Table of Contents

- Agreement Template Bundle

- 11+ Stock Repurchase Agreement Form Templates

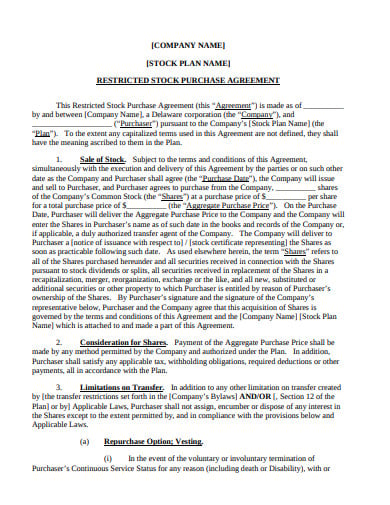

- 1. Stock Repurchase Agreement Start-Up Form Template

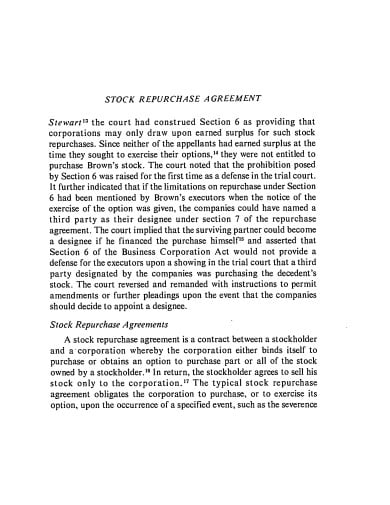

- 2. Stock Repurchase Agreement Template

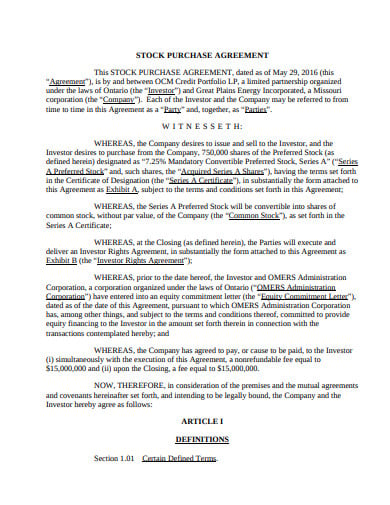

- 3. Company Stock Repurchase Agreement Form Template

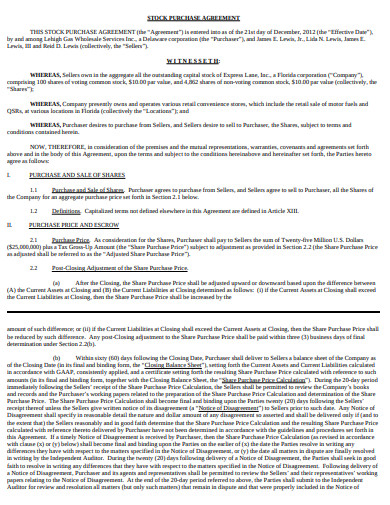

- 4. Stock Repurchase Sale Share Agreement Template

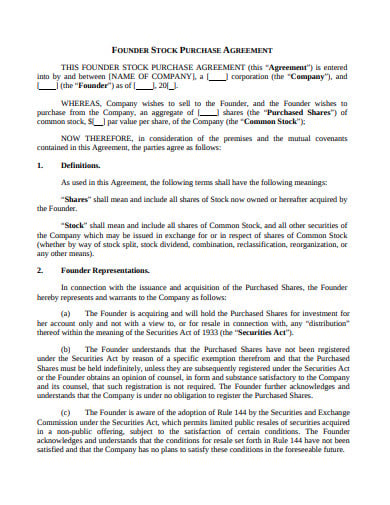

- 5. Founder Stock Repurchase Agreement Form Template

- 6. Stock Repurchase Option Agreement Form Template

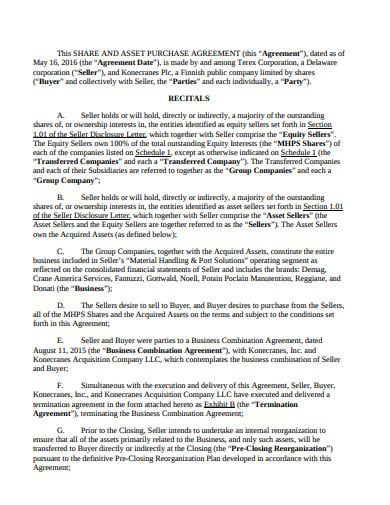

- 7. Share Asset Repurchase Agreement Form Template

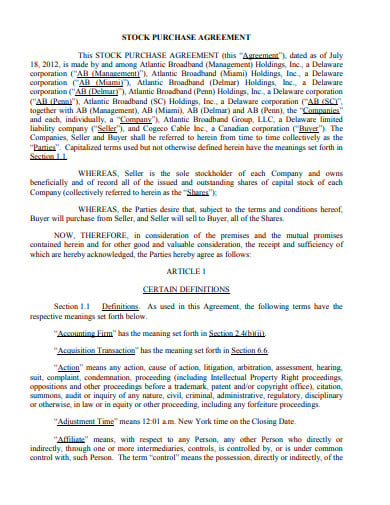

- 8. Management Stock Repurchase Agreement Form Template

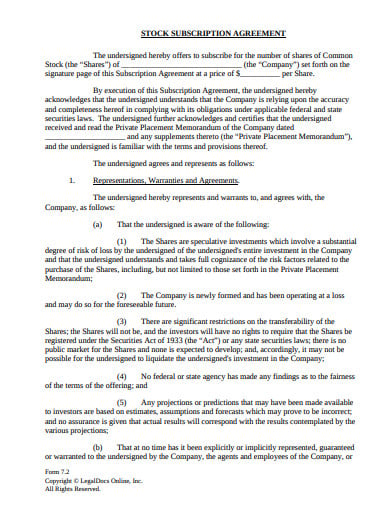

- 9. Stock Repurchase Subscription Agreement Form Template

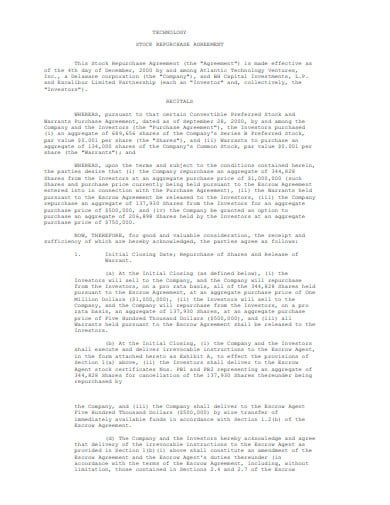

- 10. Technology Stock Repurchase Agreement Form Template

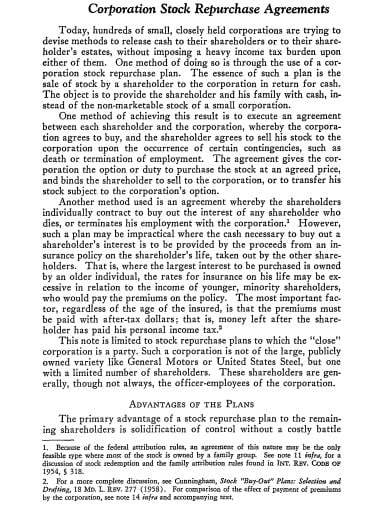

- 11. Corporation Stock Repurchase Agreement Form Template

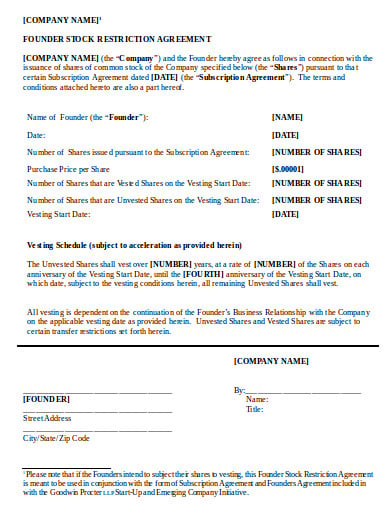

- 12. Stock Repurchase Restriction Agreement Form Template

- How does Share Repurchase Work?

- For What Reason Would an Organization Repurchase its Stocks?

- What are the Types of Purchase Agreements in Stock Investments?

- What is the Purpose of a Stock Investment?

11+ Stock Repurchase Agreement Form Templates in PDF

A Share Repurchase Agreement is a contract between a company and at least one of its investors where the organization can repurchase it’s very own portion of the basic stock from where they have set their roots. The archived stocks recognize the gatherings in question and record the absolute cost of the shareholding, the strategy for installment, and the date of the exchange. The agreement likewise remembers portrayals and guarantees for sake of the two gatherings to the general impact that they are each lawfully equipped for finishing the exchange.

Agreement Template Bundle

11+ Stock Repurchase Agreement Form Templates

1. Stock Repurchase Agreement Start-Up Form Template

cdn.relayto.com

cdn.relayto.com2. Stock Repurchase Agreement Template

scholarship.law.duke.edu

scholarship.law.duke.edu3. Company Stock Repurchase Agreement Form Template

efis.psc.gov

efis.psc.gov4. Stock Repurchase Sale Share Agreement Template

lw.com

lw.com5. Founder Stock Repurchase Agreement Form Template

leaplaw.com

leaplaw.com6. Stock Repurchase Option Agreement Form Template

sec.gov

sec.gov7. Share Asset Repurchase Agreement Form Template

konecranes.com

konecranes.com8. Management Stock Repurchase Agreement Form Template

dps.ny.gov

dps.ny.gov9. Stock Repurchase Subscription Agreement Form Template

allbusiness.com

allbusiness.com10. Technology Stock Repurchase Agreement Form Template

ir.tgtherapeutics.com

ir.tgtherapeutics.com11. Corporation Stock Repurchase Agreement Form Template

scholarlycommons.law.case.edu

scholarlycommons.law.case.edu12. Stock Repurchase Restriction Agreement Form Template

goodwinlaw.com

goodwinlaw.comHow does Share Repurchase Work?

As such, the partnership sells its attractive protections, similar to stocks or bonds, to an investor. As a feature of the arrangement, the organization consents to repurchase the attractive protections sometime in the future. Partnerships in the United States can browse five essential strategies to repurchase stocks or offers, including:

Open market

In an open market, otherwise called the stock trade, the organization essentially declares the buyback program and afterward continues to repurchase shares.

Private arrangements

In private dealings, the offer repurchase is haggled between the organization and an individual investor.

Repurchase ‘put’ rights

Repurchase ‘put’ rights are an investment opportunity conceded by an enterprise to its investors that permits those investors to sell their offers back to the company at a fixed cost inside a fixed timespan.

Self-sensitive offer

A self-delicate repurchase is an organization’s idea to repurchase their offers at a value that is higher than the present market esteem.

Dutch sale repurchase

A Dutch sale repurchase permits the company to indicate a value go in which their offers will, at last, be bought. Investors may delicate their offers at any cost inside the range.

For What Reason Would an Organization Repurchase its Stocks?

An enterprise or business repurchases its offers from the commercial center because the administration of the organization accepts that the offers presently available are underestimated. By repurchasing a portion of the offers, the organization can build the estimation of any outstanding offers.

A Share repurchase can be utilized as another option, or notwithstanding, the issue of profits as a method for conveying organization benefits to the investors. Following an offer repurchase, as there are presently less residual offers, those offers will encounter expanded income per share.

What are the Types of Purchase Agreements in Stock Investments?

Offer Purchase Agreement

A Share Purchase Agreement sets out the terms and conditions for the offer of offers by a current investor of a company to an outsider purchaser.

Investor Agreement

A Shareholder Agreement determines investor rights and duties between investors of a partnership.

Investor Loan Agreement

A Shareholder Loan Agreement is utilized when a company needs to acquire or take care of cash from one of its investors, and the two gatherings require documentation of the exchange for charge purposes.

What is the Purpose of a Stock Investment?

Offer Subscription

A Share Subscription is utilized when new normal stocks are given by a partnership and offered to a buyer, otherwise called an endorser.

Acquisition of Business Agreement

A Purchase of Business Agreement is an agreement for the offer of a whole business.