Free Finance Portfolio Performance Form

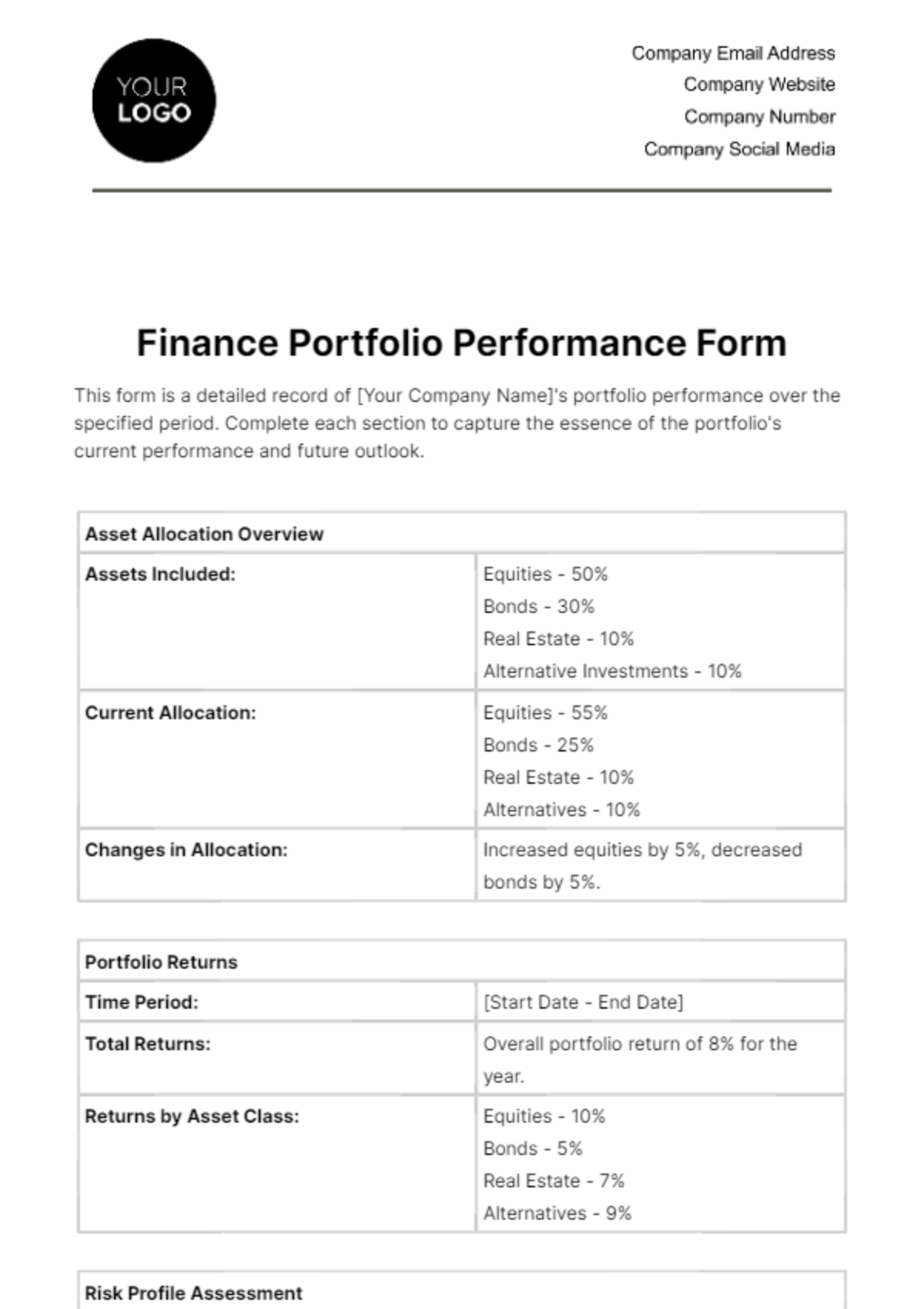

This form is a detailed record of [Your Company Name]'s portfolio performance over the specified period. Complete each section to capture the essence of the portfolio's current performance and future outlook.

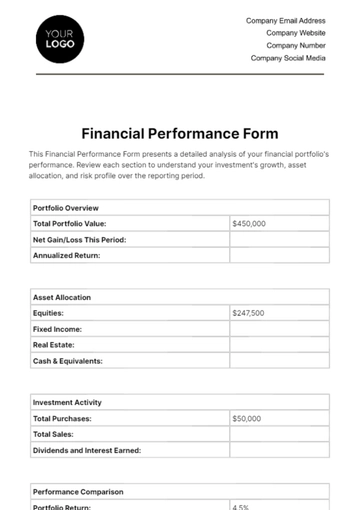

Asset Allocation Overview | ||

Assets Included: | Equities - 50% Bonds - 30% Real Estate - 10% Alternative Investments - 10% | |

Current Allocation: | Equities - 55% Bonds - 25% Real Estate - 10% Alternatives - 10% | |

Changes in Allocation: | Increased equities by 5%, decreased bonds by 5%. | |

Portfolio Returns | ||

Time Period: | [Start Date - End Date] | |

Total Returns: | Overall portfolio return of 8% for the year. | |

Returns by Asset Class: | Equities - 10% Bonds - 5% Real Estate - 7% Alternatives - 9% | |

Risk Profile Assessment | ||

Risk Tolerance Level: | Moderate | |

Volatility Measures: | Portfolio standard deviation - 12% | |

Risk Exposure by Asset Class: | Equities - High Bonds - Low Real Estate - Medium Alternatives - Medium | |

Benchmark Comparison | ||

Selected Benchmarks: | S&P 500 for Equities Barclays Aggregate for Bonds | |

Performance vs. Benchmarks: | Portfolio underperformed S&P 500 by 2%, outperformed Barclays Aggregate by 1% | |

Analysis of Deviations: | Underperformance in equities due to market volatility and overexposure to tech stocks. | |

Future Outlook and Adjustments | ||

Market Outlook: | Anticipating economic recovery with moderate market growth. Watching interest rate changes for bond investments. | |

Strategic Adjustments: | Suggest reducing tech stock exposure and increasing allocation in healthcare and consumer goods. Consider longer-term bonds for stability. | |

Goals for Next Period: | Achieve a portfolio return of 9%, maintain a moderate risk profile, and improve alignment with benchmarks. | |

This performance form reflects a comprehensive picture of [Your Company Name]'s investment activities and results for the year. It should be used as a basis for upcoming investment strategy meetings and future portfolio adjustments.

- 100% Customizable, free editor

- Access 1 Million+ Templates, photo’s & graphics

- Download or share as a template

- Click and replace photos, graphics, text, backgrounds

- Resize, crop, AI write & more

- Access advanced editor

Drive financial success with Template.net's Finance Portfolio Performance Form. This editable platform provides a customizable, comprehensive overview of portfolio performance. Impressively designed and easily editable using our Ai Editor Tool, it simplifies tracking your investments. Turn complex data into tangible results. Upgrade to professional financial management today.