Table of Contents

- Agreement Template Bundle

- Business Agreement Template Bundle

- 10+ Investment Partnership Agreement Templates in PDF | DOC

- 1. Investment Partnership Agreement Template

- 2. Investment Partnership Agreement Template in PDF

- 3. Investment Partnership Agreement Example

- 4. Sample Investment Partnership Agreement Templates

- 5. Trade Investment Partnership Agreement Templates

- 6. Business Investment Partnership Agreement Templates

- 7. Deed Investment Partnership Agreement Template

- 8. Contract Investment Partnership Agreement Template

- 9. Investor Investment Partnership Agreement Template

- 10. Investment Partnership Agreement Template in DOC

- 11. Small Business Investment Partnership Agreement Template

- What does an Investment Partnership Agreement Include?

- What are the Types of Partnerships?

- What are the Requirements for Joining a Partnership?

- Importance of Investment Partnership Agreement

10+ Investment Partnership Agreement Templates in PDF | DOC

An investment partnership agreement is like any other partnership. Nonetheless, the distinction is that there is an agreement making the partnership official and, most importantly, legal. You can often see restaurant investor agreements and other sorts of partnership agreements as well. It is a two-party enterprise agreement that will agree to bear and carry the enterprise towards its growth advancement and invest in the enterprise with the guarantee of a return of higher value at particular times.

Agreement Template Bundle

Business Agreement Template Bundle

10+ Investment Partnership Agreement Templates in PDF | DOC

1. Investment Partnership Agreement Template

stoptb.org

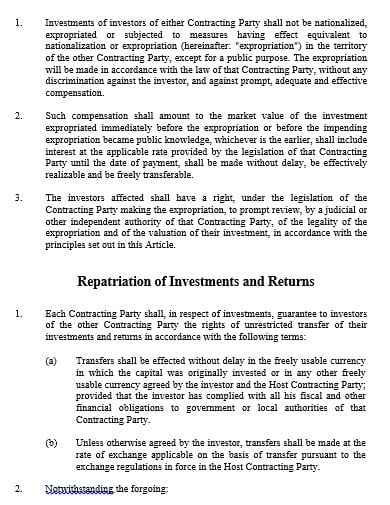

stoptb.org2. Investment Partnership Agreement Template in PDF

nsc.org

nsc.org3. Investment Partnership Agreement Example

skladi.si

skladi.si4. Sample Investment Partnership Agreement Templates

bruegel.org

bruegel.org5. Trade Investment Partnership Agreement Templates

eua.eu

eua.eu6. Business Investment Partnership Agreement Templates

nsdcindia.org

nsdcindia.org7. Deed Investment Partnership Agreement Template

elsevier.com

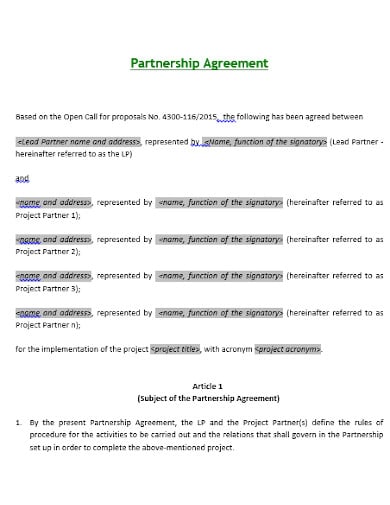

elsevier.com8. Contract Investment Partnership Agreement Template

businessfinland.vc

businessfinland.vc9. Investor Investment Partnership Agreement Template

co.uk

co.uk10. Investment Partnership Agreement Template in DOC

embassies.gov

embassies.gov11. Small Business Investment Partnership Agreement Template

si-hu.eu

si-hu.euWhat does an Investment Partnership Agreement Include?

There are various major areas that most of the partnership agreement covers. It is wise that you and your partner-to-be must consider some of these issues before you put these terms in writing.

-

Name of the Partnership

One of the very first things that you must do is decide a name for your partnership. This can be any name as your last name such as Robertson & Smiths, or you can also adopt and register a fictitious business name like Eastside County Repairs, etc. In case you do choose a fictitious name and you must make sure that the name is not already in use.

-

Contributions to the Partnership

You and your partners must function properly out and record who will contribute cash, property, or services to the business before it opens and what percentage of ownership each partner has. Contribution disputes have killed many promising businesses.

-

Assignment of Profits, Losses, and Draws

This part of the agreement lays out certain questions like will the profits and losses be assigned in proportion to a partner’s percentage interest in the business or not? Or will each partner be qualified to a regular draw or will all the profits be distributed at the end of each year? You and your partners may even have different ideas about how the money should be divided as well as distributed. Each of you must have different financial needs, so this can be an area in which you must pay some sort of particular attention.

-

Authority of the Partner

Every partner may bind the relationship without the permission of the other partners without an agreement to the contrary. If you want to get approval from one or all of the partners before binding the contract, this must be made clear in your partnership agreement.

-

Decision-Making of the Partnership

Though there is no magic formula or any kind of language for sharing the decisions among the partners and you will head off a lot of trouble in case you try to work it out beforehand. For instance, you may want to require a unanimous vote of all the partners for every business decision. You may require a unanimous vote for some major decisions and also allow individual partners to make some minor decisions on their own. Your partnership agreement, in that case, will have to describe what initiates a major or minor decision.

-

Duties of the Management

It is wise to work out some guidelines in advance and might want to make some rules about every management detail. For instance, who is in charge of keeping the books? Or who will deal with the customers or supervise employees? There are other duties as well like making negotiations with the suppliers and think through the management needs of your partnership.

-

Accepting New Partners

You might want to gradually grow the company and bring in new partners. Agreeing on a plan to accept new partners would make your lives much simpler when this issue arises.

-

Death or Withdrawal of a Partner

The rules for managing an owner’s departure are at least as important as the rules for adding new partners to the company. Hence, in your partnership agreement, you can set up a reasonable buyout scheme to deal with this eventuality.

-

Resolving Disputes

If you are deadlocked on a topic with your parents, do you want to go immediately to court? If the partnership agreement provides for alternative dispute settlement, such as negotiation or arbitration, it could benefit those involved.

What are the Types of Partnerships?

You’ll need to determine which form of relationship you want before you start a partnership. You might have heard the terms and conditions:

-

General Partnership

A general partnership is made up of investors who engage in the partnership’s day-to-day activities who are responsible for liability and claims as shareholders. Investors may also be limited.

-

Limited Partnership

A limited partnership has one common partner who runs the firm, and one or more limited partners who are not involved in the partnership’s activities and who are not responsible.

-

Limited Liability Partnership

A limited liability partnership (LLP) is identical to a limited partnership but may have several general partners. Partners in the same professional group like accountants, architects, etc. form an LLP, and the agreement protects partners from the actions of other partners from liability. Every state has different divisions of professionals which make it possible to shape an LLP.

What are the Requirements for Joining a Partnership?

A person can enter a partnership at the outset or after the partnership has been operating. The next partner will invest in the relationship, bring capital into the company which is usually money and build a capital account. The size of the investment and other considerations, such as the amount of responsibility that the partner voluntarily accepts, decide the contribution of the new partner and the share of the business’ gains and losses each year.