Table of Contents

- Agreement Template Bundle

- 11+ Mortgage Agreement Templates in PDF | DOC

- 1. Mortgage Agreement Template

- 2. Mortgage Loan Agreement Template

- 3. Mortgage Purchase Agreement Example

- 4. Mortgage and Security Agreement Template

- 5. One Mortgage Program Agreement Format

- 6. Mortgage Origination Master Agreement Template

- 7. Mortgage Loan Agreement Sample

- 8. Mortgage Agreement in PDF

- 9. Mortgage Purchase Agreement Template

- 10. Mortgage Origination and Sale Agreement Example

- 11. Mortgage Origination Agreement Template

- 12. Real Estate Mortgage Subordination Agreement

- 13. Mortgage Modification Agreement Example

- 5 Steps to Draft a Mortgage Agreement

11+ Mortgage Agreement Templates in PDF | DOC

In definition, a mortgage agreement is a type of contract between a mortgagor (borrower) and a mortgagee (lender). The term “simple mortgage” was first introduced in Great Britain during the Middle Ages. It is a French Law term that means “death pledge” – a pledge made when a person has fulfilled his/her obligations, or the property has taken away from him/her through a foreclosure. In this agreement, both a lender and a borrower need to secure many things, which includes an agreement template. Hence, we have listed below a wide variety of mortgage agreement templates that you can get and download anytime you need one.

Agreement Template Bundle

11+ Mortgage Agreement Templates in PDF | DOC

1. Mortgage Agreement Template

2. Mortgage Loan Agreement Template

housing.mt.gov

housing.mt.govIf you’re in dire need for a template to draft a mortgage loan contract agreement, then make sure to secure a copy of this Mortgage Loan Agreement Template anytime today. This template is ready to use and easy to access using a portable document format (PDF). What are you waiting for? Download it now to your advantage!

3. Mortgage Purchase Agreement Example

njhousing.gov

njhousing.govLearn from how the professionals drafted this Mortgage Purchase Agreement Example and apply it to your mortgage agreement-making activity. Read the content and take note of the relevant aspects that should be present also in a document sample that you are going to draft. Access the file now and download it using a portable document format (PDF). Make haste and grab now!

4. Mortgage and Security Agreement Template

admortgage.com

admortgage.comBoth mortgage and security agreements serve the same purpose as they create an interest that secures a debt of a borrower to the lender. They operate in a similar manner and provide preferential rights to the secured party in cases where assets are in question. The only difference is that a mortgage agreement follows a traditional way of securing payment obligations in a real estate transaction, while a security agreement serves as an instrument that secures obligations in most commercial transactions under the Uniform Commercial Code. You can combine these two into one document; hence, the mortgage and security agreement to help you secure both obligations. If you need this type of agreement document, you may download this Mortgage and Security Agreement Template immediately.

5. One Mortgage Program Agreement Format

mhp.net

mhp.netFormat your mortgage program sample agreement document using this One Mortgage Program Agreement Format in PDF. Download the file and study the layout well. Surely, you can learn a thing or two from this example. Don’t just allow it to slip through your hands. Download and utilize this one mortgage program agreement format now!

6. Mortgage Origination Master Agreement Template

destatehousing.com

destatehousing.comA mortgage origination master agreement is an “umbrella” document that augments the general terms and conditions outlined in a mortgage origination agreement. It provides additional clauses, provisions, or phrases that can be of high relevance to a mortgage agreement document. For you to draft the document right and accurate, we’ve made this Mortgage Origination Master Agreement Template available now in PDF. You may download the template anytime to your advantage.

7. Mortgage Loan Agreement Sample

freddiemac.com

freddiemac.comIf you’re struggling to draft a mortgage loan sample agreement of your own, you may refer to this Mortgage Loan Agreement Sample now. The file is downloadable using a portable document format (PDF), so it wouldn’t be a problem accessing this sample agreement. And if you’re in a hurry, you may download it right away!

8. Mortgage Agreement in PDF

atb.com

atb.comGet to create a mortgage agreement document instantly as you download this Mortgage Agreement in a portable document format (PDF). Make use of the original content and the layout that you can use and learn from to your advantage. Make haste and secure a copy of this file now!

9. Mortgage Purchase Agreement Template

southindianbank.com

southindianbank.comA purchase agreement is also known as an agreement of sale or sales agreement. It is a document that details the terms and conditions, the payment schedules, the interest rates, and other relevant information for the sale of a property. To help you draft this agreement document better, we have prepared a ready-made Mortgage Purchase Agreement Template in PDF. You may download it now or later.

10. Mortgage Origination and Sale Agreement Example

in.gov

in.govUse this Mortgage Origination and Sale Agreement Example to aid you in drafting an agreement document you need. The file is downloadable and accessible in a portable document format (PDF). You can keep this file to your personal computer and use it anytime you need a sample agreement document. So what are you waiting for? Download it now!

11. Mortgage Origination Agreement Template

maryland.gov

maryland.govBuying a home does not necessarily require a person to pay for it in cash. A purchaser may opt for paying directly to a bank, to a mortgage lender, or use a mortgage broker. To avoid possible fraud, a mortgage broker or lender may require a mortgage origination agreement. Origination example means that a borrower must go through a multi-step process to get a mortgage or a home loan. So if you need a Mortgage Origination Agreement Template to help you draft this type of agreement document, you can download it right away.

12. Real Estate Mortgage Subordination Agreement

sba.gov

sba.govIn a real estate business documents transaction, a subordination agreement happens when a property has the first and the second mortgages, and the borrower wants to repay the first mortgage. A lender would undoubtedly require a borrower this type of agreement if your home has two mortgages, and you have to refinance the first one. To help you draft a Real Estate Mortgage Subordination Agreement, consider downloading this file in a Microsoft Word file format today. Hurry and download now!

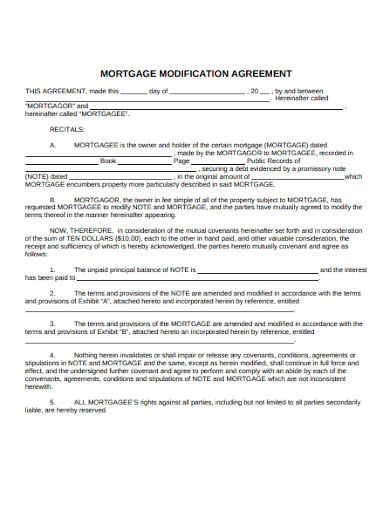

13. Mortgage Modification Agreement Example

stmpartners.com

stmpartners.comWhen a borrower struggles to pay for a mortgage simple payment , he/she may apply and qualify for a loan modification program. In this program, the lender would lower down the mortgagor’s monthly payment to accommodate his/her financial situation. To address this problem and carry out the plan better, you may download this Mortgage Modification Agreement Example in a portable document format (PDF).

5 Steps to Draft a Mortgage Agreement

Like a deed of trust, a mortgage agreement establishes the lien – the right to have possession over a property that is not his/her to claim yet until the payment is done – and requires a promissory note containing the payment details and the specific terms and conditions. And like drafting any contract, it demands you to follow certain stages and a very complicated process. To ensure that you’ll get to prepare a mortgage agreement document right, we have provided a step-by-step guide below. You may follow and learn from them to your advantage.

Step 1: Ensure a Repayment By Downloading a Mortgage Agreement Template

Without a template to help you draft a mortgage agreement document, you will surely have to prepare it from scratch. And surely, you’ll be wasting time and exerting too much effort. But who doesn’t want a shortcut in this long process? Of course, the templates provided can either guide you or help you finish the task quickly and effectively. It teaches nothing but only to be practical with everything that we do. And that includes drafting a well-organized legal agreement such as a mortgage agreement document.

Step 2: Ask For a Co-Signer

Every mortgage agreement requires a co-signer or a guarantor. A guarantor is a person who jointly pledges with the borrower to pay for the loan when the mortgagor’s income situation makes him/her unable to secure a repayment and has no longer enough money to pay for it. It guarantees the lender’s capital as well as the borrower’s dignity. Hence, it is of great importance for a mortgagee to ask for a co-signer or a borrower to provide one.

Step 3: Register the Necessary Information

In drafting a mortgage agreement, make sure to provide the necessary details. It may include the names and contact information of both the lender and the borrower, the information concerning the property, and other information that are of relevance to the agreement. Remember that every detail in the deal keeps the contract formally and legally binding.

Step 4: Incorporate Additional Clauses

A clause is a separate article, provision, requirement, or stipulation in a mortgage agreement. When a lender adds a particular phrase to the understanding, it only means that it secures something in the contract example. But make sure to explain and share the details with the borrower. A mortgagor must have to understand the clause clearly before he/she agrees to it. And as a lender, it is your job, if in any way you would want to add a provision that is relevant to the agreement, to communicate it to your mortgagor.

Step 5: Identify the Principal and Other Matters Relating to Payment

The last aspect to provide in the mortgage agreement document is the amount of money borrowed by a mortgagor (or the principal) and other essential matters concerning the payment. You may include here the payment schedule, interest rates, due dates, or prepayment terms. For the plan of payment, we have a wide array of payment schedule templates that you can download and utilize.