Free Economic Brief

Prepared by [YOUR NAME] for [YOUR COMPANY NAME]

Executive Summary

This Economic Brief presents an integrated view of the prevailing economic conditions, highlighting key trends and challenges facing the economy. It synthesizes data on major economic indicators to offer a concise overview of the current economic health and outlines forecasts for the near future.

Overall Economic Conditions and Health

The economy has shown resilience in the face of global uncertainties, registering a steady growth rate of 2.5% over the past quarter. Consumer spending has remained robust, supported by stable employment rates and rising wages. However, inflationary pressures persist, primarily due to supply chain disruptions and energy price volatility.

Key Economic Indicators and Their Implications

GDP Growth: The sustained growth rate underscores the economy's underlying strength but also signals potential overheating risks.

Inflation: Current inflation rates, standing at 3.8%, are above the target set by the central bank, indicating pressures that may warrant tightening monetary policies.

Unemployment: The unemployment rate has stabilized at 4.2%, reflecting a healthy labor market but also highlighting areas of skill mismatches and labor shortages.

Interest Rates: Interest rates have been adjusted to 1.75%, aiming to balance inflation control with economic growth.

Forecasts and Prospective Possibilities

Looking ahead, the economy is poised for moderate growth, projected at 2.3% for the next fiscal year. Inflation is expected to gradually decline as supply chain issues are resolved and energy markets stabilize. However, geopolitical tensions and trade policy uncertainties pose downside risks to the economic outlook. Policymakers and businesses are advised to prepare for potential volatility by enhancing economic resilience and flexibility.

Current Economic Conditions

This table provides a snapshot of the growth rates across various sectors, highlighting the economic performance and trends in each area. For instance, it shows a robust expansion in the Technology sector, indicating strong innovation and demand for tech products and services.

Sector | Growth Rate (%) |

|---|---|

Manufacturing | 3.2 |

Services | 4.5 |

Construction | 2.8 |

Agriculture | 1.9 |

Retail | 3.7 |

Technology | 6.1 |

Finance | 2.5 |

Real Estate | 2.2 |

Transportation | 3.0 |

Energy | -0.5 |

Economic Trends

These trends encapsulate significant movements within the current economic environment, indicating a period of transition and adaptation.

Trend 1: Digital Transformation and Technological Innovation

Digital transformation across sectors, driven by AI, blockchain, and IoT, is transforming industries, driving efficiency, productivity, and growth. However, it also presents challenges like job displacement and workforce upskilling.

Trend 2: Shift Towards Green Economy

The shift towards sustainability and a green economy is gaining momentum, with increased investments in renewable energy, sustainable agriculture, and green technologies. This shift is reshaping consumer preferences and impacting industries like energy and real estate.

Trend 3: Global Economic Realignment and Trade Dynamics

The global economic landscape is undergoing a realignment due to shifting trade dynamics and geopolitical tensions, with countries diversifying sources and increasing domestic production capabilities to mitigate risks and improve international relations and market access.

Policy Implications

Each of these policy trends has far-reaching implications for the economy and the business environment. Expansionary monetary and fiscal policies aim to stimulate economic activity but require careful management to avoid long-term destabilizing effects. Meanwhile, the shift towards sustainability is not only a policy trend but also a business imperative, reflecting changing consumer preferences and the global acknowledgment of the need to address climate change.

Expansionary Monetary Policies

Central banks worldwide are implementing expansionary monetary policies to stimulate economic growth, including lower interest rates and quantitative easing. These policies can boost short-term economic activity but also pose risks of asset bubbles, overheating markets, and distorted market signals.

Fiscal Stimulus Measures

Governments have implemented fiscal stimulus measures to address global challenges like COVID-19, providing financial support to individuals and businesses, tax relief, and increased public spending. However, these measures may lead to increased national debt and future tax or spending reductions.Policies Focused on Sustainability and Green Economy Transition

Countries are implementing sustainability policies, such as carbon pricing and renewable energy subsidies, to transition to a green economy. This shift is reshaping industries, driving investment in green technologies, and creating new market opportunities.

Economic Forecasts

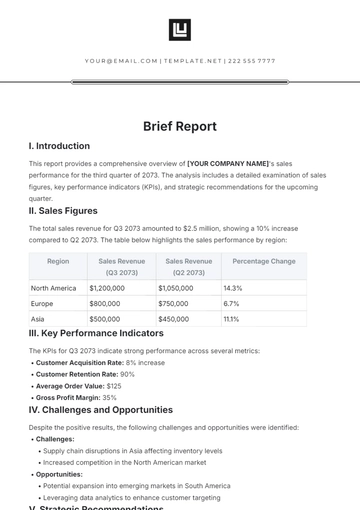

This table provides a simplistic view of economic growth projections over seven years, showcasing an economy that is expected to experience fluctuating yet generally positive growth rates.

Forecasts for Year | Growth Rate (%) |

|---|---|

2023 | 3.0 |

2024 | 3.5 |

2025 | 3.8 |

2026 | 3.2 |

2027 | 4.0 |

2028 | 3.6 |

2029 | 3.4 |

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Inform your economic strategies with Template.net's Economic Brief Template. This customizable and editable template, designed for use in our AI Editor Tool, provides a structured format for economic analysis and forecasting. Ideal for economists and financial analysts, it ensures your insights are well-documented. Navigate economic complexities with this essential template.