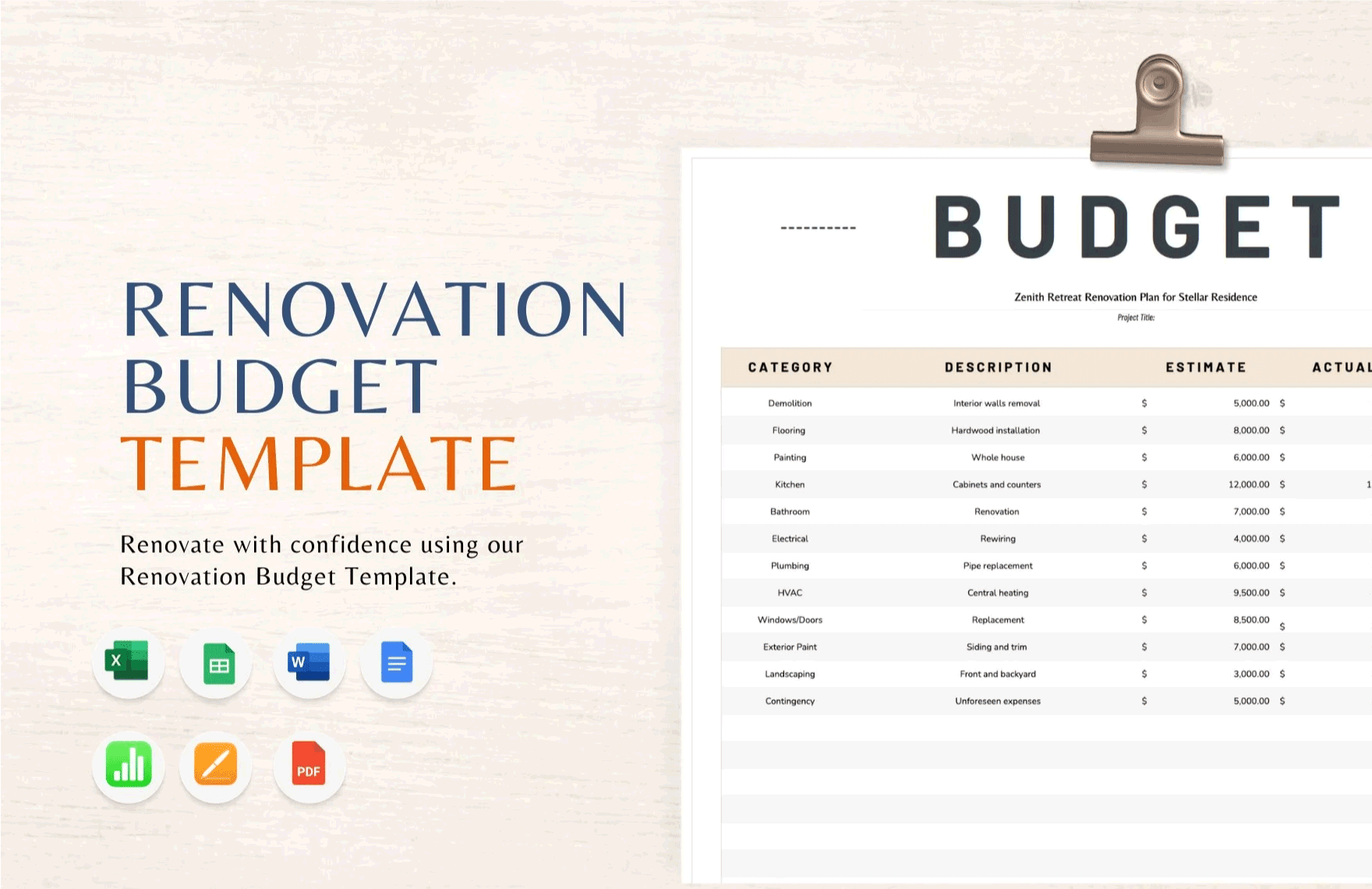

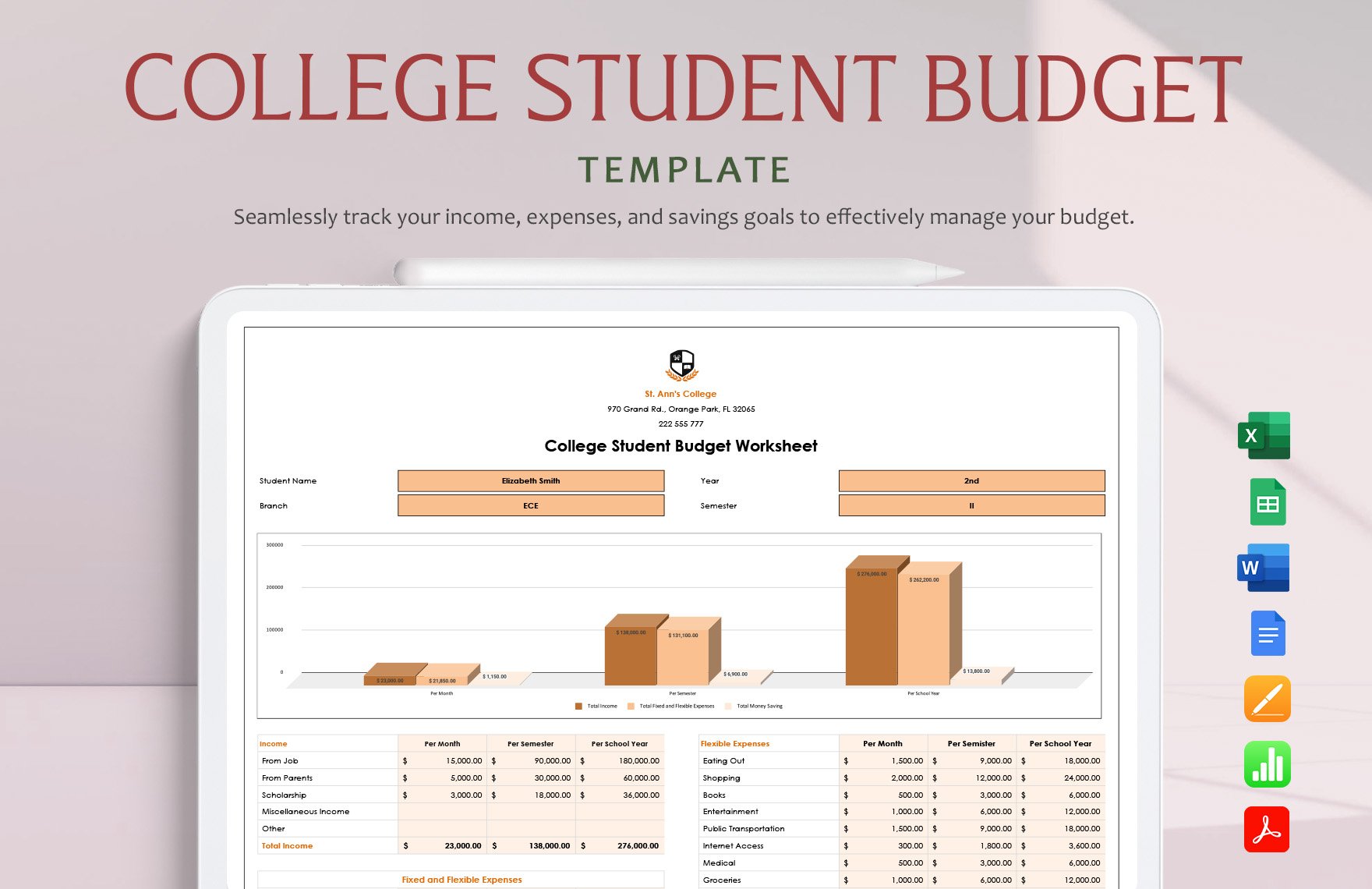

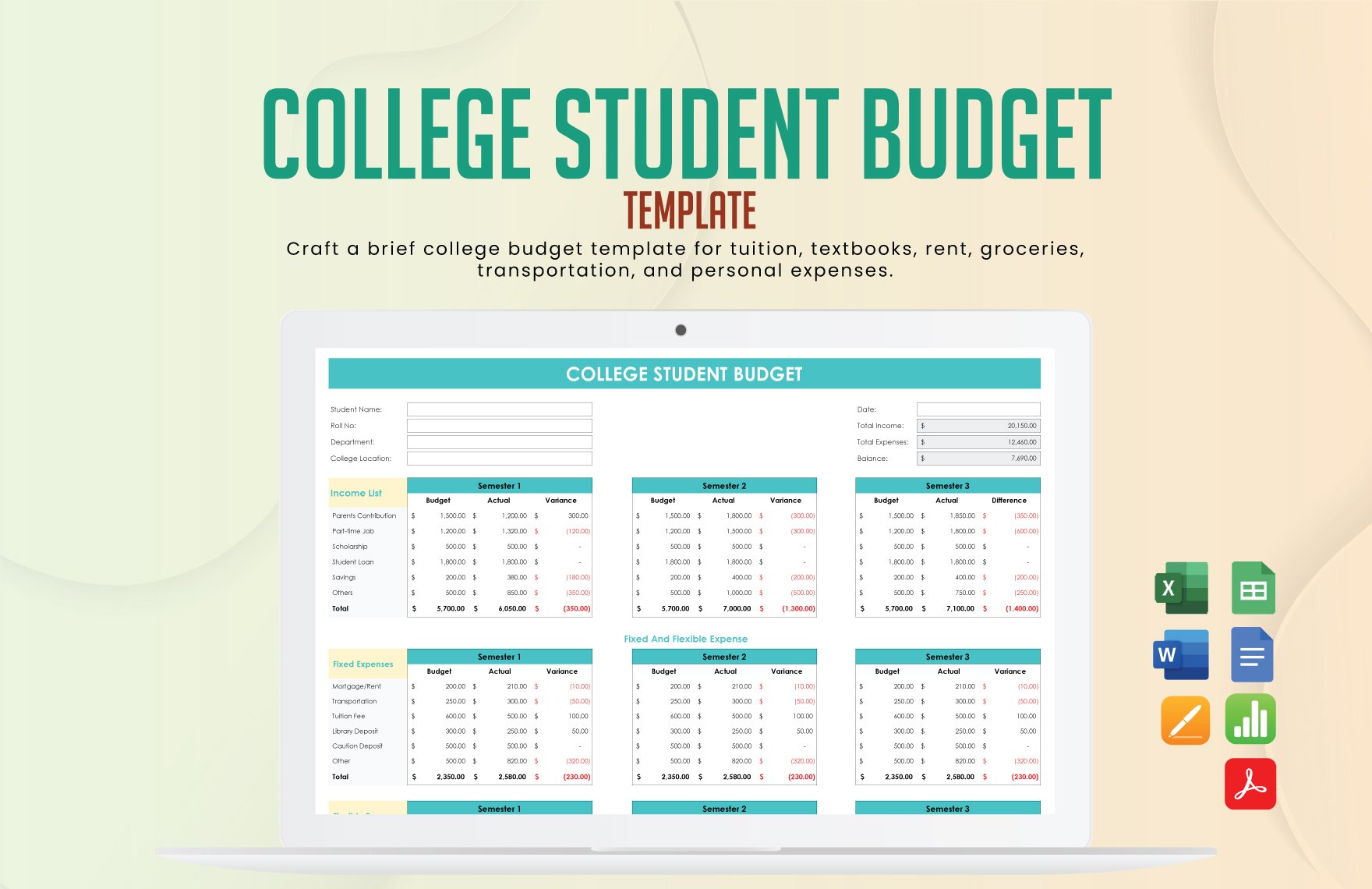

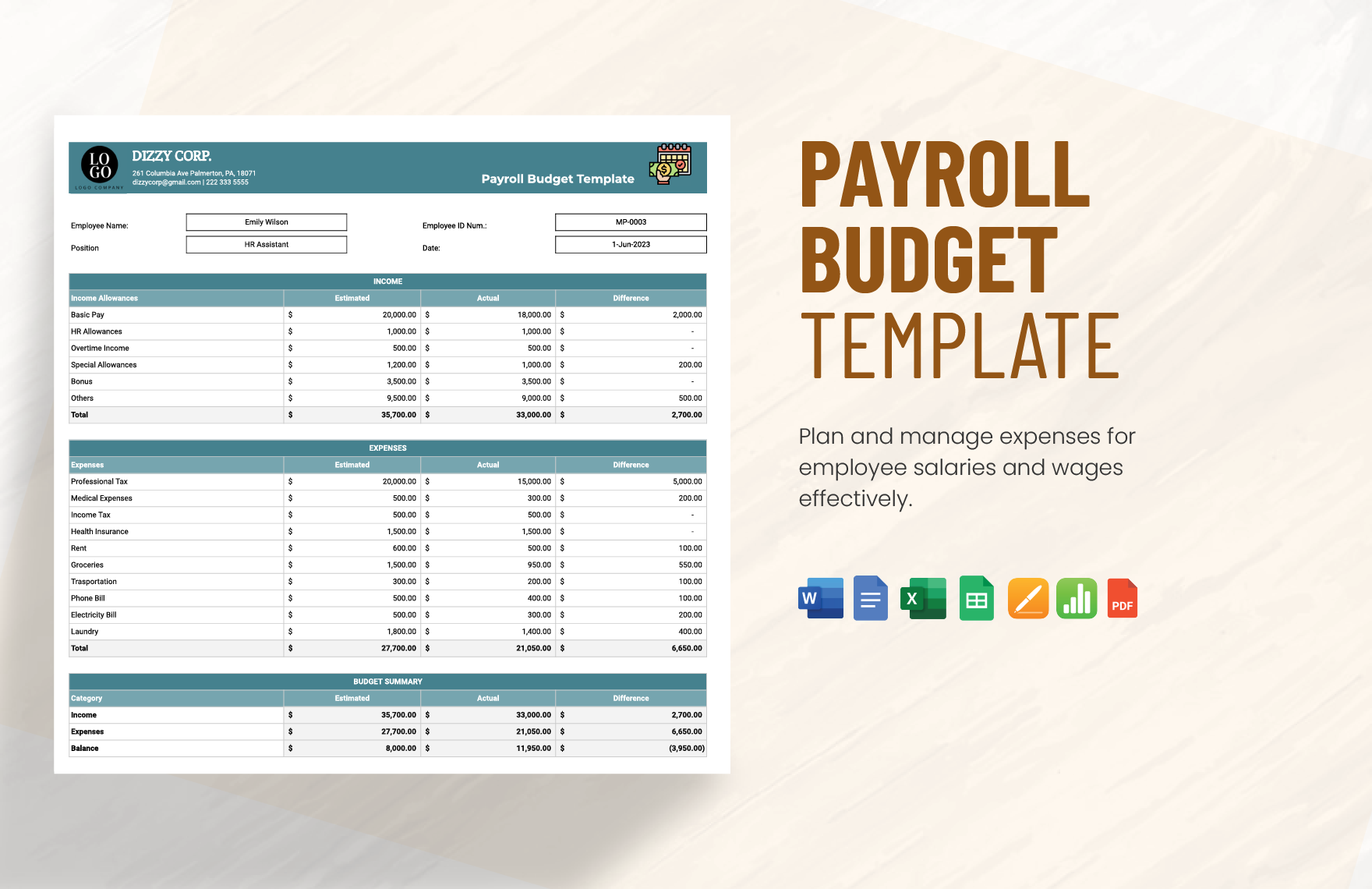

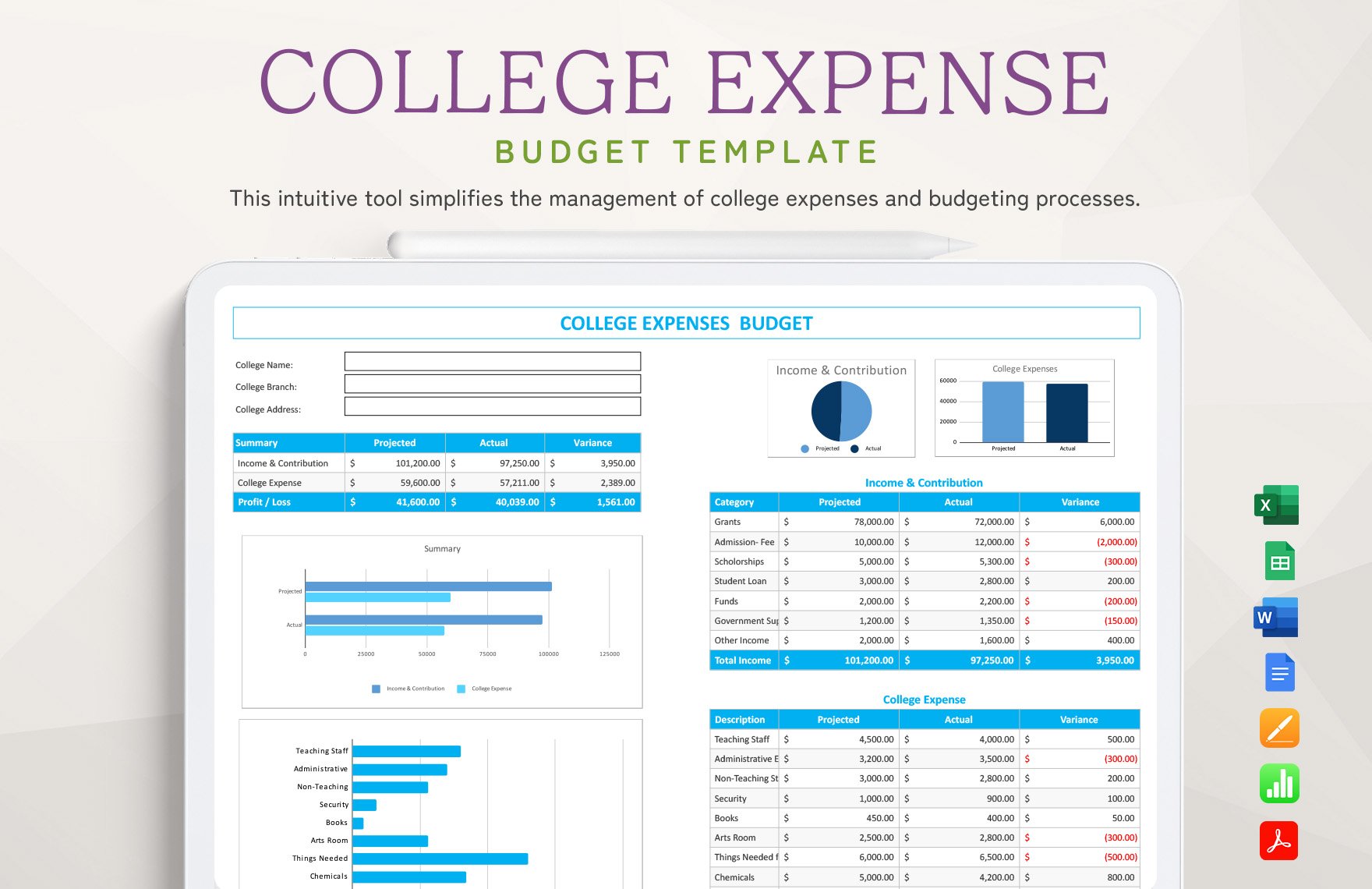

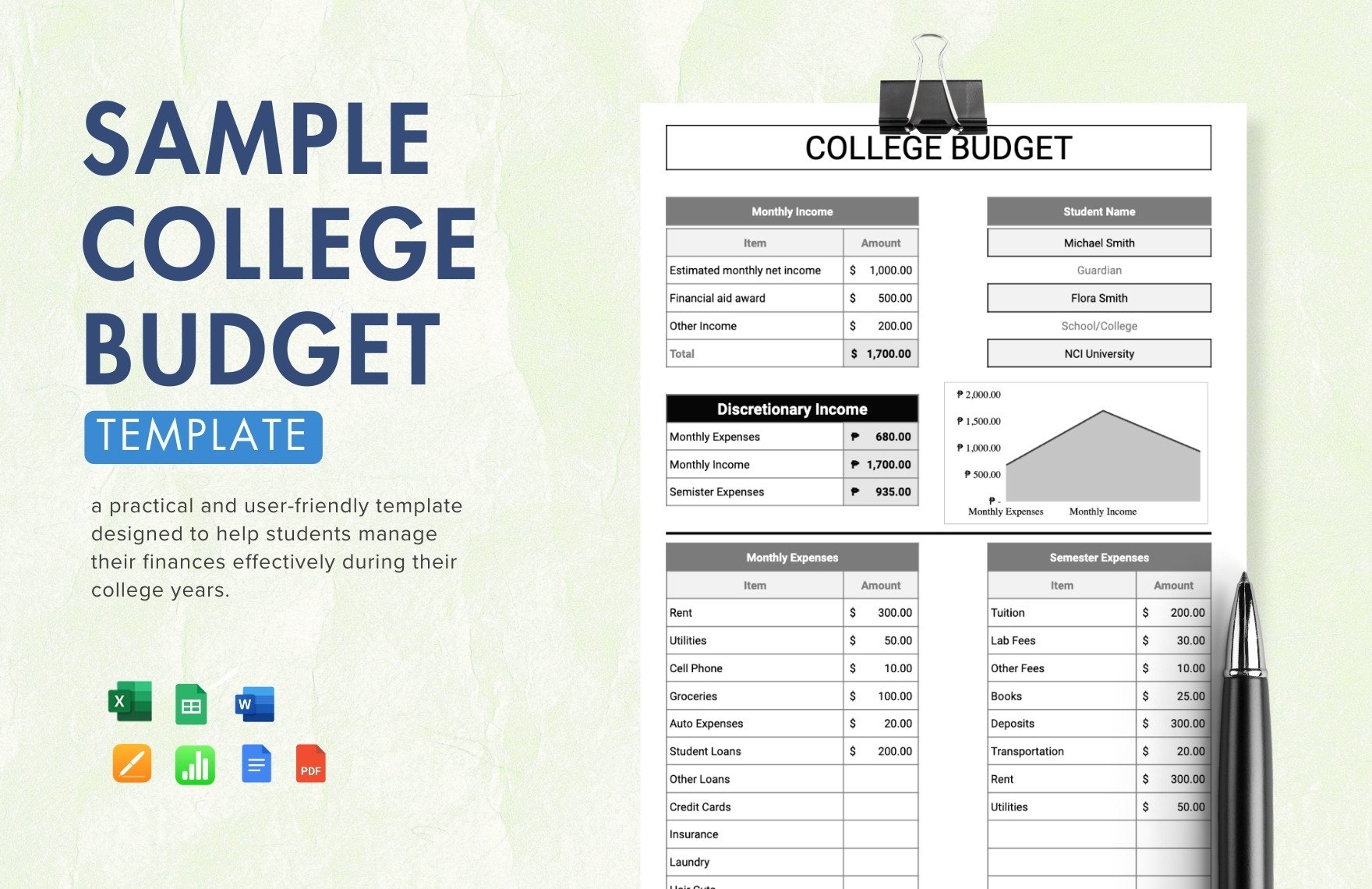

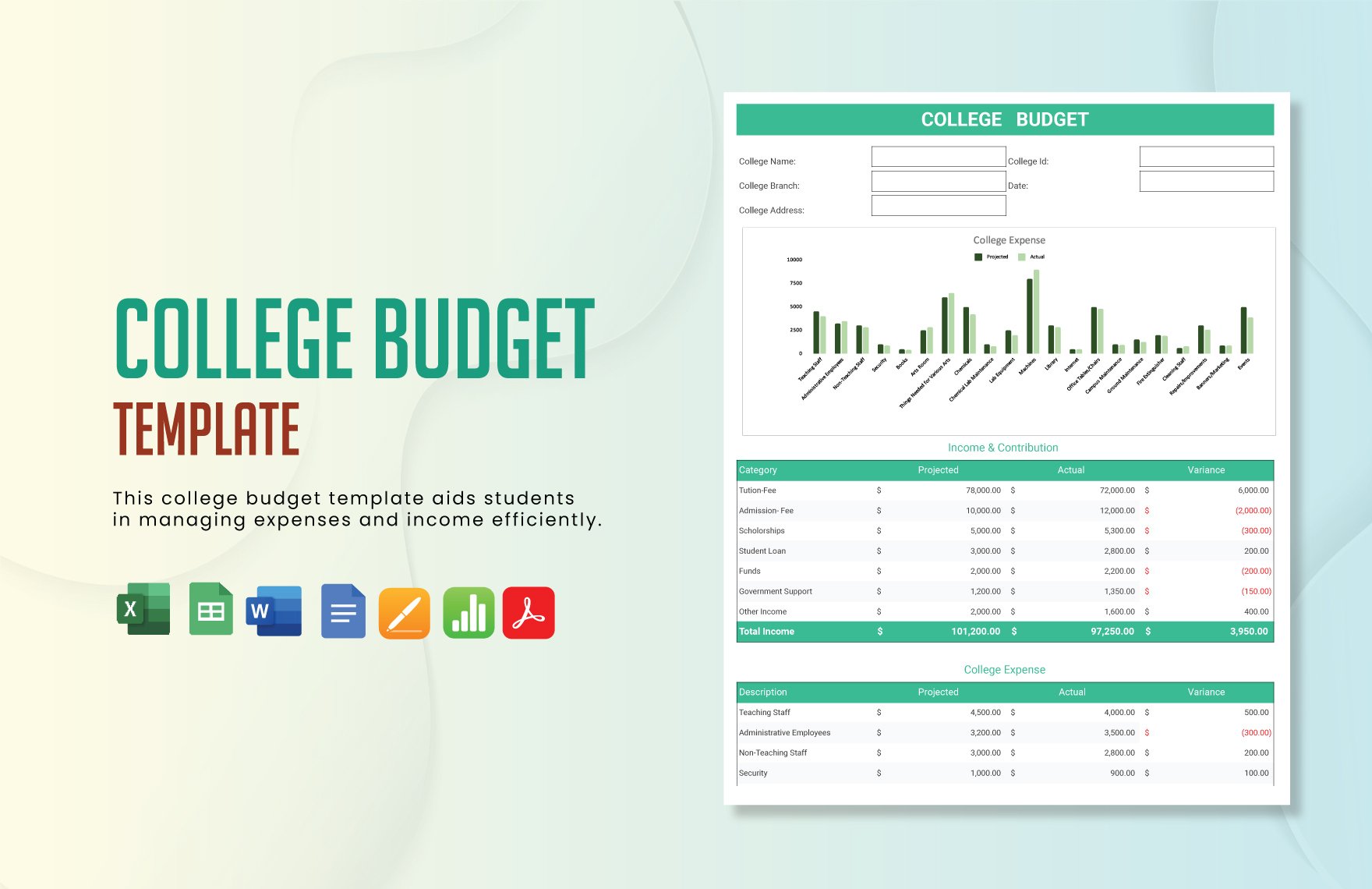

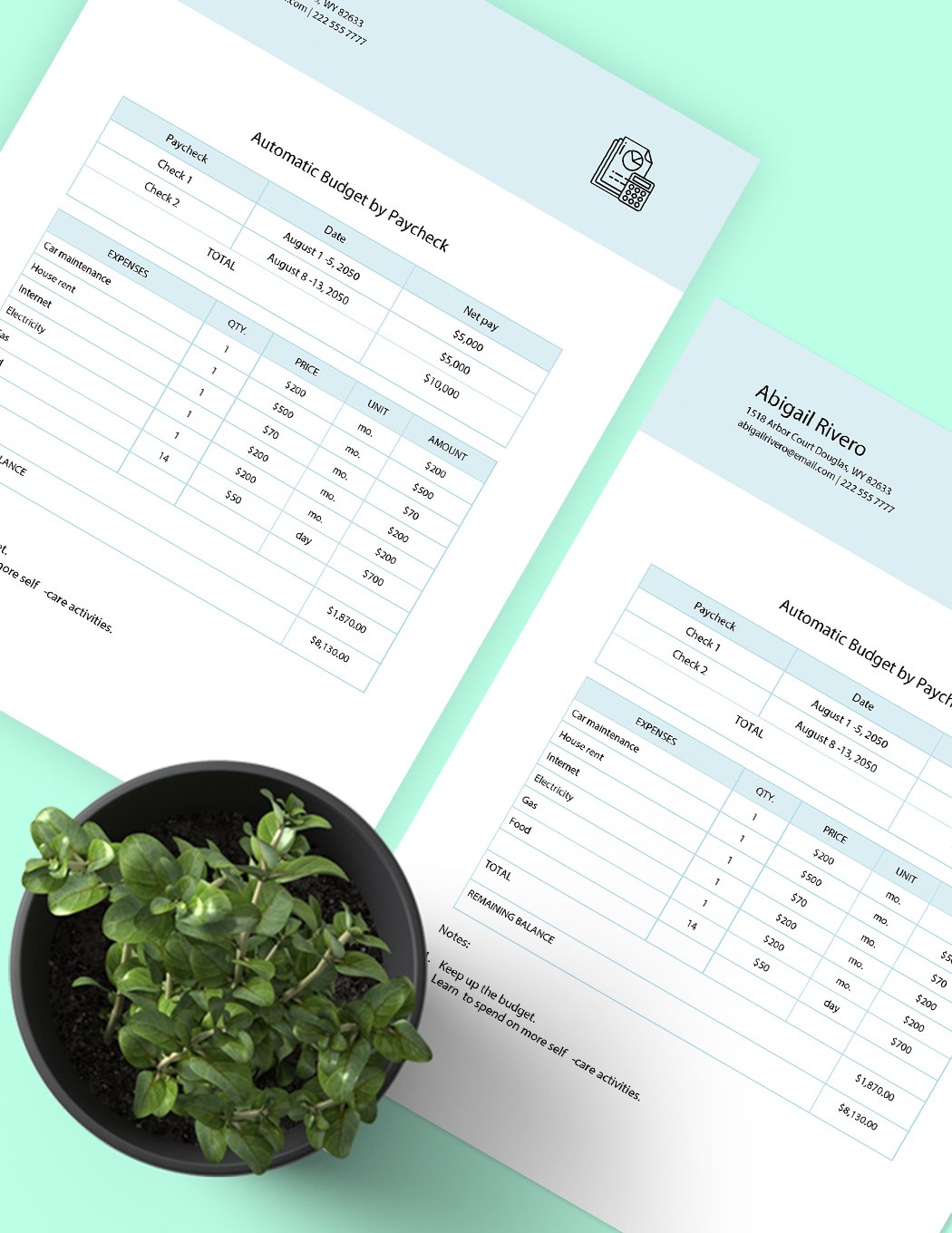

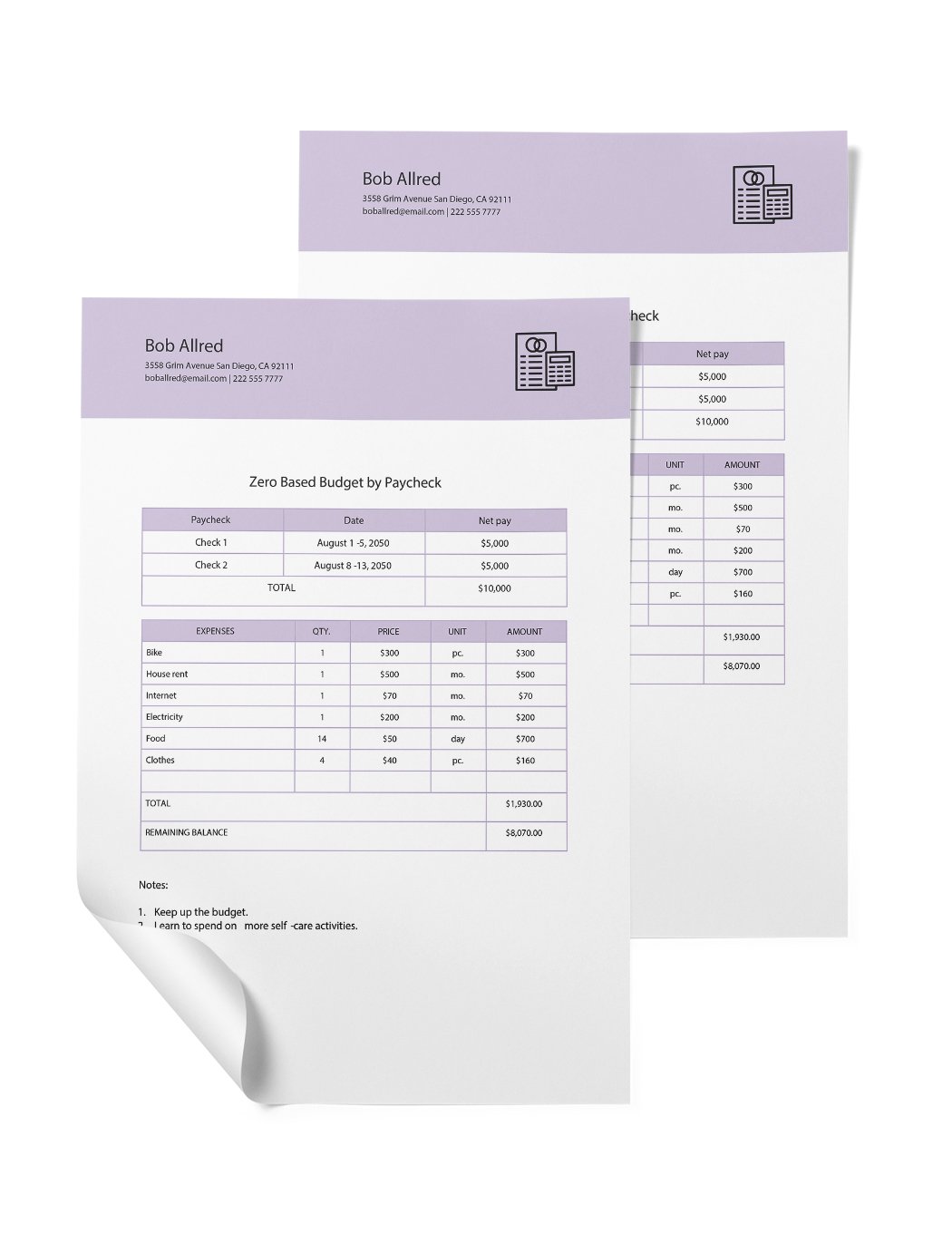

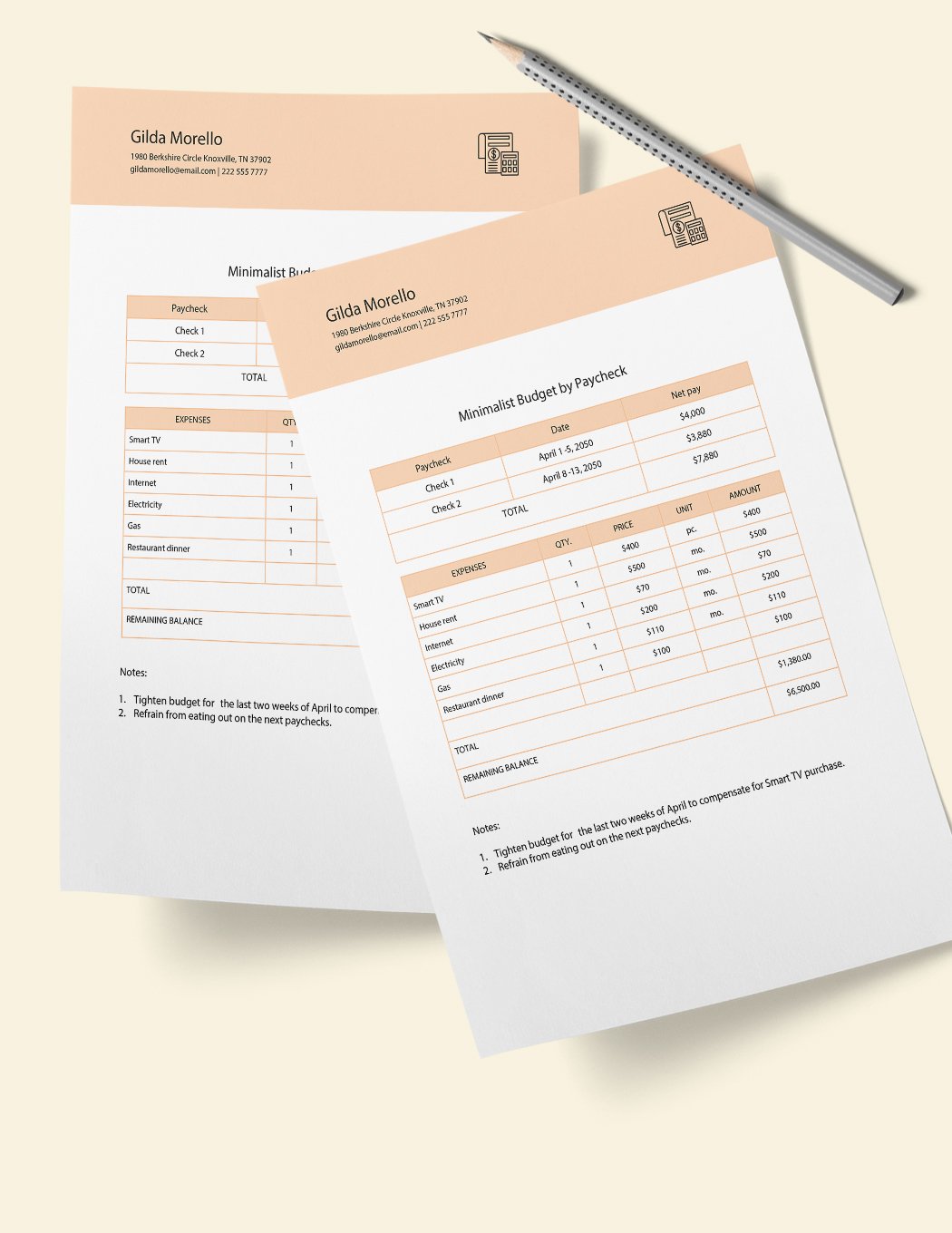

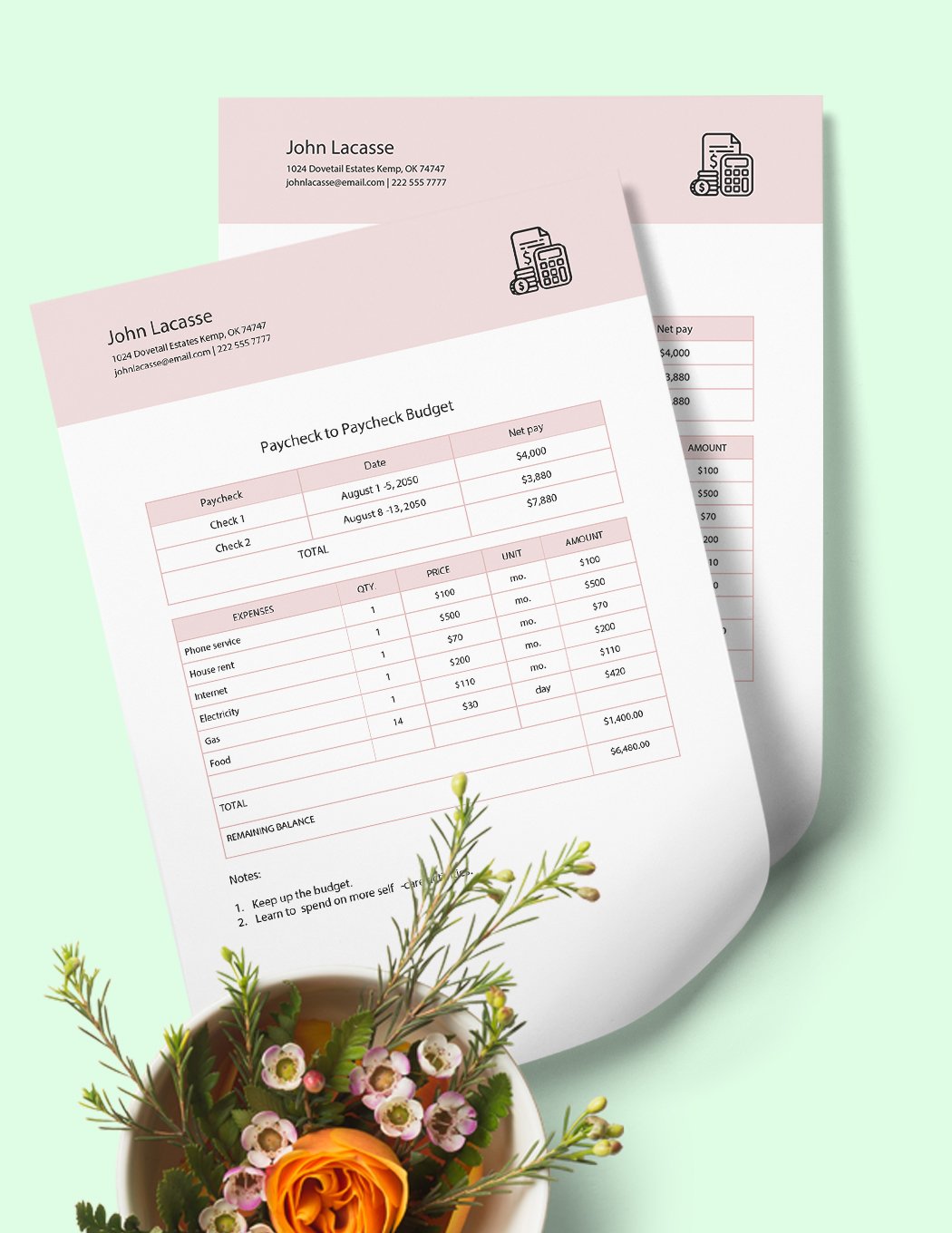

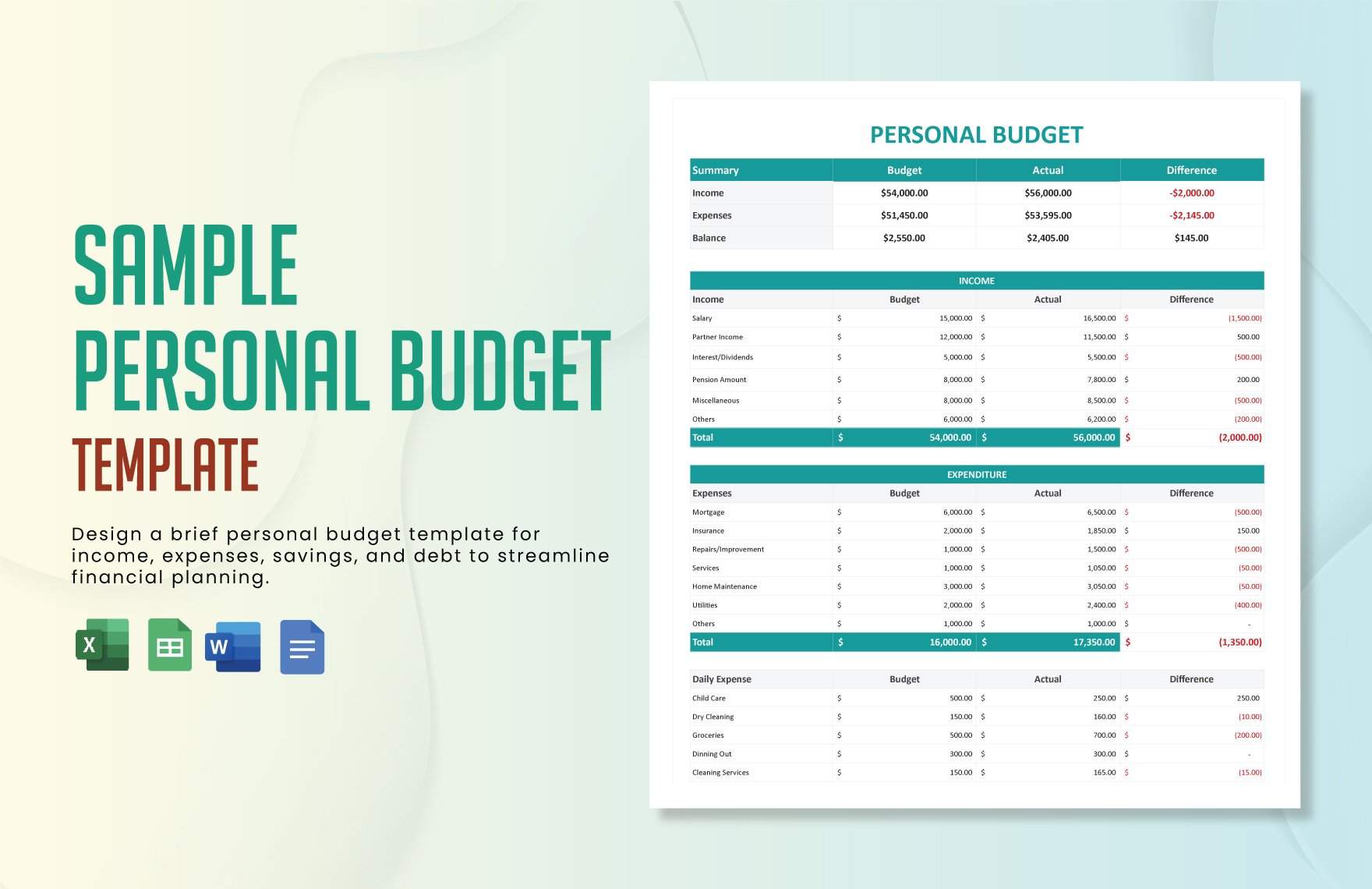

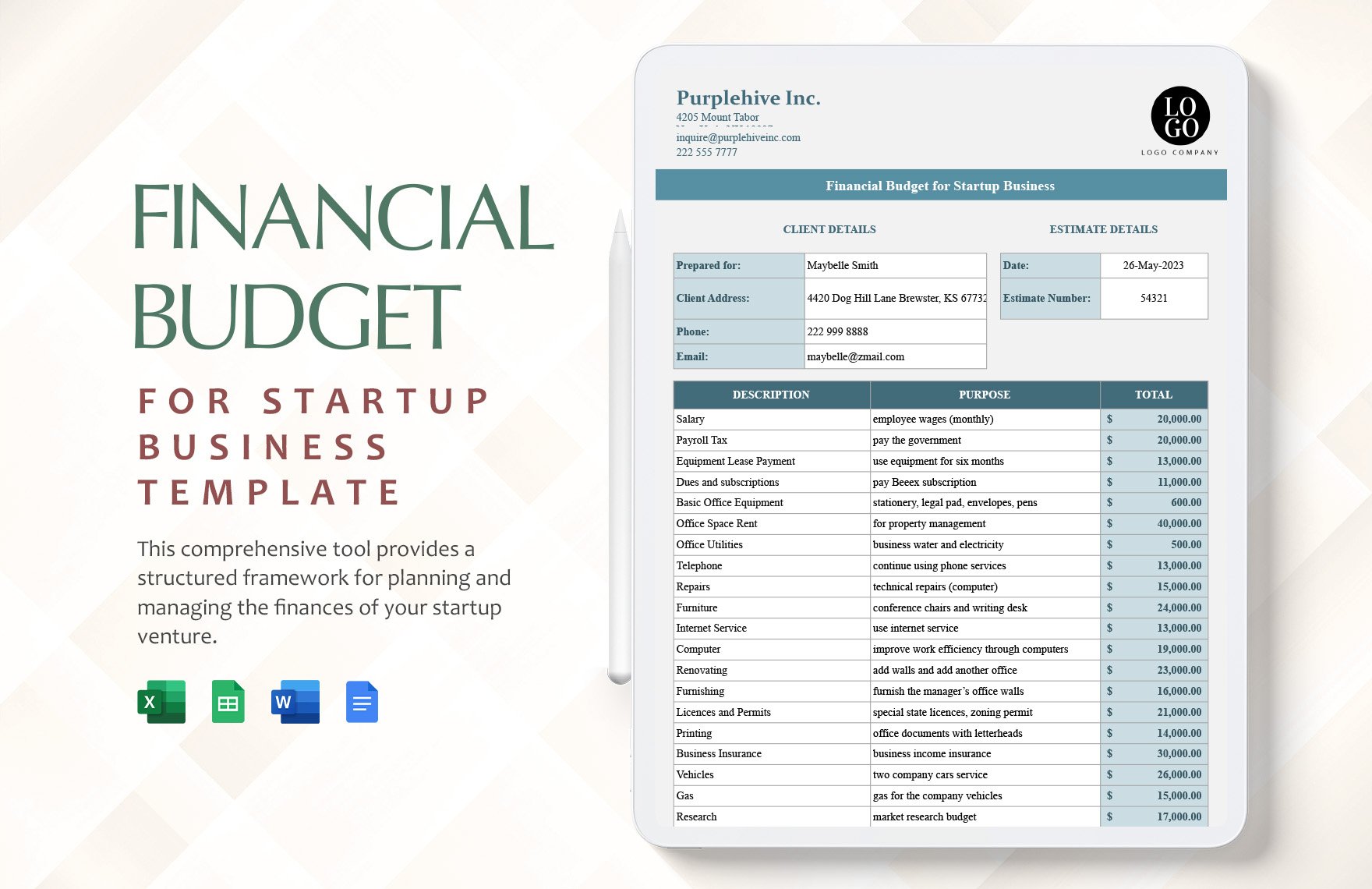

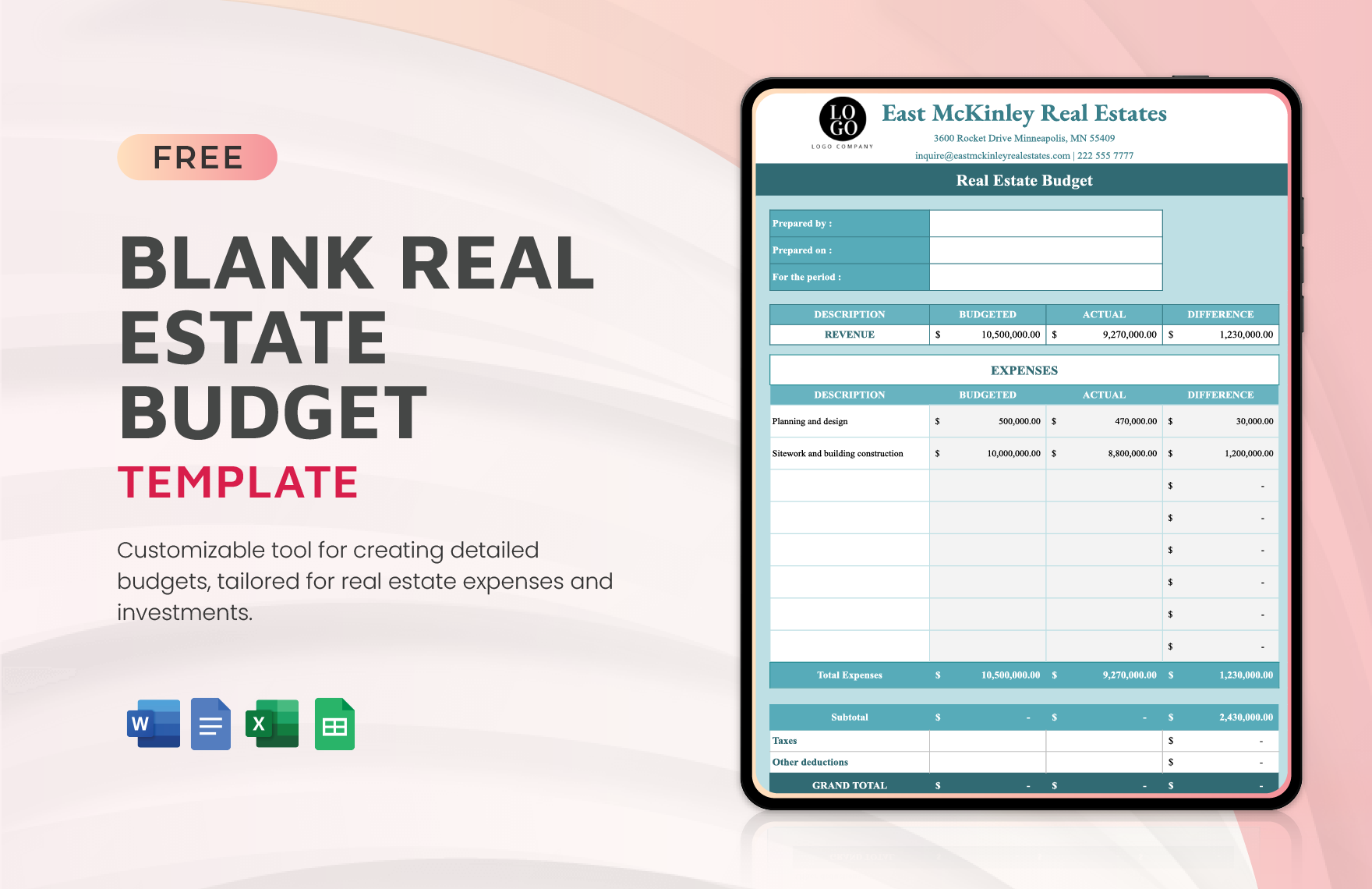

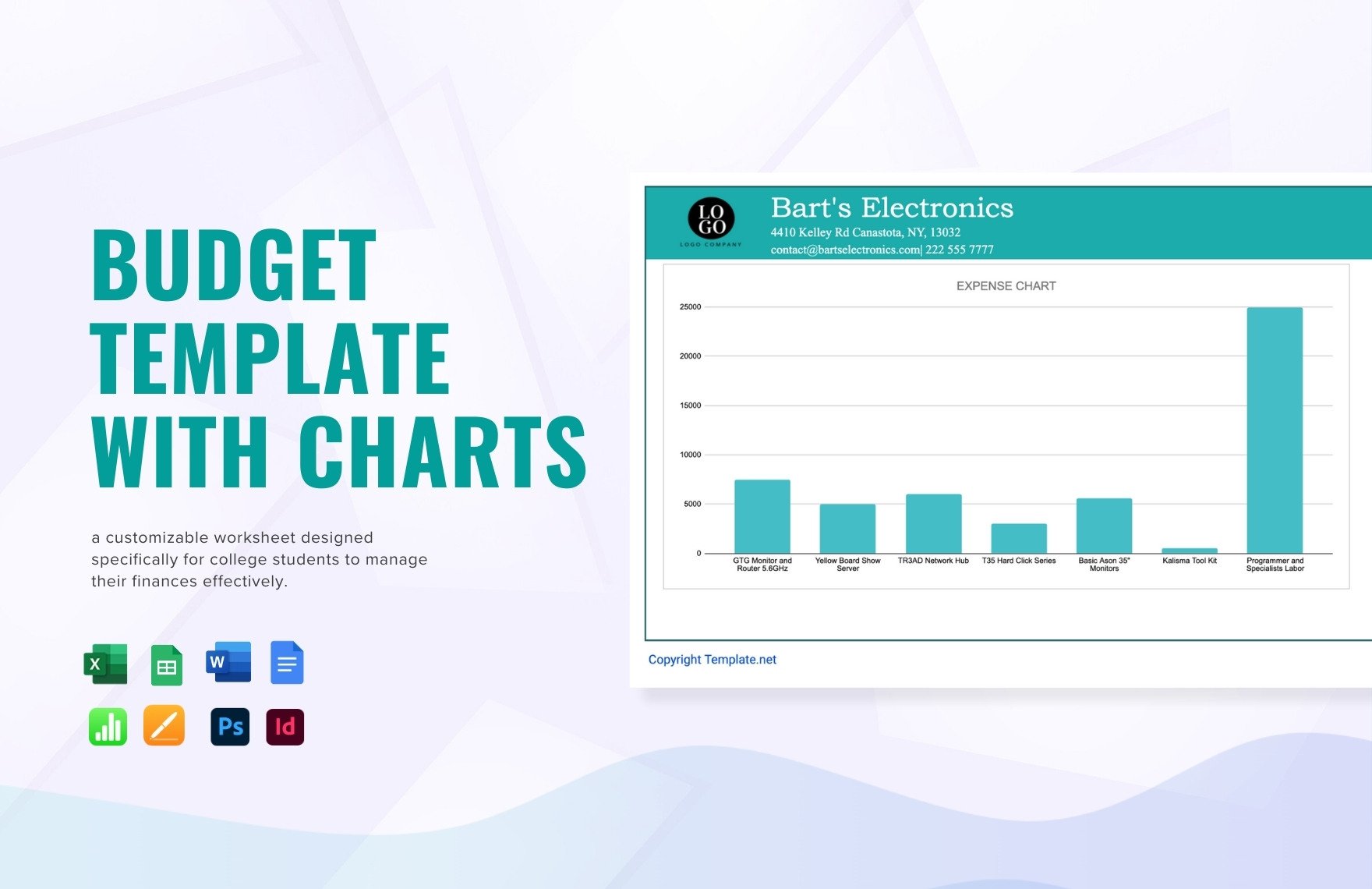

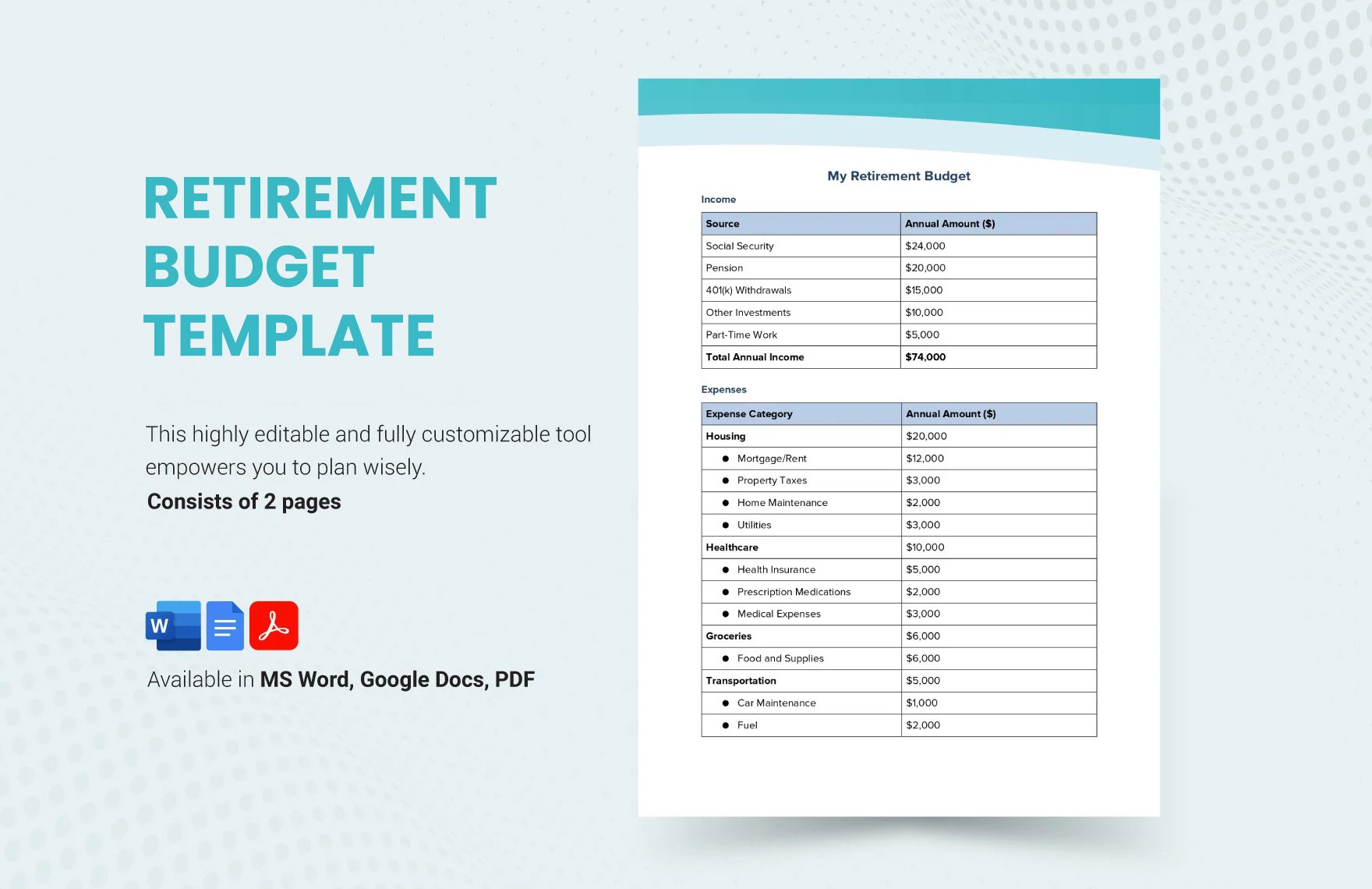

Bring your financial management to the next level with beautifully crafted pre-designed Personal Budget Templates in Google Docs by Template.net. These templates are perfect for anyone looking to create detailed budget plans without any prior experience in spreadsheet or financial design. With these templates, you can easily plan a monthly budget to keep your expenses in check or manage a family budget to make sure every member stays on track with their spending. Each template comes with free pre-designed layouts that are downloadable and printable in your preferred Google Docs file format, ensuring you have both digital and physical copies at hand. You'll find yourself saving time and energy with these templates as no design skills are needed to craft your personal budget forms. Utilize customizable layouts to fit specific needs such as household budgeting or business expense tracking, allowing for seamless Google Docs integration.

Discover a wide array of Personal Budget Templates that suit any financial goal, available in both free and premium options for Google Docs. Template.net frequently updates its library with fresh designs and new functionalities to keep your budgeting strategies modern and effective. Easily download or share your customized budget sheets via email or export them for increased reach and collaboration with family members or financial advisors. Leverage the flexibility of both free and premium templates to experiment and find the perfect fit for your budget planning needs. These tips will help you maximize the use of both free and premium resources, ensuring comprehensive and practical budget management.