Table of Contents

- What is a Due on Sale Clause?

- What are the Exceptions for Due on Sale Clause?

- 8+ Due on Sale Clause Templates in PDF | DOC

- 1. Due on Sale Clause Template

- 2. Basic Due on Sale Clause Template

- 3. Mortgages Due on Sale Clause Template

- 4. Due on Sale and Due on Encumbrance Clause Template

- 5. Due on Sale Clause Letter Template

- 6. Due on Sale Clause Form Template

- 7. Simple Due on Sale Clause Template

- 8. Due on Sale Clause Straight Note Template

- 9. Standard Due on Sale Clause Template

- 5 Steps How to Make Due on Sale Clause Agreement

8+ Due on Sale Clause Templates in PDF | DOC

Owning a house or property is as fulfilling as getting a university degree for some people. Not everyone has the chance to live their dream. For other people, it can be the cause of continuous financial misfortune if not being planned well. Purchasing a house is not as easy as buying snacks in a supermarket, where you can return it if you don’t have enough money to pay for it. It involves a lot of decision-making, effort, and, most importantly, money. Fortunately, there are other ways for you to achieve your dream, and that is through applying for a loan. But there are some things that you should consider before you sign in any legal agreement.

What is a Due on Sale Clause?

A due-on-sale clause is an arrangement in a mortgage contract agreement that requires it to be compensated in full amount upon a sale or transferring of a property. This is to ensure that the mortgage is secured. It protects the lender and mortgage holder from the risk of a transferrable lease to the new proprietor of a property when it is below-market interest rate. So when homeowners decide to put their houses or properties on sale, they must use their sales revenue to pay off the mortgage, and the new buyer must attain a new mortgage for the same property.

What are the Exceptions for Due on Sale Clause?

A due-on-sale clause might not be something that every homeowners can read right away for it is usually found in the later pages of the contract. It is also known as an acceleration clause, this only started to be included in loans made after 1988. But not everyone are required to this settlement, there are exceptions that are needed to looked into. Under the 1982 Garn-St. Germain Act, lenders cannot always impose due-on-sales clause in some situations even though there is a change of ownership. These includes situations like if the debtor or borrower is deceased and the ownership is transferred to a relative. The same thing can be applied if the owner transfers the property ownership to their children and if there is a judicial separation, divorce or property settlement agreement.

8+ Due on Sale Clause Templates in PDF | DOC

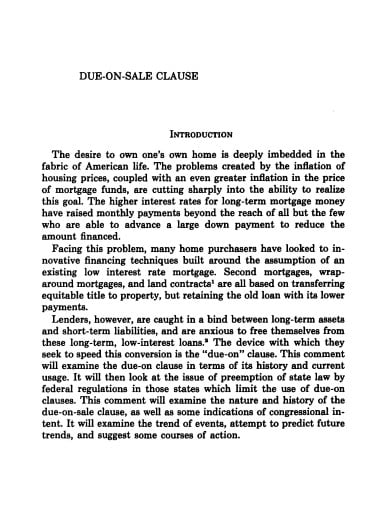

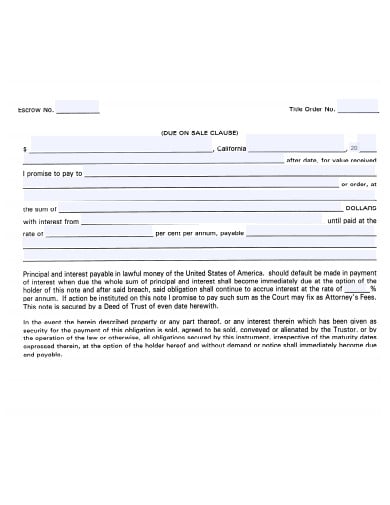

1. Due on Sale Clause Template

fsu.edu

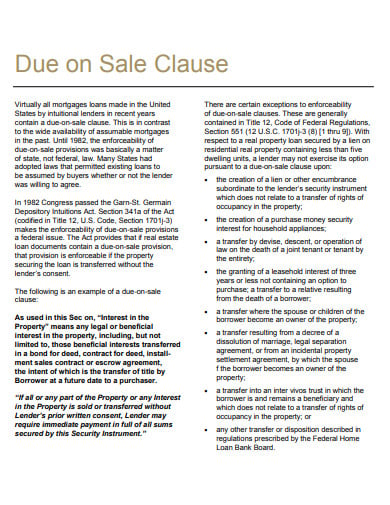

fsu.edu2. Basic Due on Sale Clause Template

wfgnationaltitle.com

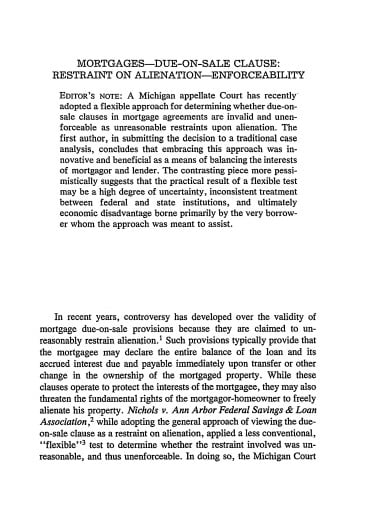

wfgnationaltitle.com3. Mortgages Due on Sale Clause Template

case.edu

case.edu4. Due on Sale and Due on Encumbrance Clause Template

ubalt.edu

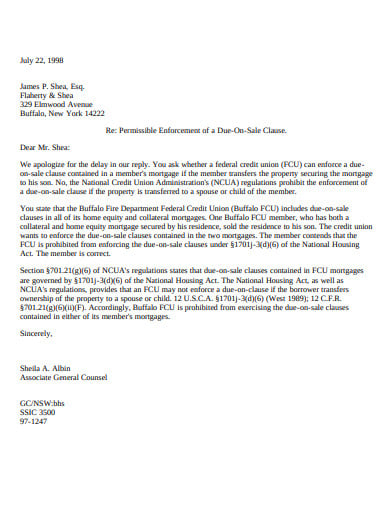

ubalt.edu5. Due on Sale Clause Letter Template

ncua.gov

ncua.gov6. Due on Sale Clause Form Template

micasitaescrow.com

micasitaescrow.com7. Simple Due on Sale Clause Template

ali-aba.org

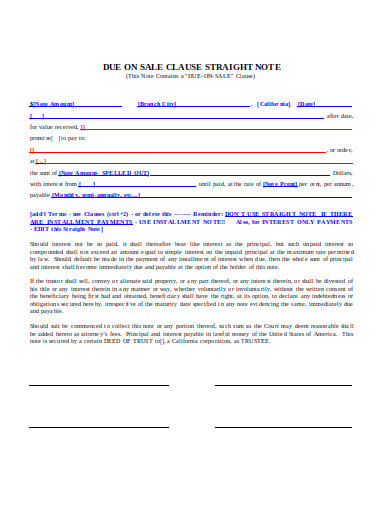

ali-aba.org8. Due on Sale Clause Straight Note Template

wfgnationaltitle.com

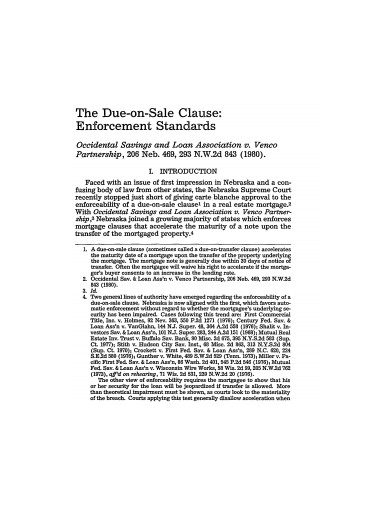

wfgnationaltitle.com9. Standard Due on Sale Clause Template

unl.edu

unl.edu5 Steps How to Make Due on Sale Clause Agreement

In mortage, there is always a settled agreement between the lender and the debtor. It is important to enclose everything in the contract to have formalize loan process. There are a lot of types of loan agreement, ranging from terms, interest rates, repayment schedule to provisions or regulations between the debtor and lender. But what is needed to be incuded in the agreement is the due-on-sale clause. This is to avoid the risk of mortgage of the property and due-on-sale clause is the most common arrangement included in a contract.

Step 1: Be Definite

Any contract agreement needs to have precise details, and this includes the terms that are associated with the type of mortgage or loan the debtor applied, for example, due on sale provisions. Both parties need to understand everything, and in the event of miscommunication or legal action that might happen in the future, this serves as a proof of agreement that you can present.

Step 2: Transact With The Right People or Institution

This step applies both to lenders and debtors. For instance, if you are a lender, you have to feel secure about whom to lend your money into while getting a profitable interest rate. And as a debtor, finding a trustable company that can help you with your financial situation without having to pay more is crucial. Hence, it is essential to set qualifications and standards for this process.

Step 3: Specify Reimbursement Agreement

It is important to specify when and how is the procedure when it comes to payment and certain conditions that might happen if one failed to pay it on time. Money is the main focus of the whole agreement, so it is safe to say that everything that involves around this should be well detailed and should be agreed on to avoid misunderstanding.

Step 4: Ask for a Professional Advice

If you still have doubts about your situation and how to handle it, the safest thing that you can do is ask for professional help, for example, real estate agents or brokers, especially for those who are experts in this field. With this, it can help you lessen the probability of terrible situations to happen. And it will provide more information about what kind of mortgages you can apply and how their terms differ from each other.

Step 5: Gather Important Data

Nothing beats the power of research skills. Gathering informative data and comparing them can help you make your work easier. It can help you differentiate the one with possible situations and how to manage them. Using datasheet can help you organize these data.

There are other things that you can do to make due on sale clause agreement. Different resources are also useful when you want to have an adequate settlement that will be functional for the whole lending process. But the point is, it is to help protect and secure everyone involved. It is also essential that you know what you are getting into before you signed any agreement to dodge any misfortunate event in the future.