Free Self Employed Expense Report

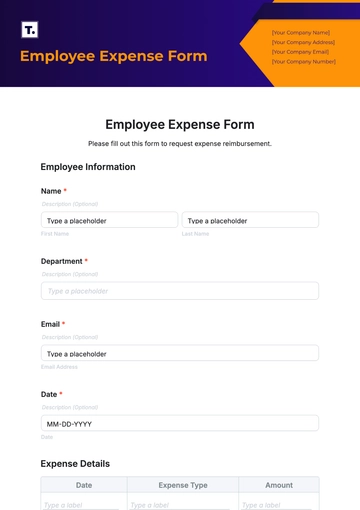

I. Personal Information

Name: | [YOUR NAME] |

|---|---|

Business Name: | [YOUR COMPANY NAME] |

Tax ID Number: | 123-45-6789 |

Address: | [YOUR COMPANY ADDRESS] |

Phone Number: | [YOUR COMPANY NUMBER] |

Email: | [YOUR COMPANY EMAIL] |

II. Business Details

Business Type: | Freelance Writing |

|---|---|

Reporting Period: | January 1, 2050 - December 31, 2050 |

Accounting Method: | Cash |

Business Entity Type: | Sole Proprietorship |

Prepared By: | [YOUR NAME] |

Preparation Date: | January 15, 2051 |

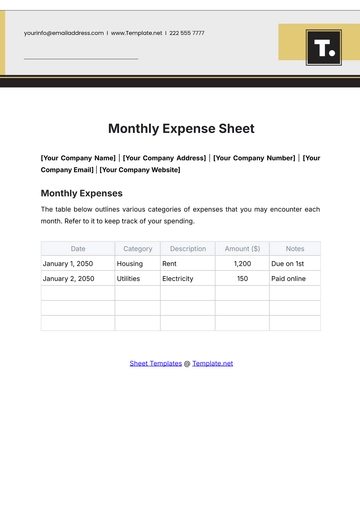

III. Expense Summary

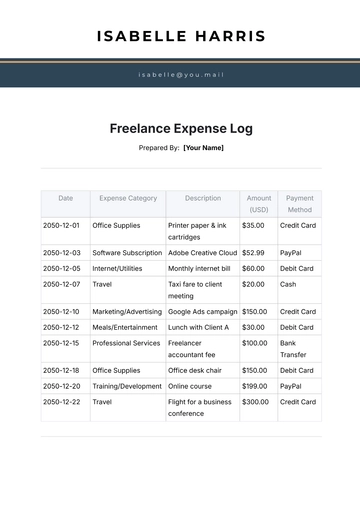

Date | Description | Amount ($) | Category | Receipt Attached (Yes/No) |

|---|---|---|---|---|

01/10/2050 | Office Supplies | 150.00 | Supplies | Yes |

02/15/2050 | Travel to Conference | 500.00 | Travel | Yes |

03/05/2050 | Software Subscription | 100.00 | Software | Yes |

04/20/2050 | Client Entertainment | 200.00 | Meals & Entertainment | Yes |

06/10/2050 | Marketing Expenses | 300.00 | Advertising | Yes |

08/15/2050 | Professional Fees | 400.00 | Professional Services | Yes |

09/25/2050 | Office Rent | 1,200.00 | Rent | Yes |

12/15/2050 | Internet Service | 50.00 | Utilities | Yes |

IV. Detailed Expense Descriptions

1. Office Supplies

Date: January 10, 2050

Description: Purchase of office supplies including paper, pens, and notebooks.

Amount: $150.00

Category: Supplies

Receipt Attached: Yes

2. Travel to Conference

Date: February 15, 2050

Description: Travel expenses to attend a writing conference in New York.

Amount: $500.00

Category: Travel

Receipt Attached: Yes

3. Software Subscription

Date: March 5, 2050

Description: Annual subscription to writing software.

Amount: $100.00

Category: Software

Receipt Attached: Yes

4. Client Entertainment

Date: April 20, 2050

Description: Dinner with clients to discuss project details.

Amount: $200.00

Category: Meals & Entertainment

Receipt Attached: Yes

5. Marketing Expenses

Date: June 10, 2050

Description: Payment for online advertising campaigns to promote freelance writing services. This includes social media ads and Google AdWords.

Amount: $300.00

Category: Advertising

Receipt Attached: Yes

6. Professional Fees

Date: August 15, 2050

Description: Payment for legal and accounting services. This includes fees for consulting with a business lawyer and tax preparation services by an accountant.

Amount: $400.00

Category: Professional Services

Receipt Attached: Yes

7. Office Rent

Date: September 25, 2050

Description: Monthly rental payment for office space used for conducting freelance writing business. The office space is essential for meeting clients and working on projects in a professional environment.

Amount: $1,200.00

Category: Rent

Receipt Attached: Yes

8. Internet Service

Date: December 15, 2050

Description: Monthly payment for high-speed internet service used for business operations, including research, client communication, and uploading completed writing projects.

Amount: $50.00

Category: Utilities

Receipt Attached: Yes

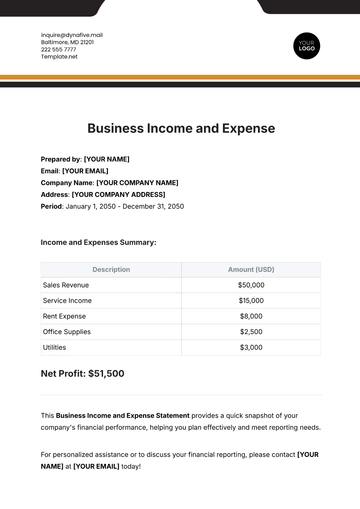

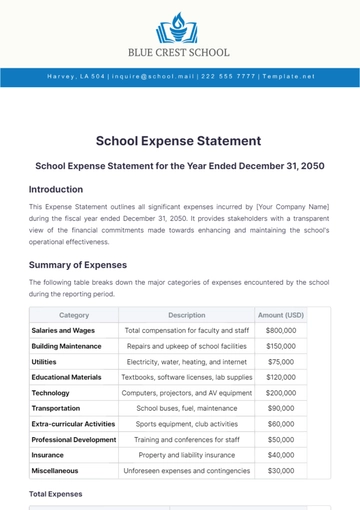

V. Summary and Totals

Category | Total Amount ($) |

|---|---|

Supplies | 150.00 |

Travel | 500.00 |

Software | 100.00 |

Meals & Entertainment | 200.00 |

Advertising | 300.00 |

Professional Services | 400.00 |

Rent | 1,200.00 |

Internet Service | 50.00 |

Total Expenses | 2,900.00 |

VI. Receipts and Documentation

Ensure that all receipts and documentation are attached and organized for each listed expense.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Designed specifically for self-employed professionals, Template.net's Self-Employed Expense Report Template helps you stay organized and on top of your finances. This customizable template allows for detailed tracking of all your business-related expenses, ensuring compliance and accuracy. Editable in our AI Editor Tool, it provides a user-friendly experience, streamlining your expense management process.