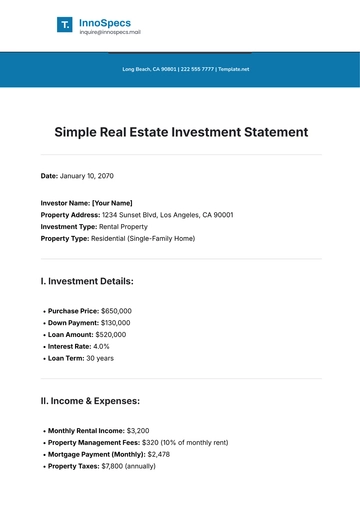

Free Simple Real Estate Investment Statement

Date: January 10, 2070

Investor Name: [Your Name]

Property Address: 1234 Sunset Blvd, Los Angeles, CA 90001

Investment Type: Rental Property

Property Type: Residential (Single-Family Home)

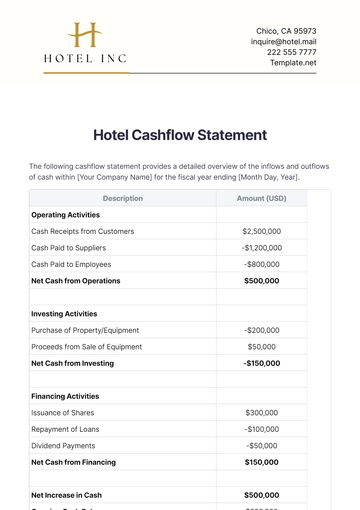

I. Investment Details:

Purchase Price: $650,000

Down Payment: $130,000

Loan Amount: $520,000

Interest Rate: 4.0%

Loan Term: 30 years

II. Income & Expenses:

Monthly Rental Income: $3,200

Property Management Fees: $320 (10% of monthly rent)

Mortgage Payment (Monthly): $2,478

Property Taxes: $7,800 (annually)

Insurance: $1,200 (annually)

Maintenance/Repairs: $250 (monthly)

Utilities (if applicable): $150 (monthly, tenant pays some utilities)

III. Cash Flow Summary:

Total Monthly Income: $3,200

Total Monthly Expenses: $3,198

Net Monthly Cash Flow: $2

IV. Projected Returns:

Cap Rate: 5.0%

Formula: Net Operating Income / Property Value

NOI: $3,200 (monthly rent) x 12 = $38,400 annually

Cap Rate = $38,400 / $650,000 = 0.059 or 5.0%

Cash-on-Cash Return: 7.0%

Formula: Net Income / Total Investment

Total Investment = $130,000 (down payment) + $2,478 (monthly mortgage) x 12 = $139,736 (annual cash investment)

Cash-on-Cash Return = $2 x 12 / $130,000 = 0.07 or 7.0%

Total ROI (Return on Investment): 9.5%

Formula: Total Profit / Total Investment

Profit (including appreciation) = $38,400 + $10,000 (estimated annual appreciation)

ROI = $48,400 / $650,000 = 0.074 or 9.5%

VI. Appreciation & Equity Build-up:

Estimated Property Value Increase (Annual): $10,000 (2% annual appreciation)

Equity Build-Up (Year 1): $7,072 (based on principal paid down in the first year of the mortgage)

VII. Exit Strategy:

Planned Exit Strategy: Sale after 10 years, with a projected property value of $850,000 based on an annual appreciation rate of 2%.

Prepared by:

[Your Name]

[Your Name]

Investor

Real Estate License #: 12345678

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Monitor investments with Template.net's Simple Real Estate Investment Statement Template. Fully editable and customizable, this template ensures precise documentation. Easily adapt it to your requirements using our AI Editor Tool. A straightforward solution for real estate investment tracking.