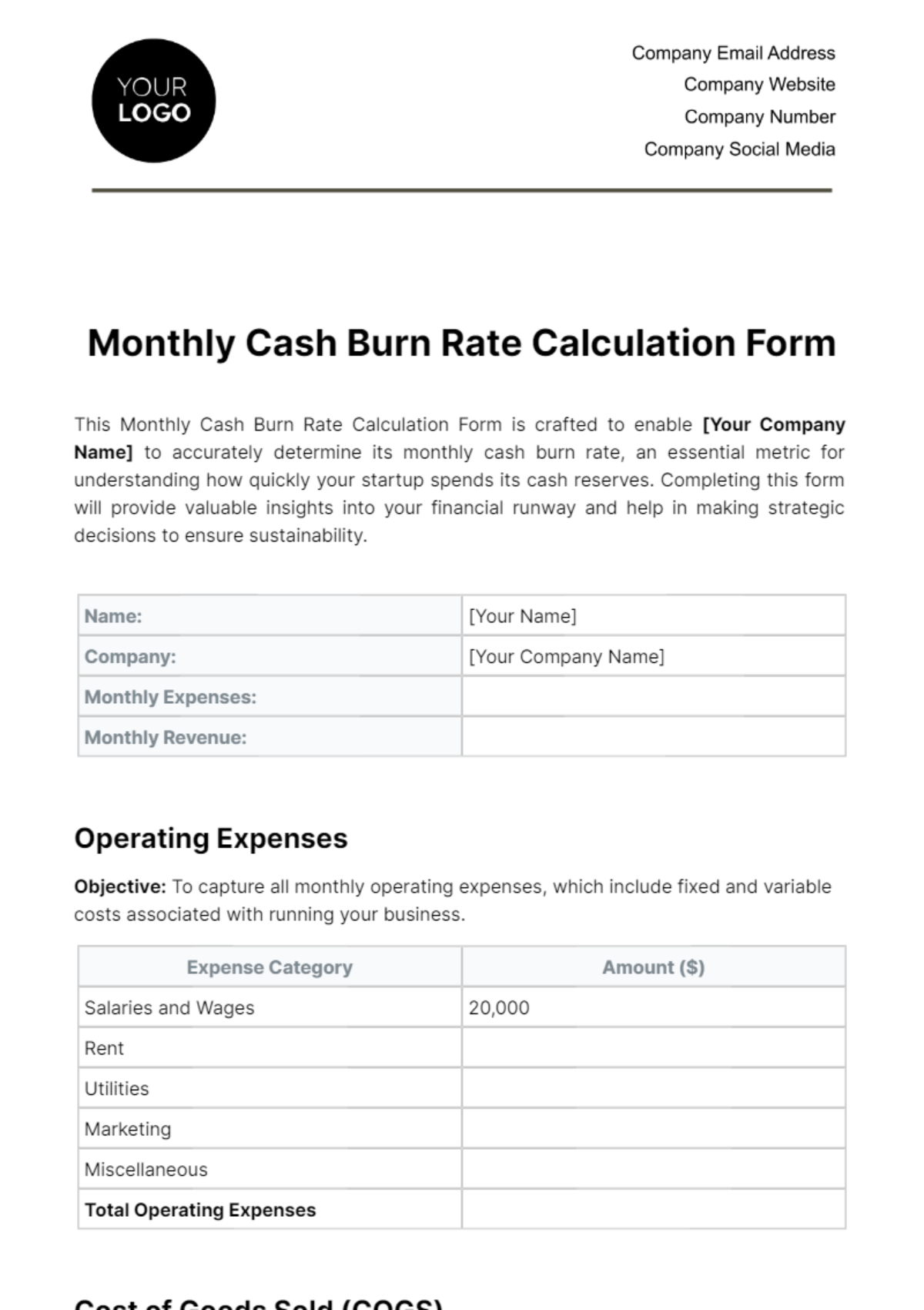

Free Monthly Cash Burn Rate Calculation Form

This Monthly Cash Burn Rate Calculation Form is crafted to enable [Your Company Name] to accurately determine its monthly cash burn rate, an essential metric for understanding how quickly your startup spends its cash reserves. Completing this form will provide valuable insights into your financial runway and help in making strategic decisions to ensure sustainability.

Name: | [Your Name] |

|---|---|

Company: | [Your Company Name] |

Monthly Expenses: | |

Monthly Revenue: |

Operating Expenses

Objective: To capture all monthly operating expenses, which include fixed and variable costs associated with running your business.

Expense Category | Amount ($) |

|---|---|

Salaries and Wages | 20,000 |

Rent | |

Utilities | |

Marketing | |

Miscellaneous | |

Total Operating Expenses |

Cost of Goods Sold (COGS)

Objective: To document the direct costs attributable to the production of the goods sold by your company.

Item | Amount ($) |

|---|---|

Raw Materials | 5,000 |

Direct Labor | |

Manufacturing Overheads | |

Total COGS |

Capital Expenditures

Objective: To list outlays for assets that improve your business's future benefits, not accounted for in monthly operating expenses.

Asset Purchase | Amount ($) |

|---|---|

Equipment | 10,000 |

Software | |

Total Capital Expenditures |

Revenue

Objective: To record all sources of income within the month, providing a counterbalance to the expenditures.

Revenue Source | Amount ($) |

|---|---|

Product Sales | 30,000 |

Service Fees | |

Total Revenue |

Cash Burn Rate Calculation

Objective: To compute the monthly cash burn rate by considering the total expenditures against total revenue.

Description | Amount ($) |

|---|---|

Total Monthly Expenditures (Operating Expenses + COGS + Capital Expenditures) | 58,500 |

Total Monthly Revenue | |

Monthly Cash Burn Rate (Total Expenditures - Total Revenue) |

Instructions for Completion:

Please ensure that all figures are accurately recorded in their respective sections. The Monthly Cash Burn Rate Calculation Form is pivotal for assessing your startup's financial health and planning for future cash flow needs. Regular monitoring and updating of this form will assist in strategic financial planning and management.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Maximize your financial control with Template.net's Monthly Cash Burn Rate Calculation Form. This fully editable and customizable document template, editable in our Ai Editor Tool, empowers you to accurately manage your marketing investment. Enhance your financial forecasting, inform future planning, and drive business success. Trust in our tools to elevate your financial understanding and strategy implementation. Invest in your success today.