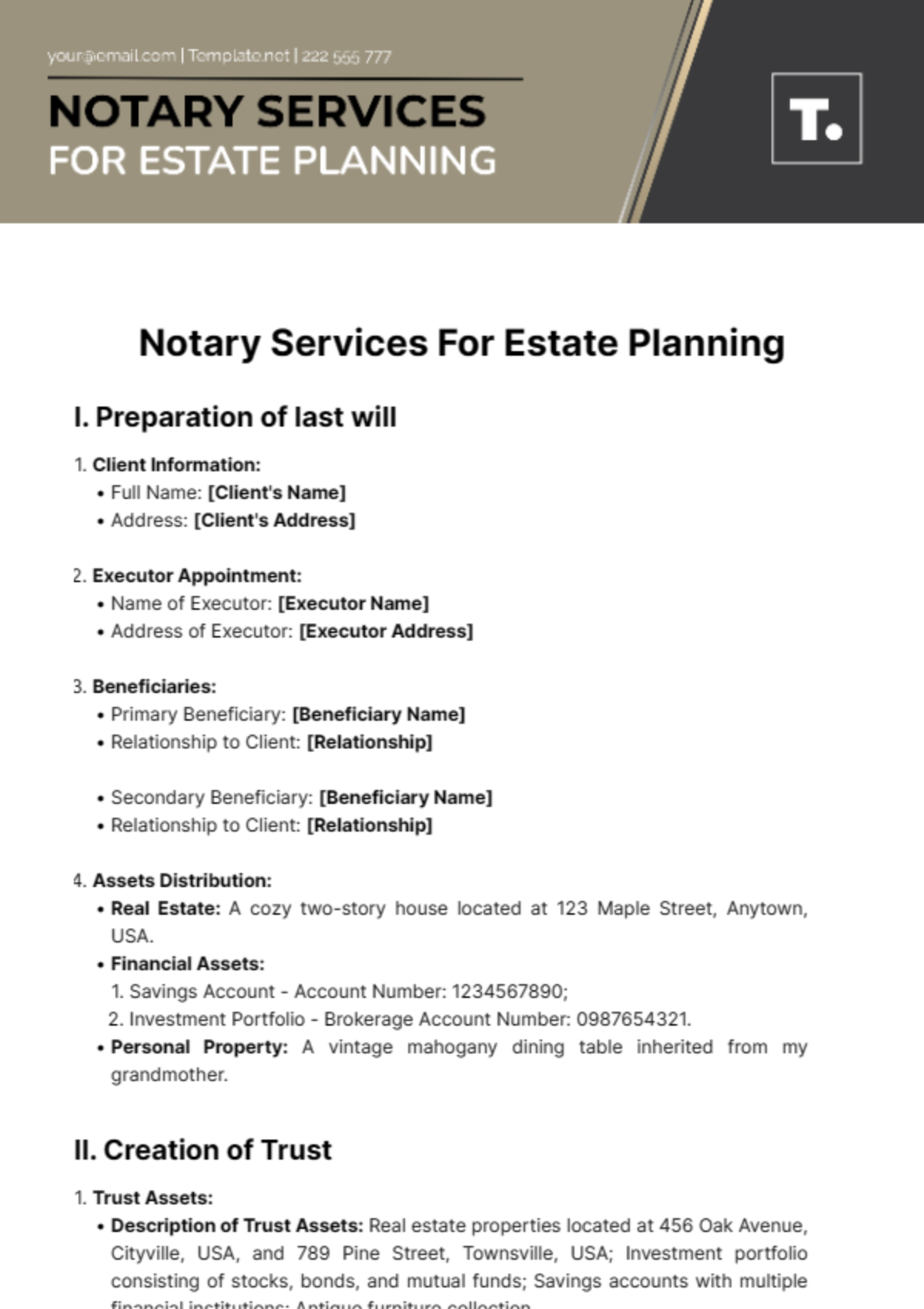

Free Notary Services For Estate Planning

I. Preparation of last will

Client Information:

Full Name: [Client's Name]

Address: [Client's Address]

Executor Appointment:

Name of Executor: [Executor Name]

Address of Executor: [Executor Address]

Beneficiaries:

Primary Beneficiary: [Beneficiary Name]

Relationship to Client: [Relationship]

Secondary Beneficiary: [Beneficiary Name]

Relationship to Client: [Relationship]

Assets Distribution:

Real Estate: A cozy two-story house located at 123 Maple Street, Anytown, USA.

Financial Assets:

Savings Account - Account Number: 1234567890;

Investment Portfolio - Brokerage Account Number: 0987654321.

Personal Property: A vintage mahogany dining table inherited from my grandmother.

II. Creation of Trust

Trust Assets:

Description of Trust Assets: Real estate properties located at 456 Oak Avenue, Cityville, USA, and 789 Pine Street, Townsville, USA; Investment portfolio consisting of stocks, bonds, and mutual funds; Savings accounts with multiple financial institutions; Antique furniture collection.

Management Instructions: Ensure regular maintenance and upkeep of the real estate properties; Diversify investment portfolio across various sectors; Monitor market trends and adjust investment strategy accordingly; Distribute interest and dividends to beneficiaries quarterly; Preserve and protect the integrity of the antique furniture collection through proper storage and occasional restoration if necessary.

Beneficiaries and Distributions:

Primary Beneficiary: [Beneficiary Name]

Relationship to Trust: [Relationship]

Secondary Beneficiary: [Beneficiary Name]

Relationship to Trust: [Relationship]

III. Power of Attorney Appointment

Agent Information:

Name of Agent: [Agent Name]

Address of Agent: [Agent Address]

Scope of Authority:

Financial Affairs:

Monthly budget allocation for necessities, savings, and discretionary spending.

Investment strategy focused on long-term growth with a diversified portfolio.

Regular review of financial statements and adjustment of investment allocations as needed.

Retirement planning, including contributions to retirement accounts and pension funds.

Emergency fund management for unexpected expenses or financial downturns.

Healthcare Decisions:

Preferred healthcare providers and medical facilities for routine check-ups and specialized treatments.

Advanced directives specifying preferences for end-of-life care and medical interventions.

Authorization for designated individuals to make healthcare decisions in case of incapacity.

Regular health screenings and preventative measures to maintain overall well-being.

Awareness of medical insurance coverage and coordination with healthcare providers for optimal care.

IV. Signature Section

Printed Name of Client: [Client's Name]

Date: [Date Signed]

Printed Name of Notary Public: [Your Name]

Date: [Date Signed]

Notary Seal (if applicable): [Seal]

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Discover the Notary Services For Estate Planning Template, exclusively on Template.net. Crafted for efficiency, this editable and customizable document simplifies the complexities of estate planning. Tailor it seamlessly to your requirements using our intuitive Ai Editor Tool. Ensure accuracy and precision in every detail, facilitating a smooth and hassle-free estate planning process. Experience convenience and sophistication with Template.net.