Free Moving Abroad Financial Checklist

Prepared by:[Your Name]

Address: [Your Relocation Address]

Relocation Date: [Date]

Moving abroad is an exciting adventure, but it comes with its own set of financial considerations. By following this financial checklist, you can better prepare yourself for a successful and financially stable move abroad. Research thoroughly, seek professional advice when necessary, and plan to minimize any financial surprises.

Budgeting: Start by creating a detailed budget outlining your anticipated expenses in your new country. Consider cost of living differences, taxes, housing, healthcare, transportation, and other essentials.

Currency Exchange: Research the exchange rate between your current currency and the currency of your destination country.

Banking: Open a bank account in your destination country before your move, if possible. Research banking options, including fees for international transactions and ATM withdrawals.

Taxes: Understand your tax obligations both in your home country and in your new country of residence. Consider consulting with a tax advisor to ensure compliance with tax laws in both jurisdictions.

Insurance: Evaluate your insurance needs, including health insurance, travel insurance, and coverage for your belongings during the move.

Pension and Retirement Accounts: Determine how moving abroad will affect your pension or retirement accounts.

Income Sources: Explore potential sources of income in your new country, such as employment opportunities, freelancing, or remote work.

Education and Childcare Costs: If you have children, research education options and associated costs in your destination country. Budget for school fees, uniforms, transportation, and other expenses.

Emergency Fund: Build or replenish your emergency fund to cover unexpected expenses that may arise during the transition period or after your move.

Legal and Immigration Fees: Budget for any legal or immigration fees associated with obtaining visas, residency permits, or citizenship in your new country.

Settling-in Costs: Allocate funds for initial settling-in costs, such as rental deposits, utility deposits, furniture, and household items.

Savings Goals: Set realistic savings goals for short-term and long-term financial objectives in your new country.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Embark on your international move with confidence using the Moving Abroad Financial Checklist Template from Template.net. This comprehensive, editable tool ensures you cover all financial aspects, from budgeting to currency exchange. Secure your financial peace of mind as you transition to a new country. Download now for a stress-free move abroad.

You may also like

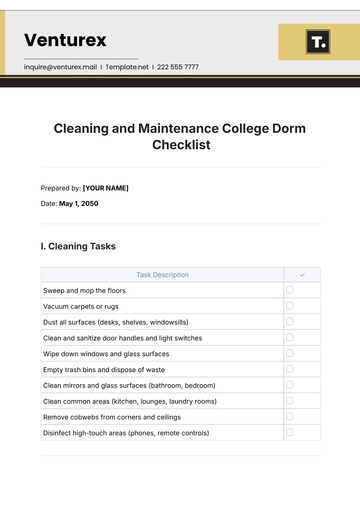

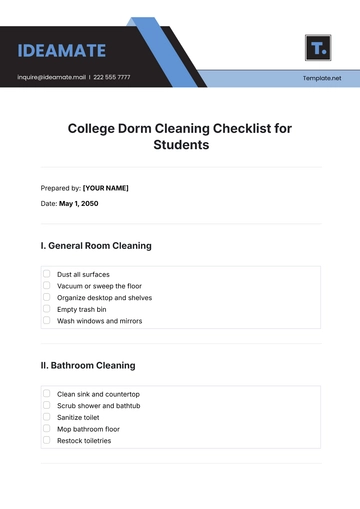

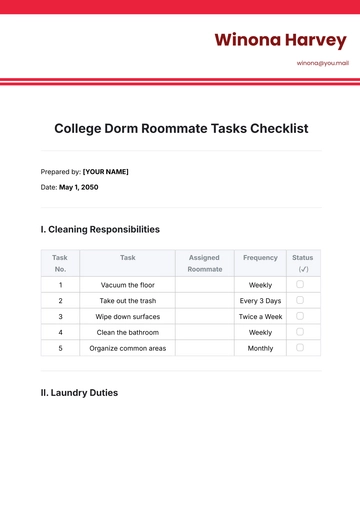

- Cleaning Checklist

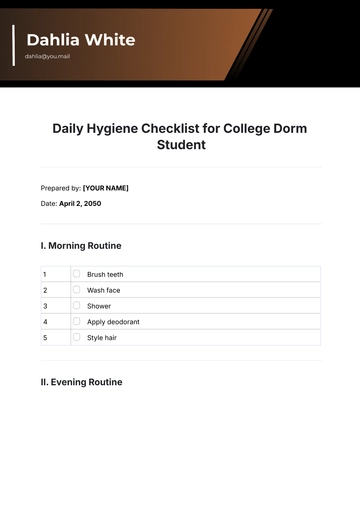

- Daily Checklist

- Travel Checklist

- Self Care Checklist

- Risk Assessment Checklist

- Onboarding Checklist

- Quality Checklist

- Compliance Checklist

- Audit Checklist

- Registry Checklist

- HR Checklist

- Restaurant Checklist

- Checklist Layout

- Creative Checklist

- Sales Checklist

- Construction Checklist

- Task Checklist

- Professional Checklist

- Hotel Checklist

- Employee Checklist

- Moving Checklist

- Marketing Checklist

- Accounting Checklist

- Camping Checklist

- Packing Checklist

- Real Estate Checklist

- Cleaning Checklist Service

- New Employee Checklist

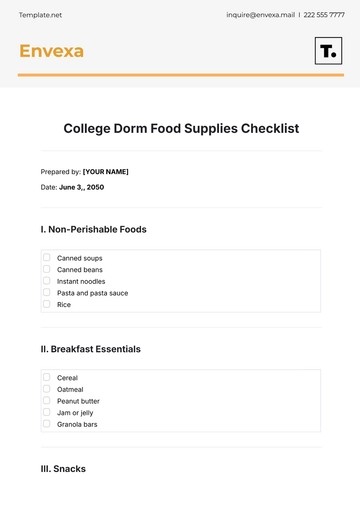

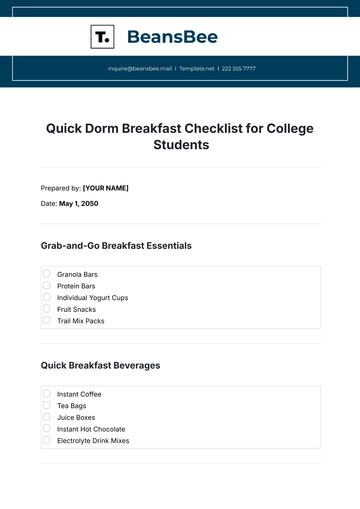

- Food Checklist

- Home Inspection Checklist

- Advertising Checklist

- Event Checklist

- SEO Checklist

- Assessment Checklist

- Inspection Checklist

- Baby Registry Checklist

- Induction Checklist

- Employee Training Checklist

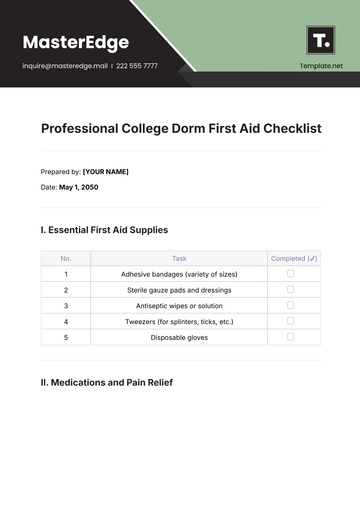

- Medical Checklist

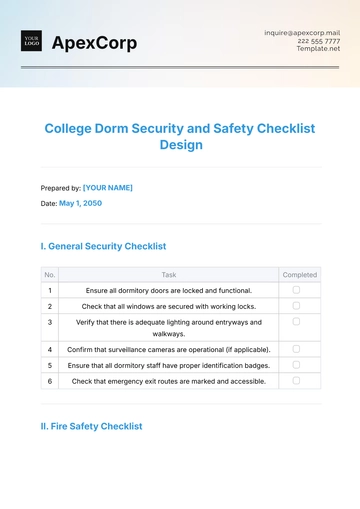

- Safety Checklist

- Site Checklist

- Job Checklist

- Service Checklist

- Nanny Checklist

- Building Checklist

- Work Checklist

- Office Checklist

- Training Checklist

- Website Checklist

- IT and Software Checklist

- Performance Checklist

- Project Checklist

- Startup Checklist

- Education Checklist

- Home Checklist

- School Checklist

- Maintenance Checklist

- Planning Checklist

- Manager Checklist

- Wedding Checklist

- Vehicle Checklist

- Travel Agency Checklist

- Vehicle Inspection Checklist

- Interior Design Checklist

- Backpacking Checklist

- Business Checklist

- Legal Checklist

- Nursing Home Checklist

- Weekly Checklist

- Recruitment Checklist

- Salon Checklist

- Baby Checklist

- Equipment Checklist

- Trade Show Checklist

- Party Checklist

- Hospital Bag Checklist

- Evaluation Checklist

- Agency Checklist

- First Apartment Checklist

- Hiring Checklist

- Opening Checklist

- Small Business Checklist

- Rental Checklist

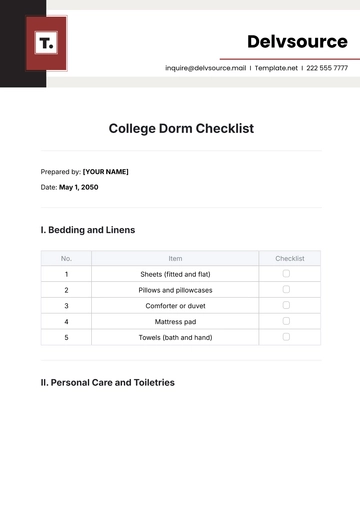

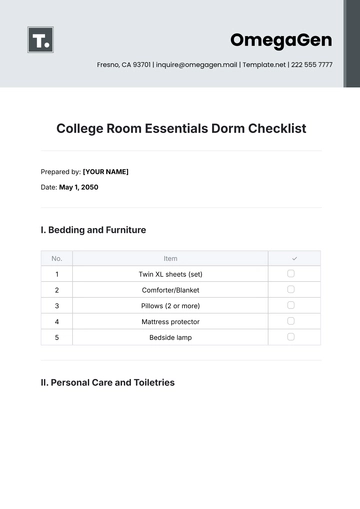

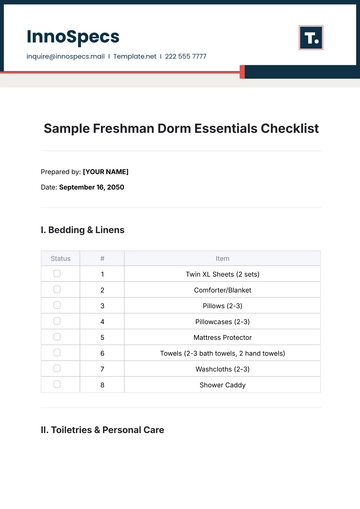

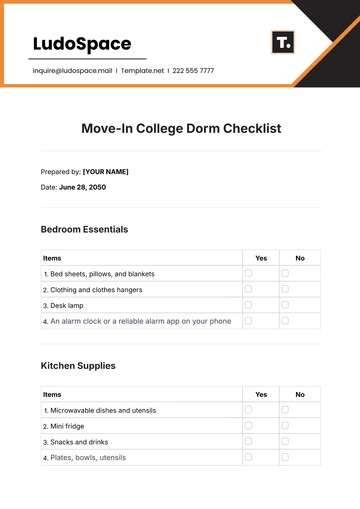

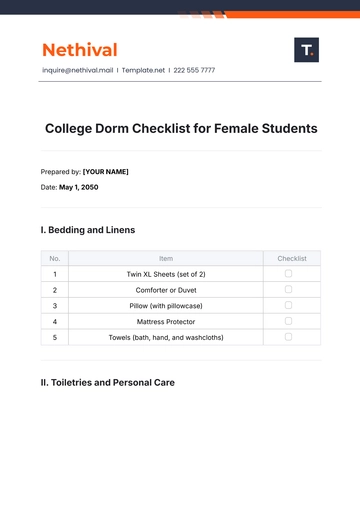

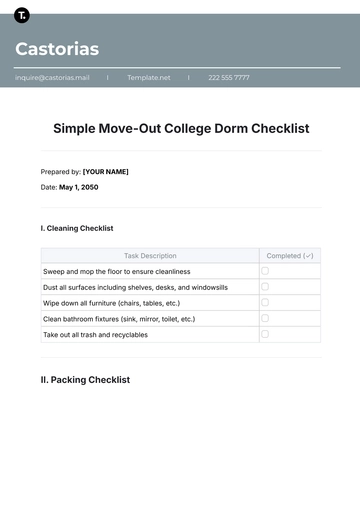

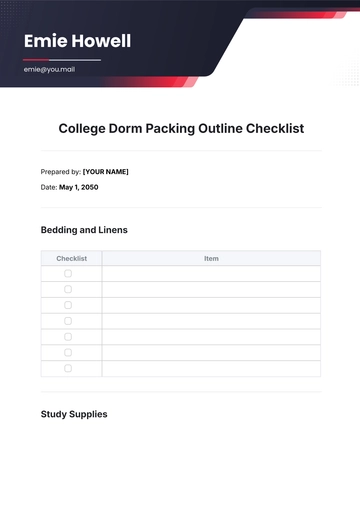

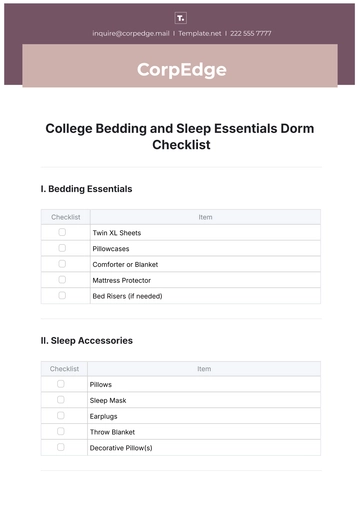

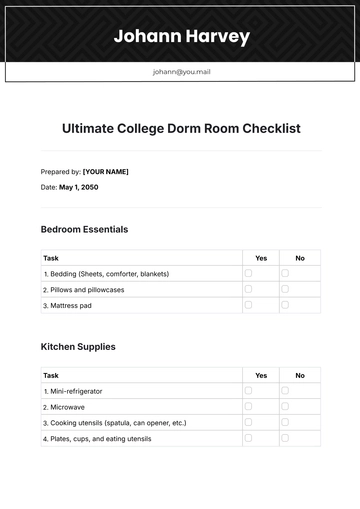

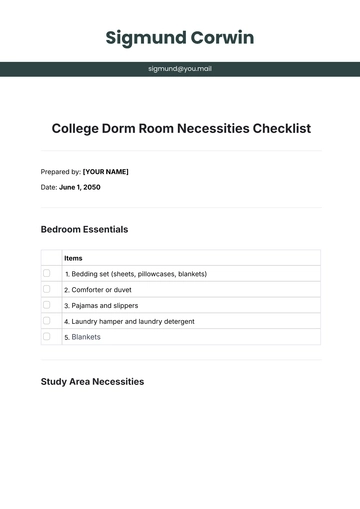

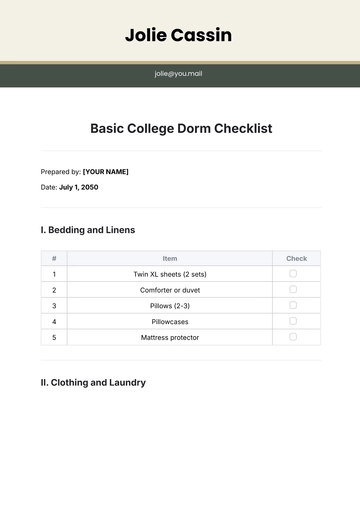

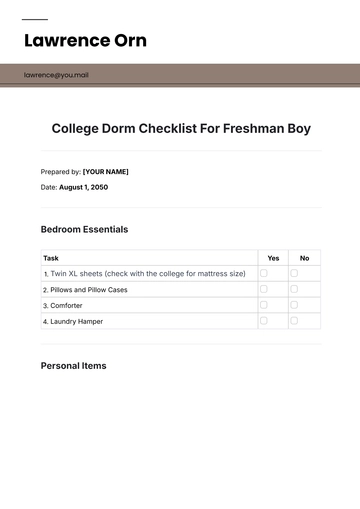

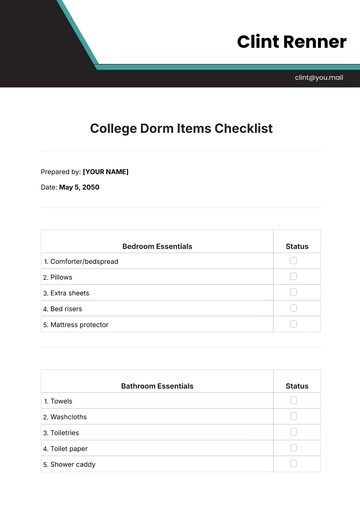

- College Dorm Checklist

- New Puppy Checklist

- University Checklist

- Building Maintenance Checklist

- Work From Home Checklist

- Student Checklist

- Application Checklist