Free Payment Convertible Note Term Sheet

I. Introduction

[Your Company Name], herein referred to as the "Company," is offering a Payment Convertible Note to [Investor Name], herein referred to as the "Investor," on the terms and conditions set forth below. This term sheet outlines the basic terms of the proposed investment.

II. Overview of Investment

A. Amount: The Company proposes to raise a total of $1,000,000 in the form of a Payment Convertible Note from the Investor.

B. Conversion: The Payment Convertible Note shall convert into equity upon the occurrence of a Qualifying Financing Round, defined as a subsequent equity financing round in which the Company raises at least $5,000,000 at a valuation of no less than $20,000,000.

C. Interest Rate: The Payment Convertible Note shall accrue interest at a rate of 8% per annum, compounded semi-annually.

D. Maturity Date: The Payment Convertible Note shall mature on [Date], at which point the outstanding principal and accrued interest shall become due and payable unless converted earlier under its terms.

III. Conversion Terms

A. Conversion Price: The Conversion Price of the Payment Convertible Note shall be determined by dividing the aggregate principal amount of the Note plus any accrued but unpaid interest by the Conversion Amount.

B. Conversion Events: The Payment Convertible Note shall convert into equity upon the occurrence of either a Qualifying Financing Round or a Change of Control.

C. Conversion Discount: The Investor shall receive a 20% discount on the conversion price in the event of a Qualifying Financing Round.

D. Conversion Cap: In the event of a Qualifying Financing Round, the Conversion Price shall not exceed $15.00 per share.

IV. Interest and Repayment Terms

A. Interest Accrual: Interest shall accrue on the outstanding principal amount of the Payment Convertible Note from the date of issuance until conversion or maturity, whichever occurs first.

B. Payment: The Company shall pay accrued interest on the Payment Convertible Note at the time of conversion or maturity, in cash or, at the Company's discretion, by adding such interest to the principal amount of the Note.

C. Default: In the event of default, all principal and accrued interest under the Payment Convertible Note shall become immediately due and payable.

V. Miscellaneous Terms

A. Governing Law: This Term Sheet shall be governed by and construed under the laws of the State of [State], without regard to its conflict of law principles.

B. Confidentiality: The terms of this Term Sheet and any discussions or negotiations relating thereto shall be treated as confidential by both parties.

C. Binding Agreement: This Term Sheet constitutes a binding agreement between the Company and the Investor to the proposed investment, subject to the execution of definitive documentation.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Introducing the Payment Convertible Note Term Sheet Template from Template.net. Crafted for ease and efficiency, this editable and customizable resource empowers entrepreneurs with flexibility. Seamlessly tailored to your needs, it's editable in our Ai Editor Tool, ensuring precision and professionalism in every detail. Streamline your business journey with this indispensable tool.

You may also like

- Delivery Note

- Notes Release

- Concept Note

- Class Note

- Hospital Note

- Apology Note

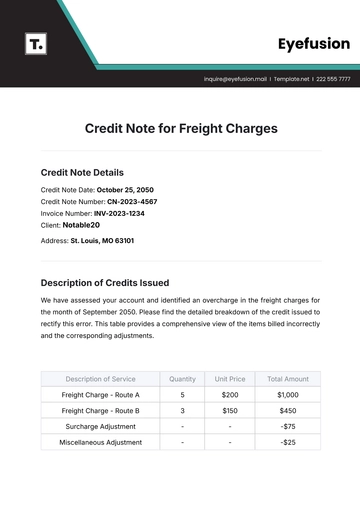

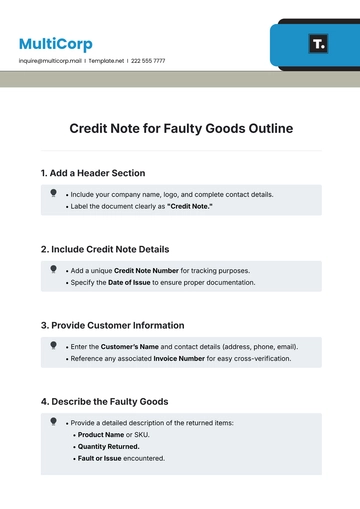

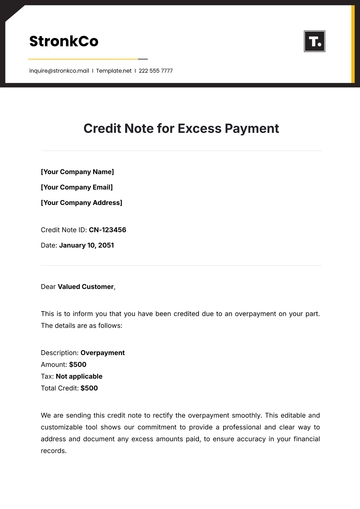

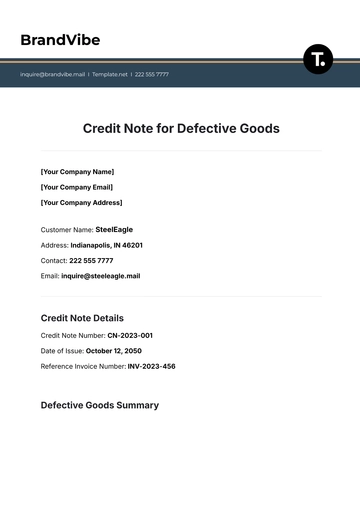

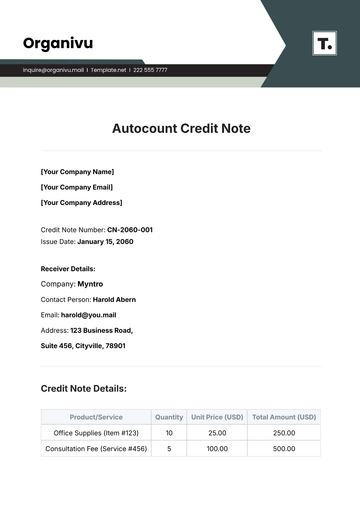

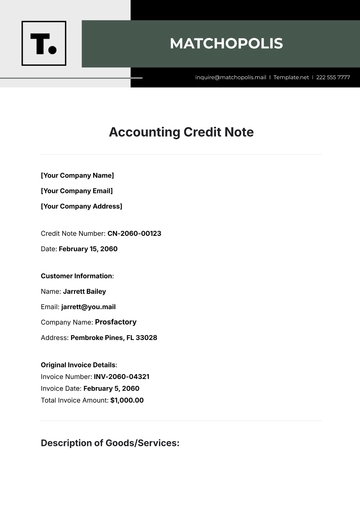

- Credit Note

- Handover Note

- Personal Note

- Excuse Note

- Case Note

- Sample Doctor Note

- Lesson Note

- Appointment Note

- Piano Note

- School Note

- Progress Note

- Business Note

- SOAP Note Templates

- Therapy Note

- Briefing Note

- Summary Note

- Sample Note

- Printable Note