Free Tax Compliance Budget Justification

Prepared by: [Your Name]

Date: [Date]

I. Introduction

The purpose of this document is to provide a comprehensive justification for the expenses allocated in the tax compliance budget. It outlines how the budget aligns with current tax regulations, demonstrates the necessity of specific expenses, and ensures that all funds are utilized in a manner compliant with tax laws. This detailed justification is crucial for maintaining transparency, adhering to legal requirements, and optimizing the organization's tax strategy.

II. Budget Alignment with Tax Regulations

A. Regulatory Framework

The budget has been meticulously prepared in compliance with all relevant tax laws and regulations. Special attention was given to the following areas:

Federal Income Tax Regulations: The budget accounts for the latest federal income tax laws, ensuring that all deductions, credits, and obligations are accurately reflected.

State and Local Tax Codes: The budget incorporates the specific tax codes of the states and localities in which the organization operates, considering variations in tax rates and regulations.

Payroll Tax Requirements: Provisions have been made for payroll taxes, including Social Security, Medicare, and unemployment taxes, to ensure full compliance.

Corporate Tax Compliance: The budget aligns with corporate tax regulations, including provisions for estimated tax payments, deductions, and credits.

B. Compliance Procedures

To ensure ongoing compliance with tax laws, the following procedures have been incorporated into the budget:

Monthly Audits: Regular audits are conducted to verify the accuracy of financial records and tax filings, identifying any discrepancies early.

Quarterly Tax Reviews: Quarterly reviews are held to assess tax liabilities, update projections, and adjust the budget as needed.

Annual Compliance Training: Staff members receive annual training on the latest tax regulations and compliance practices to stay informed and competent.

Software Subscriptions for Tax Filings: The budget includes subscriptions to specialized tax software, ensuring accurate and timely filings.

III. Need for Specific Expenses

A. Personnel Costs

Personnel costs are essential for maintaining compliance with tax laws. These expenses include:

Salaries for Tax Advisors: Tax advisors play a critical role in planning, preparing, and filing tax returns, ensuring that the organization maximizes deductions and credits.

Compensation for Compliance Officers: Compliance officers oversee adherence to tax laws, implement best practices, and manage risk.

Overtime for Staff During Filing Periods: Additional work hours are often required during tax season, necessitating overtime pay to ensure timely and accurate filings.

B. Software and Tools

Investments in state-of-the-art software and tools are crucial for accurate and efficient tax management:

Tax Preparation Software Licenses: These licenses provide access to advanced software that streamlines the tax preparation process, reducing errors and increasing efficiency.

Data Analytics Tools for Tax Reporting: Analytics tools help in analyzing financial data, identifying tax-saving opportunities, and ensuring compliance.

Secure Storage Solutions for Financial Records: Secure storage is necessary for maintaining confidential financial records and supporting documents, ensuring data security and compliance with data retention policies.

C. Training and Development

Continuous training is vital for staying updated with the latest tax regulations and maintaining a high level of expertise:

Annual Workshops and Seminars: These events provide staff with the latest insights into tax laws, industry trends, and compliance strategies.

Online Courses for Staff: Online courses offer flexible learning opportunities, allowing staff to gain knowledge at their own pace.

Certifications in Tax Law and Compliance: Obtaining certifications ensures that staff members possess the necessary qualifications to handle complex tax issues.

D. Professional Services

Engaging external experts provides an additional layer of assurance and expertise:

External Auditors: External auditors conduct independent reviews of financial statements and tax filings, providing credibility and assurance of compliance.

Tax Consultants: Tax consultants offer specialized advice on complex tax issues, helping the organization optimize its tax strategy.

Legal Advisory Services: Legal advisors guide tax-related legal matters, ensuring that the organization adheres to all applicable laws and regulations.

IV. Table of Expenses

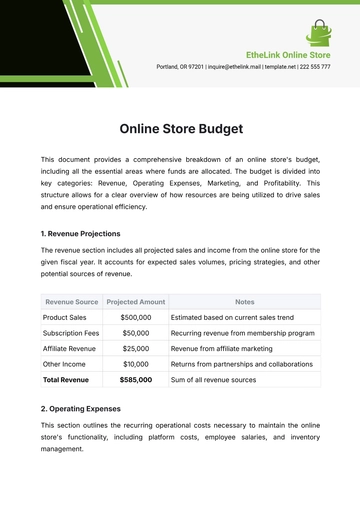

Category | Expense | Amount ($) | Justification |

|---|---|---|---|

Personnel Costs | Salaries for Tax Advisors | 150,000 | Essential for tax planning and filings |

Software and Tools | Tax Preparation Software | 20,000 | Ensures accurate and timely filings |

Training and Development | Workshops and Seminars | 10,000 | Maintains staff proficiency in tax laws |

Professional Services | External Auditors | 30,000 | Provides independent review and certification |

Total | 210,000 |

V. Conclusion

This Tax Compliance Budget Justification ensures that all financial aspects are aligned with tax regulations. The necessity for each expense is meticulously documented, guaranteeing that funds are used in compliance with tax laws. Adopting this budget will ensure continued adherence to all applicable tax codes and regulations.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Ensure your organization's tax obligations are met with Template.net's Tax Compliance Budget Justification Template. This editable and customizable template is designed to help you outline necessary expenditures for tax compliance. Editable in our AI Editor Tool, it offers a user-friendly interface for easy content adjustments. Present a clear and detailed budget justification that demonstrates the importance of compliance investments.

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising