Free Accounting Budget

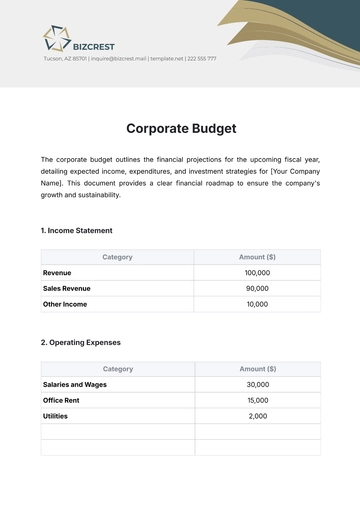

I. Overview

This accounting budget outlines the projected financial activities for [Your Company Name] in 2050, focusing on revenue growth, cost management, and profitability.

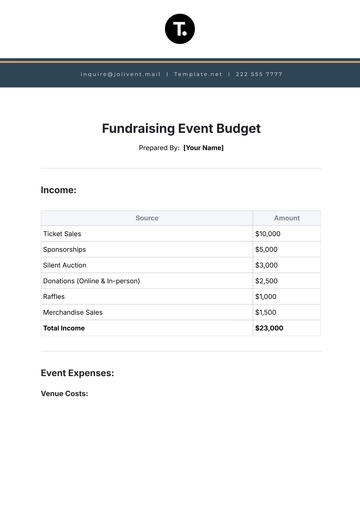

II. Revenue Projections

Revenue Source | Projected Revenue (2050) |

|---|---|

Product Sales | $15,000,000 |

Service Contracts | $5,500,000 |

Subscription Services | $3,200,000 |

Licensing Fees | $2,000,000 |

Investment Income | $1,000,000 |

Total Revenue | $26,700,000 |

Product Sales: Largest revenue source, driven by new products and market expansion.

Service Contracts: Significant revenue from long-term client agreements.

Subscription Services: Expected 12% growth.

Licensing Fees: Strategic partnerships to increase this stream.

Investment Income: Focus on low-risk investments.

III. Expenditure Projections

Expenditure Category | Projected Expenditure (2050) |

|---|---|

Cost of Goods Sold (COGS) | $10,000,000 |

Salaries and Wages | $6,500,000 |

Marketing and Advertising | $2,500,000 |

Research and Development (R&D) | $1,800,000 |

Administrative Expenses | $2,200,000 |

Depreciation and Amortization | $900,000 |

Interest Expense | $600,000 |

Taxes | $1,200,000 |

Total Expenditures | $25,700,000 |

COGS: Major cost component at 39% of revenue.

Salaries: 25% of revenue, reflecting investment in talent.

Marketing: 9.4% of revenue to boost brand and sales.

R&D: Focus on innovation, representing 7% of revenue.

Administrative: 8.2% for general business operations.

IV. Capital Investments

Capital Investment | Projected Cost (2050) |

|---|---|

New Manufacturing Equipment | $2,500,000 |

Technology Upgrades | $1,800,000 |

Facility Expansion | $3,200,000 |

R&D Facilities | $1,500,000 |

Total Capital Investments | $9,000,000 |

Key Investments: Enhancing production capacity, technology upgrades, and facility expansion.

V. Cash Flow Management

Cash Flow Activity | Projected Amount (2050) |

|---|---|

Cash Inflows from Operations | $26,000,000 |

Cash Outflows from Operations | $22,000,000 |

Net Cash Flow from Operations | $4,000,000 |

Cash Inflows from Investing | $1,000,000 |

Cash Outflows from Investing | $9,000,000 |

Net Cash Flow from Investing | $(8,000,000) |

Cash Inflows from Financing | $5,000,000 |

Cash Outflows from Financing | $2,000,000 |

Net Cash Flow from Financing | $3,000,000 |

Net Increase in Cash | $(1,000,000) |

Operations: Positive cash flow of $4 million.

Investing: Significant outflows for long-term growth.

Financing: Net inflow of $3 million to support investments.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Streamline your financial planning with the Accounting Budget Template from Template.net. This customizable template helps you create detailed budgets to manage your finances effectively. Editable in our AI Editor Tool, it ensures you cover every aspect of your accounting needs. Download now and take control of your budgeting process!

You may also like

- Budget Sheet

- Personal Budget

- Non Profit Budget

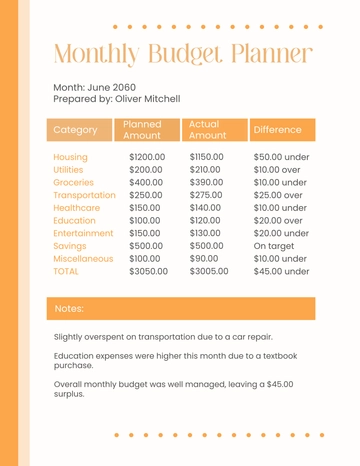

- Monthly Budget

- Project Budget

- HR Budget

- Company Budget

- Home Budget

- Weekly Budget

- College Budget

- Business Budget

- Construction Budget

- Small Business Budget

- Hotel Budget

- Annual Budget

- Home Renovation Budget

- Household Budget

- Student Budget

- Grocery Budget

- Marketing Budget

- Corporate Budget

- Startup Budget

- Manufacturing Budget

- Church Budget

- University Budget

- Annual Budget Plan

- Event Budget

- Operating Budget

- Travel Budget

- Food Budget

- IT and Software Budget

- School Budget

- Real Estate Budget

- Sales Budget

- Conference Budget

- Budget Finance

- Freelancer Budget

- Budget Advertising