5+ Mortgage Buyout Agreement Templates in DOC | PDF

Agreements are a staple in business because there is security in formality and authenticity. Negotiations need to have closure through writing it down on paper with all signatures in place. The same goes for mortgage buyouts because these transactions are crucial. Property ownership is on the line, and it is not a light matter to tackle. And avoiding disputes is one of the primary reasons why documentation needs to take place to respect a person’s fundamental rights. Thus, contract agreements are the real deal for mortgage buyouts. All parties need it to be final and free from disputes, and that is why sealing the deal with ink on the dotted line is the way to go.

Agreement Template Bundle

5+ Mortgage Buyout Agreement Templates in DOC | PDF

What is a Mortgage Buyout Agreement

Buyouts deal with payments that can acquire ownership of something when someone can no longer fulfill their obligations. And mortgage buyouts follow on the same flow but about houses. An agreement form formalizes this transaction to give it legality and finality. This situation usually happens when a co-owner can longer continue with the obligation, and the other party does the buyout, which is the usual case with couples on divorce.

Buy the Share and Close the Deal

Not everybody is capable of paying their obligations. Several circumstances prevent people from fulfilling real estate property payments, such as financial incapacity or severed marital relations. That is why buyouts come as a way to secure property rights. And since rights are part of the picture, then you need formalities like an agreement, which will seal the deal. Concerned parties should respect the decisions they made and should make it known to the public to allow the oversight of authorized third parties. The state with the law will help in securing the bargain as agreements need to follow legal principles. So when a particular property is on the buyout list, make sure that a purchase needs ink to seal.

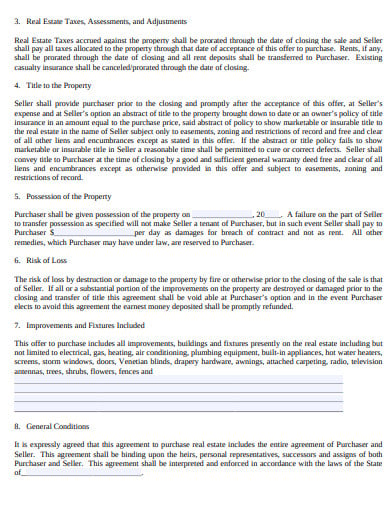

1. Agreement for Mortgage Purchase Real Estate

cmich.edu

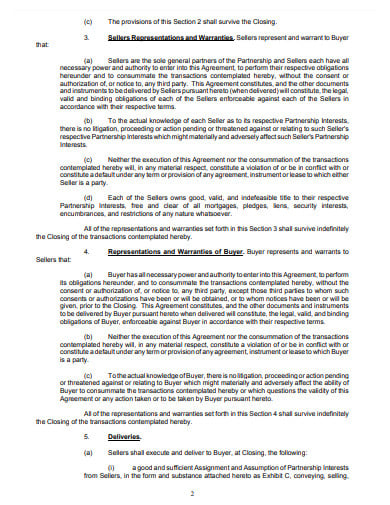

cmich.edu2. Mortgage Partnership Buyout Agreement

sec.gov

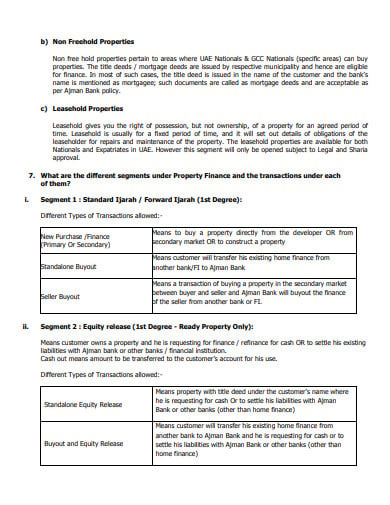

sec.gov3. Mortgage Buyout Agreement Template

ajmanbank.ae

ajmanbank.ae4. Mortgage Buyout Agreement Template in PDF

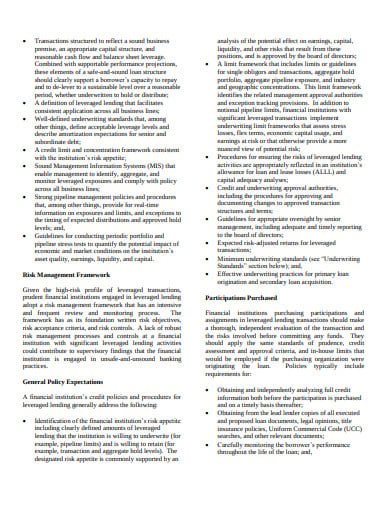

fdic.gov

fdic.gov5. Mortgage Voluntary Buyout Agreement Template

csd.harriscountytx.gov

csd.harriscountytx.gov6. Sample Mortgage Buyout Agreement Template

occ.gov

occ.gov6 Steps How to Create a Mortgage Buyout Agreement

Buyouts are one way to acquire property, especially when somebody cannot anymore meet their obligations. Sometimes you course the transaction through settlement agreements or sale contract transfers. Deals like these need formalities to assert authenticity; thus, follow the simple list below to start making the necessary documents for it.

Step 1: Determine the Equity

Buyouts can never be without payments; thus, determining the figures to settle in this arrangement is crucial. You have to know the costs for both assets and liabilities, especially for the concerned property. Also, include the debt as a liability. Any statement sheet that can offer this valuable information is useful. And a simple asset minus liabilities will do the job.

Step 2: Ask Legal Help

Whether it is a commercial property purchase or a partner agreement, seeking help from legal personnel is vital. Not only that you need the advice, but also you need your arrangement within the bounds of the law. Keeping the transactions under legal wings secures your agreement. So pop up a business card of a legal firm you know.

Step 3: Sit Down and Talk

Agreements need to be a result of actual communication. Thus, take the time to meet concerned parties under one roof. Allow the negotiations to happen and try to furnish a favorable situation for all parties. Plus, giving time for dialogue will make the agreement undergo due process.

Step 4: Use Clear Statements

Clear and vivid statements are a caveat in any document because accuracy and clarity make any form authentic. You need to accurately jot down the results of the negotiation in the paper. Avoid vague statements that will further question the document’s validity. Moreover, avoid confusion at all costs by keeping the contents understandable.

Step 5: Organize

Mortgage payment documents need organization so that it will be an easy read for all parties. Moreover, you do not want to jumble the contents that will surely place the document’s authenticity at stake. So better make sure that statements and data neat stack in a coherent flow.

Step 6: Make Room for Signatures

Signatures are essential as they are proofs of mutual understanding. Your agreement documents are similar to your legal contracts, i.e., there has to be evidence of consent. Plus, when one signs on the dotted line, it shows one takes upon oneself the duty to fulfill obligations.

Settle any deal with a document to have finality, especially mortgage buyouts. Make every transaction smooth sailing and spotless without a doubt so that any deal is good as done.