Table of Contents

- Agreement Template Bundle

- 11+ Investment Agreement Templates in DOC

- 1. Stock Investment Agreement Format

- 2. Investment Agreement Template

- 3. Simple Investment Agreement in DOC

- 4. Investment Management Agreement Template

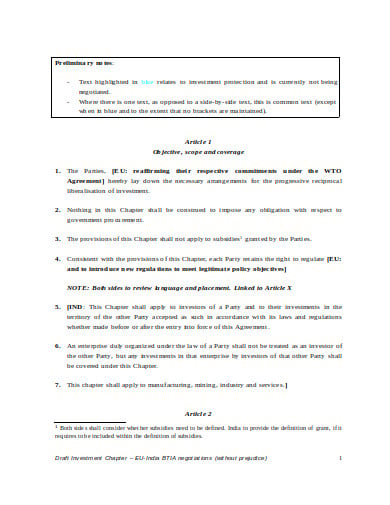

- 5. Trade and Investment Agreement Example in DOC

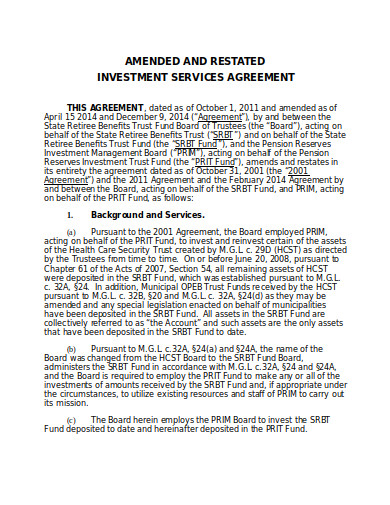

- 6. Investment Services Agreement Template

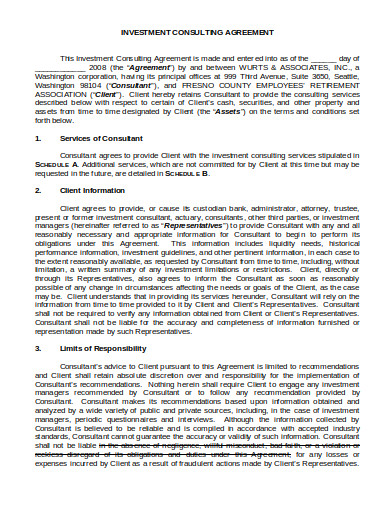

- 7. Investment Consulting Agreement Sample

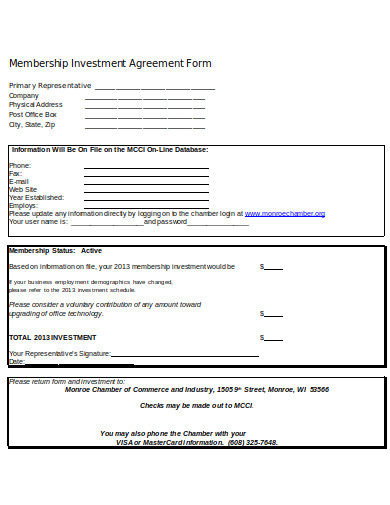

- 8. Membership Investment Agreement Form

- 9. Basic Investment Agreement

- 10. Confidentiality Investment Agreement Template

- 11. Sample Investment Agreement Template

- 12. Standard Investment Club Partnership Agreement

- What Does it Mean by Investment?

- What is the Difference between An Investment Agreement and a Shareholder Agreement?

- What are the Factors that Determine an Investment Agreement?

- What is a Shareholder Agreement?

- What are the Intrinsic Characteristics of an Investment Agreement?

11+ Investment Agreement Templates in DOC

An Investment Agreement is an agreement characterizing the provisions of speculation – the absolute worth and when these investments develop and form a shape. Different names for understanding an investment agreement is to incorporate, “stock buy and having an understanding” or “membership understanding”.

Agreement Template Bundle

11+ Investment Agreement Templates in DOC

1. Stock Investment Agreement Format

seriesseed.com

seriesseed.com2. Investment Agreement Template

local.gov.uk

local.gov.uk3. Simple Investment Agreement in DOC

vitebsk-region.gov.by

vitebsk-region.gov.by4. Investment Management Agreement Template

utsystem.edu

utsystem.edu5. Trade and Investment Agreement Example in DOC

files.wordpress.com

files.wordpress.com6. Investment Services Agreement Template

mass.gov

mass.gov7. Investment Consulting Agreement Sample

fresno.ca.us

fresno.ca.us8. Membership Investment Agreement Form

wmc.org

wmc.org9. Basic Investment Agreement

thedynamicsale.com

thedynamicsale.com10. Confidentiality Investment Agreement Template

nietzer.info

nietzer.info11. Sample Investment Agreement Template

accd.vermont.gov

accd.vermont.gov12. Standard Investment Club Partnership Agreement

myiclub.com

myiclub.comWhat Does it Mean by Investment?

The term investment and gradually understanding it is commonly utilized before or during the beginning periods of organization arrangement. In any occasion, this understanding will start by distinguishing the terms and conditions that are to be altered. It will at that point express the thought between the organizations as exchanging esteem or monies from the financial specialist for stock in the organization.

What is the Difference between An Investment Agreement and a Shareholder Agreement?

- These are generally utilized and regularly befuddled archives utilized by companies. Speculation and an understanding are settled between an organization and people wishing to buy a possession in the organization. The buyer might be a current investor or outside financial specialists.

- An investor’s understanding is an understanding between another organization investor and the current investors of the organization. It by and large concerns an understanding between investors to exercise or cease from practicing their privileges as investors in a specific manner.

- An investor’s goal is a move made by investors during an investor meeting. It, for the most part, requires a vote of a predefined number of levels of investors to make the move. The activity will consequently influence the privileges of all things considered.

What are the Factors that Determine an Investment Agreement?

Adherence Clause

Obligating any later transferees of the stock to be dependent upon the provisions of the speculation understanding.

Installment Tranches

If the financial specialist won’t make the whole interest in the organization at once, the venture assets might be paid in indicated sums at determined timeframes. These installments are known as tranches. It is normal in new businesses for financial specialists to focus on capital speculation at different organizational achievements. The tranches are commonly attached to item improvement, income targets, or other operational measurements.

Portrayals and Warranties

Representations are confirmations made by each gathering that a specific reality is valid. A guarantee is an announcement by the organization that a specific truth will stay valid until some expressed point later on. The portrayals and guarantees by and large rundown out organization conditions that will be analyzed through due industriousness. These may concern the money related position (bookkeeping and expense portrayals), organization resources (possession and valuation), the proprietorship structure, the operational attributes, and the legitimate circumstance of the organization. As a component of these portrayals, the organization might be committed to creating explicit reports related to therewith.

Speculator Rights

The understanding may incorporate any number of financial specialist rights (especially casting ballot rights) including:

- Giving new offers in future rounds of value financing;

- Changing the Articles or Bylaws of the organization.

- Choosing chiefs;

- Mergers, acquisitions, or offers of significant organization resources; or

- Significant capital consumptions.

Prohibitive Covenants

This worries the capacity to sell or move shares. It might likewise confine the degree to which investors can take certain activities, for example, going up against the organization or serving a contender.

Classification

These are by and large affirmations that the organization will keep organization or arrangement data secret. This is normal with speculation concurrences with privately owned businesses. There might be special cases for revelation to existing organization partners.

What is a Shareholder Agreement?

The investor understanding is utilized to ensure the privileges of existing investors. At the point when financial specialists look to put resources into the organization, the current investors will require the speculator to go into the investor understanding. The provisions of the investor understanding will shift depending on the premiums of existing investors.

What are the Intrinsic Characteristics of an Investment Agreement?

Casting a ballot arrangements

These arrangements are confirmations that an investor will cast a ballot her offers as per certain limitations. It may be the case that the investor consents to cast a ballot in a square with different investors.

Arrangement/Removal Rights

These worry the privileges of the investors to choose or evacuate explicit investors. The privilege to expel chiefs.

Minority Shareholder Protections

This may incorporate the capacity for investors to make the organization proposition. It might likewise incorporate interest rights in intently held organizations.

Move Restrictions

These arrangements concern if and how an investor can move her offers. These arrangements will frequently allow privileges of the first refusal to the organization to repurchase the offers. It might likewise concede co-deal rights to the investor on the occasion different investors offer their offers to the organization or outsiders.

Contest Resolution

These arrangements concern how investors can voice objections or resolve debates between investors.

What is a Shareholder’s Investment Goal?

An investor’s goals will follow a basic organization. It will demonstrate who is deciding in favor of investor activity. It will show the quantity of investors presents, with the goal that the move is made dependent upon the majority of those qualified for vote. At that point, it will spread out the activity that the investors affirm. This may incorporate selling significant resources of the organization, changing the organization reports, supporting speculator financing, or dissolving the organization.