Free Finance Audit Evidence Slip

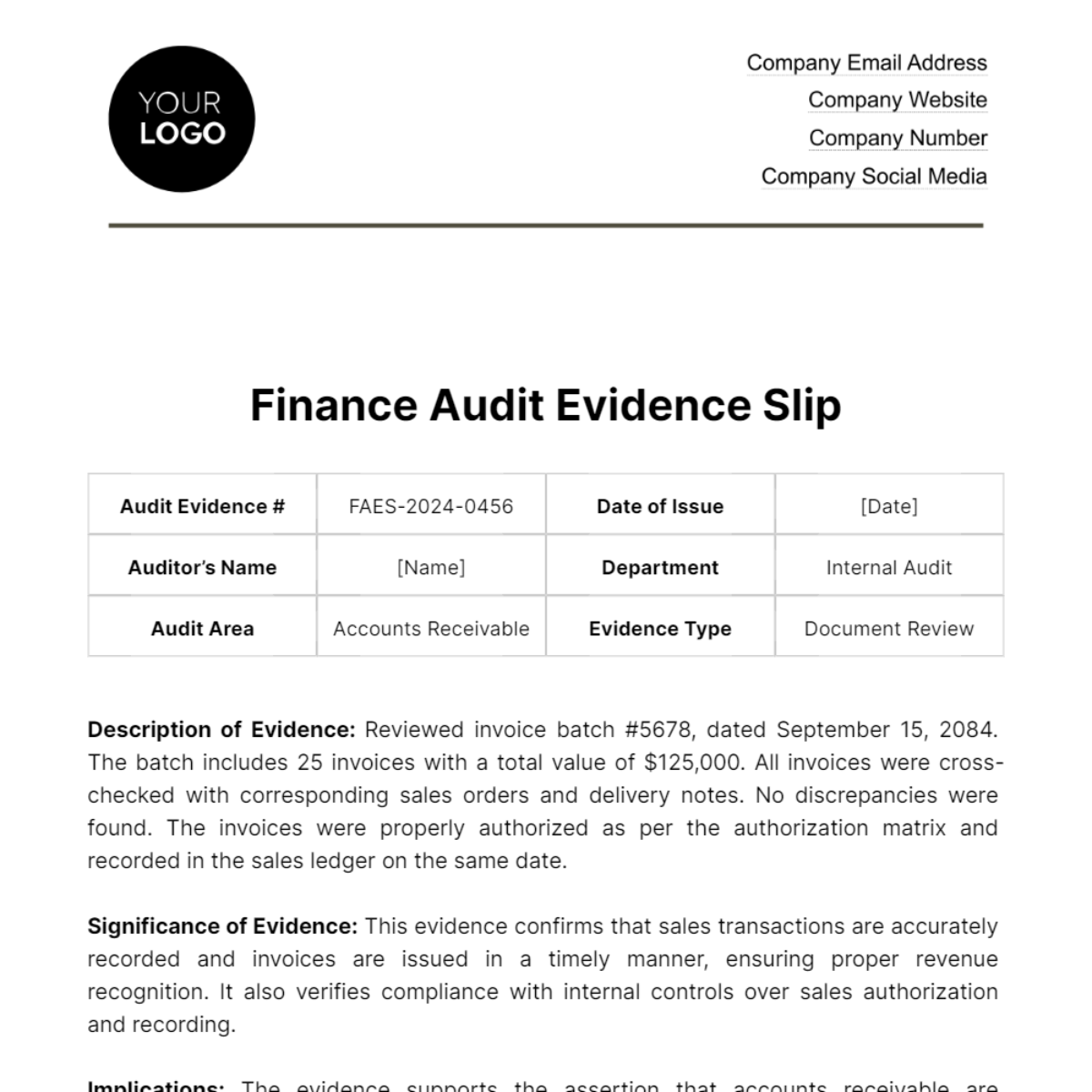

Audit Evidence # | FAES-2024-0456 | Date of Issue | [Date] |

Auditor’s Name | [Name] | Department | Internal Audit |

Audit Area | Accounts Receivable | Evidence Type | Document Review |

Description of Evidence: Reviewed invoice batch #5678, dated September 15, 2084. The batch includes 25 invoices with a total value of $125,000. All invoices were cross-checked with corresponding sales orders and delivery notes. No discrepancies were found. The invoices were properly authorized as per the authorization matrix and recorded in the sales ledger on the same date.

Significance of Evidence: This evidence confirms that sales transactions are accurately recorded and invoices are issued in a timely manner, ensuring proper revenue recognition. It also verifies compliance with internal controls over sales authorization and recording.

Implications: The evidence supports the assertion that accounts receivable are accurately stated in the financial statements as of September 30, 2084. It indicates strong internal control procedures in the sales and invoicing process.

Auditor's Remarks: The reviewed transactions align with our financial policies and standards. The efficient and error-free processing of these transactions demonstrates the effectiveness of our current controls in the area of sales and accounts receivable.

Follow-Up Actions: None required at this stage. Routine monitoring of transactions and periodic audits are recommended to maintain control effectiveness.

Auditor's Signature

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore the Finance Audit Evidence Slip Template at Template.net, an indispensable tool for auditors and financial professionals. Fully editable and customizable in our AI Editor tool, this template simplifies the process of recording and organizing audit evidence. It ensures accuracy and thoroughness in financial audits, making the documentation process more efficient and reliable. Tailor it to your specific audit needs.