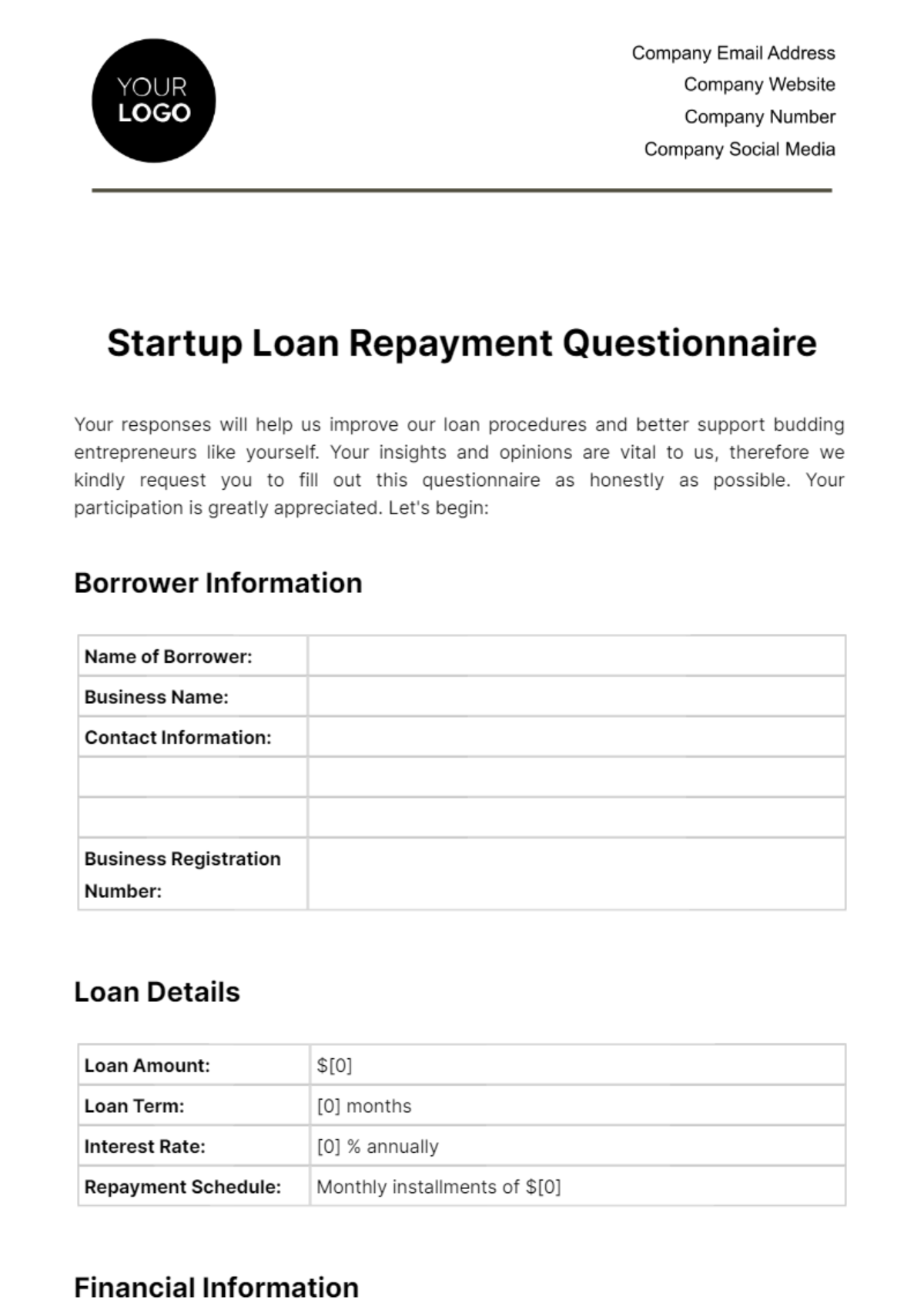

Free Startup Loan Repayment Questionnaire

Your responses will help us improve our loan procedures and better support budding entrepreneurs like yourself. Your insights and opinions are vital to us, therefore we kindly request you to fill out this questionnaire as honestly as possible. Your participation is greatly appreciated. Let's begin:

Borrower Information

Name of Borrower: | |

Business Name: | |

Contact Information: | |

Business Registration Number: |

Loan Details

Loan Amount: | $[0] |

Loan Term: | [0] months |

Interest Rate: | [0] % annually |

Repayment Schedule: | Monthly installments of $[0] |

Financial Information

Projected Annual Revenue: | $[0] |

Actual Annual Revenue: | $[0] |

Profit/Loss Statement: | Available upon request |

Cash Flow Statement: | Available upon request |

Break-even Analysis: | Breakeven point reached in October 2050 |

Use of Loan Funds

The loan funds were utilized as follows:

Purpose | Amount (USD) |

|---|---|

Purchase of Equipment | $[0] |

Hiring Staff | $[0] |

Marketing and Advertising | $[0] |

Working Capital | $[0] |

Business Progress

Milestones Achieved:

What significant milestones has the business achieved since its inception?

Can you provide details on the development and launch of your primary product or service?

Have you secured any noteworthy partnerships or contracts?

Market Validation:

How have customers responded to your products or services?

Have you received any feedback or testimonials from early adopters?

What measures have you taken to validate the demand for your offerings in the market?

Challenges Faced:

What obstacles or challenges has the business encountered during its operations?

How have you addressed or overcome these challenges?

Are there any ongoing challenges that may impact the business's growth trajectory?

Repayment Ability

Current Financial Position:

Can you provide an overview of the business's current financial position, including cash reserves and outstanding debts?

How do you plan to manage operational expenses while repaying the loan?

Are there any potential financial risks or uncertainties that could affect your ability to meet repayment obligations?

Revenue Projections:

What are your revenue projections for the next 12, 24, and 36 months?

What factors have influenced these projections, and how realistic do you consider them?

How do you plan to diversify revenue streams or increase sales to meet or exceed these projections?

Contingency Plans for Loan Repayment:

Do you have contingency plans in place to address unexpected financial challenges or disruptions?

Yes

No

How would you adjust your business strategy or operations if faced with difficulties in meeting loan repayment obligations?

Are there alternative sources of funding or financing options available to support loan repayment if needed?

Collateral:

Collateral Offered:

Are you able to provide any collateral to secure the loan?

Yes

No

If yes, please provide details on the type and estimated value of the collateral.

How does the collateral offered mitigate the lender's risk and enhance the security of the loan?

Documentation of Collateral Ownership:

Can you provide documentation or proof of ownership for the collateral being offered?

Yes

No

Have any existing liens or encumbrances been placed on the collateral?

How would the collateral be assessed and evaluated in the event of default or non-repayment?

Declaration:

I, the undersigned, do hereby put forth a declaration affirming that the information which I have provided within the confines of this Startup Loan Repayment Questionnaire holds true to the fullest extent of my personal knowledge and is accurate in its representation of the reality as I understand it.

[Respondent's Name]

[Month Day, Year]

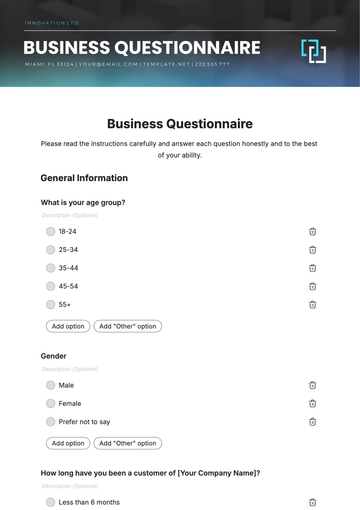

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Explore the Startup Loan Repayment Questionnaire Template on Template.net. This editable and customizable document, powered by an advanced AI Editor Tool, streamlines the loan assessment process. Crafted with precision, it empowers financial organizations to effortlessly gather comprehensive borrower information, ensuring a thorough evaluation for informed lending decisions. Elevate your loan management with this intuitive and efficient template.