Free Financial Needs Analysis

Prepared By : | [YOUR NAME] |

Company : | [YOUR COMPANY NAME] |

Department : | [YOUR DEPARTMENT] |

I. Executive Summary

A. Summary of the Financial Goals

Short-Term Goals: These are typically achievable within 1-3 years and may include goals like building an emergency fund, paying off high-interest debt, or saving for a specific purchase like a vacation or a down payment on a home.

Long-Term Goals: These encompass objectives that require more time to achieve, often spanning 5 years or more. Examples include saving for retirement, funding a child's education, buying a property, or achieving financial independence.

B. Key Financial Challenges

Insufficient Savings: Highlight if there is a lack of emergency funds or savings for specific goals, which could pose risks in case of unexpected expenses or missed investment opportunities.

High Debt Levels: Identify if there are significant debts such as credit card balances, loans, or mortgages that are impacting financial stability or hindering progress towards financial goals.

Low Income: If income levels are not meeting the desired financial objectives or are unstable, it can be a significant challenge that needs to be addressed in the financial plan.

C. Recommended Strategies

Emergency Fund Establishment: Recommend setting aside a specific amount (usually 3-6 months’ worth of expenses) into a high-yield savings account to cover unexpected expenses without resorting to debt.

Debt Reduction Plan: Suggest strategies such as debt consolidation, prioritizing high-interest debts, or negotiating lower interest rates to accelerate debt payoff and improve overall financial health.

Income Enhancement: Explore avenues for increasing income such as negotiating salary raises, pursuing additional education or certifications for better job prospects, starting a side business, or investing in income-generating assets.

Investment Diversification: Recommend spreading investments across different asset classes (stocks, bonds, real estate) to reduce risk and optimize returns over the long term.

II. Financial Status Assessment

A. Current Financial Status

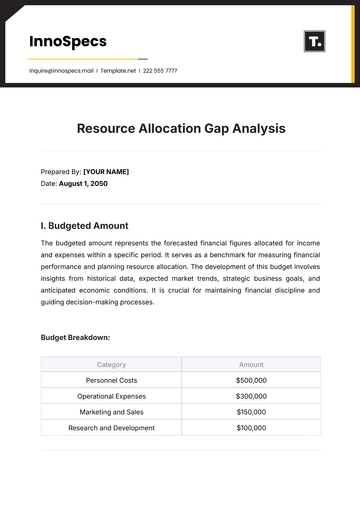

Category | Details | Amount |

|---|---|---|

Assets | Cash in checking/savings accounts, investments (stocks, bonds, mutual funds), real estate value, valuable items (jewelry, art). | $315,000 |

Liabilities | Credit card balances, outstanding loans (student, auto, personal), mortgage balance. | $225,000 |

Income | Salary/wages, rental income, dividends/interest from investments, side business income, and other sources of income. | $5,000 |

Expenses | Budget categories include housing, utilities, food, transportation, insurance, entertainment, savings/investments, and other recurring expenses. | $3,200 |

B. Financial Ratios

Liquidity Ratio:

Formula: Liquidity Ratio = (Cash + Investments) / Total Monthly Expenses

Calculation: Liquidity Ratio = ($10,000 + $50,000) / $3,200

Liquidity Ratio = 19.06 (rounded to two decimal places)

Debt-to-Income Ratio:

Formula: Debt-to-Income Ratio = Total Monthly Debt Payments / Gross Monthly Income

Calculation: Total Monthly Debt Payments = Credit Card Payments + Student Loan Payments + Mortgage Payment

Total Monthly Debt Payments = $5,000 (Credit Cards) + $20,000/12 (Student Loans) + $200,000/360 (Mortgage) ≈ $5,000 + $1,667 + $556.67 ≈ $7,224.67

Debt-to-Income Ratio = $7,224.67 / $5,000

Debt-to-Income Ratio = 1.44 (rounded to two decimal places)

Investment Ratio:

Formula: Investment Ratio = (Savings/Investments) / Gross Monthly Income

Calculation: Investment Ratio = $500 / $5,000

Investment Ratio = 0.1 (or 10%, representing the portion of income being saved/invested)

III. Financial Goals and Objectives

A. Short-Term Goals (1-3 years)

Emergency Fund:

Target Amount: Save 3-6 months' worth of living expenses

If monthly expenses are $2,000, target savings would be $6,000 - $12,000.

Debt Repayment:

High-Interest Credit Card Debt: Pay off $5,000 in the next 12-24 months.

Student Loan Reduction: Aim to reduce student loan balance by $3,000 per year

Investment Starter:

Monthly Investment Amount: Begin investing $300 per month in diversified mutual funds or ETFs

B. Mid-Term Goals (3-5 years)

Homeownership:

Down Payment Goal: Save for a down payment of $30,000 for a home or real estate investment

Education Fund:

Savings Target: Save $40,000 for a child's college education fund or personal skill development

Investment Growth:

Portfolio Growth Goal: Increase investment portfolio to $100,000 by diversifying across stocks, bonds, and real estate

C. Long-Term Goals (5+ years)

Retirement Savings:

Target Retirement Fund: Aim for a retirement fund of $1,000,000 by age 65 through consistent contributions and investment growth

Financial Independence:

Passive Income Streams: Generate passive income from real estate investments, dividend-paying stocks, or other sources to cover living expenses

Legacy Planning:

Establish Trusts or Investment Vehicles: Create trusts, investment funds, or charitable giving plans for future generations or personal legacies.

IV. Gap Analysis

A. Insufficient Emergency Funds

Current Status: The emergency fund target is $12,000 - $24,000, but current savings are $10,000.

Gap: Shortfall of $2,000 - $14,000 in emergency fund savings.

Risk: Vulnerability to unexpected expenses or financial emergencies without an adequate savings buffer.

Opportunity: Prioritize savings contributions to meet the target within the desired timeframe.

B. Lack of Investment Diversification

Current Status: Investments primarily in cash savings, with limited exposure to diversified assets like stocks, bonds, or real estate.

Gap: Lack of diversification increases investment risk and may limit potential returns over the long term.

Risk: Over-dependence on low-yield assets may not keep pace with inflation or long-term financial goals.

Opportunity: Develop an investment plan to allocate funds across various asset classes based on risk tolerance and investment objectives.

C. High Level of Debt

Current Status: Total debt includes high-interest credit card debt, student loans, and mortgage balance.

Gap: Debt-to-Income ratio indicates moderate debt burden but reducing high-interest debt is crucial for financial health.

Risk: High-interest debt can lead to increased interest payments, hindering savings and investment growth.

Opportunity: Implement a debt repayment plan focusing on high-interest debts first, negotiate lower interest rates, and increase debt payments with improved cash flow.

V. Action Plan

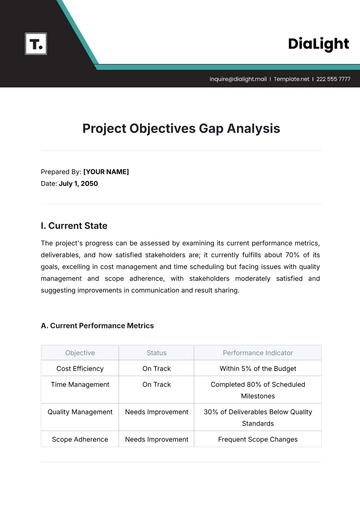

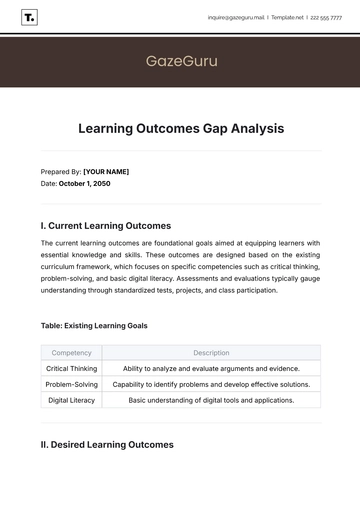

Action Item | Responsibilities | Actions | Timeline |

|---|---|---|---|

Review and Adjust Budget | Individual/Family: Review budget Financial Advisor: Guidance | Identify non-essential expenses, Allocate toward savings/debt | Implement immediately, Monthly review of progress |

Consolidate Debt to Reduce Interest Payments | Individual: Research options Financial Advisor: Recommendations | Consolidate high-interest debts, Negotiate for lower rates | Complete within [Specify Timeframe], Monthly interest check |

Explore Investment Opportunities | Individual: Research investments Financial Advisor: Recommendations | Allocate funds to diversified assets, Rebalance portfolio | Start within [Specify Timeframe], Quarterly portfolio review |

VI. Monitoring and Review

Quarterly Financial Reviews: Every three months, conduct a thorough assessment of your financial status by meticulously tracking your income, expenses, savings, and the performance of your investments to gauge and monitor progress effectively.

Annual Financial Plan Update: Carry out an annual evaluation to ensure that financial objectives are aligned with the present circumstances, make necessary adjustments to strategies, and revise long-term plans accordingly.

Criteria for Plan Adjustment: Adjust the financial plan based on significant changes in income, expenses, investment performance, life events, or goal achievement.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Easily assess your financial needs with the editable Financial Needs Analysis Template from Template.net. This customizable tool allows you to analyze personal or business finances effectively. Fully editable in our Ai Editor Tool, you can tailor it to meet specific requirements and ensure comprehensive financial planning. Perfect for both personal and professional financial assessments