12 Paycheck Stub Templates in Excel

Employees need to work in order for them to earn their salaries to live their day-to-day lives. However, they also need to learn just how much they earn and why they’re getting the amount of money that they receive. They need some form of document which lays out the details regarding their salary.

This is exactly why there are paycheck stubs to give them all the information they need. With a paycheck stub, employees are able to know how much their employer should be paying them, as well as help them out during certain situations where they feel there are errors in their slips templates. Paycheck stub is important for employers to calculate the payment of an employee

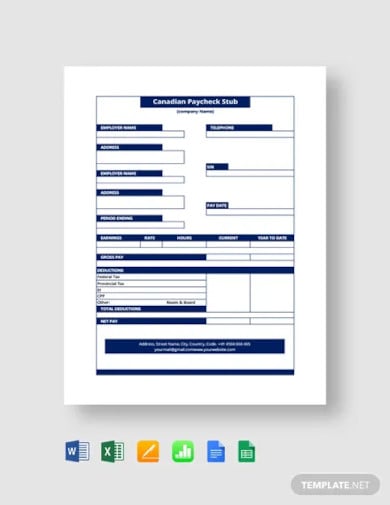

Free Canadian Check Pay Stub Template

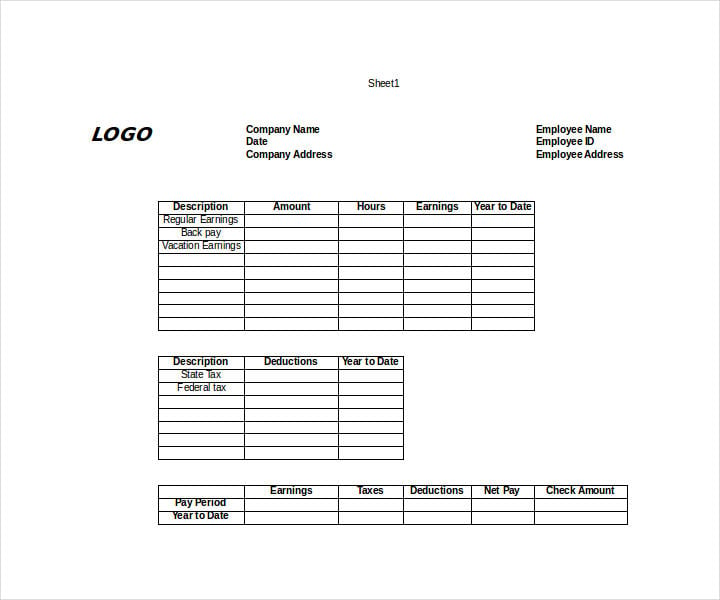

Free Pay Check Pay Stub Template

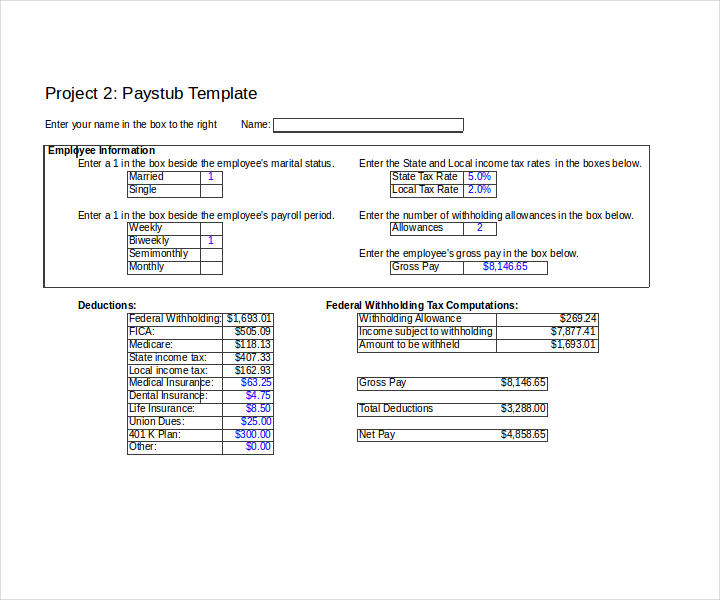

Employee Paystub Template

prenhall.com

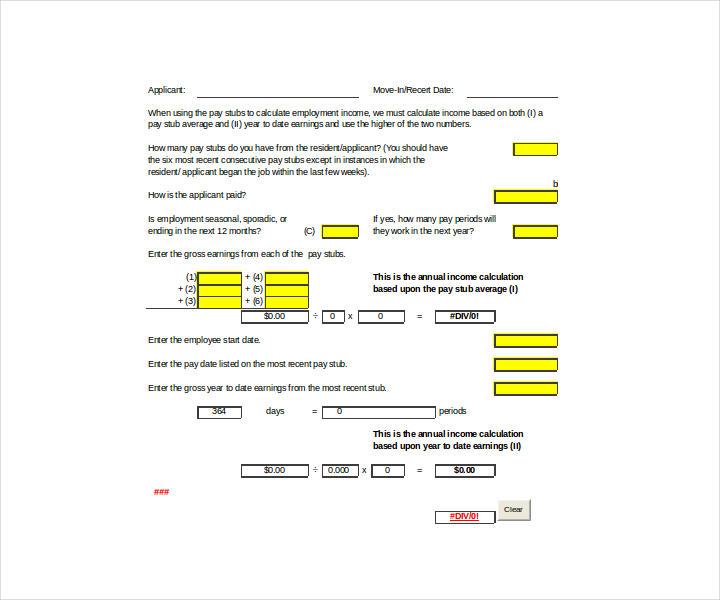

Pay Stub Worksheet Template

themichaelsorg.com

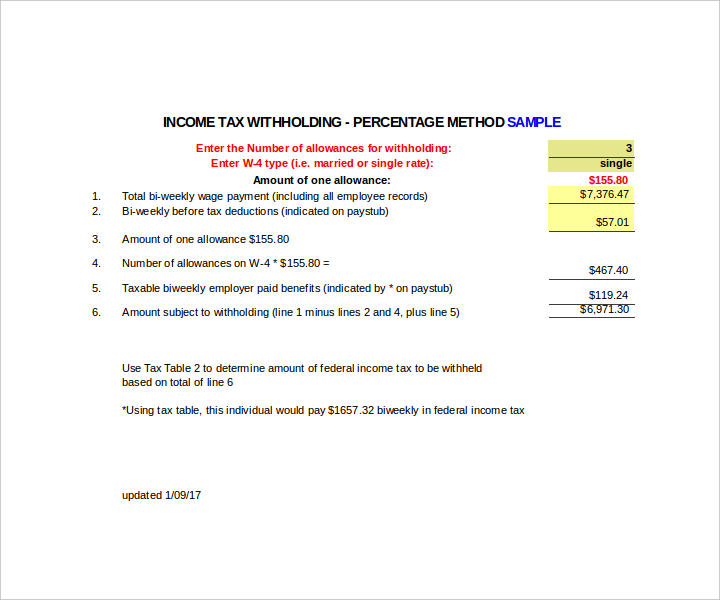

Payroll Tax Sample

ch13ut.org

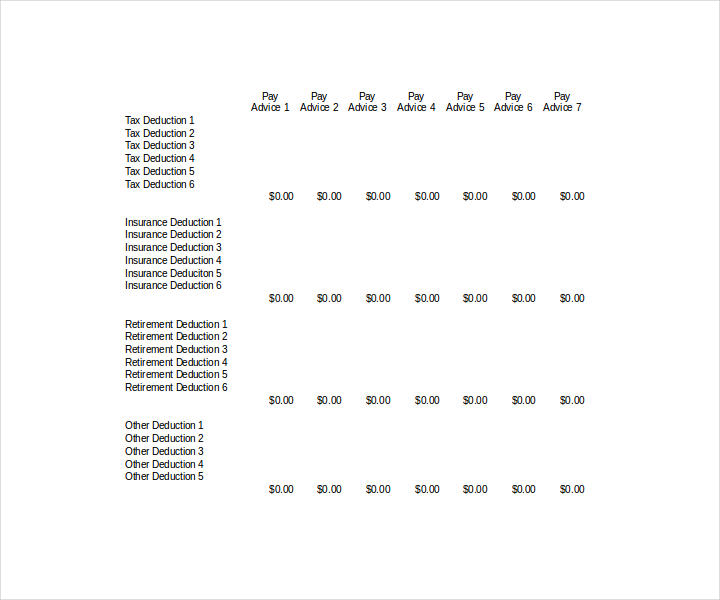

Basic Payroll Stub Template

medinfo.ufl.edu

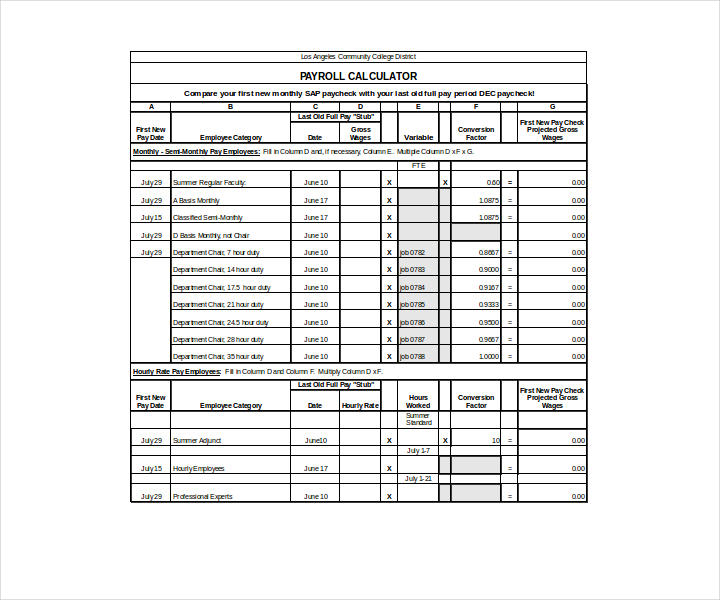

Employee Payroll Sample

laccd.edu

Simple PayStub Format

freetemplatedownloads.net

Creating pay stubs with Excel

A successful business owner knows how to take care of his or her employees. One of the best ways to do this is to provide the employees with simply customized pay stubs. Pay stubs will be required by employees in the event that they would like to apply for a loan, prove their employment, or even track the number of hours that they have been working. Employers must know that it’s not the most cost-effective thing to hire a strategic payroll company to run your human resources department. This is why you can use Microsoft Excel to track your bookkeeping and create pay stubs in the Excel format.

So if you already have the software installed on your computer, then it will make things a lot easier for you. You can make the pay stubs you want by using the generator and the templates that already come with Excel. However, you have to remember that there may be a few differences depending on the version of Windows or Microsoft Office that you are using. So if you plan on making these stubs, then here are the following steps that should help you out:

- The first thing that you are going to have to do is locate Excel and open it up on your computer. Locate the icon and double-click to open it. Once you do, the Excel program should open up on your desktop. The Excel icon can usually be found on your desktop, but you may have to do a quick search for it if it’s not.

- The next step would be after Excel opens. After it opens, you will immediately see a search page and since you’re going to be using Excel to create your pay stubs, you can type in something like “blank pay stub template” to find what you’re looking for. Once you do, the payroll calculator with the pay stub template will pop up for you to click on and use.

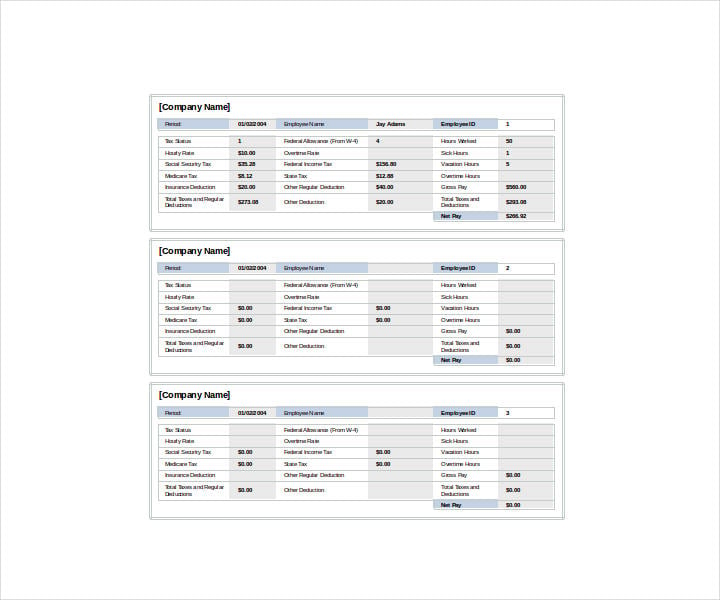

- Step three would be for you to input employee information into the pay stub. The pay stub template consists of three pages. The first contains the information of the employee. Once you open up the template, there will be a chart that’s already designed for you to input the name of the employee, the employee’s hourly wage, and tax information. The number of total columns will generate on their own.

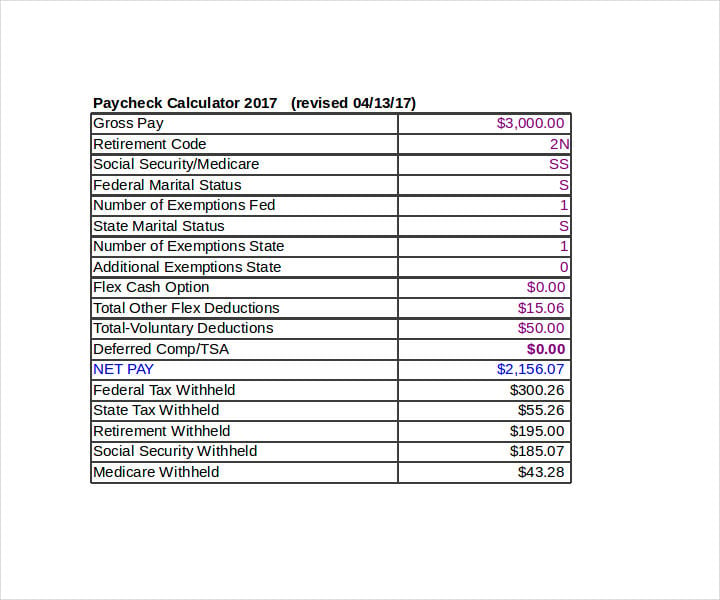

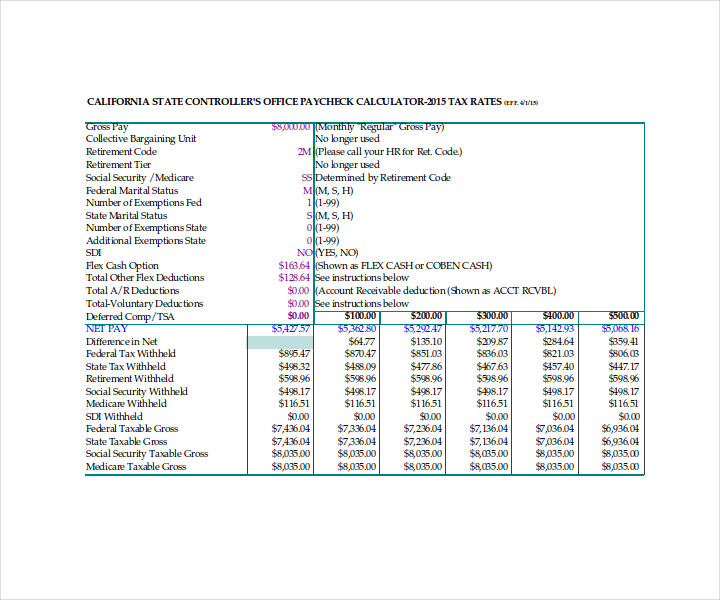

- Step four would involve the payroll template. Before you can create pay stubs for your employees, Microsoft Excel will calculate the employee’s gross and net pay. There is a payroll calculator page on the program where you are going to have to input the number of hours that the employee has worked, the number of hours the employee has rendered as overtime, and the number of times the employee has filed for sick leave. You will need to type in the overtime pay rate. And if you have already provided the tax rates and hourly wage, the calculator will automatically make use of these figures.

- The last step would be for you to create the pay stub with Microsoft Excel. Now that you have done all that, you’re ready to generate as many pay stubs as you please. When you open the third page in the spreadsheet template, you’ll be able to see that the previous blank pay stubs template has already been automatically filled in. Every employee should have their own individual pay stub. You can add in your company information on top of the pay stub and insert any graphics you desire before you start saving and printing them out.

And that’s it. Those are the steps that will help you create your business’ pay stubs. Since these pay stub templates can be easily customized, they can just about meet every business owner’s needs. So if you’re looking for the most cost-effective way to create pay stubs, then you’ll find that making them through Excel is one of the easiest ways to do it.