Table of Contents

- What Is a Blanket Mortgage?

- Blanket Mortgage Advantages

- 5+ Blanket Mortgage Templates | PDF

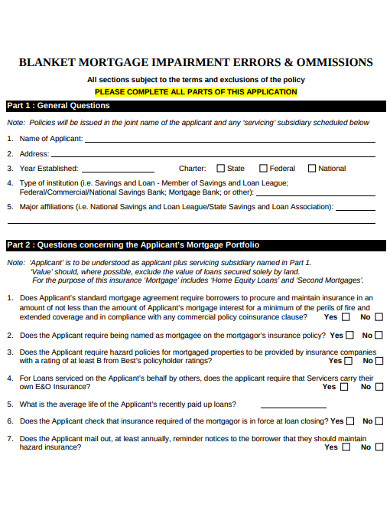

- 1. Impairment Blanket Mortgage

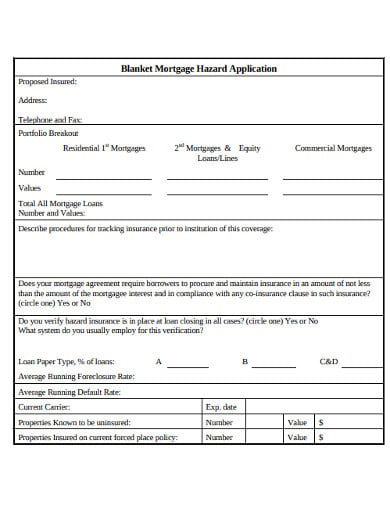

- 2. Blanket Mortgage Hazard

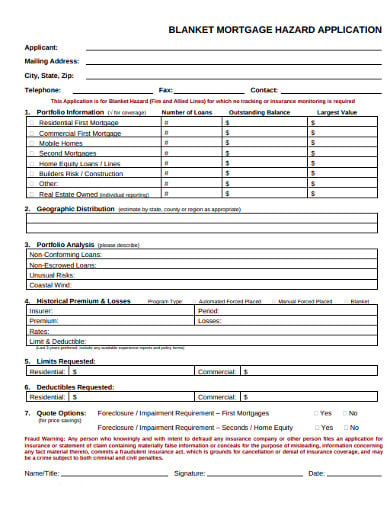

- 3. Application Blanket mortgage

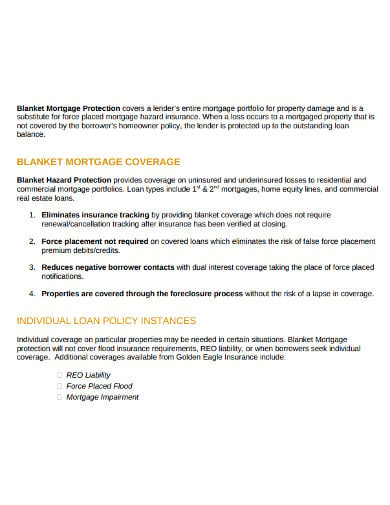

- 4. Blanket mortgage Coverage Template

- 5. Blanket mortgage Residential Template

- 6. Blanket mortgage Tax Credit

- 5 Steps in Making a Blanket Mortgage Letter

5+ Blanket Mortgage Templates | PDF

Have you experienced situations where buying items in bundles will give you more savings than purchasing those individually? For example, you compare the price of one box of chocolate bars to buying every chocolate bar. Indeed, there are chances for products to cost less when you buy in bulk compared to individual purchases. When you apply such a scenario to mortgage loans, you can also experience savings by gathering your numerous loans into one big loan called blanket mortgage. People who invest in many commercial buildings and rental properties take more than two loans for funding, and blanket mortgage for multiple properties is a great solution.

What Is a Blanket Mortgage?

A blanket mortgage helps you compile all your loans into a single loan. Expect blanket mortgage to let you buy many properties, particularly in real estate. Processing for one mortgage already takes many steps by observing a good credit score, completing requirements, sending your loan application, waiting for an approval letter, and more. Imagine doing the same processes for more properties. With a compiled version, thanks to a blanket mortgage note template, it is more convenient because payments get grouped into one set.

Blanket Mortgage Advantages

You might have doubts in considering this loan because a bundled loan can give cost savings but you also pay a big amount in financing that one set. You focus at the many advantages the loan offers. The most notable advantage is to save on interest rate. Combining loans will grant you interest savings so you expect a big difference from blanket to the regular mortgage. Good news will come to financial plans too because greater capital is possible. You also earn an advantage towards negotiating for spending less on the total amount of mortgage because many bundled loans are negotiable. You only communicate properly with the lender upon negotiating. Lastly, this loan isn’t simply limited to commercial establishments only because residential mortgage and other loan programs get accepted too.

5+ Blanket Mortgage Templates | PDF

1. Impairment Blanket Mortgage

jtmillercompany.com

jtmillercompany.com2. Blanket Mortgage Hazard

inbankersins.com

inbankersins.com3. Application Blanket mortgage

lendersrisk.com

lendersrisk.com4. Blanket mortgage Coverage Template

hubspot.net

hubspot.net5. Blanket mortgage Residential Template

scotsmanguide.com

scotsmanguide.com6. Blanket mortgage Tax Credit

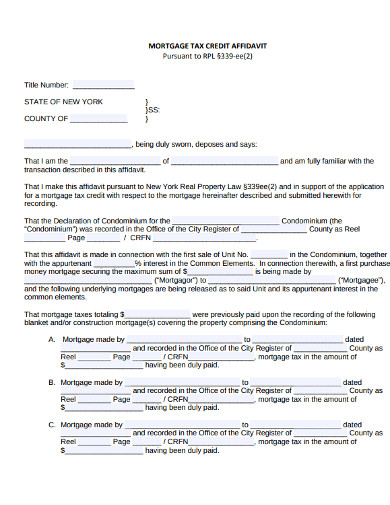

gamericantitle.com

gamericantitle.com5 Steps in Making a Blanket Mortgage Letter

A letter that contains the important details about blanket loans is essential to make, especially for lenders that are about to approve the request of borrowers to loan. You need to observe considerations in forming that letter though because maybe you made a lot of mistakes there. Sending out wrong information to borrowers will only create chaos. Not to worry because it isn’t that difficult to come up with an acceptable blanket mortgage form. You recognize easy and significant steps while using formats you can choose in PDF, Google Docs, Pages, and many more.

Step 1: Set Up the Framework

Planning a framework means you structure what should be presented first in the letter until the body follows with the right close at the end. You generally place an introduction or definition of terms at first before providing the main content. When you personalize the letter, greetings will be necessary to set a friendly tone. The key is to draft what you want to say first until you organize the whole idea by sequencing what to present. Expect an organized result after arranging accordingly.

Step 2: Be Transparent

Lenders become trustworthy to borrowers by providing clear instructions or information and by not hiding the truth about the mortgage. Maybe the content of the letter wasn’t specified. The document should tackle on accurate blanket loan rates, insurance, conditions, and more. When you don’t provide the full info, it will only invite more questions from the borrower. However, it doesn’t mean you will write a lot because there could be wordy sentences that can be simplified to summarize.

Step 3: Don’t Be Too Technical

You probably use very technical and complex words when there are more natural ways to do it. These letters aren’t like detailed technical reports because mortgage lenders should make the borrowers or the public understand easily. Indeed, it sounds fancy to use complicated terms but not on the part of some borrowers who like to understand things in simpler terms. Keeping it brief is enough anyway if the message gets delivered quickly.

Step 4: Provide Correct Details about the Mortgagor

Precision should stay high when you talk about mortgagors because they might find it offensive that you misspell their names, or there are inaccuracies and errors to the pricing or related data. Confusion arises when details about borrowers do not match from the document. You remain careful about anything to input, so no complaint occurs. Lenders are supposed to know their borrowers first through research, interviews, and analysis anyway to avoid causing mistakes.

Step 5: Add Tables and Blanks

Letters that tackle on a mortgage can have tables to give visuals on the presented data. The visuals usually have subcategories to signify information about borrowers and the blanket mortgage details. Leaving spaces for blanks is also required because there are times certain information must be written down. Adding blanks is more useful when you use that same format for other borrowers. Thus, you only jot down the different information while retaining the rest of the details for more applications.

While blanket mortgage grants excellent savings on a lot of loans, there are also considerable responsibilities to consider here too. Borrowers shouldn’t merely take this without being ready for the duties. There could be a problem on one property, and it could affect the whole loan. For lenders, it helps not to trust randomly because some mortgagors could be irresponsible to manage on the payments timely. Observing standards is expected among lenders anyway. As mortgagees and mortgagors agree on terms properly, there would hardly be an issue to expect. Building trust is part of this business, so both parties turn beneficial.